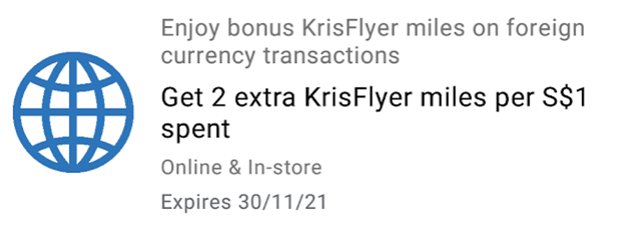

American Express has launched a new AMEX Offer for AMEX Singapore Airlines cobrand credit cardholders, which allows them to earn up to 3.3 mpd on all foreign currency transactions.

Registration is required, and can be done via the AMEX app or AMEX online banking portal. A maximum of 12,000 cards can be registered.

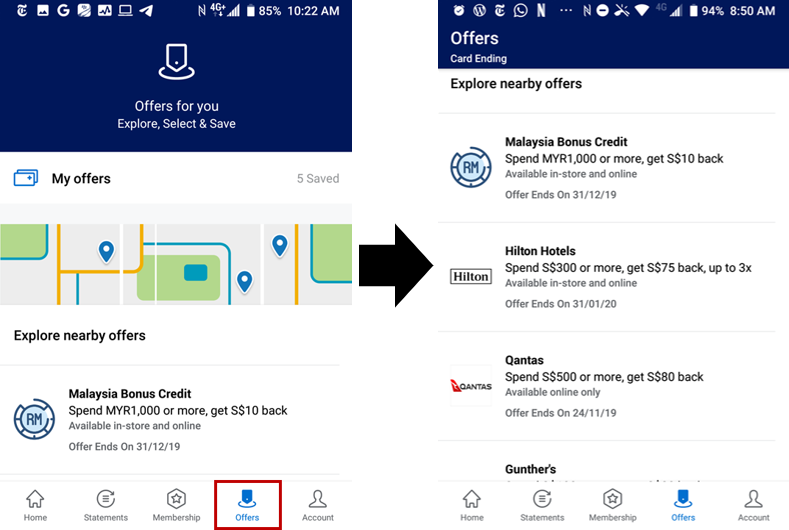

| ❓ What are AMEX Offers? |

|

AMEX Offers are opportunities to earn bonus miles or Membership Rewards points, or discounts in the form of statement credits. These are available to Platinum, True Cashback, and KrisFlyer cardholders, and can be found in the “Offers” section of the AMEX app or web portal. Registration is required, and some offers may be targeted. These are not applicable to DBS/Citi/UOB AMEX cardholders. |

Earn up to 3.3 mpd on foreign currency transactions

From 1 October to 30 November 2021, AMEX Singapore Airlines cobrand credit cardholders will earn an additional 2 mpd on all foreign currency transactions as follows:

| Card | Base | Bonus | Total |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 2 mpd | 3.1 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 2 mpd | 3.2 mpd |

AMEX PPS Credit Card AMEX PPS Credit Card |

1.3 mpd | 2 mpd | 3.3 mpd |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

1.3 mpd | 2 mpd | 3.3 mpd |

The bonus component is capped at S$300 of spending throughout the entire campaign period. In other words, the maximum bonus you can earn is 600 KrisFlyer miles.

If you’re planning to purchase something from an e-commerce merchant, remember that it’s common practice to only charge the card once the goods are dispatched; if you place an order towards the tail end of November, be careful about this.

Bonus miles will be credited within 5 business days from qualifying spend, but may take up to 90 days from the end of the offer date. In practice, they post very fast though.

While the AMEX KrisFlyer Credit Card and the AMEX KrisFlyer Ascend award 2 mpd on foreign currency transactions in June and December, this offer will end before there’s an opportunity to stack the two.

What counts as eligible spending?

All transactions in foreign currency will qualify for this offer, with the exception of transactions on AMEX’s rewards exclusion list. The main ones to note are:

- Insurance

- GrabPay top-ups (not that you’d be doing this in foreign currency anyway!)

- Utilities (ditto)

Everything else is fair game, and for what it’s worth, educational institutions are not on the AMEX exclusion list. If you have overseas school fees to pay, this could be a nice opportunity to pick up some miles in the process.

What are the alternatives?

Even with the upsized earn rate, the AMEX Singapore Airlines cobrand credit cards aren’t the best option to use for foreign currency transactions. It’s easy to earn up to 4 mpd with the right cards, at a lower CPM to boot.

| 🌎 Best Cards for FCY Spend |

|||

| Card | Earn Rate | FCY Fee | CPM |

HSBC Revolution HSBC Revolution |

4 mpd1 | 2.8% | 0.7 |

UOB Visa Signature UOB Visa Signature |

4 mpd2 | 3.25% | 0.81 |

Citi Rewards Citi Rewards |

4 mpd3 | 3.25% | 0.81 |

DBS Woman’s World Card DBS Woman’s World Card |

4 mpd4 | 3.25% | 0.81 |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

3.1 mpd | 2.95% | 0.95 |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

3.2 mpd | 2.95% | 0.92 |

| 1. On selected transactions, capped at S$1K per calendar month 2. Min. spend of S$1K per statement month required, capped at S$2K per statement month 3. Must be online, excludes travel, capped at S$1K per statement month 4. Must be online, capped at S$2K per calendar month |

|||

And we can’t talk about foreign currency transactions without bringing up Amaze. Really, there’s no reason to use any of the above cards, so long as Amaze offers 4 mpd + 1% cashback without any foreign currency transaction fees (although you’d probably pair the Amaze with the Citi Rewards).

| 💳 tl;dr: Amaze card |

|

| Sign Up Here |

|

This may not be the case forever, so enjoy it while it lasts.

Conclusion

Registered AMEX cardholders can earn up to 3.3 mpd on foreign currency transactions up till 30 November 2021, but the low cap and presence of superior alternatives means you’re better off looking elsewhere.

At most, this would be useful for individuals who prefer to use one card for everything.

There is also an ongoing 2% cashback promo for foreign currency spendings with Amex. Presumably these two promos are stackable. With the lower FCY fee, Amex is a much better option than other credit cards, except for Amaze.

correct me if i’m wrong, but isn’t that FCY CB promo only for the AMEX TCB card?

I don’t think so. I got it for my blue KF card. The promo runs from June till the end of the year.

ah right i just saw the offer on someone else’s phone. yes, that’s a very compelling offer then, albeit for $300.

only $300 cap? who thinks up these promos lol.

I can’t wrap my head around which one is more worth it with the amazing Amaze card: 1. use the physical card to convert offline spendings (otherwise earning 1.x mpd) into 4 mpd on my Citi Rewards Mastercard, or 2. use the physical/virtual card to turn online FCY spending into free miles. Personally I’ve been religiously doing the former. Last month I used it to pay for a car servicing package with Cycle & Carriage and maxed out at 4000 miles, which is really amazing. So now I just put my online spending on my other cards: Citi Rewards Visa… Read more »