“What’s the best card to use for petrol?” is always a tricky question, not because I don’t know which cards give the most miles, but because of all the discounts involved.

You see, petrol pricing in Singapore is a complicated thing. You pull up to the pump and ask for S$50 of petrol, only to go to the register and pay S$45. Discounts are great, don’t get me wrong, but the complicated layers of bank, site and chain discounts make it difficult to do price comparisons on the fly.

In this post we’ll look at how you can enjoy the best of both worlds: miles and discounts.

| 💳 What’s the Best Card for… | ||

| ❓ Overall Guide |

||

| ✈️ Air Tickets |

🌎 Amaze | 💗 Charity |

| 🍽️ Dining |

🏫 Education | 🥡 Food Delivery |

| 🏨 Hotels | ☂️ Insurance |

📱 Kris+ |

| ⚕️ Medical | ⛽ Petrol | 🚍 Public Transport |

| 🛒 Supermarkets | 🚰 Utilities | |

Miles or discounts?

If the question is which card gives the most miles, period, then we can end the post here because the answer is pretty straightforward:

| ⛽ Highest Miles Earning Cards for Petrol |

||

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s Card |

6 mpd* | Max. S$1K per c. month, must declare Transport as quarterly 10X category |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

6 mpd* | Max. S$3K per c. month, must declare Transport as quarterly 10X category |

UOB Visa Signature UOB Visa Signature |

4 mpd^ | Min. S$1K spend on petrol + contactless per s. month, max. S$2K |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

4 mpd^ | Max. S$1.1K per c. month, must use mobile payments |

Maybank World Mastercard Maybank World Mastercard |

4 mpd | |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

4 mpd | Max. S$1K per s. month |

| C. Month= Calendar Month, S. Month= Statement Month *Ends 31 Mar 24, after which 4 mpd ^Excludes SPC |

||

Where it gets complicated is that the best card from a miles perspective may not necessarily be the best card from a discounts perspective.

As much as I want to maximise the miles I earn, at the end of the day it still boils down to what’s a better deal. If Chain X offers a 10% discount and 6 mpd, but Chain Y offers a 90% discount and no miles, you can bet I’m going for the latter.

So I hope you have your value of a mile figure handy, because you’re going to need it for this post; it’s how you evaluate whether trading an X% discount for Y miles makes sense.

Two more points before we get started:

- I’m going to be focusing on the cards that represent a good trade-off between miles and discounts. If you’re interested in pure cashback, this isn’t the article for you.

- I’m going to assume you’re pumping 92/95 grades. Petrol stations may give slightly higher discounts for premium grades like Shell V-Power or Caltex Platinum 98

Shell

Membership discount

Anyone with the free-to-use Shell Go+ app (Android | iOS) will receive a 10% discount.

Shell Go+ App Shell Go+ App |

10% discount (min. S$20 spend) |

Credit card discounts

| Bank | Additional Discount |

|

+4% |

| +4% | |

| +4% (+7% for UOB Reserve) |

Citi, HSBC and UOB cardholders receive a further 4% discount (total: 14%) at Shell.

While UOB’s T&Cs explicitly state that Shell transactions do not earn UNI$, it’s been well documented that they actually do. But since this is an unofficial feature, UOB could “fix” it at any time without warning.

| Card | Discount | Earn Rate |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

14% | 6 mpd1 |

UOB Lady’s Card UOB Lady’s Card |

14% | 6 mpd1 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

14% | 4 mpd2 |

UOB Visa Signature UOB Visa Signature |

14% | 4 mpd3 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

10% | 4 mpd4 |

Maybank World Mastercard Maybank World Mastercard |

10% (15% with the Corporate Fuel Card) |

4 mpd |

UOB Reserve UOB Reserve |

17% | 1.6 mpd |

Citi Prestige Citi Prestige |

14% | 1.3 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

14% | 1.25 mpd5 |

Citi PremierMiles Citi PremierMiles |

14% | 1.2 mpd |

| 1. Must select Transport as quarterly bonus category. Earn rate decreases to 4 mpd from 1 March 2024. Capped at S$1,000 per c. month (Lady’s) or S$3,000 per c. month (Lady’s Solitaire) 2. Must use mobile contactless payments. Capped at S$1,110 per c. month 3. With min. S$1,000 spend on petrol + local contactless in a s. month 4. Capped at S$1,000 per s. month 5. With min. spend of S$50K in previous membership year. If <S$50K or first year of membership, 1 mpd |

||

SPC

Membership discount

All SPC&U Cardholders receive a 10% discount.

SPC&U Card SPC&U Card |

10% discount |

Credit card discounts

| Bank | Additional Discount |

|

+11% |

| +5% | |

| +5% (+S$3 off every S$51 nett petrol purchase till 31 Mar 24) |

American Express cardholders enjoy a further discount of 11% (total: 21%) at SPC, broken down as follows:

- 10% SPC&U card discount

- 5% AMEX discount

- 7.1% statement credit on final charge amount (registration required, capped at S$120 per card)

Do note that American Express cards will not earn any miles on SPC transactions, however.

DBS and UOB cardholders enjoy a further 5% discount (total: 15%) at SPC, with UOB cardholders receiving a further S$3 off every S$51 nett purchase (i.e. after all station discounts and coupons are deducted).

SPC transactions are explicitly excluded from earning rewards with UOB cards, but like Shell, it’s different in practice. The latest data points I have suggest that the UOB Preferred Platinum Visa and UOB Visa Signature will not earn miles for SPC, but the UOB Lady’s Cards will.

| Card | Discount | Earn Rate |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

15% | 6 mpd1 |

UOB Lady’s Card UOB Lady’s Card |

15% | 6 mpd1 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

10% | 4 mpd2 |

Maybank World Mastercard Maybank World Mastercard |

10% | 4 mpd |

DBS Insignia DBS Insignia |

15% | 1.6 mpd |

DBS Vantage DBS Vantage |

15% | 1.5 mpd |

DBS Altitude Card DBS Altitude Card |

15% | 1.3 mpd |

| 1. Must select Transport as quarterly bonus category. Earn rate decreases to 4 mpd from 1 March 2024. Capped at S$1,000 per c. month (Lady’s) or S$3,000 per c. month (Lady’s Solitaire) 2. Capped at S$1,000 per s. month |

||

Esso

Membership discount

All Esso Smiles Cardholders receive a 10% discount.

Esso Smiles Card Esso Smiles Card |

10% discount |

Credit card discounts

| Bank | Additional Discount |

|

+4% |

| +4% (+8% for Insignia and Vantage) |

|

| +4% |

Citibank, DBS and OCBC cardholders receive a further 4% discount at Esso (total: 14%). DBS Insignia and DBS Vantage Cards receive a further 8% discount (total: 18%).

Drivers who pump the premium Synergy Supreme+ grade will be eligible to double dip on KrisFlyer miles and Esso Smiles points, earning the equivalent of 2 mpd on top of credit card miles. Registration is required, and can be done via this link.

| Card | Discount | Earn Rate |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

10% | 6 mpd1 |

UOB Lady’s Card UOB Lady’s Card |

10% | 6 mpd1 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

10% | 4 mpd2 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

10% | 4 mpd3 |

UOB Visa Signature UOB Visa Signature |

10% | 4 mpd4 |

Maybank World Mastercard Maybank World Mastercard |

10% | 4 mpd |

DBS Insignia DBS Insignia |

18% | 1.6 mpd |

Citi ULTIMA Citi ULTIMA |

14% | 1.6 mpd |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

14% | 1.6 mpd |

DBS Vantage DBS Vantage |

18% | 1.5 mpd |

Citi Prestige Citi Prestige |

14% | 1.3 mpd |

OCBC 90°N Cards OCBC 90°N Cards |

14% | 1.3 mpd |

OCBC VOYAGE OCBC VOYAGE |

14% | 1.3 mpd |

DBS Altitude Card DBS Altitude Card |

14% | 1.3 mpd |

Citi PremierMiles Citi PremierMiles |

14% | 1.2 mpd |

| 1. Must select Transport as quarterly bonus category. Earn rate decreases to 4 mpd from 1 March 2024. Capped at S$1,000 per c. month (Lady’s) or S$3,000 per c. month (Lady’s Solitaire) 2. Capped at S$1,000 per s. month 3. Must use mobile contactless payments. Capped at S$1,110 per c. month 4. With min. S$1,000 spend on petrol + local contactless in a s. month |

||

Caltex

Membership discount

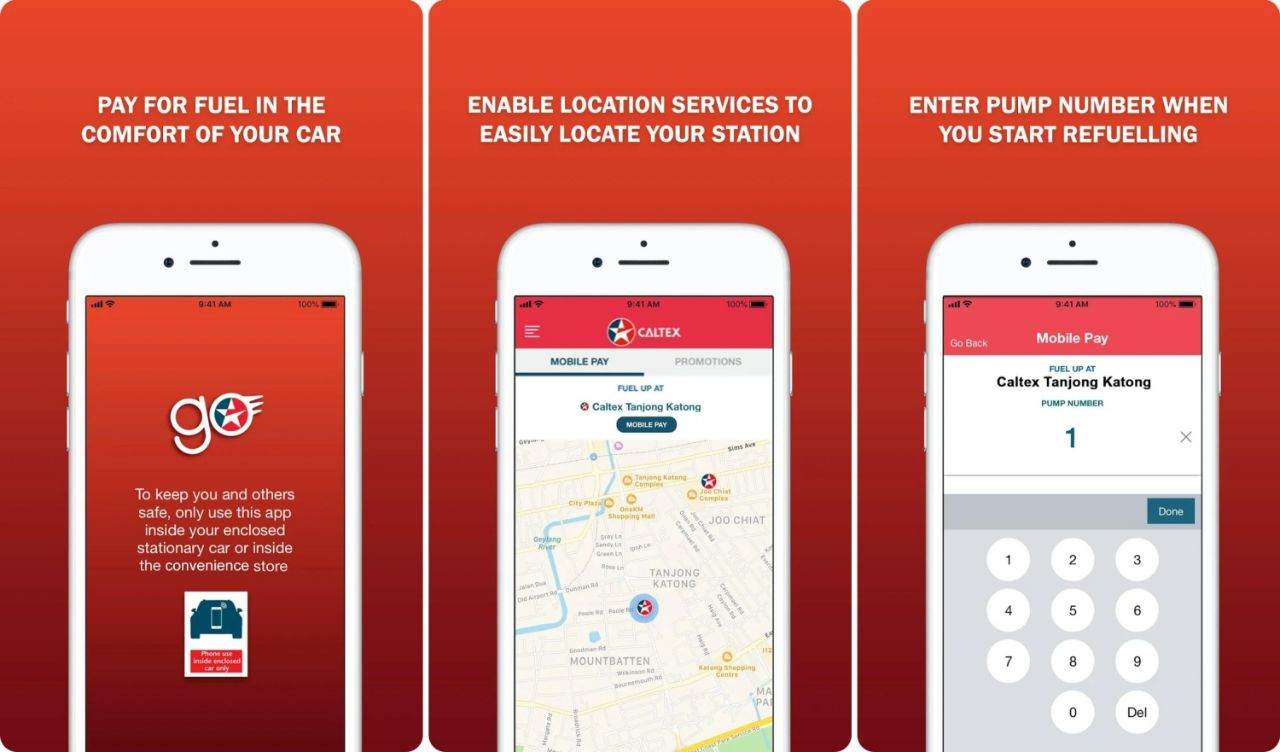

CaltexGO app CaltexGO app |

14% discount |

The free-to-use CaltexGo app (Android | iOS) allows cardholders to pay for petrol without entering the station, and the default discount for CaltexGo users is 14% with any Visa or Mastercard credit/debit card.

Caltex scrapped its in-house loyalty program in 2016 in favour of Plus! by NTUC Link.

- Motorists earn 2 LinkPoints per litre of fuel purchased

- 100 LinkPoints can be redeemed for S$1, or converted to Asia Miles at a rate of 290 LinkPoints= 110 Asia Miles (equivalent to an extra 0.76 miles per litre)

Credit card discounts

| Bank | Additional Discount |

| +2% |

|

| +4% (+5% for VOYAGE, Premier Visa Infinite) |

|

|

+2% (+3% for Visa Infinite) |

HSBC and Standard Chartered cards enjoy an additional 2% discount (total: 16%) when paying with the CaltexGo app. The discount increases to 3% (total: 17%) when paying with the Standard Chartered Visa Infinite.

OCBC cards enjoy an additional 4% discount (total: 18%), while OCBC VOYAGE and OCBC Premier Visa Infinite cards will enjoy an additional 5% discount (total: 19%).

| Card | Discount | Earn Rate |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

14% | 6 mpd1 |

UOB Lady’s Card UOB Lady’s Card |

14% |

6 mpd1 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

14% | 4 mpd2 |

UOB Visa Signature UOB Visa Signature |

14% |

4 mpd3 |

Maybank World Mastercard Maybank World Mastercard |

14% | 4 mpd |

OCBC VOYAGE OCBC VOYAGE (Premier, PPC, BOS) |

19% |

1.6 mpd |

SCB Visa Infinite SCB Visa Infinite |

17% | 1.4 mpd4 |

OCBC 90°N Card OCBC 90°N Card |

18% (Pay via CaltexGo) |

1.3 mpd |

OCBC VOYAGE OCBC VOYAGE |

19% |

1.3 mpd |

HSBC Visa Infinite HSBC Visa Infinite |

16% | 1.25 mpd5 |

SC Journey Card SC Journey Card |

16% | 1.2 mpd |

| 1. Must select Transport as quarterly bonus category. Earn rate decreases to 4 mpd from 1 March 2024. Capped at S$1,000 per c. month (Lady’s) or S$3,000 per c. month (Lady’s Solitaire) 2. Must use mobile contactless payments. Capped at S$1,110 per c. month 3. With min. S$1,000 spend on petrol + local contactless in a s. month 4. ≥S$2K spend per statement month, otherwise 1 mpd 5. With min. spend of S$50K in previous membership year. If <S$50K or first year of membership, 1 mpd |

||

Sinopec

Membership discount

Sinopec has its own loyalty card called the X Card, which isn’t so much a discount programme as it is a rewards one. Members earn 1-1.5 points per litre pumped, and every 90 points gives you S$3 off petrol.

Credit card discounts

Sinopec keeps things very straightforward by running periodic 23% off discounts, valid for all grades of petrol, and all payment methods. This discount may not be available at all of its three stations though, so be sure to consult the Sinopec Facebook page for the latest details.

| Card | Discount | Earn Rate |

UOB Lady’s Solitaire Card UOB Lady’s Solitaire Card |

Up to 23% | 6 mpd1 |

UOB Lady’s Card UOB Lady’s Card |

Up to 23% | 6 mpd1 |

Amaze + Citi Rewards Mastercard Amaze + Citi Rewards Mastercard |

Up to 23% | 4 mpd2 |

UOB Pref. Plat. Visa UOB Pref. Plat. Visa |

Up to 23% | 4 mpd3 |

UOB Visa Signature UOB Visa Signature |

Up to 23% | 4 mpd4 |

Maybank World Mastercard Maybank World Mastercard |

Up to 23% | 4 mpd |

| 1. Must select Transport as quarterly bonus category. Earn rate decreases to 4 mpd from 1 March 2024. Capped at S$1,000 per c. month (Lady’s) or S$3,000 per c. month (Lady’s Solitaire) 2. Capped at S$1,000 per s. month 3. Must use mobile contactless payments. Capped at S$1,110 per c. month 4. With min. S$1,000 spend on petrol + local contactless in a s. month |

||

Conclusion

Petrol transactions in Singapore are a confusing mix of discount schemes, but my overall strategy is to stick to Shell and Sinopec and use my UOB Lady’s Card or UOB Preferred Platinum Visa.

As always, you need to have your value of a mile figure in mind so you can weigh whether the incremental miles justify any loss in discount.

Forgotten about UOB ladies card?

yes! added it in.

The FAQ for uob/SPC promo states that “No UNI$ or SMART$ will be awarded on your UOB card for any spend at SPC, unless otherwise stated for any respective UOB card entitled privileges.”

Based on this UOB ppv should earn 4mpd if you paywave at SPC

you can try if you’d like, but i’m pretty sure you’ll be disappointed.

Amex cashback card is excluded from the T&C changes in March, so using that card offers effectively another 1+% rebate, bringing the total rebate to 22+%. Sinopec (especially with PPV) is still better for now, but this isn’t far behind.

SCB Visa Infinite gives additional 10.8% ($200 cap) if >$600 monthly spend. So if you spend >$2000, you will get 1.4mpd and ~25% discount. If you spend $600-1999, then 1mpd and ~25% discount. If you spend below $600, then 1mpd and 16% discount.

For Caltex, it would be good to include the miles that you can earn should you convert your Linkpoints to miles (I believe Linkpoints has a tie up with Asia Miles)

The math:

440 Linkpoints converts to 110 Asia Miles (4:1)

1 litre of Caltex fuel earns 3 linkpoints.

Therefore, 1 litre of Caltex fuel earns 0.75 miles.

thanks! have added a note about this.

SPC x UOB

can get up to 20% on a normal VISA/MC UOB card ( but no miles 🙁 )

S$3 off is only applicable with every gross S$60 spend (or S$51 nett after all station discount and/or coupons are deducted from the gross amount), for payment made with UOB Visa, MasterCard or UnionPay Credit/Debit Cards only.

https://www.uob.com.sg/personal/cards/cards-privileges/fuel-power/spc.page

UOB one card with Shell 20.88%

For SPC, doesn’t the POSB Everyday card give the best discount. Have been using it for ages, and don’t know whether I am still mechanically flipping out the card without checking the discount anymore.

20.1%, inferior to Amex in that aspect.

Believe you are referring to the AMEX Capitastar card?

as mentioned, this post talks about the best discounts you can get given the decision to pursue miles.

13% + 3% at Caltex for Favepay, link it to Grab and it’ll open other options like CRV or UOB One for Caltex.

https://www.caltex.com/sg/motorists/rewards-and-offers/promotions/favepay-caltex.html

Don’t bother with miles with petrol. Just go for the cheapest based on your CC discount

Juat to confirm, does UOB krisflyer card get miles or SMART points at SPC?

I am pretty sure I earn UNI$ for SPC transaction back in January this year. Just make sure you choose transport as the category.

UOB no longer lists SPC as smart$ merchant?

Hi Aaron, will this be updated soon?

it’s on the to update list…

Hi Aaron, found out recently that Grabpay option allows for 16% discount. Not the best payment method to use out there right now but this can be combined with the 0.9mpd for Amex HF or 1mpd topup for Amex cards going on now.

More info: https://www.caltex.com/sg/motorists/rewards-and-offers/promotions/grabpay-caltexgo.html

yup, will get that added.

Don’t forget cashback cards, where cashback is still given and points or miles aren’t. Eg smart$ and spc transactions still count towards uob one spend targets, and amex true cashback still earns 1.5% cashback at spc.

HSBC Revo don’t enjoy 4mpd at Sinopec? Contactless …

I seem to recall being told at Esso? that using contactless payments will cause credit cards discounts not to register. Does anyone know if this is true at Esso, or any of the other brands?

that’s the first i’ve heard of it. at other merchants, i’ve always been able to take advantage of credit card discounts even when paying with mobile phone.

Yes, I have been told numerous times by the Esso station staff. Was asked to pay with physical card instead of mobile contactless option. This needs to be investigated further and the impact on discounts/miles updated on this article

Shell no longer earns Smart$. Does that mean UOB PPV is now available to earn 14% + 4MPD at Shell?

nope!

https://milelion.com/2021/05/01/shell-increases-uob-credit-card-discount-ceases-smart-participation/

Its too confusing lol.

Which card gives you best on-site upfront discount for shell petrol station ignoring miles points?

I find this the easiest. So many card with cash back or miles have so many rules on min monthly spend etc.

Just looking for the easiest instant on the spot discount for shell. Can anyone help?

Thanks in advance

Stajin

Will this article be updated? 🙂

What about Amaze + WWMC at Sinopec during their regular 23% discounts? Able to get 4 mpd?

Yes.

Would the credit card xtra discount be applied if you’re using mobile payment? I.e. UOB card through Google pay.

yeah it should (Though note some of the comments re: Esso, which is odd).

ahh ok. Though must be physical card present for the 5% to kick in (at least for SPC since it is not manually entered by the cashier but through a tap on the POS).

How about overseas petrol stations? Only VS and Amaze? How PPV?

If you’re overseas best to use Amaze + CRMC (or Lady’s, possibly) to save on FX fees,

DBS Vantage gives 18% off at Esso and earns 1.5 mpd

Amex highflier is the best card ever. A pity only $30,000 a year

FYI DBS Vantage Card gives 1.5 MPD + up to 19% petrol discounts at Esso.

Does applying for the MayBank Shell Corporate card and then linking it to the Maybank world master card provides the best of both world of discount of 15% and 4mpd?

Can update the OCBC N90 MC to 1.3 mpd

done!

Hi, how would you get 10% discount + 4mpd with Amaze + Citi combo? Because Amaze technically is not a Citi branded card?

Thx

Are petrol usually considered as “Utilities”?

Anybody had issues adding amaze card to caltex go? Order keeps decline during the verification stage

Thanks for your kind work. I always refer to your articles to work out the best way to use the various CCs. In general, I go for more discount rather than miles for petrol as it is money saving upfront and with CCs shifting T&Cs, things can fall into the gap.

Just experimented with UOB cards and shell – did get bonus points for PPV but not VS.