American Express has launched a new AMEX Offer for its KrisFlyer cobrand cards, allowing cardholders to earn 5,000/10,000 bonus miles for meeting a certain minimum spend.

Registrations are limited and like all AMEX Offers, this may be targeted.

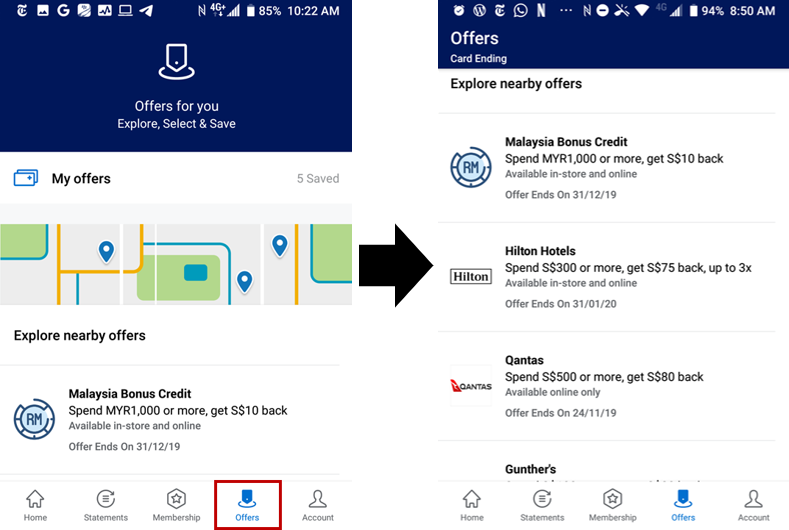

| ❓ What are AMEX Offers? |

|

AMEX Offers give cardholders bonus miles or Membership Rewards points, or discounts in the form of statement credits. These can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. If you don’t see an offer, you can try calling customer service for manual registration, but YMMV. These are not applicable to DBS/Citi/UOB AMEX cardholders. |

Earn up to 10,000 bonus miles with KrisFlyer cobrand cards

From now till 12 October 2021, registered AMEX KrisFlyer Ascend or AMEX KrisFlyer Credit Card members can earn 10,000 bonus miles when they spend S$8,000. There is another permutation floating around, offering 5,000 bonus miles with a minimum spend of S$5,000.

| Spend | Bonus | Cap | |

| Offer 1 | S$8,000 | 10,000 miles | 20,000 cards |

| Offer 2 | S$5,000 | 5,000 miles | 10,000 cards |

This is on top of whatever base miles you normally earn, so an AMEX KrisFlyer Ascend cardholder registered for Offer 1 would receive a total of 19,600 miles (S$8,000 @ 1.2 mpd + 10,000) for S$8,000 of spend.

Bonus miles will normally be credited within 5 business days from qualifying spend, but may take up to 90 days from the end of the offer date. In practice, however, they post very fast.

What spending is eligible?

This offer is only valid for payments made in Singapore Dollars– not that you should be using your AMEX KrisFlyer Ascend/KrisFlyer Credit Card for foreign currency transactions anyway, given how weak the earn rate is.

Payments can be made in-person, in-app or online. The offer terms are quiet about eligible categories, but it’s safe to assume that the regular American Express rules apply. You can find the full list of excluded spending categories here; the key ones to note are:

- GrabPay top-ups

- Insurance

- SPC transactions

- Utilities

For the avoidance of doubt, hospital transactions, donations, and anything else not explicitly stated in the exclusion list will count as eligible spend.

Is it worth participating?

On the face of it, this offer may not seem all that attractive. S$8,000 spend for 19,600 miles works out to 2.45 mpd, but you could earn as much as 32,000 miles by putting that spend on the right 4 mpd card.

However, this might be useful for anyone paying hospital bills or making charitable donations– categories that don’t earn rewards with most other credit cards.

It could also be viable for someone with the AMEX KrisFlyer Credit Card working towards an upgrade to the AMEX KrisFlyer Ascend– if they spend S$10,000 within 12 months, they’d be looking at:

- 11,000 base miles (S$10,000 @ 1.1 mpd)

- 10,000 miles from AMEX offer

- 12,000 miles from upgrade bonus

Conclusion

Registered AMEX KrisFlyer cobrand cardholders can earn either 5,000 or 10,000 bonus miles for meeting a minimum spend within the next two months. If you have a big ticket expense coming up that won’t earn you 4 mpd on any of your other cards, this could be a good opportunity to get something extra out of it.

Registrations are limited, so get yours done ASAP.

It could also be viable for someone with the AMEX KrisFlyer Credit Card working towards an upgrade to the AMEX KrisFlyer Ascend– if they spend S$10,000 within 12 months, they’d be looking at:

^ If it’s someone with the AMEX KF CC, it should be 1.1 mpd as base rate, I suppose!

correct! edited, thanks

Does ipaymy/ Cardif consider as eligible spending?