| 👍 Good news |

|

SingSaver has upsized the cash gift from S$300 to S$350. This will retroactively apply to all applicants who applied via The MileLion from 1 March onwards. If you’ve chosen a different gift and now want to change to the cash gift, send an email to info@singsaver.com.sg with the subject: Milelion- SCB Smart Card, ARN No. “XXX” where XXX is your application reference number. Inside the email body, inform them that you wish to change your gift to the S$350 cash option. |

From 1-14 March 2022, new-to-bank cardholders who apply for a Standard Chartered Smart Card through SingSaver can choose one of the following gifts:

- Sonos One Speaker

- JEN Singapore Orchardgateway Superior Room staycation

- S$350 cash

Existing customers will receive S$30 cash.

Both new and existing customers will be required to spend at least S$350 on qualifying transactions (see below) within 30 days of approval.

|

| Apply Here |

| ❓ New-to-bank Definition |

| New-to-bank customers are defined as those who do not currently hold a principal Standard Chartered card, and have not in the 12 month period before application. Debit cards, supplementary cards and corporate cards do not count. |

Applications must be received by 11.59 p.m on 14 March 2022 and approved within 14 days to be eligible.

The full T&C can be found here.

Application Steps

- Apply through any of the links in this article

- You will be directed to a SingSaver landing page. Enter your email address and click “confirm”

- Complete your application and take a screenshot of the Application Reference Number (for Standard Chartered, it’s in the format SGYYYYMMDDxxxxxx)

- Fill in the SingSaver rewards form that will be sent to your email. It’s vital you fill in the form– no form, no reward.

You’ll be able to indicate your choice of gift in the rewards form if applicable.

Qualifying Spend

The approved card must be activated and a minimum qualifying spend of S$350 made within the first 30 days of approval.

“Qualifying spend” refers to any retail transaction, except the following:

|

Gift Fulfillment

All gifts will be fulfilled within 4 months of approval.

Do note that you will not receive your gift immediately upon meeting the minimum spend- the reason for the delay is the need to confirm eligibility with the bank. Please take note of this timeline before applying, and only apply if you’re willing to wait.

The Hotel Jen Orchardgateway staycation is available on both weekends and weekdays, but the following blackout dates apply:

- Singapore F1 (29 Sep to 2 Oct 2022)

- New Year’s Eve (31 Dec 2022)

The voucher is valid for six months, and validity cannot be extended.

For those who want to track the fulfillment of their reward, SingSaver provides fulfillment timeline updates for Citibank and Standard Chartered cards on its website.

Any enquiries about gift fulfillment should be sent to info@singsaver.com.sg

Get a free Disney+ subscription

If you’re a new-to-bank customer, Standard Chartered is offering a complimentary 3-month Disney+ subscription as well, with no minimum spend required.

Eligible cardholders will receive their Disney+ promotion redemption code within 60 working days of the date of activation of the physical card. This must be used within 3 months.

The T&C for this offer can be found here.

Recap: Standard Chartered Smart Card

|

||

| Apply Here | ||

| T&Cs | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 | None | 3.5% |

| Regular Earn | Bonus Earn | Cap |

| Up to 0.64 mpd | 5.6 mpd/7.7 mpd on fast food, streaming, public transport | S$818 per statement month |

The Standard Chartered Smart Card has a S$30,000 income requirement and no annual fee.

Cardholders normally earn a very underwhelming 1.6 rewards points per S$1 spent (equivalent to 0.46/0.64 mpd depending on whether you hold a Standard Chartered Visa Infinite or X Card- see the explainer below) on all spending.

| ❓ Got Visa Infinite? |

|

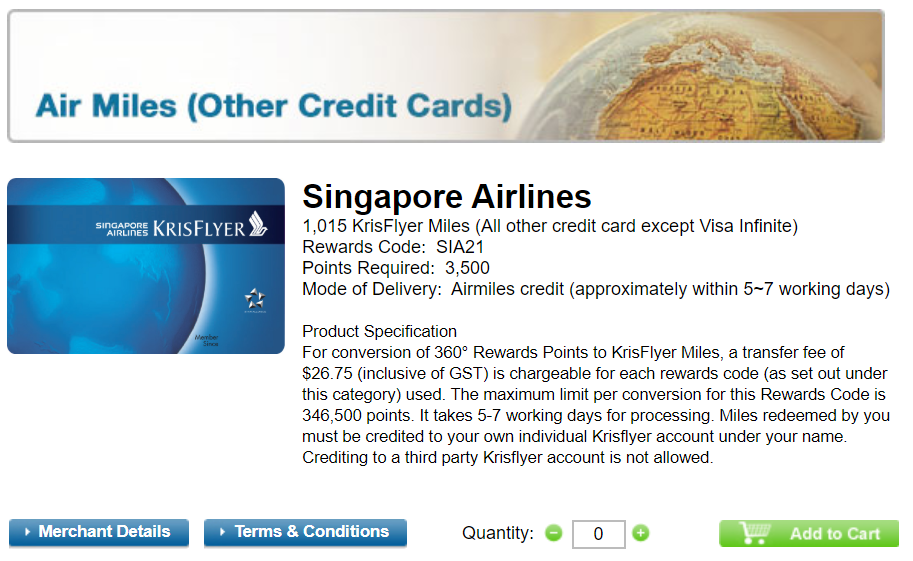

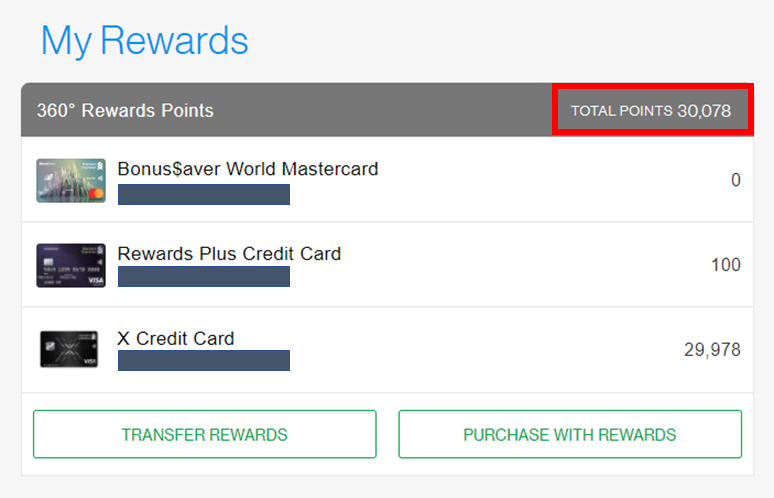

StanChart’s rewards ecosystem is much more favourable to those with a Standard Chartered Visa Infinite or Standard Chartered X Card. These cardholders can redeem KrisFlyer miles at an enhanced rate of 2,500 points = 1,000 miles.

All other cardholders redeem KrisFlyer miles at a rate of 3,500 points= 1,015 miles.

Here’s the fun part. If you have a Visa Infinite or X Card, all your rewards points can be redeemed at the 2,500 points = 1,000 miles rate. You can see this illustrated in my example below- the 100 points on my Rewards+ card are pooled with those from the X Card.

tl;dr: 1 SCB rewards point= 0.4 miles for Visa Infinite cardholders, and 0.29 mpd for all others. |

However, if cardholders spend on fast food, streaming entertainment or public transportation (no min. spend required), they’ll earn:

- the regular base rate of 1.6 rewards points per S$1 (0.46/0.64 mpd)

- a bonus of 17.6 rewards points per S$1 (5.10/7.04 mpd)

This means a total earn rate of 19.2 rewards points per S$1 (5.57/7.68 mpd), capped at S$818 per statement month. That’s actually very good if you frequently spend on these categories.

| Category | Merchants |

| 🍔 Fast Food |

|

| 📺 Streaming Entertainment |

|

| 🚆 Bus/MRT |

|

For comparison, the best alternative cards would earn “only” 4 mpd on such transactions (e.g. UOB Preferred Platinum Visa for mobile payments at fast food merchants, or the Citi Rewards for monthly streaming subscriptions).

This bonus rate is valid till 31 December 2022.

Conclusion

|

| Apply Here |

The Standard Chartered Smart Card could be a very useful companion to have, thanks to its upsized earn rate on fast food, streaming and public transport. Moreover, if your main card is a Standard Chartered X Card or Visa Infinite, it’s a no brainer to add the Smart Card to your wallet too (since there’s no annual fee and the points pool anyway).

For those who don’t already have a Standard Chartered credit card, there’s an additional gift of a Sonos One, Hotel Jen Orchardgateway staycation or S$350 cash in it for you, provided you apply by 14 March 2022.

Is this stackable with the $300 statement credit for new cardholders (also with $350 qualifying spend) offered on the SCB website?

nope, not stackable.

Hi Aaron, long time reader here but first time poster. I applied for the Smart Card based on this promotion. I was expecting, as your article notes, to have 30 days from card approval (Mar 9 in my case) to make the $350 min spend. However, I have just noticed that T&C clause 5(iv) provides that the min spend has to be made “within a 30-day period from the account opening date and in any event no later than 28 March 2022“. Given that the promotion period ran from March 1-14, I find it strange that there is a reference… Read more »

hi david- for promo mechanics you’ll need to refer to singsaver (info@singsaver.com.sg). They’ll be better placed to advise you. do note that the T&C file is regularly updated since new promotions get launched, so what you’re seeing now may not be the T&Cs as they existed at the time of your sign up. That’s why you should ask them what rules apply to the period your application went through.

Got it, will do. Thank you Aaron!