Back in November, Singapore Airlines launched a 15% bonus for KrisFlyer miles transfers from credit cards, with no cap on the number of bonus miles. This offer was originally scheduled to end on 27 December 2020, but has now been extended to 16 January 2021.

That’s good news for those who fear they may have left their transfers too late, and means the KrisFlyer transfer bonus will now overlap with the one from Asia Miles that’s set to start on 28 December 2020.

|

| KrisFlyer 15% Transfer Bonus |

Implications of the extension

Since KrisFlyer miles expire at the end of the month three years after they were credited, you might want to hold off transferring your credit card points until at least 1 January 2021. This basically gives you an additional month of validity, at no cost.

| Miles Credited | Expiry |

| 1-31 December 2020 | 31 December 2023 |

| 1-31 January 2021 | 31 January 2024 |

The extension of the campaign is also good for those accumulating miles on specialised spending cards, where the crediting of bonus points is delayed. You’re basically able to accumulate and transfer another month’s worth of bonus points, minimizing transfer costs in the process.

Here’s a summary of when different cards credit their bonus points:

| Card | Bonus Points |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

Instant |

UOB Preferred Platinum AMEX UOB Preferred Platinum AMEX |

Instant |

Citi Rewards Citi Rewards |

Instant |

Maybank World Mastercard Maybank World Mastercard |

Instant |

DBS Woman’s World Card DBS Woman’s World Card |

Delayed: next calendar month |

OCBC Titanium Rewards OCBC Titanium Rewards |

Delayed: next calendar month |

HSBC Revolution HSBC Revolution |

Delayed: next calendar month |

UOB Lady’s Card/ UOB Lady’s Card/Lady’s Solitaire |

Delayed: next calendar month |

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

Delayed: next calendar month |

UOB Visa Signature UOB Visa Signature |

Delayed: next calendar month |

However, it’s also worth remembering that Cathay Pacific Asia Miles is running a transfer bonus of their own from 28 December 2020 to 31 January 2021. All members will be eligible for at least a 10% bonus, with selected members enjoying a 15% bonus.

| FYI: I’ve confirmed with Cathay Pacific’s PR team that the 10% bonus is for everyone; it’s the 15% bonus that is targeted. |

It’s probably a good idea not to have all your eggs in one basket, and if you were targeted for a 15% bonus, I’d certainly consider taking advantage of it. Remember, Asia Miles has some pretty good sweet spots of their own, especially to Europe (and no fuel surcharges for Cathay Pacific flights).

Overview: KrisFlyer 15% transfer bonus

For those out of the loop, here’s a rundown of the KrisFlyer transfer bonus.

For a limited time, KrisFlyer is awarding a 15% bonus on all credit card points transfers of at least 10,000 miles. No registration is required to participate; all KrisFlyer members are automatically eligible.

| Bank Points | Bonus | KrisFlyer Miles |

| Equivalent of 10,000 miles |

+15% | |

| → |

To receive the bonus, your conversion must be completed by 2359 (GMT +8) on 16 January 2021. This refers to the time the miles show up in your KrisFlyer account, not when you initiate the transfer on the bank’s side. Different banks will have different processing times, so budget accordingly (see next section).

All banks in Singapore are participating, as are selected banks overseas.

| 💳 20% bonus for selected overseas banks |

|

If you have credit card points from the above banks in Brunei, Hong Kong or Indonesia, you’ll earn a 20% transfer bonus instead. For Hong Kong DBS customers, 20% bonus miles is applicable to the first 10,000 DBS Bank reward points conversion to KrisFlyer miles only, after which 15% bonus miles will apply. |

Sadly, this offer does not apply to cobrand credit cards, so AMEX KrisFlyer and UOB KrisFlyer credit card members are out of luck.

How long do points conversions take?

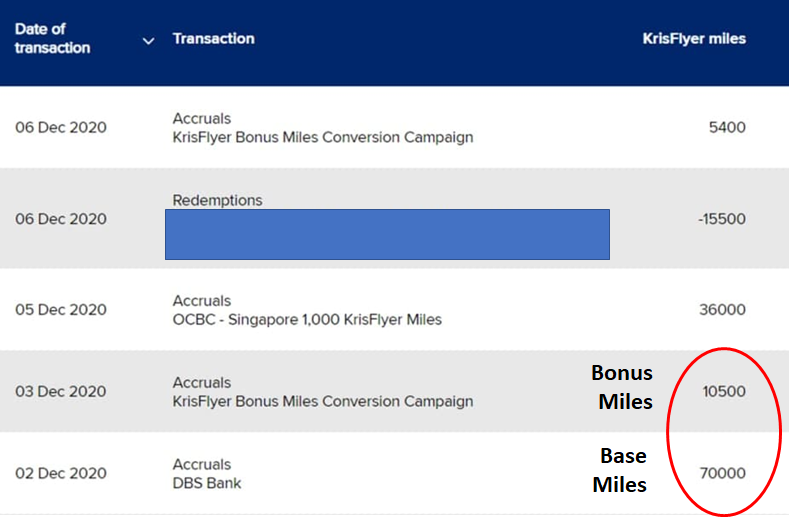

Miles are credited in two components- first the usual base miles will post, then the bonus miles will post within a day or two. Bonus miles should generally not take more than three days to post, if you’re still waiting after that, give KrisFlyer membership services a call (+65 6789 8188).

Based on my own personal experience and data points from the Milelion community, here’s how long points transfers are taking.

| Posting Time (base) refer to number of days after transfer initiated Posting Time (bonus) refers to number of days after base miles posted |

||

| Card | Posting Time (Base) |

Posting Time (Bonus) |

American Express American Express |

Same day | +1 day |

| +2 days | Same day | |

| +1 day | +1 day | |

| Same day* | +3 days | |

| Same day | +1 day | |

| Same day | +1 day | |

SCB SCB |

+1 day | Same day |

| Same day | +1 day | |

| *Exercise caution here: HSBC transfers are batched by week, so you may have to wait up to 7 days if you just miss the cutoff | ||

The good news is that most transfers are happening extremely quickly, with some even going through on the same day. I wouldn’t play with fire and leave things till the last minute, but there’s some comfort for you if you’re reading this close to the deadline.

Important note about Kris+ transfers

Kris+ (formerly KrisPay) allows DBS and UOB cardholders to instantly convert DBS points/UOB UNI$ to KrisPay miles, which can then be converted to KrisFlyer miles at a 1:1 ratio (within 7 days of transfer- wait too long and they’re stuck in Kris+ forever).

With the 15% bonus, here’s the relevant transfer ratios:

| Transfer Ratio | |

| 100 DBS Points: |

|

| 1,000 UNI$: |

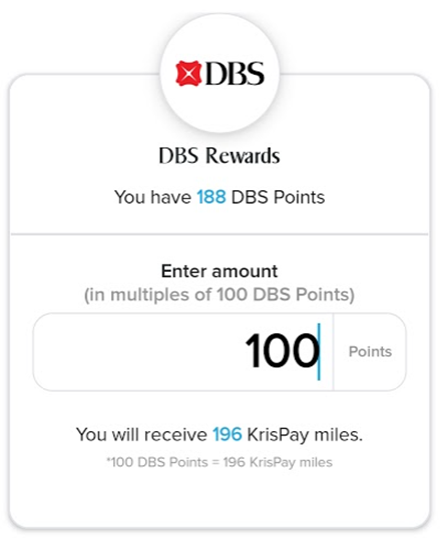

People are getting confused as to why KrisPay transfers to KrisFlyer aren’t showing any bonus. The simple answer is that the 15% bonus is awarded upfront, when you convert UNI$/DBS Points to KrisPay miles. This is illustrated below: Note how 100 DBS points should normally be 170 KrisPay miles, but thanks to the 15% bonus, that becomes 196 KrisPay miles.

So there’s no further bonus to speak of, and transfers from KrisPay to KrisFlyer will post as one line item.

While the Kris+ route may seem enticing to some (thanks to the absence of transfer fees), the math doesn’t really work out for larger transfers. Assuming a 1.8 cents/mile valuation and a S$26.75 transfer fee, you need to be forgoing fewer than ~1,500 miles for Kris+ to make sense. Basically, unless you’re transferring a relatively small number of miles, it doesn’t work out.

How am I approaching this offer?

During this promotion, I’ve cashed out virtually all my points from the following banks:

- DBS

- OCBC

- UOB

The reason I chose these is because they don’t have a lot to offer by way of transfer partners. OCBC only partners with Singapore Airlines, UOB has Singapore Airlines and Cathay Pacific (for which I’m already well-stocked), DBS has both of those plus Qantas Frequent Flyer (not interested). Since I’d ultimately be funneling these points to KrisFlyer anyway, I might as well do it now.

On the other hand, I’ve left my American Express, Citibank and Standard Chartered balances untouched. These have a much wider range of transfer partners, and I’d prefer to keep the flexibility. For instance, Citibank cardholders can transfer points to Turkish Airlines Miles&Smiles to take advantage of their 30% off award sale, which brings down the cost of a round-trip Business Class award to Europe to just 63,000 miles- incredible stuff (pity you have to fly by 15 June 2021).

Here’s a summary of which banks partner with which frequent flyer programs.

| KrisFlyer |  |

|

|

|

|

|

|

|

|

| Star Alliance | |||||||||

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |

|

✅ | ✅ | ✅ | ||||||

|

✅ | ✅ | |||||||

|

✅ | ||||||||

| ✅ | |||||||||

|

✅ | ||||||||

| Oneworld | |||||||||

| ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | |||

|

✅ | ✅ | |||||||

| ✅ | ✅ | ✅ | |||||||

| ✅ | ✅ | ✅ | |||||||

| ✅ | ✅ | ||||||||

| SkyTeam | |||||||||

| ✅ | ✅ | ||||||||

|

✅ | ||||||||

| Non-aligned | |||||||||

| ✅ | ✅ | ||||||||

| ✅ | ✅ | ||||||||

| Hotels | |||||||||

|

✅ | ||||||||

|

✅ | ||||||||

| ✅ | ✅ | ||||||||

| ✅ | |||||||||

*Not shown: Air Asia BIG, which is more of a rebates program than a frequent flyer program

I know that by making the transfer now, I’m starting the three year countdown clock early (KrisFlyer miles expire after three years, unless you’re a PPS Club member). But put it this way: I can’t see all of 2021 going by without any sort of leisure travel materializing, and as new routes open up, I’ll be burning miles to fly them and write reports.

KrisFlyer will continue to be my primary frequent flyer program for the foreseeable future, so transferring points also helps hedge against a future devaluation, when that happens (for the record, I don’t think it’ll be anytime soon).

If you hold credit cards from various banks and don’t know which ones to transfer, I suggest you focus on converting the least flexible points first, or points which expire. OCBC$ would be high on my list (1 transfer partner, 2 year validity), as would DBS points from the Woman’s World Card (3 transfer partners, 1 year validity).

Conclusion

KrisFlyer transfer bonuses are like unicorns, so it’s good to see this one get extended just a little bit longer.

Even though the deadline has been pushed to 16 January 2021, you’ll ideally want to start your transfers at least one week in advance to allow sufficient lead time. Do give Asia Miles some serious consideration though, as their program has the added advantage of non-expiring miles.

With the Citibank Prestige Spend promotion, I wonder if the bonus points will arrive in time to be able to be credited to KrisFlyer with the bonus 15%. Bonus on bonus??

Anyone knows which day of the week does the HSBC batch processing takes place?

Maybe I’m reading too much into the 15% bonus. I wonder about SIA’s motivation for launching such a promotion for the first time just when flying opportunities are limited. Just my idle thoughts: Keep KF members invested in SQ brand. But this is probably unnecessary if the target group is Singaporeans who mainly bank with DBS UOB OCBC for whom transfer partners are limited anyway. Even if these Singaporeans had non-UOB/DBS/OCBC cards, they would have to maintain their KF accounts just for their DBS/UOB/OCBC transfers. Maybe a large proportion of KF membership is outside Singapore in Thailand Malaysia Brunei? Obtain… Read more »