The HSBC Revolution will be getting a major upgrade from 1 August 2020, which turns it from also-ran to virtually essential.

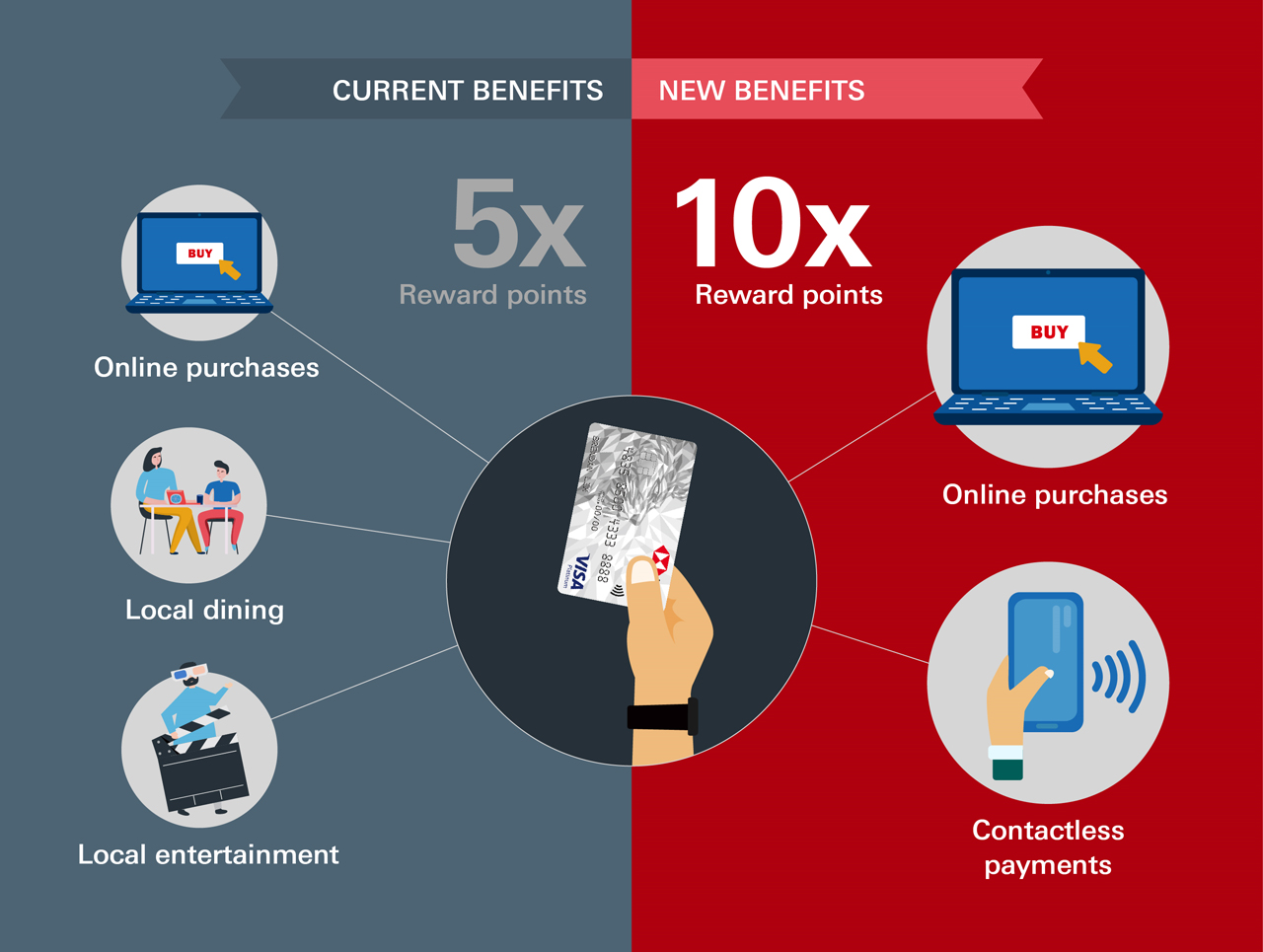

Gone is the anemic 2 mpd on online spending, dining and entertainment. In its place comes a beefy 4 mpd on online spending and offline contactless payments. It’s going to give the HSBC Revolution a new lease of life, and I for one am excited.

But some of you may have spotted how similar the new HSBC Revolution will be to a tried-and-tested incumbent: the UOB Preferred Platinum Visa. How exactly do the two cards measure up, and which one’s the better option?

Let’s take a look.

How do the requirements and annual fees compare?

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| Income Requirement | S$30,000 | S$30,000 |

| Annual Fee | None | S$192.60 (First year free) |

| Application Link | Apply Here | Apply Here |

Both the HSBC Revolution and UOB Preferred Platinum Visa are entry-level credit cards with S$30,000 income requirements.

When it comes to annual fees, however, it’s no contest. From 1 August 2020, the HSBC Revolution will scrap its S$160.50 annual fee, becoming a free-to-hold credit card. This represents phenomenal value, considering the fact you’ll also get a complimentary copy of The Entertainer too.

The UOB Preferred Platinum Visa, on the other hand, has a S$192.60 annual fee that’s waived for the first year. In theory, it shouldn’t be too difficult to secure a waiver in subsequent years- I’ve never had any issues. That said, YMMV, and you’ll need to watch out for UOB’s automatic points deductions for annual fee waivers.

What bonus categories does each card have?

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| Regular Spending | 0.4 mpd | 0.4 mpd |

| Online Shopping | 4 mpd (Whitelist) |

4 mpd (Whitelist) |

| Offline Contactless | 4 mpd (Whitelist) |

4 mpd (Blacklist) |

| Monthly Cap | S$1,000 | S$1,110 |

On paper, the HSBC Revolution and UOB Preferred Platinum Visa have very similar bonus categories. They both offer 4 mpd on online shopping and offline contactless payments, with the UOB Preferred Platinum Visa enjoying a monthly cap that’s 11% higher.

| ❓ Why S$1,110 for the UOB Pref. Plat Visa? |

|

UOB’s T&Cs state that “The total UNI$ awarded to you from qualifying spend on Selected Online Transactions, Contactless Transactions and/or Mobile Contactless Transactions is capped at UNI$2,000 for each calendar month”. This leads many to conclude the cap is S$1,000 (2,000 @ 10 points per S$5). Not true. In practice, the bonus UNI$ is what’s capped, i.e 9 UNI$ per S$1. Therefore the 4 mpd cap for each month is S$1,110 (2000 @ 9 points per S$5) |

However, there are some important differences in the fine print.

Online shopping

When it comes to online shopping, both HSBC and UOB adopt a “whitelist” approach. What this means is that only specified categories will earn 4 mpd. You can do a full comparison with the T&Cs (HSBC, UOB), but here’s my summary:

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| Attraction Tickets | ✗ | ✔ |

| Cinemas | ✗ | ✔ |

| Department Stores | ✔ | ✔ |

| E-Commerce Merchants | ✔ | ✔ |

| Fashion Stores | ✔ | ✔ |

| Florists | ✔ | ✔ |

| Food Delivery | ✔ | ✔ |

| Gym Memberships * | ✔ | ✔ |

| Supermarkets | ✔ | ✔ |

| Taxis | ✔ | ✗ |

| Travel | ✔ | ✗ |

| *Assuming your gym membership codes under 7997. Some gym memberships may code under 8699 | ||

It’s more or less the same, but do note that only the HSBC Revolution covers travel, and only the UOB Preferred Platinum Visa covers recreation.

Offline Contactless Spending

When it comes to offline contactless spending, the picture changes. HSBC keeps the same “whitelist” approach and categories as for online spending (e.g supermarket transactions earn 4 mpd, whether done online or offline via contactless).

In contrast, UOB adopts a “blacklist” approach. Any offline contactless transaction will earn 4 mpd, so long as the merchant is not on the exclusion list (e.g education, insurance, government agencies, non-profits). This makes the UOB Preferred Platinum Visa a much more idiot-proof option, as you can earn 4 mpd almost everywhere.

| ⚠️ Watch out for SMART$ merchants! |

| With the UOB Pref. Platinum Visa, you won’t earn any miles at SMART$ merchants, such as BreadTalk, Cold Storage, Giant, Jasons, Market Place, Cathay Cineplexes, Shell, SPC (even though it’s technically not a SMART$ merchant) and Guardian. There’s no such restriction on the HSBC Revolution. |

Another point of difference regards eligible contactless payments. You’ll have more options with the UOB Preferred Platinum Visa, which can be added to Apple Pay, Google Pay, Fitbit Pay, and Samsung Pay. The HSBC Revolution only supports Apple Pay at the moment.

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

|

|

✔ | ✔ |

|

✗ | ✗ |

| ✗ | ✔ | |

| ✗ | ✔ | |

| ✗ | ✔ | |

| ✔ | ✗ | |

| You can earn 4 mpd by tapping the physical HSBC Revolution card at a credit card terminal. You can no longer do so with the UOB Preferred Platinum Visa effective 22 May 2020. | ||

How are points calculated and awarded?

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| Earning Blocks | S$1 | S$5 |

| Bonus Credited | End of following month | Immediately |

The HSBC Revolution earns points in blocks of S$1, while the UOB Preferred Platinum Visa, infamously, earns in blocks of S$5.

What does this mean? It means the minimum spending to earn points on the HSBC Revolution is S$1, versus S$5 for the UOB Preferred Platinum Visa. It also means that you’ll lose more miles due to rounding on the latter, because every transaction is rounded down to the nearest S$5.

To illustrate, consider the following:

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| $5 | 20 miles | 20 miles |

| $9.99 | 39.6 miles | 20 miles |

| $15 | 60 miles | 60 miles |

| $19.99 | 79.6 miles | 60 miles |

| $25 | 100 miles | 100 miles |

| $29.99 | 119.6 miles | 100 miles |

On the plus side, it should be easier to reconcile points on the UOB Preferred Platinum Visa, which credits both base and bonus points when the transaction posts.

The HSBC Revolution awards 0.4 mpd when the transaction posts, and the remaining 3.6 mpd as a lump sum figure at the end of the following calendar month.

Which card has better points policies?

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| Points Expiry | 37 months | 2 years |

| Points Pool? | No | Yes |

| Transfer Fee | S$42.80 (per year) | S$25 (per transfer) |

| Transfer Partners |

|

|

| Min Transfer Block | 25,000 points (10,000 miles) |

5,000 UNI$ (10,000 miles) |

HSBC Points have a longer validity period (37 months) than UOB UNI$ (2 years). That might matter for some people who accumulate points at a slower rate, but I don’t think that’s a deal-breaker as such.

UOB pools points across different cards. This means that if you have several UOB cards, you can combine your points and cash them out by paying a single transfer fee of S$25. With HSBC cards, each account must have a minimum of 25,000 points (10,000 miles) before a conversion can be done (you’ll pay a single S$42.80 fee that covers unlimited transfers from all your HSBC cards).

There’s no difference in transfer partners or minimum transfers blocks between HSBC and UOB; both partner with Singapore Airlines and Cathay Pacific, and both require a minimum conversion of 10,000 miles.

What sign-up gifts are on offer?

HSBC Revolution HSBC Revolution |

UOB Pref. Plat Visa UOB Pref. Plat Visa |

|

| Must be new-to-bank? | Yes | Yes |

| Minimum Spending | S$800 in 1-2 months (depends when you open card) |

S$1,500 in 30 days |

| Gift | S$150 cashback or Samsonite Prestige 69cm Luggage | S$150 cashback |

| Capped? | No | First 400 customers |

| Application Link | Apply Here | Apply Here |

| T&Cs | Link | Link |

While the HSBC Revolution and UOB Preferred Platinum Visa both have an offer for new-to-bank customers, the former is clearly the winner.

Spending S$800 on the HSBC Revolution by the end of the calendar month after approval gets you S$150 cashback, or a Samsonite luggage bag. There’s no cap on the number of eligible customers, and they’ll throw in a bonus S$30 of Grab vouchers when you apply using SingPass MyInfo.

The UOB Preferred Platinum Visa requires you to spend S$1,500 within 30 days to get S$150 cashback…and only if you’re in the first 400 customers! That cap, mind you, is shared with all other UOB credit cards, so good luck getting it.

Conclusion

Both the HSBC Revolution and UOB Preferred Platinum Visa will be excellent options for miles collectors. The former has no annual fee, a more beneficial rounding policy, longer points validity and the absence of pesky SMART$ merchants, while the latter boasts a much wider scope for 4 mpd (due to the “blacklist” approach), points pooling, and more mobile wallet support.

Let’s be frank: this whole exercise is a false dichotomy, insofar as there’s nothing stopping you from having both. However, this may bring up the issue of orphan points- if your total monthly spending is more modest, splitting your points across two different banks may create problems down the road.

I’m personally going to be holding both cards, using the HSBC Revolution’s more restrictive 4 mpd cap before the UOB Preferred Platinum Visa’s less restrictive one.

Will you get the HSBC Revolution, the UOB Preferred Platinum Visa, or both?

Thanks Aaron for this wholistic review!

I will still stick to HSBC revo.

You also answered another question for my Fitness First membership charge though.

cheers!

glad it helped! also glad that cards aren’t either/or propositions (most of them, anyway)

Hi, i am curious about fitness first membership too. I am using uob ppv but am not getting the uni$

Hi I am curious about fitnessfirst mcc too. I am using uob ppv and according to whatcard.com, it gives 4mpd. But i am not getting it. Please advise.

Really? i’ve been getting the UNI$ fine for FF membership fees pre CB and pre gym closure.

Hi Bent, i will check with uob. Ty for the info!

I was thinking how many credit cards do you own? because you need to have the card to understand and share the insights at times.

When you open your wallet holy shit you got 30 credit cards. joke ok.

The beauty of mobile wallets like Apple Pay is that you can save the cards in them!

Maximum 12 though, it’s not enough if I were to add all my cards in…

actually, credit cards are different from other consumer products. you couldn’t review a car or laptop or cell phone without owning it and playing around with it. a card, on the other hand, doesn’t really need a “hands on” aspect. at most you learn a few more quirks like customer service and how points are calculated, but beyond that all you need to know is in the terms and conditions.

but anyway i have maybe 15 or so, of which only 5-6 see heavy usage.

Hi Aaron, thanks for the post and info. Do you know what about Petrol Stations? 4 mpd also?

https://milelion.com/2020/01/23/what-are-the-best-credit-cards-for-petrol/

So UOB PP doesn’t earn any miles if the spending is less than $5?

Exactly~that’s why I hate all those $5 block cards

Spend $4.99 = 0 points for UOB PPV

yup. use grabpay for those

Re the hsbc revo transfer fee, it’s stated $42.80 per year, is that charged even if no transfers are made for the year?

If that’s the case it’s going to cost $128.40 just for transfers especially if u only transfer once every 3 years!

you can sign up for it in the year that you want to transfer points.

will get hsbc consider ppv only can use mobile payment. now all wear mask, faceid is troublesome

correct me if im wrong, I thought only UOB cards have unlimited contactless payment limit, the other banks all limited to $100 for contactless payment

These contactless limits were lifted a long time ago. Unless you find a merchant with a very old terminal, there’s effectively no limit

Aaron, can I clarify your paragraph about points pooling? We all know that UOB PPV pools points, so there is less issue with orphan miles. For HSBC, do you mean to say the points pool, or they don’t? For context, I am considering taking up the HSBC Premier card again to pay 1.25cts/mile for their tax facility. At the same time, sign up for HSBC Revolution. Three years later, say if I have 55k points in Premier and 20k points in Revo, does it mean that I can redeem 75k at the same time?

hsbc points DO NOT pool. for example, if i have 10,000 points with HSBC VI and 15,000 points with HSBC Revo, i can’t convert anything (Both amounts are below the minimum 25,000 points block). however, if i have 25,000 points with HSBC VI and 25,000 points with HSBC Revo, I can convert one block from each card while paying a SINGLE annual transfer fee of 42.80. the reason why it’s only a single transfer fee even though the points are not pooled is because hsbc’s frequent flyer conversion program covers unlimited conversions for a 1-year period from ALL cards under… Read more »

Please correct me if i am wrong Aaron…

1) 4mpd starts on 1 Aug.

2) sign-up offer requires spending $800 within the same month of approval to get $150 cash back.

This means if i were to apply for it today and get approved within the next few days, I will need to spend $800 in July 2020 to get the $150 cash back, but this $800 spending will not get me 4mpd?

In order to get both 4mpd on $800 + $150 cash back, I should only aim to only get the card approved from 1 Aug onwards?

I suppose contactless transactions at clinics like EagleEye does not fall under HSBC whitelist, correct? I don’t see anything ‘clinic’ or ‘health’ related

where does this leave OCBC TR? Given the abundance of online shopping cards now.

When you have a big purchase exceeding the monthly caps of Revo and PPV card?

Mainly miles claims that HSBC revo rounds points to the nearest dollar instead of rounding down like other cards.

Would Favepay qualify for 10x on hsbc Revo?

I am waiting to find out about this as well.

Was told by HSBC officer that transactions in FCY do not earn points. Does anyone know if this is true?