OCBC VOYAGE has launched a new acquisition offer in conjunction with CardUp, giving new applicants up to S$400 cash credit when they spend S$1,500 with CardUp in the first 1-2 months of approval.

This offer runs till 31 August 2021, but it’s also capped at the first 100 customers to apply.

OCBC VOYAGE x CardUp offer

|

| Apply for CardUp offer |

| Terms & Conditions |

From 20 May till 31 August 2021 (both dates inclusive), new cardholders who apply for an OCBC VOYAGE Card and spend a minimum of S$1,500 with CardUp during the eligible period (1-2 months, see below) will receive up to S$400 cash credit.

| ⚠️ This offer is only valid for the regular OCBC VOYAGE Card. OCBC Premier Banking, PPC and BOS VOYAGE cards are not eligible. |

OCBC has two definitions of “new cardholder”:

- New to Bank: Do not have any existing relationship with OCBC Bank (also excludes bank accounts, personal/home loan)

- New to Card: Do not have any existing OCBC credit card in the last 12 months (this covers any kind of OCBC card, not just VOYAGE)

New cardholders will be rewarded as follows:

| Spend S$1.5K on CardUp | VOYAGE Miles from annual fee | Total Value | |

| New to Bank (cap: first 50) |

S$200 | 15,000 VM (equal to S$200) |

S$400 |

| New to Card (cap: first 50) |

S$150 | 15,000 VM (equal to S$200) |

S$350 |

Note that “new to bank” and “new to card” are each capped at the first 50 eligible applicants.

Cardholders also receive 15,000 Voyage Miles (VMs) from paying the S$488 annual fee. Assuming they elect to convert this to cash credit at the limited-time enhanced rate (which lapses on 30 June 2021), they’ll get S$200. This, stacked with the new cardholder welcome gift of S$200 or S$150, yields a total of up to S$400 cash rebates.

The minimum S$1,500 spend on CardUp must be made during the eligible period, which is defined as the end of the month following approval. In other words:

| Card Approval Month | Eligible Period (Qualifying Spend end date) |

| May 2021 | 30 June 2021 |

| June 2021 | 31 July 2021 |

| July 2021 | 31 August 2021 |

| August 2021 | 30 September 2021 |

| September 2021 | 31 October 2021 |

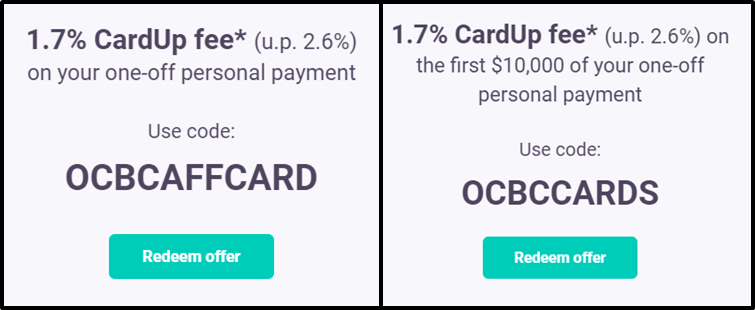

CardUp transactions normally incur a 2.6% fee, but they’ve just launched a special promo code for OCBC cardholders. OCBC VOYAGE members in particular can use the code OCBCAFFCARD and enjoy a 1.7% fee on a one-off payment of any kind, with no maximum limit.

In other words, someone who makes a S$1,500 CardUp payment with this 1.7% offer will pay a fee of S$25.50 in total. For the avoidance of doubt, CardUp transactions will earn VMs just like any other transaction.

The full T&Cs can be found here.

How good is this offer?

For the record, this isn’t the most generous acquisition offer we’ve ever seen.

Back in March, those who applied for a VOYAGE card through The Milelion could get a S$300 cash credit for spending S$1,500, which worked out to S$500 in total once you factored in the VMs from paying the annual fee. There was also no need for the cardholder to be new to OCBC, and there was no cap on the maximum number of eligible applicants.

OCBC is currently running an alternative offer in conjunction with the Warehouse Hotel, which lapses on 31 May 2021. Cardholders will receive S$300 of hotel vouchers for spending S$1,500, and there’s no new to OCBC requirement. However, that this is capped at the first 330 eligible applicants, and the offer started running on 26 March so it could already be fully tapped out.

Conclusion

If you’re intending to make a CardUp payment and have also been eyeing an OCBC VOYAGE card, this may be a way of killing two birds with one stone. The offer runs for a few months, but since there’s a cap you’ll need to decide quickly if you want to hop onboard.