Of all the elite credit cards in Singapore, not one of them even comes close to matching the mythos of the American Express Centurion Card.

Colloquially known as the Black Card, the product was actually launched in 1999 in response to urban legends that circulated throughout the 80s and 90s about a super-exclusive card that American Express issued only to the wellest of the well-heeled.

Today, the Centurion is held by celebrities, CEOs, and crazy rich Asians the world over. It’s been featured in rap songs and novels, spawned shameless knock-offs, and entered the public consciousness as the ultimate status symbol.

But all that power doesn’t come cheap, and in Singapore, you’ll pay S$7,490 a year, every year, for the privilege of being a card-carrying member. Is it worth it? Let’s find out

| As with every super premium card, there are bound to be some unpublished and ad-hoc benefits. If you’re familiar with these, do share them in the comments below. |

How do you qualify for an AMEX Centurion?

Here’s a question as old as time immemorial. How do you get an invitation to join the ranks of the fabled Black Card? The qualification criteria is shrouded in secrecy, but from what I understand, successful applicants:

- Have an NOA showing more than S$1 million in income

- Spend at least S$300,000 a year on the AMEX Platinum Charge

Now, there’s some wriggle room here, and I have heard of people getting approved with lower incomes or spending. However, there’s also a hard cap on the maximum number of members in a given country at a time. That’s because AMEX is particular about service, and if they don’t have enough relationship managers at the moment, they won’t be able to take on additional members.

If you really want an AMEX Centurion invite, your best bet is to have a demonstrated history of six-digit spending on the AMEX Platinum Charge.

Or be a celebrity.

Not a YouTube celebrity.

AMEX Centurion Basics

| Income Req. | Annual Fee | Miles from Annual Fee | FCY Fee |

| S$500,000 | S$7,490 (Joining fee of S$7,490) |

None | 2.95% |

| Local Earn | FCY Earn | Special Earn | Points Validity |

| 0.98 mpd | 0.98 mpd | 8.0 mpd on EXTRA merchants | No expiry |

Here’s a sobering thought: before you even spend the first dollar on your AMEX Centurion, you’ll be out of pocket S$14,980. In addition to the S$7,490 annual fee, all cardmembers pay a further S$7,490 initiation fee. It’s like hazing, but with more zeros.

For comparison, other top-tier cards like the Citi ULTIMA and the DBS Insignia will “only” set you back S$4,160 and S$3,210 respectively. Quite simply, the AMEX Centurion is in a league of its own when it comes to cost. Oh, and don’t even think of asking for an annual fee waiver- if Kayne West pays his annual fee, so do you.

Centurion members get two supplementary Centurion cards, and an additional two Platinum Charge cards free for whoever they wish.

It’s been rumoured that the Centurion card has no fixed credit limit. Whether that’s truth or urban legend I have no idea, but this I do know: if you’re hoping to rake up the miles quickly, this isn’t the right card to use.

That’s because the AMEX Centurion card is a benefits card more than a miles card. You earn 2.5 Membership Rewards (MR) points per S$1.60 spent in Singapore or overseas, which works out to 0.98 mpd. I don’t need to tell you that’s way below every other miles card in Singapore.

On the bright side, the first S$16,000 of spending per calendar year at EXTRA partners earns 20.5 MR points per S$1.60, or 8 mpd. This includes merchants like American Tourister, Breitling, Fred Perry, Hublot, IWC, Lee Hwa Jewellery, Montblanc, and other chi chi places. Any spending in excess of S$16,000 earns 10.5 MR points per S$1.60.

Members who spend at least S$250,000 in a calendar year will receive a bonus of 100,000 MR points, or 62,500 miles. This represents an incremental 0.25 mpd, assuming you spend S$250,000 on the dot.

MR points never expire, and Centurion members can transfer them to eight different frequent flyer programs and two hotel partners at the following ratios (no conversion fees apply):

| Transfer Ratio (MR Points: Partner Miles/Points) |

|

|

400: 250 |

| 400:250 | |

| 400:250 | |

| 400:250 | |

|

400:250 |

|

400:250 |

|

400:250 |

|

400:250 |

|

1000:1250 |

|

1000:1000 |

Welcome vouchers

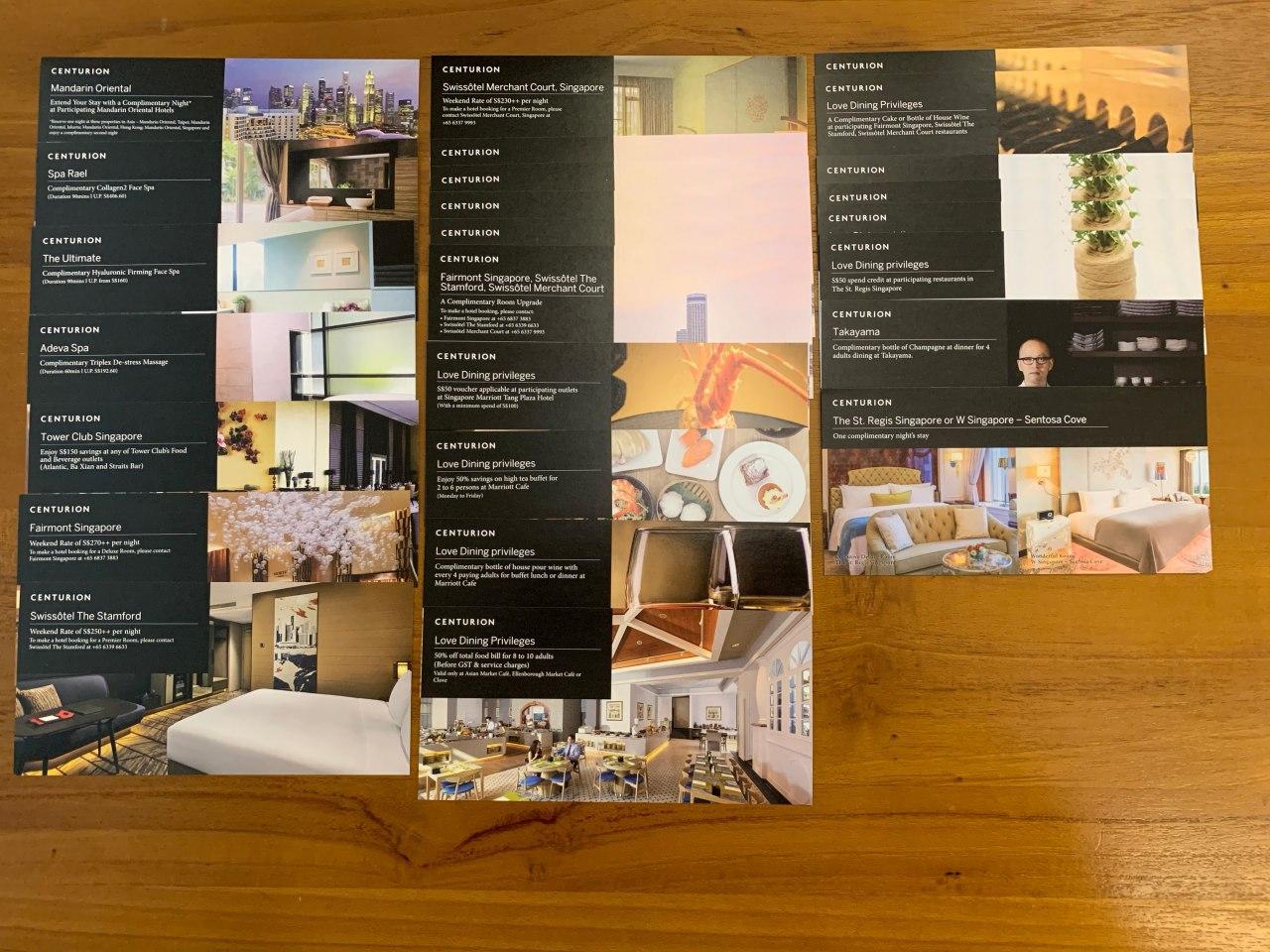

Upon approval or renewal, Centurion members receive a pack of vouchers that includes the following:

- S$150 Tower Club F&B voucher

- Complimentary one night stay at St Regis Singapore/W Singapore

- 4 x S$50 St Regis Singapore dining voucher

- 3 complimentary spa treatments at Spa Rael, The Ultimate and Adeva Spa

- Buy one night get one night free at selected Mandarin Oriental hotels

- S$50 Marriott Tang Plaza Hotel (min S$100 spend)

- Assorted Love Dining vouchers

- Assorted upgrade and special rate vouchers at the Fairmont/Swissotel Stamford

This is largely similar to what AMEX Platinum Charge cardholders get, with a few exceptions. Platinum Charge cardholders…

- Receive a S$400 hotel and S$400 airline credit voucher

- Only get a S$100 Tower Club F&B voucher

- Don’t receive the buy one get one Mandarin Oriental hotels voucher

By the way, in case you were hoping that paying the S$7,490 initiation fee got you a second set of vouchers, don’t. You receive one set of vouchers per annual fee paid.

Extensive airport lounge access, with guests

Among the elite cards in Singapore, the AMEX Centurion’s lounge access is unrivaled.

The principal cardholder and one supplementary member each receive an unlimited-visit Priority Pass with two free guests (vs one for the AMEX Platinum Charge). On top of that, all AMEX Centurion cardholders (whether principal or supplementary) enjoy access to:

- Delta Sky Clubs (when flying on Delta Airlines)

- International American Express Lounges (guest allowance varies)

- The Centurion Lounges (+2 guests)

- Escape Lounges in the USA (+2 guests)

- Plaza Premium Airport Lounges (+2 guests)

Although some of these lounges could anyways be accessed via Priority Pass, this mechanic means you get a larger guest allowance. For example, a Centurion cardholder visiting a Plaza Premium lounge could bring two guests by virtue of the Centurion card, and a further two guests by virtue of the Priority Pass.

Complimentary airport limo + meet & greet service

Centurion members enjoy complimentary two-way limo transfers to and from Changi Airport when they book a First or Business Class ticket through The Centurion Concierge. Up to four guests can be accommodated in the same vehicle, and the benefit only applies to the principal cardholder.

In addition to this, principal Centurion cardholders receive complimentary meet and greet services at selected airports worldwide, provided they’re flying in First or Business Class and booked their tickets through The Centurion Concierge. When flying to/from Mainland China, however, Economy Class travel is also eligible (except on low cost carriers).

Instant hotel elite status with five chains

Centurion cardholders enjoy instant elite status with the following programs (normal qualification requirements in brackets)

- Hilton Honors Diamond (60 nights)

- Shangri-La Golden Circle Diamond (50 nights)

- IHG Platinum Elite (40 nights)

- Radisson Rewards Gold (30 nights)

- Marriott Bonvoy Gold (25 nights)

That’s an impressive list, and it’s noteworthy that they get top-tier status with both Hilton and Shangri-La. These can lead to some significant savings during the course of your stay, not to mention the occasional snazzy upgrade.

Hilton Diamond members enjoy:

- 100% points bonus

- Room upgrades

- Complimentary breakfast

- Complimentary high-speed premium internet

- Late check-out

- Guaranteed lounge access

- A welcome gift at check-in

Shangri-La Golden Circle Diamond members enjoy:

- 50% points bonus

- Room upgrades

- Complimentary breakfast

- 8 a.m check-in

- 6 p.m check-out

- Guaranteed lounge access

- A choice of three welcome amenities, including wine, beer and mineral water

Shangri-La Diamond members are also eligible for a fast track to KrisFlyer Elite Gold under the Infinite Journeys partnership. All they need to do is make one eligible (non-award) flight within four months of registration. Even deep-discount Economy Class tickets qualify, so this is a veritable walk in the park.

Instant Emirates Skywards Gold

Centurion members get instant Emirates Skywards Gold status, the second highest status in the program. This normally requires 50,000 tier miles or 50 flights.

Skywards Gold members enjoy:

- 50% bonus miles

- Complimentary lounge access (including Qantas lounges)

- Complimentary seat selection

- Excess baggage allowance

- Priority baggage delivery

- Priority check-in and boarding

- Priority waitlisting

Anecdotally speaking, you’ll also have a decent chance of enjoying upgrades when you fly on Emirates- definitely more so than Singapore Airlines elite members.

Instant rental car elite status with Avis/Hertz

Centurion cardholders receive instant Avis President’s Club and Hertz President’s Circle status.

Avis President’s Club status is the second highest tier in the Avis program:

- Avis Preferred

- Avis Preferred Plus

- Avis President’s Club

- Avis Chariman’s Club

This tier doesn’t have a published qualification threshold, and is an invitation-only level. Benefits include two-class upgrades, along with guaranteed availability even without a reservation. There’s also a rental discount of up to 30%.

Likewise, Hertz President’s Circle is the second highest tier in Hertz program.

- Hertz Gold

- Hertz Five Star

- Hertz President’s Circle

- Hertz Platinum

This tier normally requires 20 or more rentals per year, or at least US$4,000 in spending. Benefits include one-class upgrades, 50% bonus points and guaranteed vehicle availability.

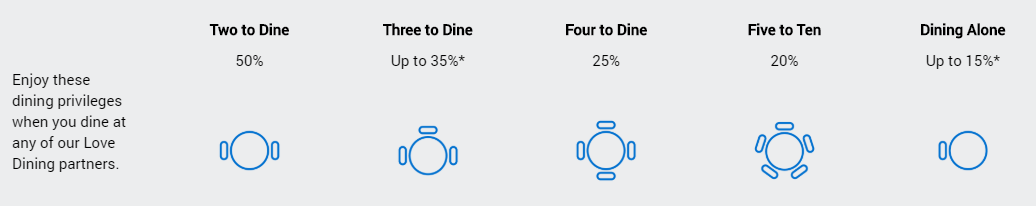

Up to 50% off with Love Dining

This benefit isn’t exclusive to the AMEX Centurion, but it’s still worth mentioning since it can give fantastic value.

AMEX Centurion cardholders enjoy up to 50% off dining at selected restaurants and hotels through the Love Dining program. This includes places like Mikuni, Yan Ting, 15 Stamford, and SKIRT, and is easily one of the best dining privilege programs out there.

Needless to say, Centurion cardholders will also be able to get reservations at some of the most sought-after restaurants around the world. It’s supposedly the concierge’s forte, although apparently the “secret” is to buy a couple of tables in AMEX’s name at a given restaurant.

Discounted premium cabin tickets, private club access

Other benefits of the Centurion card include discounted premium cabin tickets through the International Airline Program, access to the Tower Club, access to special rates for private jets, cruise perks and complimentary golf.

Some of these benefits overlap with the Platinum Charge card, so I won’t go over them again here.

How does the AMEX Centurion compare to other elite cards?

If you just look at benefits alone, none of the Citi ULTIMA, UOB Reserve or DBS Insignia even come close to challenging the AMEX Centurion. Whether it’s lounge access, elite status, dining privileges or just that general feeling of superiority, the AMEX Centurion towers over the competition.

Unfortunately, so does its annual fee. The Centurion takes pay-to-play to new levels, with an annual fee that’s 2X everyone else’s (let’s not forget the initiation fee too). That’s why I feel it’s somewhat unfair to draw straight comparisons between the AMEX Centurion and other elite cards- how do you account for the gulf in cost?

I think the short answer is “you can’t”, so that’s just something that people will have to decide for themselves. That said, my guess is that most Cenutrion cardholders consider the annual fee ’tis but a scratch, and if you’re the sort for whom a S$7,490 annual bill would cause concern, you’re probably not the right profile anyway.

Conclusion

What I’ve listed here are the published benefits of the Centurion. It goes without saying that there may very well be a whole suite of unpublished perks that further sweeten the deal- but the only way you’ll find out is to get a foot in the door (some of the stuff that US cardholders get is listed here)

While it’s clear that the Centurion is not the right card for rapid miles accumulation (unless, perhaps, you’re shopping at EXTRA merchants), I don’t think it was created with the miles-chasing audience in mind. This is the card for the guy who drops $170M on a painting, or wants a concierge who knows what they need before they ask (check out some interesting stories here), or simply loves the idea that they’re holding one of the most exclusive pieces of metal anywhere on the globe.

If you’re one of those folks, then you may very well find the AMEX Centurion right up your alley. Just promise me you won’t turn out like one of these guys.

Bonvoy Gold is a typo error?

Yes bonvoyed another different way again. It’s really gold…..

i’m sure centurion cardholders are as surprised as you 🙂

Bonvoy Gold has really little value even if it is not the lowest tier………

But Centurion holders who are billionaires and Bill Gates who stay at penthouse and presidential suites won’t bother with Bonvoy, unlike majority of us

It’s about access. The discounts and upgrades don’t really matter for this group of people (but still nice to have). You’d have to be away from home a lot to make it up to 7.5-15k of discounts – this level of affluence usually allows a less peripatetic/nomadic lifestyle. And these people would already travel and stay as they wish without the potential hazard of maybe not getting an upgrade. Nope it’s about having access 365 days a year to a discrete Fixer/ top NYC hotel concierge/Clefs d’Or who can get spots for any event/venue/restaurant anytime. Not even the best PA’s… Read more »

always find it is funny, the target client who earns over a million annually probably don’t need any lounge access or hotel elite membership, can’t imagine they are not taking Business or First, staying in a crappy hotel without an upgrade, can’t afford to pay the suite. Some of the benefits are really jokes. It is like laughing at them that they don’t have club membership, don’t have their own limo.

I got KrisFlyer Elite Gold by the Shangri-la diamond fast track last year, however this year downgrade to a normal member without receiving the extension letter.

Your fast track status is only valid for 1 year. Subsequently you will need to re-qualify through regular means.

I’m not sure if you’ve heard of this but some of the Amex’s Centurion lounges, have a ‘hidden’ Centurion member only space. Check-out this review of the AMEX Centurion Dining Room at HKG: https://www.executivetraveller.com/dining-at-hong-kong-s-invitation-only-amex-centurion-lounge-restaurant

They have indeed Centurion only member private lounge where you are served by personal waiters. For example in HK.Nothing to shout about but nice experience though.

I recall the days when the product and an annual card fees $2.5K and initiation fee $7.5K. The world is changing. I wonder if the product will appeal to the next generation.

I once ordered a unicorn from amex centurion concierge… all I got was horse with a rainbow colored paper horn on it. I paid for it of course…

Sorry I ordered the last 5 unicorns. You could have had a narwhal if you asked though.

The perfect card to have when the ego pays the bills!

Will you still get the diamond status and krisflyer gold if you renew the Amex Plat Charge ?

The service you get (good to excellent to near perfection) is highly dependent on your relationship manager.You will rate them every few months. The annual is steep but I consider this like joining a country club with local and international benefits. I use my investment profits and dividends to pay for this. Some recent perks you get include getting double and bonus reward points for all purchases (ceased on 20th July) and getting $750 rebate from certain purchase. There are some free hotel stays as vouchers and you will get invited to exclusive events and dinners where you will meet… Read more »

I’ve been in retail most of my life, and I’ve come to appreciate the difference between the ‘rich’ and the rich, partly from my interactions with centurion card holders. I think I’ve had… 4 centurion card customers in my life, and you could not tell that they were rich. They behaved and dressed liked normal people. No posturing of any kind, verbal or physical (like trying to ‘subtly’ show off a watch, or talk loud about some big purchase/deal). And they were the best customers. Kind, polite, considerate etc. I’m sure there are the fair share of dicks with theses… Read more »