HSBC has launched a recurring payments promotion that runs from now till 31 October 2021. Registered cardholders can earn up to 4 mpd and a S$50 cash rebate on selected recurring payments by charging them to HSBC credit cards.

This represents a great opportunity to earn some extra cashback on transactions that normally wouldn’t qualify for rewards, like insurance and donations.

HSBC Recurring Payments Promotion

HSBC cardholders will first need to register by filling in this form (use the gift code RECUR). Registration must be done by 31 July 2021.

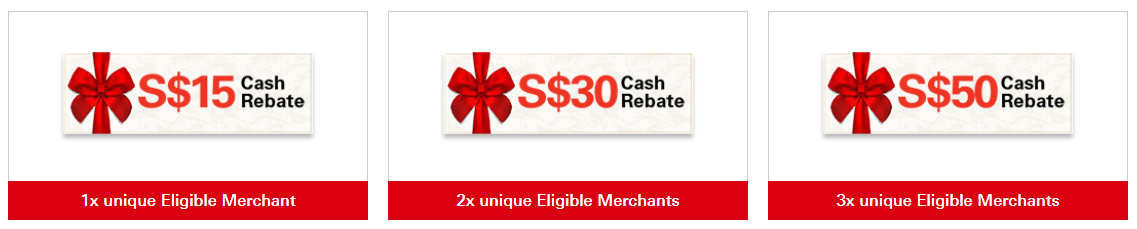

Once registered, cardholders can earn up to a S$50 cash rebate by charging recurring payments at eligible merchants to their HSBC card from 1 August to 31 October 2021.

- 1x unique eligible merchant: S$15 rebate

- 2x unique eligible merchants: S$30 rebate

- 3x unique eligible merchants: S$50 rebate

This offer is capped at the first 2,000 qualified customers, and transactions must be made with one or more of the following merchants:

| Category | Merchants | 4 mpd? (MCC) |

| Telecomms |

|

❌ (4814) |

| Utilities |

|

❌ (4900)^ |

| Charities |

|

❌ (8398) |

| Insurance |

|

❌ (6300) |

| Entertainment |

|

❌ (Various)# |

| Fitness |

|

✅ (7997) |

| Clubs & Societies |

|

✅ (7997)* |

| Ride Hailing |

|

✅ (4121) |

| ^No 4 mpd with Town Councils (9399) #4 mpd available with Economist and NY Times (5968) *No 4 mpd with Seletar Country Club (7992) |

||

Cardholders must charge at least one eligible transaction to their registered card per month for a period of three consecutive months (i.e. one transaction in August, one in September, one in October at the same merchant).

Each transaction must be at least S$10 in value, and here’s the crucial part- you must not have had a recurring transaction with that particular merchant on any HSBC card from 1 April to 30 June 2021.

For example, if you already used your HSBC Revolution for a Gojek transaction in May 2021, taking a Gojek ride each month from August to October 2021 won’t count towards this campaign. It’s unfortunate, but those are the rules.

You’ll notice I’ve added a column in the table above indicating which categories are eligible for 4 mpd with the HSBC Revolution. These are the categories you’ll want to aim for in order to minimize the opportunity cost of participating in this promotion (e.g. it’s not a good idea to switch to the Revolution for Disney+ (0.4 mpd), given how you could earn 4 mpd with the Citi Rewards).

That said, there’s no opportunity cost involved with the insurance and charity categories, since you wouldn’t earn rewards with almost every other credit card in the first place.

While your transactions need to be across different merchants, they need not be across different categories. For example, you could charge recurring payments to both Singtel and StarHub during the August to October 2021 period, and earn a S$30 rebate for 2x unique eligible merchants.

Can supplementary cardholders register?

Supplementary cardholders cannot register for this promotion, but their spending will be consolidated under the main cardholder’s account for the purpose of accumulating the relevant minimum qualifying spend.

When will the rebate be credited?

The cash rebate will be credited by 31 December 2021.

Terms and conditions

The full T&C and FAQ for this promotion can be found here.

Conclusion

With the wide range of eligible merchants, most cardholders should be able to find at least one or two categories to pick up bonus cashback. In fact, you might as well shift your insurance transactions here for a few months, since earning S$15/30/50 cashback is better than earning nothing with other cards.

HSBC Revolution HSBC Revolution |

|

| Income Req. | Annual Fee |

| S$30,000 | None |

| Apply here | |

| Read the Full Review | |

If you don’t already have a HSBC Revolution, HSBC has just extended its S$200 cashback sign-up offer to 31 August 2021. The Revolution is one of the best cards on the market right now, offering 4 mpd on a wide range of categories, no annual fee and a free copy of The Entertainer.

Is this by per card or per customer?

Per customer

For recurring, would you know if it needs to be actually changed to a recurring payment method officially, or we can just manually make extra payment for 3months to HSBC card, just so there is no need to change paperwork? I read the T&Cs but there is no clear definition of “recurring”. Am thinking since Comfort and Gojek is not possible to have recurring bills and are charged per use, maybe other merchants can work the same way…