| ⚠️ AXS Pay+Earn has now launched. Read the full details here |

This is an interesting development.

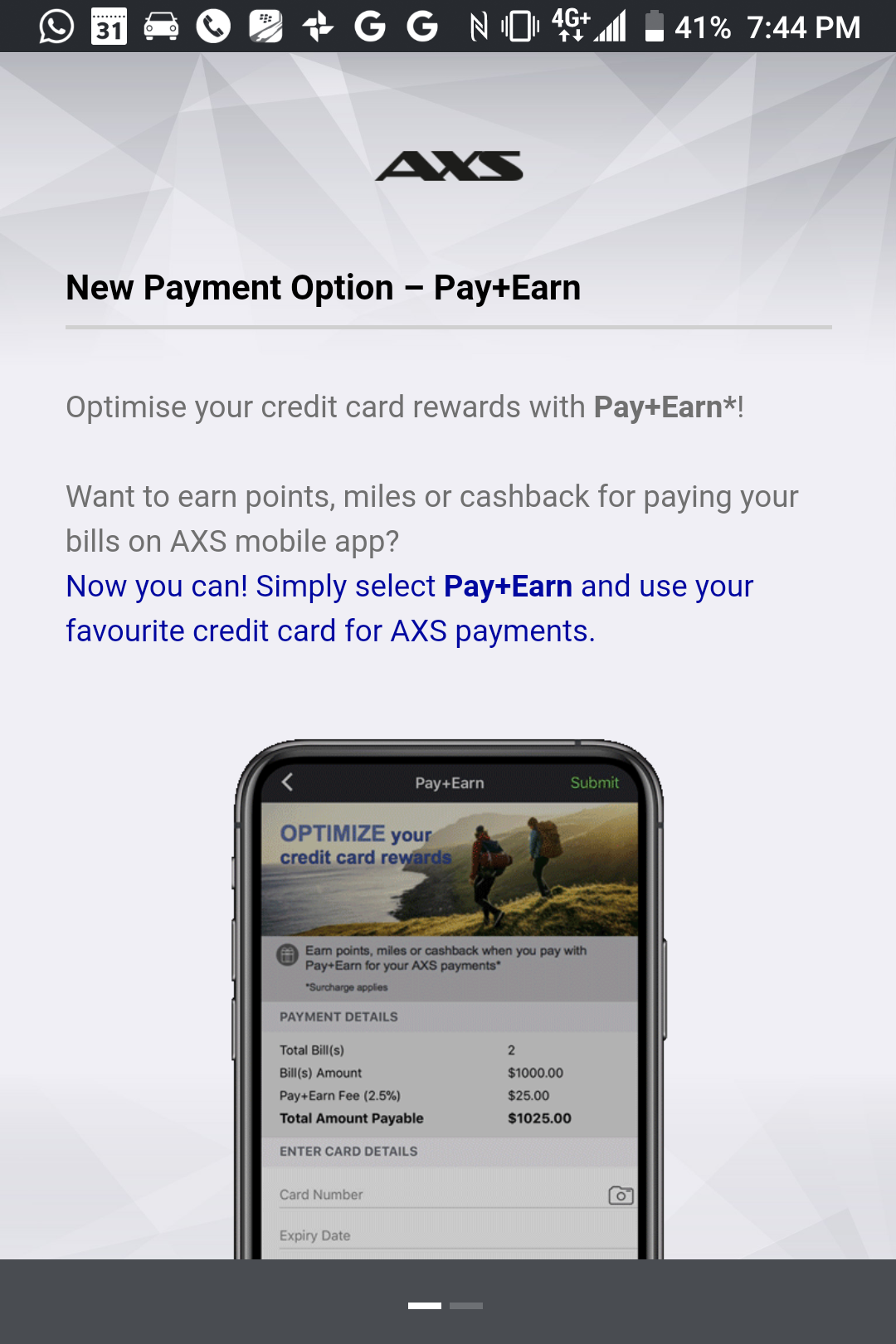

It appears that AXS is preparing to launch a service called Pay+Earn, which lets you earn credit card rewards on bill payments for a small fee. This would put it in direct competition with other bill payment facilities like CardUp, Citi PayAll, and SC EasyBill.

The new feature is mentioned in a pop-up banner when you fire up the m-station app.

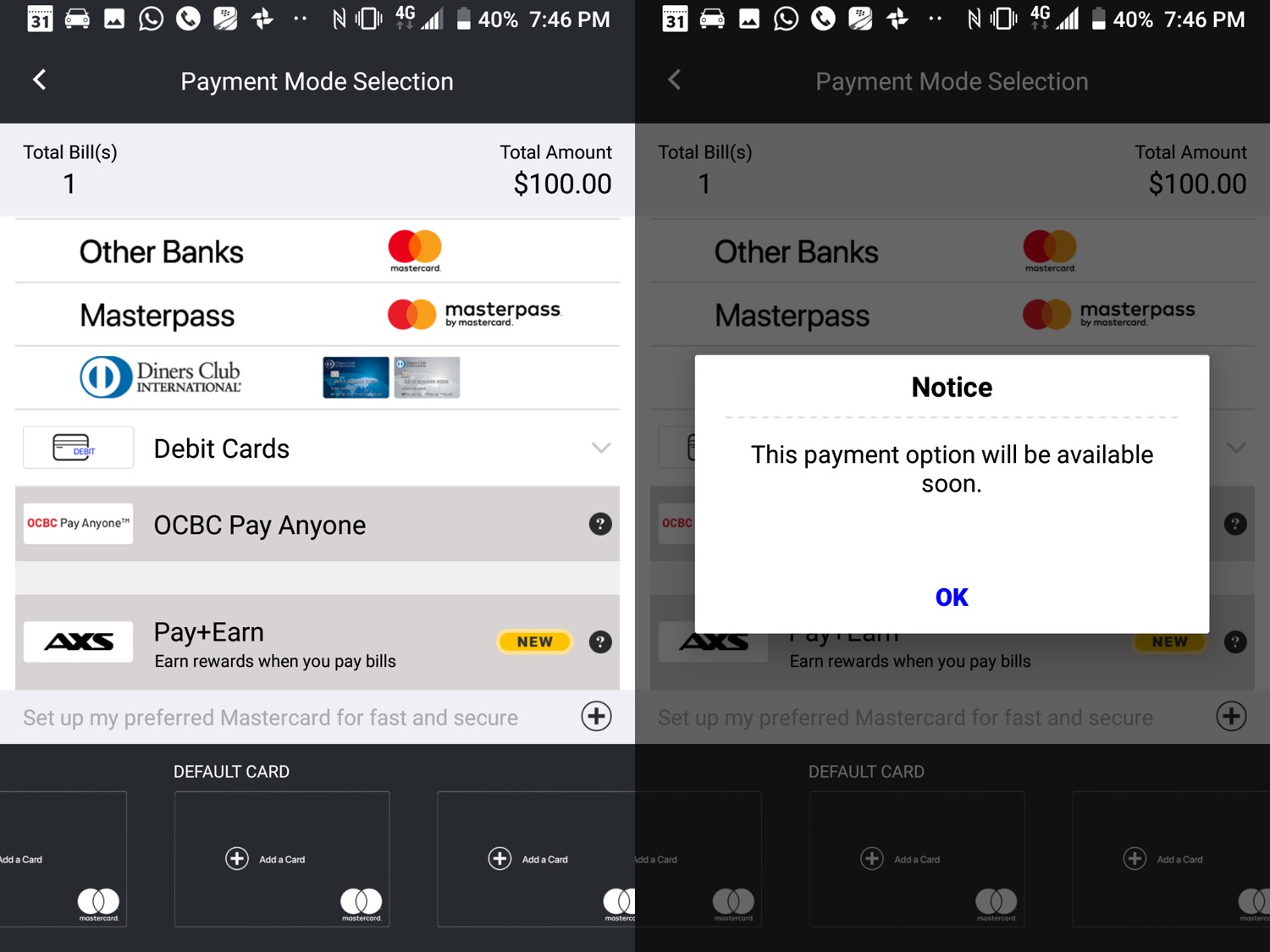

As of now, Pay+Earn has yet to launch. However, it appears as an option during the payment finalization screen, with a notice that it will be available “soon”.

What’s the fee for AXS Pay+Earn?

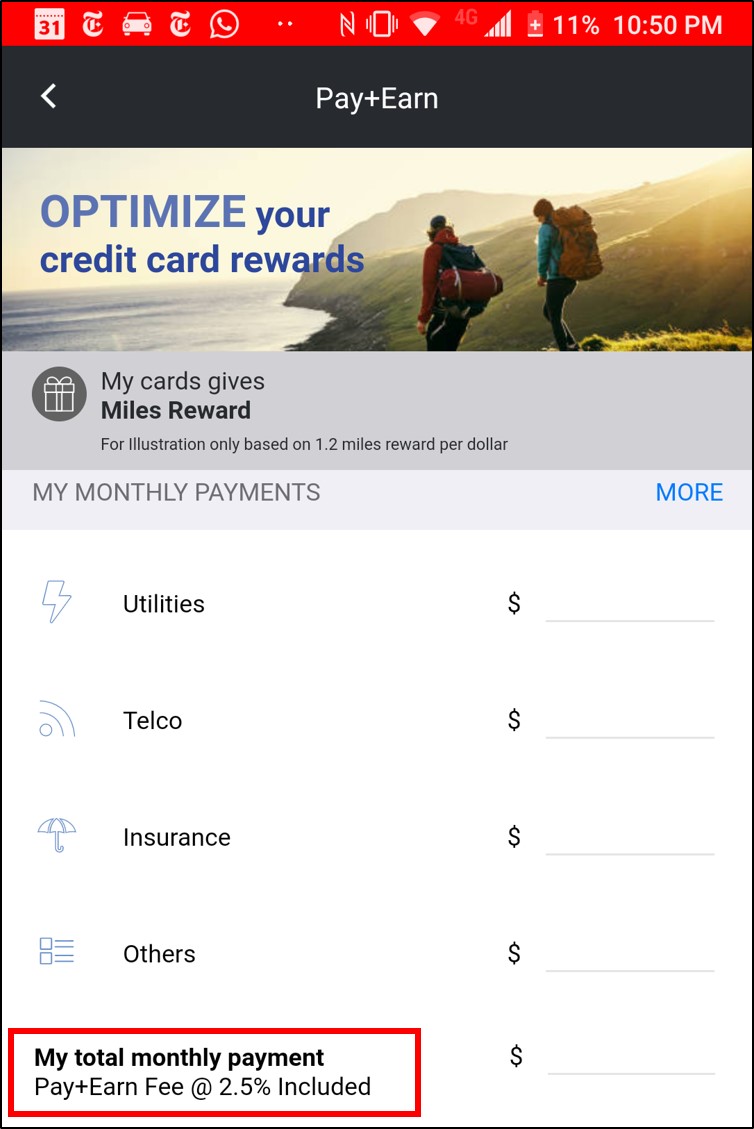

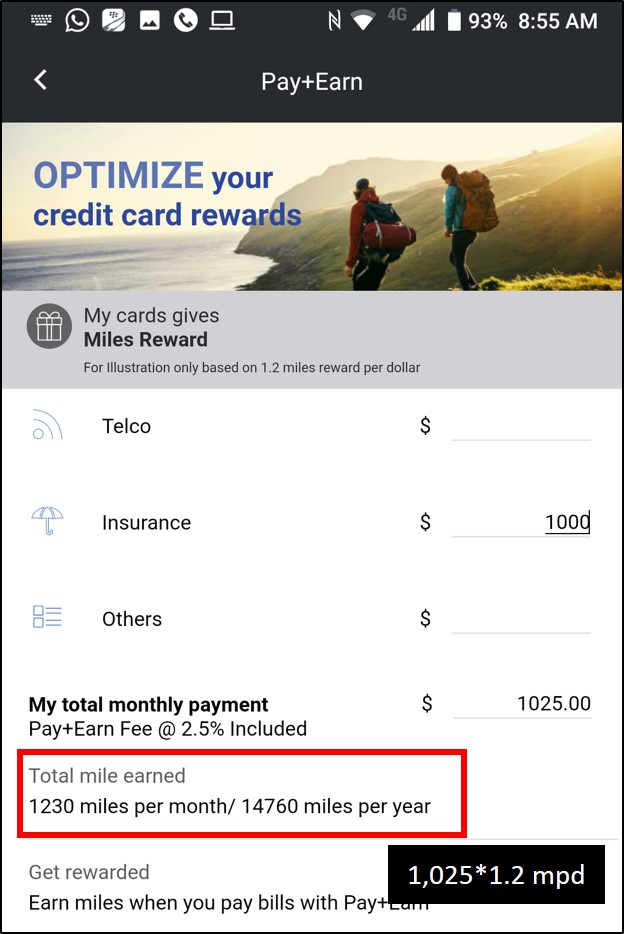

Pay+Earn has a little calculator feature that lets you estimate the number of miles you’ll earn. At the bottom, you can see the fee is a flat 2.5%.

They’ve used a 1.2 mpd credit card as their base case for illustrating the number of miles you’ll earn. Both the bill payment and the fee will earn miles, just like with CardUp.

Now, a 2.5% fee is higher than competitors like CardUp or Citi PayAll, and means that Pay+Earn will be less competitive no matter what credit card you use.

2.5% Fee 2.5% Fee |

2.25% Fee 2.25% Fee |

2% Fee 2% Fee |

|

DBS Altitude Visa DBS Altitude Visa OCBC VOYAGE OCBC VOYAGE Citi PremierMiles Visa Citi PremierMiles Visa SCB X Card SCB X Card OCBC 90N Card OCBC 90N Card |

2.03 | 1.83 | 1.67 |

Citi Prestige Citi Prestige |

1.88 | 1.69 | 1.54 |

UOB PRVI Miles Visa/Mastercard UOB PRVI Miles Visa/Mastercard SCB Visa Infinite (Spend ≥$2K per month) SCB Visa Infinite (Spend ≥$2K per month) UOB Visa Infinite Metal Card UOB Visa Infinite Metal Card |

1.74 | 1.57 | N/A |

BOC Elite Miles Card BOC Elite Miles Card |

1.63 | 1.47 | N/A |

UOB Reserve  DBS Insignia DBS Insignia OCBC VOYAGE (BOS/Premier Banking) OCBC VOYAGE (BOS/Premier Banking) Citi ULTIMA Citi ULTIMA |

1.52 | 1.38 | 1.25 |

| I’ve only considered general spending cards here because it’s highly unlikely that any 4 mpd opportunities will exist for Pay+Earn (and if they do, they’ll be nerfed rather quickly) |

Therefore, AXS is either counting on:

- Customers being unaware of alternatives to Pay+Earn, or

- Customers wanting to make payments not supported by competing services

What kind of payments are covered by AXS Pay+Earn?

The following types of payments are listed in the Pay+Earn calculator.

- Utilities

- Telco

- Insurance

- Town Council

- Education

- Membership

- Government

- MCST

- Others

Whether or not they’re exhaustive remains to be seen, but there’s an “others” category which leads me to believe that AXS wants to roll this out for all types of bill payments. Note the absence of “credit cards” as a bill payment category; I’m 100% certain this won’t happen, so don’t get your hopes up.

I also don’t think they’ll enable Pay+Earn for fines, or top-ups. It’s complicated to position the former (“earn rewards for being a menace to society!”), and the latter has too many potential MS issues.

What we don’t know yet

The main question I have about Pay+Earn is how AXS plans to ensure that rewards points are issued- after all, that’s the very reason for the service’s existence.

It’s no secret that every bank in Singapore already blocks AXS transactions from earning any rewards points, so I’m guessing they’re going to have to process Pay+Earn transactions over a different MCC. The MDR (merchant discount rate) that AXS pays on such transactions will be higher, and your fee will go towards covering the rewards.

We also don’t know whether they’ll have any “launch partner” banks where rewards will be guaranteed. I could see this as a way for banks without payment facilities of their own (e.g DBS, HSBC) to enter the space without needing to set up the infrastructure themselves. I don’t know if Citibank or SCB would be quite so enthusiastic at a potential source of cannibalization (even though their fees are more competitive).

Conclusion

That’s all we know for now, and I expect there’ll be greater publicity closer to launch.

Ultimately whether you find Pay+Earn useful depends on how you value a mile, and the alternatives available to you. CardUp and Citi PayAll are no doubt cheaper, but there may be certain types of payments they don’t support where Pay+Earn could come in handy.

(HT: WH)

Dbs owns axs

Cardup is actually quite crappy with a minimum fee for payments below $130.

I’m currently using AXS for MCST condo maintenance fees payment (can come up to 1k+ every quarter) with no miles earned. Unless Cardup offers MCST payments, this might be an option for me to get some mileage (pun not intended) out of my MCST payments

Cardup does offer MCST payments.

It probably works pretty well with government related bills (HDB housing loan repayments, SP Utilities and Town Councils) despite the 2.5% fee, since i don’t see CardUp / iPayMy handles such transactions.

1.2 mpd costing at 2.03 cpm, but that’s the only option if one is miles hungry at this point, trying to grab every miles-earning opportunity you can. As of now, there is absolutely no way we can earn miles on these government related bills that I mentioned above, thus this one is definitely a good opportunity, depends on how you value your miles.