American Express has brought back its popular offer for SPC, which allows registered cardholders to save up to 21% off petrol throughout 2021.

Registration is now open and capped at 70,000 cards, so be sure to login to the AMEX app or online banking portal and complete it as soon as you can.

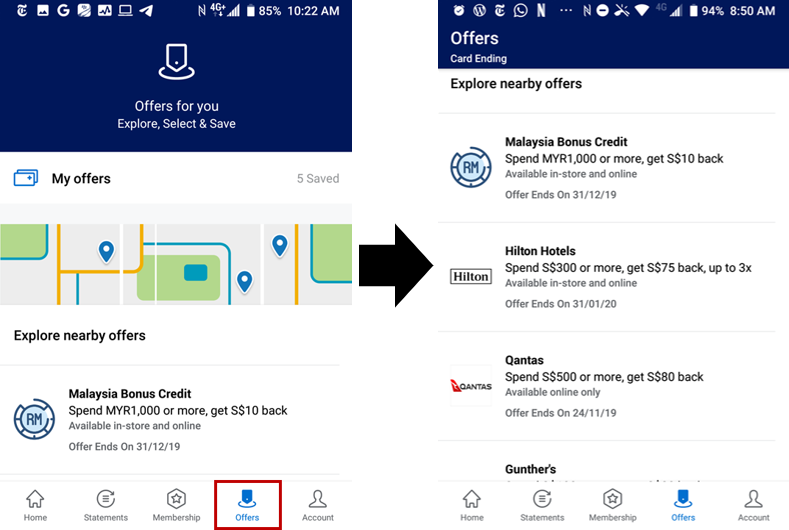

| ❓ What are AMEX Offers? |

|

AMEX Offers are opportunities to earn bonus miles or Membership Rewards points, or discounts in the form of statement credits. These are available to Platinum, True Cashback, and KrisFlyer cobrand cardholders, and can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. These are not applicable to DBS/Citi/UOB AMEX cardholders. |

Save up to 21% off petrol at SPC

From 8 January to 31 December 2021, American Express cardholders can save up to 21% off petrol at SPC. The 21% savings are broken down as follows:

- 10% discount for SPC&U Members

- 5% discount for American Express cardholders

- 7.1% rebate for registered American Express Cards

The mathematically-inclined amongst you will notice that 10+5+7.1=22.1%, so why are the savings quoted as 21%? It comes down to discounts versus rebates. Cardholders will receive a 15% discount upfront, with a further 7.1% rebated to them via statement credit.

For example, if you purchase S$100 worth of petrol:

- You’ll pay S$85 at the counter

- You’ll receive a 7.1% rebate from S$85 (S$6.04) credited to your account

- All in all, you’ve paid S$78.96 for S$100 of petrol, a discount of ~21%

The maximum statement credit that can be received per registered card is S$150, which means you’d max this out with ~S$2,113 of petrol spending (after 15% discount).

If you use more petrol than that, it’s possible to register more than one card- I see the offer available on my AMEX KrisFlyer Ascend, Platinum Reserve and Platinum Charge cards. Out of consideration to other cardmembers, however, please only register as many cards as you need. There is an overall registration cap of 70,000 cards.

Statement credits should reflect on your account within five business days from qualifying spend. The full T&C can be found below:

|

You won’t earn any miles or points with AMEX

Back in March 2020, American Express updated their rewards T&Cs to exclude SPC altogether. This was a surprising move, given that up till then, it was possible to enjoy the 21% discount together with regular miles/points accrual. While American Express is not alone in excluding rewards at SPC (UOB does it too), it does mean this will be a purely money-saving play.

Is it worth forgoing miles/points at SPC in favor of a larger discount? It comes down to your personal valuation of a mile, but put it this way: the next best alternative would be to use a DBS credit card for a 15% discount and 1.2 mpd (Altitude), so unless your valuation of a mile is a whopping 5 cents, you’re better off saving money.

Do note that the AMEX True Cashback Card continues to earn 1.5% cashback at SPC stations, so it’s an easy way to upsize your discount to 22.5% (thanks @Adam for the reminder). Interestingly enough the AMEX CapitaCard is also advertising the chance to earn 8 X STAR$ at SPC, despite the fact that SPC transactions are in its exclusion list.

What other cards can you use for petrol?

I recently updated my post on the best cards to use for petrol, which takes into account changes in discounts and miles cards over the past year.

It does approach the topic from a miles perspective, mind you, and there may be those who find the UOB One/POSB Everyday card represents “better value”. You’ll need to do the math for yourself and decide.

Conclusion

American Express is once again continuing its partnership with SPC, and while a 21% discount is enticing, it does come at the cost of earning miles. If you’re nonetheless keen, do register your cards as soon as you can, before the cap is exhausted.

Get it?

Exhausted.

While you don’t earn miles and points on SPC purchases, you do earn cashback on the Amex True Cashback Card (stackable with this), so that’s an option.

Yes, that would effectively give a better discount of 22.2%

yup, and a good one too if you have the card.

Use the amex capitaland card. U get star$ too.

The cashback using the UOB One Card at SPC is comparable (if not better) than this promotion, and there’s no limit of the rebate you can get through this card. All this assuming you hit the minimum spend.

Using CaltexGo with UOB Visa Signature gives 14% upfront plus 4 mpd, which works out to 22% if you prefer miles.

fuelkaki.sg does an admirable job of summarising the various discounts as well. But I really love the analysis you’ve done here.