For the longest time, I’ve complained how difficult it is to track credit card points in Singapore. Most banks just provide a summarised figure each month, and you have to take it on faith that it’s correct (or develop really elaborate spreadsheets to check).

Others give slightly more detail, but there’s still limitations- Citibank, for example, will show a breakdown of how many points you earned each day, but there could be several transactions lumped into that figure, making it hard to track which transaction earned what.

Now here’s an exciting development: the UOB TMRW app.

Yes, it’s a completely silly name, like someone developed a sudden fear of vowels. But you know what? I don’t care. They could call it the “biased-traversed-and-mosaicked-factual-matrix-app” and so long as it gave me this kind of functionality, I’d give it 5-Stars every day of the week.

UOB TMRW shows transaction-level points breakdowns

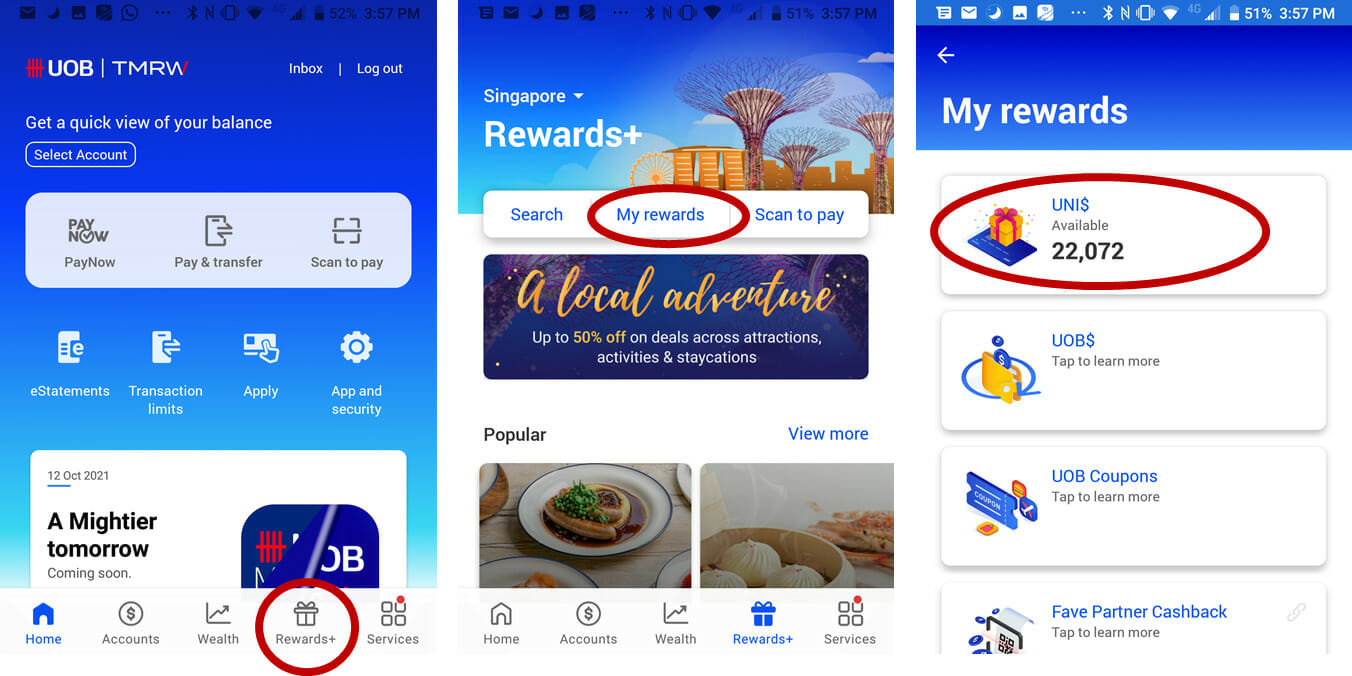

If you haven’t already done so, download the UOB TMRW app and sign in to your online banking. Tap Rewards+ ➤ My Rewards ➤ UNI$

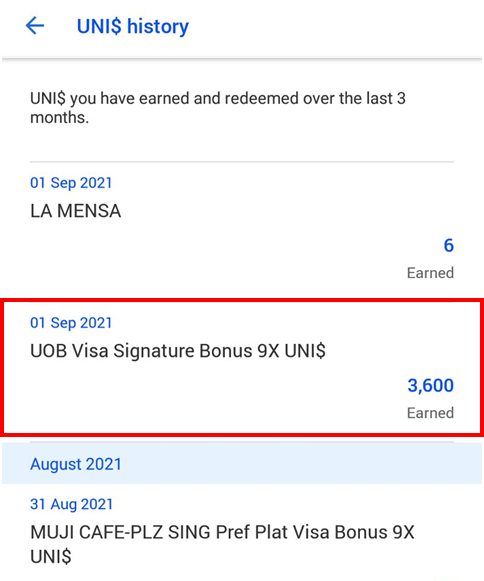

That’s it. You’ll see a breakdown under the UNI$ history section (tap “view all” to see more), for the past three months. You can’t go further back than three months, but chances are that if you need older information, you aren’t very diligent about tracking your points anyway.

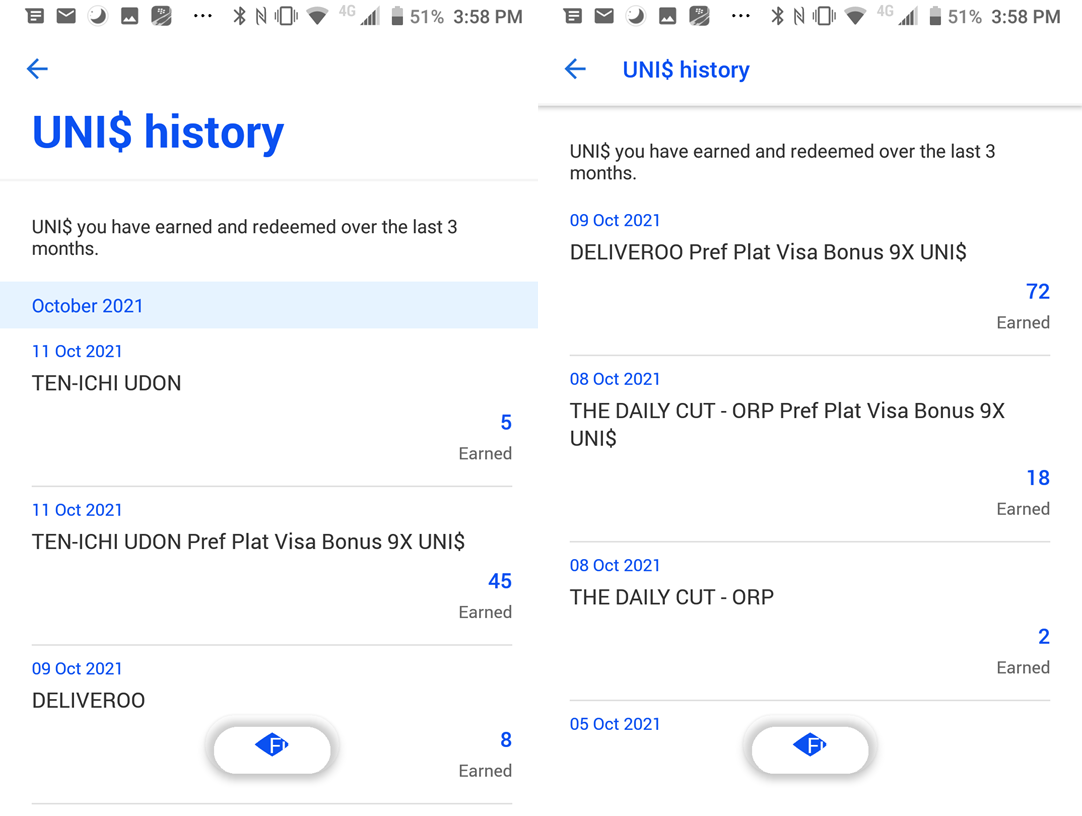

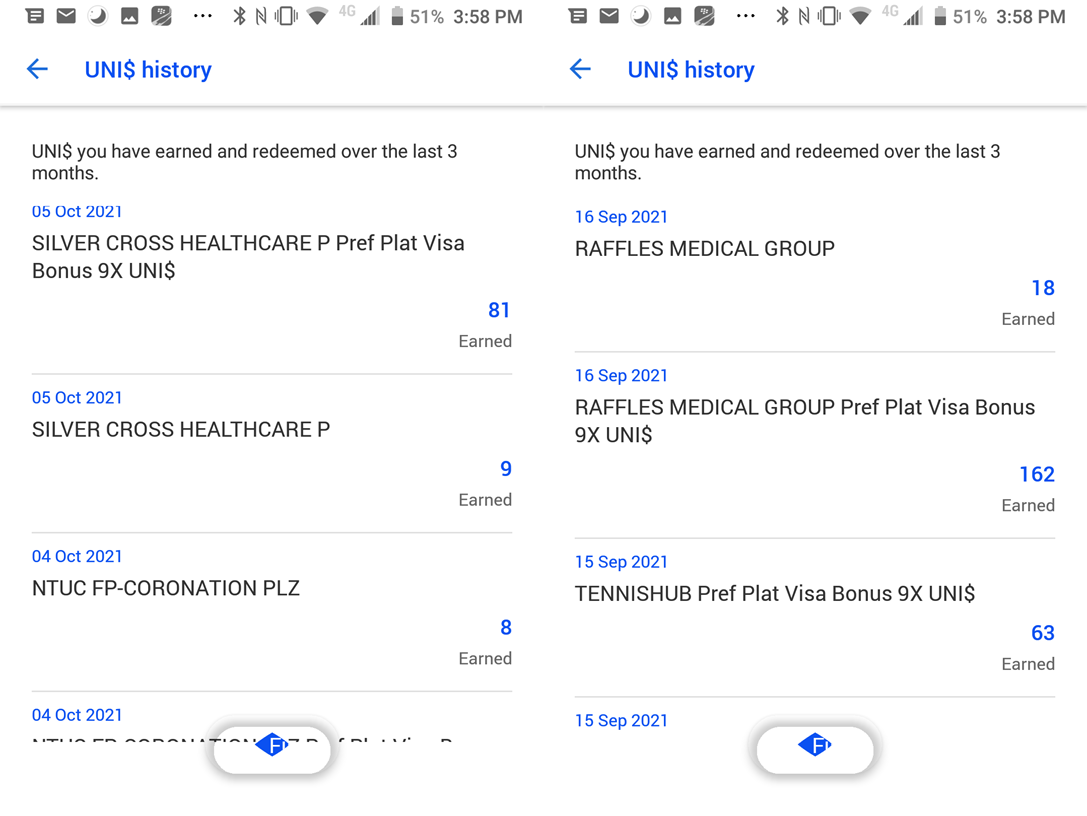

Now, this isn’t broken down on a card level, but it shouldn’t be too hard to spot what’s what. As you can see, my bonus 9X is clearly labelled “Pref Plat Visa Bonus 9X UNI$”.

Thanks to this feature, I can also confirm that you can tap your UOB Preferred Platinum Visa (well, the digitised version on your phone at least) at private clinics- they’ll quality for base and bonus points.

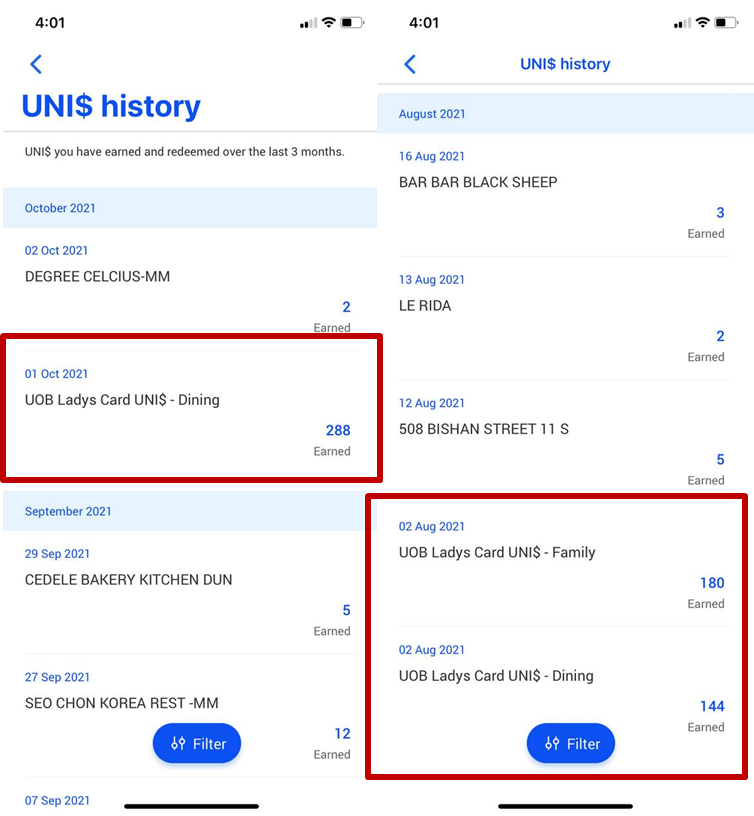

I checked out the Milelioness’ app as well (she has a UOB Lady’s Solitaire), and here’s how it appeared.

There’s an important difference to highlight. For the UOB Lady’s Card & Lady’s Solitaire Card, you will see a consolidated bonus figure each month, rather than a transaction-level breakdown. That’s because of how UOB’s points crediting mechanism works.

| Card | Bonus |

UOB Preferred Platinum Visa UOB Preferred Platinum Visa |

9X posts along with base points |

UOB Lady’s Card/ Lady’s Solitaire UOB Lady’s Card/ Lady’s Solitaire |

9X posts next calendar month |

UOB Visa Signature UOB Visa Signature |

9X posts next calendar month |

With the UOB Preferred Platinum Visa, bonus points (9x) post along with base points (1X). That’s why you see each 9X credit tied to a specific merchant.

With the UOB Lady’s Card/Lady’s Solitaire, bonus points (9x) are batched and posted the following calendar month. That’s why there’s a single credit at the beginning of the month, e.g. UOB Ladys Card UNI$- Dining and UOB Ladys Card UNI$- Family (the Milelioness’ two bonus categories on her Solitaire card). This represents the total bonus points you earned from all eligible transactions during a month.

The same goes for the UOB Visa Signature, by the way. UOB credits the bonus 9X the following month, so you only get one consolidated figure.

It does mean it’s trickier to track which transactions did and did not earn 9X with the UOB Lady’s Card and UOB Visa Signature, because all you have is a single figure which you’ll need to break down via guess and check.

| 💳 This feature would have been perfect for the UOB Preferred Platinum AMEX card, which like the UOB Preferred Platinum Visa also credited the 9X upon transaction posting. Pour one out for this fella… |

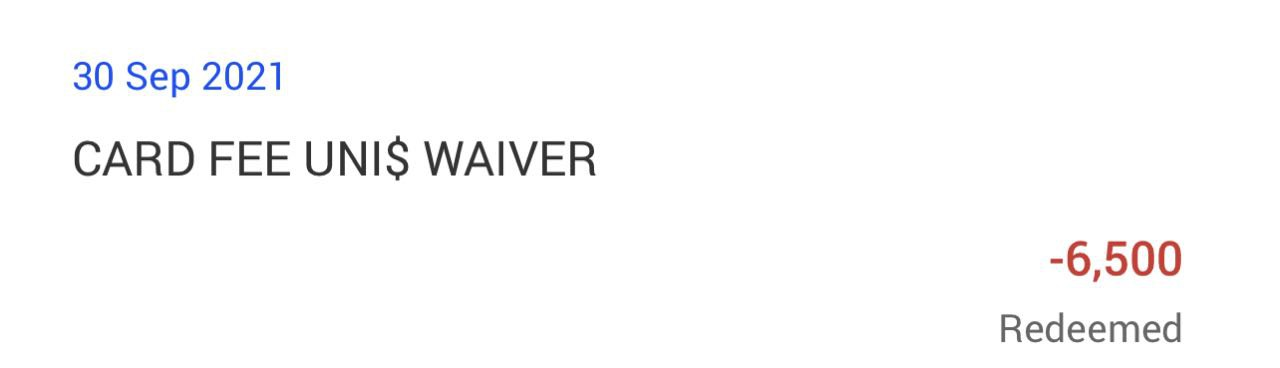

Also note that UOB will show UNI$ deductions for annual fee payment, but not a subsequent reversal if you call in and get it waived (your total balance will be correct though). Don’t ask me why, it might be a system limitation.

So UOB TMRW isn’t perfect, but at least it allows UOB Preferred Platinum Visa cardholders to get a quick and simple answer to “does merchant X earn 10X?”

Conclusion

UOB cardholders can now view their points statements in the TRMW app, and for UOB Preferred Platinum Visa cardholders, both base and bonus points are displayed on a transaction level.

This is a big step forward in rewards transparency, and full credit to UOB for being the first bank to implement it. Let’s hope other Singapore banks have similar upgrades planned.

OCBC iBanking has been showing transaction level rewards earning for a long time before this, you do have to click into each transaction to see the details such as amount spent and rewards earned though.

When you log into ibanking, go to “Rewards” tab, and click “Transaction History”

yup- but what’s slightly annoying is that it doesn’t show you the merchant name, so there’s a bit of additional work in the matching process. UOB’s interface is as clean as any i’ve seen so far.

It looks to me like someone finally caught up with Amex. This has been a feature for as long as I remember on the Amex app.

“They could call it the ‘biased-traversed-and-mosaicked-factual-matrix-app’ “

lolol good one I see you are caught up with current sagas.

Aaron, the pictures are not loading. something wrong with the site?

something went funny. i have applied a temp fix- try again please.

Just realised from downloading the app that you don’t earn miles from SPC: are petrol stations MCC one of those excluded from earning miles?

No uni$ for spc, see t and c

Hi Aaron, I can’t seem to find the payment option like Mighty Pay. Now I can’t pay via pay wave anymore ?

So since Lady’s card and Visa Signature only credits the bonus at end of each month, does that mean they also do the rounding off to award UNI$ based on end month total amount, instead of per transaction rounding? Meaning, it isn’t so bad if I pay $4.90 transaction on Lady’s card, vs on PPV? So that is a benefit in a way, if I am interpreting it correctly?

Aaron, since there’s a lot of activity/promotions on UOB cards recently, fancy a guide for the pooling and redemption of UOB points?