CardUp has launched a new promotion for recurring payments, which offers a 1.85% fee on the first six in a series. This reduces the cost per mile to just 1.14 cents, depending on the card you hold.

With the recent addition of mortgage payments to the CardUp repertoire, this might well be worth a look for those interested in buying cheap miles.

CardUp 1.85% recurring payments promo

This offer is available for payments that are set up by 31 December 2021, with a due date on or before 30 June 2022. Only Visa cards are eligible, and your payment must be on a weekly, monthly or quarterly schedule.

Using the promo code RECURING185 will reduce the CardUp fee to 1.85% on the first six payments in the series. You can use this promo code up to three times per account (i.e. 18 payments in total). The total uses for this code is capped at 300, but you’ll be able to see if the code is still valid before confirming your payment anyway.

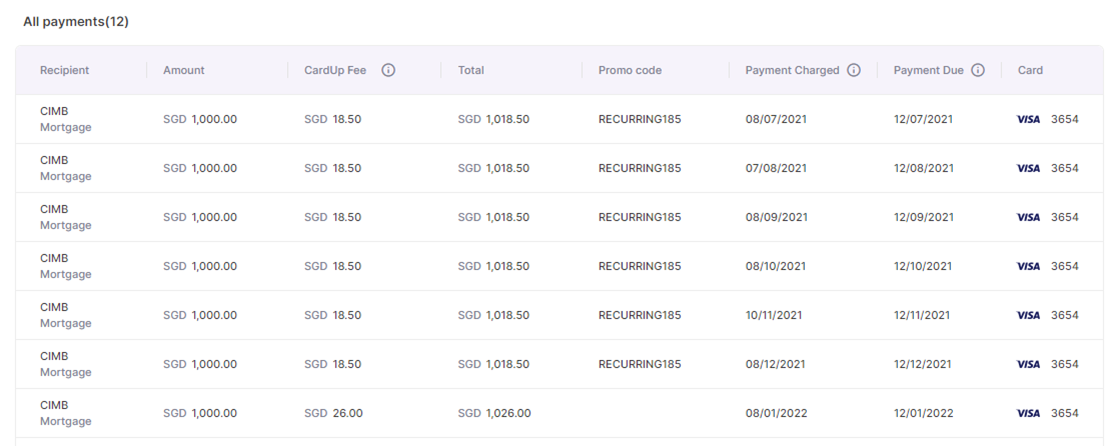

In the example below, I’ve scheduled a series of mortgage payments of S$1,000 each. Note how the fee is S$18.50 for the first six payments, before reverting to S$26 from the seventh onwards. Not to worry; you can subsequently cancel the seventh payment onwards or edit it to add a new promo code, depending on what’s available at the time.

This code does not apply to income tax payments (see below for alternatives). The T&C of the RECURRING185 code can be found here.

What’s the cost per mile?

Here’s a comparison of the cost per mile with the discounted 1.85% fee versus CardUp’s regular admin fee of 2.25%. Remember, only Visa cards can be used for the RECURRING185 promo code.

| Card | Miles per S$1 | Cost Per Mile (1.85% fee) |

Cost Per Mile (2.25% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.14 |

1.38 |

UOB Reserve UOB Reserve |

1.6 | 1.14 |

1.38 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.14 |

1.38 |

SCB Visa Infinite SCB Visa Infinite |

1.4^ | 1.30 | 1.57 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.30 |

1.57 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.30 | 1.57 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.40 | 1.69 |

SCB X Card SCB X Card |

1.2 | 1.51 | 1.83 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.51 | 1.83 |

| ^With minimum S$2K spend per statement month, otherwise 1.0 mpd |

|||

With a 1.85% fee, the cost per mile is as low as 1.14 cent each. It all boils down to your value of a mile, but I’d say that’s a very good price to pay, even right now.

Other offers

Here’s a collection of the other promotions that CardUp is currently running.

| Code | Remarks | CPM |

| MILELION | First time CardUp users save S$20 off one payment of at least S$1,000 | Depends on amt. paid |

| MLTAX2021 (read more) |

Pay a single income tax payment (of any amount) with 1.75% fee | From 1.07 |

| SAVERENT179 (read more) |

Pay rent with 1.79% fee | From 1.1 |

| OCBCAFFCARD (read more) |

1.7% fee on a single payment | From 1.04 |

| OCBCCARDS (read more) |

1.7% fee on a single payment (max. S$10K) |

From 1.39 |

Conclusion

If you’ve got a recurring series of payments to make (like your MCST fee or a mortgage), this is a good opportunity to pick up some cheap miles in the process. While payments can be set up all the way till 31 December 2021, do note the 300 user cap on the 1.85% promo fee.

Of course, it’s going to be vey hard to beat the sensational offer that Citi PayAll is currently running, which allows you to make payments and buy miles at just 0.8 cents each. That should be your first port of call at least until 31 August 2021.

I usually make condo payments on AXS … any advantage to switching to CardUp?