It’s not every day I write about cashback cards, but it’s not every day they come with such awesome names. That was the case with the UOB YOLO, which launched in 2016 in a decidedly Fellow Kids moment.

UOB on Wednesday launched UOB YOLO, a millennial-focused credit card that the bank says captures the essence of the millennial mantra, “You only live once”.

As a millennial, it constantly amuses (and depresses) me to know what executives think of people my age. I’ll have you know that not all of us are killing doorbells or struggling to send a letter; no, we’re too busy job hopping and asking for our participation trophies.

|

| UOB EVOL |

But anyway, it appears the YOLO movement is now passé (damn those millennials and their fickle trends!), because the UOB YOLO has been relaunched as the UOB EVOL.

What on earth is “EVOL” (I have it on good authority this should not be pronounced “evil”)? Well, it’s a Sonic Youth album, a five-member South Korean girl group, and now the latest credit card to grace your wallet.

The EVOL’s claim to fame is a beefy 8% cashback on mobile payments and online spending. On the surface, this makes it a credible competitor to miles alternatives like the UOB Preferred Platinum Visa (PPV).

Is he, though?

What is the UOB EVOL?

UOB ceased issuing new YOLO cards on 17 May 2021, and existing YOLO cardholders will automatically switch over to the EVOL program from 17 June 2021.

Aesthetically, the EVOL is an incremental evolution from the previous YOLO card, with the same background of blue geometric patterns. What’s changed is the card’s orientation- portrait instead of landscape, and a neon green EVOL has been stamped on the front (reminiscent of the Grab logo, come to think of it).

Card numbers have been moved to the back, in line with the new design ethos. It retains the “quick read” format, created to make e-commerce experiences more convenient (because millennials have short attention spans and often can’t complete a sentence without forgetting how it avocado).

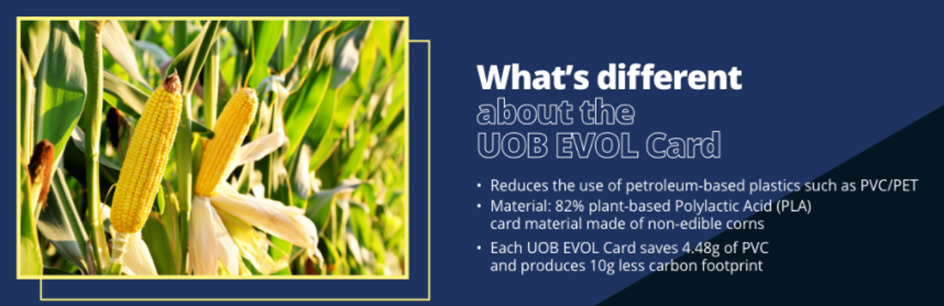

But even if the card looks largely similar, it’s made up of different stuff. The EVOL consists of 82% plant-based Polylactic Acid materials from non-edible corn (so, don’t eat it). Each card saves 4.48g of PVC and produces a 10g smaller carbon footprint, which makes you feel less bad about all the single-use consumables you’ll be buying with it.

If you’re craving the street cred though, you might be waiting a while. The new EVOL card will only be issued upon the expiry of your existing YOLO card.

How does the EVOL compare to the YOLO?

In terms of features, the EVOL is a completely different beast compared to the YOLO.

|

|

|

| UOB EVOL | UOB YOLO | |

| Cashback |

|

|

| Min. Spend per Month | S$600 | S$600 |

| Cashback Cap per Month | S$60 | S$60 |

| *Defined as payments made via Apple Pay, Google Pay, Samsung Pay or Fitbit Pay. Tapping the physical card does not count | ||

The good news is that UOB has dramatically simplified the cashback earning structure. Gone is the convoluted weekend/weekday system (it’s hard enough for some folks to remember which card to use for what, no need to further complicate it with what day of the week it is).

In its place is a relatively straightforward 8% cashback on mobile payments and online spend. This has led some to call it the cashback equivalent of the UOB PPV, and since no one’s going to value a mile at 2 cents in the current climate, 8% cashback is superior to 4 mpd- right?

Well, no. That’s not the whole story, because once again, minimum spend and caps apply.

The UOB EVOL’s monthly cashback cap is ostensibly S$60, but practically speaking it’s more like S$40. That’s because the S$60 cap is split into:

- S$20 for mobile payments

- S$20 for online spend

- S$20 for all other spend

Based on cashback rates of 8%, 8% and 0.3% respectively, you’d max out the cap by spending:

- S$250 on mobile payments

- S$250 on online spend

- S$6,667 on all other spend

(a) and (b) are achievable. (c) is not. Furthermore, if you’re the sort who would spend S$6,667 for a reward of 0.3% cashback, current MAS guidelines disqualify you from holding a credit card on the grounds of general ineptitude.

Furthermore, the EVOL requires a minimum spend of S$600 to trigger the 8% cashback rates. This means you have to spend at least S$100 on all other spend, at a measly rate of 0.3% cashback (enjoy your 30 cents).

Therefore, 8% cashback is a theoretical construct (like love), and the best you can achieve in practice is 6.7%.

| Spend | Rate | Total Cashback | |

| Mobile Payments | S$250 | 8% | S$20 |

| Online Spend | S$250 | 8% | S$20 |

| All Other Spend | S$100 | 0.3% | S$0.30 |

| Total | S$600 | 6.7% | S$40.30 |

Contrast this to the UOB PPV, where cardholders earn 4 mpd on the first S$1,000 spent on mobile payments per calendar month, with no minimum spend required. I’d say that’s a good enough reason to stick to it.

How does this compare to other millennial cards?

If the EVOL’s sustainability angle sounds familiar, it’s because DBS has already done it with its Live Fresh Card. The DBS Live Fresh is now made of 85.5% recycled plastic, accompanied by the cheesy line: “If Mother Earth had hands, she’d give it a two thumbs up.”

But DBS goes beyond basic greenwashing by awarding a bonus 5% “sustainable cashback” on transactions with the following merchants (capped at S$15 per month):

This, coupled with the fact that it also earns a bonus on contactless payments and online spending, means that comparisons are inevitable. Come to think of it, the OCBC FRANK would also be in the same ballpark, with similar bonus categories.

Here’s how the three cards stack up:

|

|

|

|

| EVOL | Live Fresh | FRANK | |

| Online Spend | 8% | 5% | 6% |

| Contactless Spend | 8% | 5% | 6% |

| “Sustainable Spend” | 0.3% | 5% | 0.3% |

| Foreign Currency | 0.3% | 0.3% | 6% |

| All others | 0.3% | 0.3% | 0.3% |

| Min. Monthly Spend | S$600 | S$600 | S$600 |

| Max. Monthly Cashback | S$60 | S$75 | S$75 |

The EVOL has the highest headline rate of all the millennial cards, but as discussed earlier, the effective cashback rate will be slightly lower. Here’s the maximum effective rebate you could achieve with each of these cards:

|

|

|

|

| EVOL | Live Fresh | FRANK | |

| S$600 | 6.7% | 5% | 6% |

| S$800 | 5.1% | 5% | 6% |

| S$1,000 | 4.2% | 5% | 5.1% |

Why the EVOL’s effective rebate keeps falling is because once you pass S$500, you have to allocate more and more spend to the 0.3% cashback category. It’s fine if you stop at S$600, but once you go beyond that, the other two cards may be better options (don’t forget their higher caps too).

Conclusion

The EVOL is certainly an improvement on the YOLO, and depending on how much you spend a month, may even convince some Live Fresh or FRANK users to switch. However, I wouldn’t consider it a competitor to the PPV, much less a replacement.

UOB certainly isn’t the first bank to target the millennial segment, and it won’t be the last. It just tickles me how ham-fisted some of these attempts are. Whether it’s cringey corporate soap operas, too-cool-for-you bank branches, copies of existing cards that do the same thing but worse, or sponsored posts insisting that debit cards are superior to credit cards, it’s like all these were conceptualized by a bunch of senior executives sitting in a boardroom throwing darts at a monkey (I may have mixed my metaphors somewhat).

“At least they’re trying, you grumpy gus”

Grumpy? Me? No way, that’s the geriatric millennials you’re thinking of.

If I did the same level of plagiarism in uni as the banks did I’d be expelled.

To make it “eco” friendly, metal cards should become standard

Metal cards take up more energy to manufacture than plastic cards though.

Eco friendly should purely exist as digital cards.

How about just not issuing any physical cards? Mobile payments are everywhere nowadays.

Is UOB simply out to grab headlines while praying (preying?) that millennials can’t do basic analysis?

…and love is evil, spell it backwards, i’ll show ya

EVOL IS LOVE SPELT BACKWARDS. NOW IT ALL MAKES SENSE.

Hey Aaron. Thanks for the comparison between the 3 cashback cards. Just to highlight that DBS Live Fresh effective will also decline after $800, so you may want to revise the table. Source link below for easy reference. Thanks!

“Cashback is capped at S$20 on eligible Online Spend, S$20 on eligible Visa Contactless Spend and S$20 on All Other Spend for each calendar month.”

https://www.dbs.com.sg/personal/cards/credit-cards/live-fresh-dbs-visa-paywave-platinum-card

the reason why DBS livefresh effective CB doesnt decline after $800 is because of the addition of the new “sustainable spend” category, which is on top of the CB for online spend and visa contactless.

basically, you could

– Spend $400 on contactless (@5%= $20)

– Spend $400 on online (@ 5%= $20)

– Spend $300 on sustainable spend (@5%= $15)

And still maintain effective CB of 5%.

Thanks Aaron for the explanation! I was only comparing the common online and mobile payment categories across the 3 cards – I see where you are coming from regarding the extra “sustainable spend” category.

This is an example of why we need a strong consumer regulator here. Somehow I don’t see how this sort of marketing would be allowed in places like Europe, Australia, etc. To advertise a headline rate but be unable to achieve it on an overall basis is quite misleading. They do the same thing with how they tier the interest on the UOB One account. This has the potential to descend into a farce, think headline grabbers like “50% cashback on your credit card spend” capped at $10 cashback with $1000 min spend required. Then you force all consumers to… Read more »

Oh my love, if you live in SG for long, you will see or hear that all the advertisement or promotion comes with “TnCs apply”, and that’s where you really should look at, coz that’s the playground of the merchant, well, say, UOB here.

I totally agree with you on that UOB one account, I keep telling my friend not to trust that headline, and calculate the effective rate..

And I hope you and Aaron become the regulator to slay those stupid and greedy banks, once for all!

UOB have been doing this for years and got away with it (and now OCBC are following suit) so as despicable as it is, this practice is here to stay. As a mere consumer, the only thing I can do is avoid these banks like a plague, and tell my friends to do the same.

In the UK we have something called the “Advertising Standards Authority” that regulates stuff like this and would never allow stuff that UOB does to fly. I couldn’t believe the advertising they get away with as a bank when I moved here!

Yes! and off-topic from the miles category, some (although a minority) retailers here still try to pass off Malaysian and Chinese products as European. It’s a bane that shouldn’t be allowed to exist.

“(a) and (b) are achievable. (c) is not. Furthermore, if you’re the sort who would spend S$6,667 for a reward of 0.3% cashback, current MAS guidelines disqualify you from holding a credit card on the grounds of general ineptitude. ”

Aaron – you have outdone yourself with the burn! Lol

Does online payment of phone bill consider online? It shows phone bill as “others” on UOB page

Meh… Not gonna bother with monitoring expenses on the different categories just for 40-50 cashback a mth. A poorer option than the live fresh for sure.

With the exception of eco categories, $40 cashback is easier to hit with EVOL than live fresh for same monitoring effort, no?

Suggest you remove the reference to MAS Guidelines in your article cos there is no such thing stated

If you can’t differentiate satire from actual facts MAS Guidelines prohibit you from owning a credit card too.