From 11-14 November 2021, Amaze is offering 1% bonus cashback on all transactions, increasing the overall earn rate to 2% cashback.

This is on top of all its usual features, namely: zero foreign currency transaction fees, and up to 4 mpd when paired with the right card.

Amaze 1% bonus cashback promotion

From 11-14 November 2021, all spending on the virtual or physical Amaze card will be awarded a bonus 1% cashback. This stacks with the usual 1% cashback for an overall earn rate of 2% cashback.

No registration is required, and the maximum bonus cashback you can earn is capped at S$11. In other words, you’d max out this promotion with S$1,100 of spending.

With the exception of prepaid account top-ups (e.g. GrabPay, YouTrip) and gambling transactions, there are no exclusion categories (keep in mind you must spend at least S$5 in a single transaction to earn cashback).

However, regular credit card exclusion categories still apply. For example, you could pair the Amaze with your Citi Rewards Card and pay insurance premiums, earning 2% cashback and no card rewards (since insurance is an exclusion category for the Citi Rewards Card).

Remember, while Amaze converts offline transactions to online ones, it does not change the underlying MCC.

|

| Sign Up Here |

|

That said, you wouldn’t normally earn rewards on transactions like charitable donations, government payments and insurance premiums, so this may be your best bet.

When is cashback credited?

Cashback is credited to your Amaze wallet on the 25th of the month following the end of the calendar quarter:

| Spend Period | Cashback Credited |

| 1 Oct- 31 Dec 2021 | 25 Jan 2022 |

| 1 Jan- 31 Mar 2022 | 25 Apr 2022 |

| 1 Apr- 30 Jun 2022 | 25 Jul 2022 |

| 1 Jul- 30 Sep 2022 | 25 Oct 2022 |

All bonus cashback earned under this campaign will be credited on 25 Jan 2022, along with the base cashback earned from 1 Oct to 31 Dec 2021.

Terms and conditions

The T&C of this offer can be found here.

How do I use Amaze cashback?

Any cashback earned can only be spent through the Amaze card at the moment; there is no mechanism to withdraw your Amaze wallet balance to a bank account.

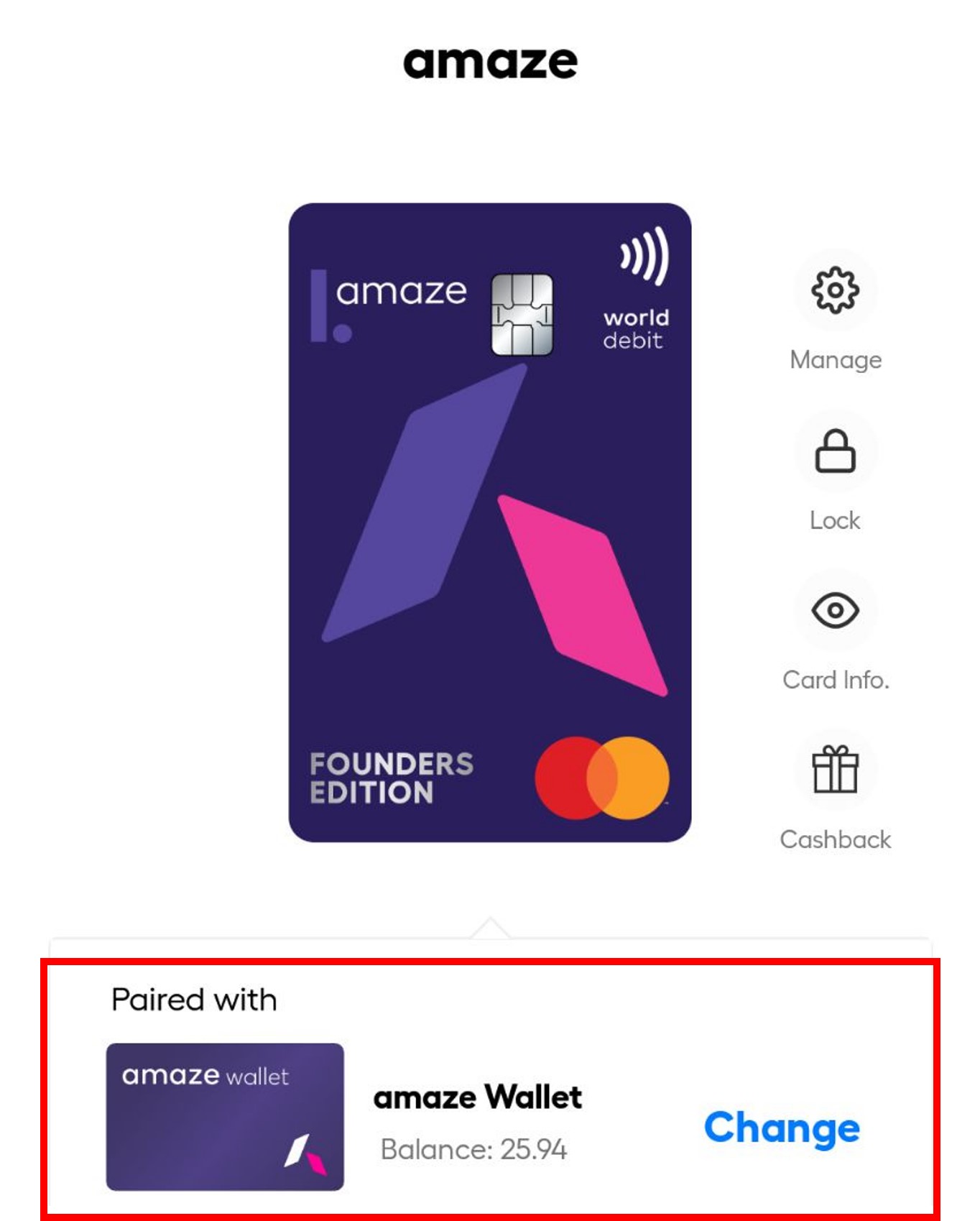

To spend cashback, switch the funding source of your Amaze card to “Amaze wallet” in the Instarem app, as shown below.

Do note that you won’t be able to combine funding sources, or spend more than the balance in your wallet. For example, if your Amaze wallet has S$10, you can only make a transaction of S$10 or less.

While this may seem frustrating, there’s actually a simple workaround to liquidate your earnings. Use the Amaze Card to top-up a GrabPay account, then cash out your balance from GrabPay (this is possible since the Amaze is a debit card; for obvious reasons, you can’t cash out GrabPay balances funded from credit cards).

You won’t earn any Amaze cashback for the GrabPay top-up (since it’s a prepaid account), but at least you can clear out your balance.

Amaze now supports Google Pay

If you’re still waiting for your physical Amaze card to show up in the mail, here’s some good news: Amaze now supports Google Pay. You can add your virtual Amaze card to your Google Pay wallet, and tap your phone to pay at physical merchants.

Of course, this only works at merchants that accept contactless payments.

Conclusion

Amaze cardholders can earn up to 2% cashback from now till 14 November 2021, and since you’ll be putting most of your spend on this card anyway, it’s basically free money.

Just remember the bonus cashback is capped at S$11, so reassess your strategy as needed after hitting S$1,100 of spending.

Actually, it could be up to 13 mpd if you use Kris+ and Amaze since it’s now enabled on Google Pay, right? 😉

that’s some good stacking right there. I have totally forgot about the ongoing Kris+ offers.

Amazing info again. Thanks to you I was able to cash out my $10 Cashback.

glad it helped!

can I stack American Express cash back card with amaze to pay for insurance premium?

You probably won’t get any reply because your question shows that you didn’t know anything about amaze at all.

The most basic info you would learn about amaze if you read into it is that, it only allows you to add MasterCard to it. Mastercard only.

Hi Aaron,

I will soon relocate from Singapore to Hong Kong (where there doesn’t seem to be 4mdp equivalent card); assuming Amaze card doesn’t get nerfed, what would prevent me from making all my HK offline expenses through my Amaze card (linked to DBS WWC / Citi Reward) and accumulate ~free DBS points that I will then convert in Asiamiles ? Exclusions aside, pretty much everything would be converted into online expenses and qualify for 4mpd, right ?

bingo.

doing that myself now 😉 i use the SC unlimited Cashback card when I max those cards out too

can i ask a silly question because im not sure yet. if i pay for something (say SGD $100) using my Amaze Card (linking a OCBC mastercard to it), so do i need to “pay” back my credit card bill to “amaze” or “OCBC”?

The expense made with the Amaze card will be reflected on your OCBC mastercard. You only need to pay back this OCBC card.

Is there any way to transfer the cents from the Amaze wallet, or does GrabPay only transfer by whole dollars?

grabpay top-ups must be in whole dollars.

If we link the SC UNLIMITED card to the AMAZE card, use the AMAZE card to top up to Grab wallet, is the transaction eligible for the 1.5% on SC UNLIMITED CARD?