Just in time for income tax season, Citi PayAll has launched an excellent 2.5 mpd promotion, which allows customers to buy miles at an unbeatable 0.8 cents each all the way till 31 July 2022.

|

| Citi PayAll 2.5mpd Promo |

This is a public offer that applies to all payments made on Citi PayAll: paying tax, rent, insurance premiums, MCST fees, education expenses, utilities bills, or even friends and family for “services rendered”.

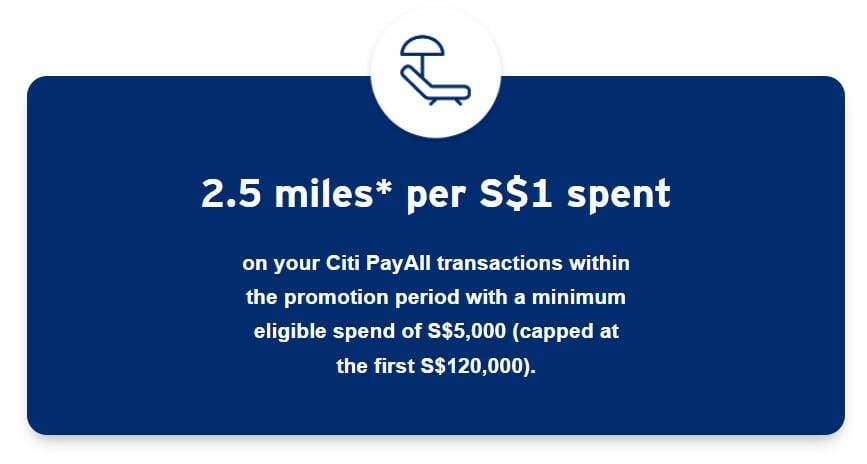

A minimum combined spend of S$5,000 and a cap of S$120,000 applies.

Even better, the earn rate is uniform across all eligible Citibank cards, so whether you’re holding an elite Citi ULTIMA or an entry-level Citi PremierMiles, the same 0.8 cents price is available to you.

Earn 2.5 mpd on Citi PayAll transactions

From 6 April to 31 July 2022, eligible Citi cardholders will earn a flat 2.5 mpd on Citi PayAll transactions, with a minimum combined spend of S$5,000 and a cap of S$120,000. Both the payment setup and charge dates must fall within the promotion period.

The following cards are eligible, and the same 2.5 mpd earn rate applies across all cards:

| Card | Earn Rate | Cost Per Mile @ 2% |

Citi ULTIMA Citi ULTIMA |

2.5 mpd |

0.8 cents |

Citi Prestige Citi Prestige |

2.5 mpd |

0.8 cents |

Citi PremierMiles Citi PremierMiles |

2.5 mpd |

0.8 cents |

Citi Rewards Citi Rewards |

2.5 mpd |

0.8 cents |

To illustrate how this works, someone who spends S$1,000 on the Citi PremierMiles Card (or any of the above cards for that matter) would earn 2,500 miles, and pay an admin fee of S$20. The cost per mile is therefore 20/2500= 0.8 cents each.

If I had to nitpick, I’d point out that Citi PayAll ran a similar promotion in 2021 which didn’t have any minimum spend, but I imagine most MileLion readers won’t have difficulty hitting a S$5,000 threshold. The S$5,000 need not be in a single transaction; it can be combined across multiple payments that fall within the promotional period.

As a reminder, the S$120,000 cap applies on a customer level, regardless of how many Citibank cards you hold.

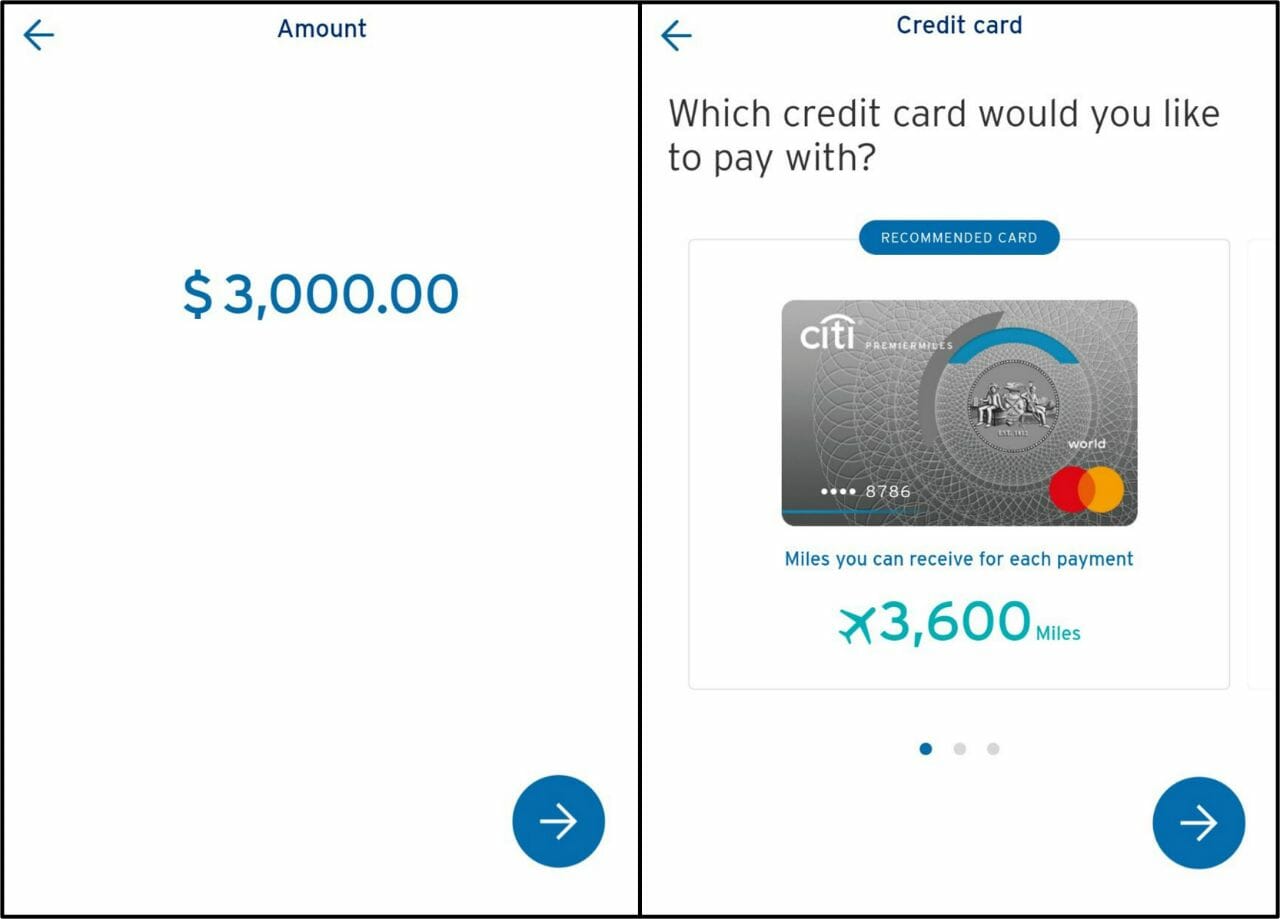

| ⚠️ Heads up: Citi app shows regular rates! |

|

Be advised that the Citi app (where PayAll payments are set up), rather unhelpfully, shows the regular earn rates by default.

For example, it tells me a S$3,000 payment on my Citi PremierMiles Card will earn 3,600 miles (based on 1.2 mpd), when in fact it should be 7,500 miles (based on 2.5 mpd). You’ll just have to take it on faith that the bonus 3,900 miles will show up later. |

What payments does Citi PayAll support?

Citi PayAll currently supports the following types of payments:

| 💰 Citi PayAll: Supported Payments | |

|

|

The “miscellaneous payments” category is surprisingly broad. You could use PayAll to pay for wedding expenses, donations, renovations, even the nebulously defined “travel expenses” and “payment for retail good and services”. Most of these don’t even require supporting documentation; you can simply transfer funds to someone else’s bank account.

But before you rush off and pay your wife S$50,000 for love and affection, remember that such transactions may have income tax implications. In general any income exceeding S$20,000 is liable to tax, provided it’s deemed to be derived in the course of a trade.

When will bonus miles/points credit?

Cardholders will receive their regular base rewards (e.g. 1.2 mpd with the Citi PremierMiles Card) when the Citi PayAll transaction initially posts.

Bonus rewards (e.g. 1.3 mpd with the Citi PremierMiles Card) will be credited within 12 weeks from the end of the promotion period, i.e. by 23 October 2022.

New customers: Get S$50 in GrabFood vouchers

If you’ve never made a Citi PayAll transaction prior to 6 April 2022, you’ll receive S$50 in GrabFood vouchers when you make at least S$5,000 of Citi PayAll transactions by 31 July 2022.

This consists of 2 x S$25 promo codes, which will be sent within 12 weeks from the end of the promotion period, i.e. by 23 October 2022. For avoidance of doubt, this promotion stacks with the 2.5 mpd offer mentioned above.

Terms and Conditions

The T&C for both the 2.5 mpd and S$50 GrabFood voucher campaign can be found here.

Is it worth it?

Oh goodness me, yes.

Buying miles at 0.8 cents is hands down and incredible offer, especially since Citibank partners with 11 different frequent flyer programmes.

There are some great sweet spots with FFPs like Etihad Guest, British Airways Executive Club, and Turkish Miles&Smiles. Even the newly-revitalised Qatar Privilege Club might be a good bet (but heads up: they’ve sneakily reintroduced award segment fees!)

| 💳 Citibank Transfer Partners | |

|

|

|

|

|

|

|

|

|

|

|

|

| For a full list of transfer partners, refer to this article | |

Assuming you opt for plain vanilla KrisFlyer miles, you could easily get >0.8 cents per mile in value for certain redemption options.

| Options for Spending KrisFlyer Miles | ||

| Redemption Option | Value per mile | |

| ✈️ | Award flights | 2-6 cents |

| 🏨 | Shangri-La Golden Circle conversion | 1.1-1.4 cents |

| ✈️ | Pay for flights with miles | 0.95 cents |

| 🚘 | KrisFlyer vRooms | 0.8 cents |

| 🛍️ | KrisShop | 0.8 cents |

| 🏬 | CapitaStar conversion | 0.7 cents |

| 📱 | Kris+ | 0.67 cents |

| 🎡 | Pelago | 0.67 cents |

| 🛒 | LinkPoints conversion | 0.65 cents |

| ⛽ | Esso Smiles conversion | 0.33- 0.67 cents |

It’s hard to think of any situation where you could buy miles at less than 0.8 cents each, so if you have the bills to pay, this is the right time to top up your miles balance.

Conclusion

Citi PayAll is offering an excellent 2.5 mpd on all payments made till 31 July 2022, with a minimum spend of S$5,000 and a cap of S$120,000. It’s especially timely for those planning to pay income tax, and it’s hard to see anyone beating this.

Time to make some hay.

(HT: Josh)

gg cardup and ipaymy

I came here to write the same thing.

I’m a milelion reader and I have problems hitting 5k..

What Aaron probably means to say (but can’t be too explicit about) is that there are many ways of using payall for transactions that shall we say, are rather unconventional. I’ve heard of left hand paying right hand type things, and payall often doesn’t ask for documentation.

So if you’re a Milelion reader you might be the kind who would sleuth this sort of thing out 😉

It is true

Not true don’t ask more ty

No documentation means left hand pay right hand to pay the same CC bill next month can?

Does PayAll count towards welcome spend of $9k?

does that mean my Citi cash back card will earn miles via this promotion, even if that is the only citi card I hold? (i.e. I don’t have any other miles earning Citi card)

Do read the text – only applies to the specific 4 Citibank credit cards indicated. Citi cashback isn’t one of them.

T&Cs say it is

What if you can’t hit the minimum 5k spend? let’s say you income tax is only 1k

suck thumb and cry. every 30 yo already got 5k income tax :'(

I’m 30 and my income tax is alr 6k. Wdym you cant hit min 5k?? Pls pay more tax

Same here. Looks like we are the poor lad here. My income tax is also below 1k

For you to get the 5k mark, u need to earn like 7k at least

To those thinking of pre-paying income tax:

Last month, I paid 2 months’ of income tax and IRAS issued a cheque refund for the extra month, which meant I ended up taking a loss on having paid the extra month’s Citi PayAll fee.

wouldnt that be a gain as you still earn the payall miles award ?

No idea.

That new article by Milelion highlighted this bit from the Citi PayAll T&Cs:

“Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount.”

Hi! Does this apply if I apply for my Citi card now? i.e. not an existing citi card user

Can I pay IRAS with GPMC topped up with TCB, then PayAll myself the same amount and use it to pay off TCB?

My limit isn’t high enough to cover my tax bill. Has anyone tried before to transfer money to their Citi account to “artificially” increase their monthly limit by having a positive balance?

yep, that is how to do it.

you can also apply to increase your credit limit. very easy now within the ibanking app. it’ll happen within a few days.

Can supplementary cardholder pay their own tax bill?

If I already have a monthly GIRO plan with IRAS, how do I use this to avoid overpaying IRAS? Must I now make one payment only instead of monthly? Thanks

You can still pay monthly. As long ss IRAS receives the money before the Giro date (6th?) they will just skip the Giro for that particular month.

Thank you. What happens if I just make one payment? Will this override all the monthly GIRO payments? I noticed there is a fixed deadline for Citi so seems one payment is necessary

No impact, once you owe money, Giro will restart.

Assuming you have a tax bill of $12k and have 12 scheduled $1k giro payments:

If you pay $1k via Payall, giro will stop for 1 month and go back to normal after that.

If you pay $2.5k via Payall, giro will stop for 2 months, deduct $500 in month 3 and go back to $1k in month 4.

Really convenient to keep the benefits of Giro (payments spread out over 1 year) and combine it with the perks of the all-year Payall promotions we’ve seen last year.

Yup Dave has summarised it very well. Good for optimisation with all the diff offers out there

Thank you. So I need to spend a minimum of approximately S$8,000 remaining for my welcome bonus on a card. According to what you’ve said, I can just allocate that sum as a one off payment in May using CitiPayall/CardUp/other direct facilities, and whatever tax I have left after that IRAS will deduct from Giro automatically. Please correct if wrong. Thanks.

Can you help clarify if this applis to even non IRAS GIRO plans, including insurance? Thank you!

Experience with Citi payall for tax purposes very unpleasant so far. Transaction declined for no reason and Citibank phone bankers have been offering very different advise

Payall limits are below your actual credit card limits (75 or 80% or so). I’ve also had some payments blocked despite having sufficient limit and learned that the hard way.

Makes no sense whatsoever but it’s the truth.

Was setting up a payment earlier, I saw somewhere along the process that Payall limit is 95% of the credit card limit.

Am assuming that this is if one has not already spent more than 5% of the CC limit for that billing cycle.

Hope it helps.

Quick question. For citibank reward card, the monthly maximum limit is 1000. Will i still get rewards points if i charge more than 1000 bills to citi rewards card?

Am toying with the idea of 2 other form of payments. Not sure if it will fly. Appreciate data points from anyone who might have done it before. 1. Am self employed, so will need to contribute to Medisave. Personally, i see this as a ‘tax’, but there’s no existing option of CPF as a payee. Can I just choose ‘other taxes’, key in my NRIC and make the payment? Have already paid income tax, so hopefully the collective stat boards will be able to tell that its for CPF/medisave. 2. My wife doesn’t have a Citi card currently. Waiting… Read more »

You can’t pay someone else’s tax.

Guess I was being too optimistic!

But thanks for the confirmation.

Have the same question here, how can we use PayAll for self-employed Medisave contributions?

Whats the transaction fee for paying income tax via credit card using Payall. e.g. my limit is 15k and i need to pay 45k income tax. i pay 15k and then pay the credit card account and do this three times. how much is the total cost incurred. the benefit is 65000 miles, i get it.

And whats the conversion ratio of these 65000 miles to lets say SQ or Qatar?

45k income tax still can’t do simple mathematics

Citipayall fees is 2%.

If I have both the Citi Premiermiles and Prestige cards, which should I use and why?

They earn at the same rate for this promo, so that won’t be a factor. I’d consider whether I plan to cancel any of them soon, and if all else is equal – Prestige earns marginally more for general spend, so I’ll choose to accumulate my miles there (slightly more likely to consolidate miles with it).

Thanks! I will do that.

wow. I did not know Citi rewards earn so little point for PayAll. What is the reason. Sorry if it is very simple as I am not sure why.

Hiya Aaron, thanks for this useful article. May I ask if I will get CitiReward points instead if I use the Rewards card?

Thank you.

Well, paragraph 5 in the T&Cs stipulates which are excluded transactions. IN MY OPINION, I think PayAll transactions don’t count?

Hello, to pay tax the reference number is my NIC in the tax reference field?

PayAll can use for Medisave top up?

Not sure if I read it correctly. The $5k min spend would include the amount spent via citi-payall (i.e tax, insurance etc) from 6 Apr to 31 Jul 2022?

Understand that there are charges for Citi Payall though. Thus, how is it worth?

Has anyone tried paying IRAS STAMP DUTY with Citi PayAll?

So I tried to donate to charity, and found that there is a limit of $30,000 per month for all categories other than income tax (which is capped at 95% of credit limit). The customer service officer told me there is no way to increase the cap, even though the terms and conditions say the limit may be revised from time to time at their reasonable discretion. Maybe some of you will have a different limit or can get it increased, but in case you are planning to hit the $120,000 cap by end July using any other way than… Read more »

Can I pay to my own account with Citi Payall

Possible to pay road tax using payall?

I have a medical bill which is claimable by medisave. If I pay it using Citi payall, thereafter, I believe medisave would reimburse my healthcare provider. What would be the situation in this case?

If I’m using citi premier miles card, I get 1.2 mpd at 0 cost usually. Using citipayall, you get 2.5 mpd at 2% of transaction cost. Normal situation 1000 spent = 1200 miles With Citi Pay all 1000 + 2% (1000) = 1020 1020 spent = 2500 miles Yes, the cost per mile for this transaction is 20/2500 = 0.8 cents but taking into account the 1200 miles that were given free of charge. Thus the additional charge of 2% (20 dollars) is actually for the 1300 miles which equates to 1.54 cents. Not saying that 1.54 cents for a… Read more »

Er, no. The types of payments you make via payall don’t qualify for miles in the first place.

I don’t get why it is 0.8cents. Essentially, you are still spending 1000 dollars to get the 2500 miles. Considering the normal situation, you are paying 20 dollars to get extra 1300.

You missed out the fact that these transactions usually don’t earn any miles if not for Citi pay all. (Income tax etc.).

Illustration 2: The aggregate amount of Bonus Points and Bonus Miles earned will be capped at

first S$90,000 charged via Citi PayAll across ALL Eligible Cards during the Promotion Period.

Is there something wrong with the above tncs?

It should be 120k instead of 90k right?

I just realised in one of the t&c of citi payall, “a maximum of 100% of your credit limit or $35,000 (whichever is lesser) is permitted to be transferred in one or more transactions per calendar month” and yet the max cap on this promotion is S$120k. So, even if you have sufficient credit limit or restore your credit limit, you need to setup at least four transactions over the promotion period monthly from Apr to Jul in order to utilitse the full cap of S$120k. May I know if anyone manage to setup in one month to utilize the… Read more »

Where do you see that in the Singapore terms and conditions? I’m only seeing it in the Australian TOC.

Apparently there is a monthly cap of something. So I’ve made an erroneous instruction which I’ve cancelled and tried to reinstate with the correct amount, and apparently cancelled payment counts against the cap so here I am stuck. Customer service is lackluster and told me to try again in August despite being a Citi Prestige card holder.

Near to the end of the promotion period Jul 2022. CSO said verbally, each transactions has to be min $5K per eligible card, and cannot be Combined…. anyone has the correct understanding from the T&C ?

Does anyone have any advice on who to contact to chase missing bonus miles?

I’m still waiting for the posting of the bonus miles from the promo ending end March 2022.

Thanks

from ur citibank app. there is a messenger. they can answer u. for promo, it is usually 12 weeks after end of promo. makes me wonder if they will definitely pay on 23 Oct 2022. i am waiting for mine.

Does anyone know if the 2.5mpd is still going on at the moment?

has anyone gotten their bonus miles from this promo already? I still haven’t 🙁

Miles credited?

has anyone gotten their bonus miles from this promo already? I still haven’t 🙁

nope. supposed to arrive by monday coming week

ah same same then, thanks! 🙂

I haven’t got them yet, but today I got my bonus 4mpd for my Citi Rewards Visa on the 8mpd campaign which they said would be credited by 27th November and which finished later than the Payall promotion.

i’m quite nervous about this cos my sis had to call them and argue about some payments she made for the prev payall promo b4 they “agreed” to award her the miles…

Anyone received the Bonus rewards yet?

nope

Just received the bonus miles this morning! YAY!

Maybe they read this?!

I had a +5__k adjustment.

Just curious. Has anyone received the bonus points from this promotion yet?

I just received mine end of Dec’22

Hi, can I check why the cost of a mile is counted on a $1,000 payment? Isn’t the min $5,000, should it be counted against 5,000? Or is the $20 is paid for every $1,000 paid?

The stick-to-one-card policy (explained by Aaron here https://milelion.com/2023/02/23/citi-payall-flash-deal-up-to-s120-ecapitavouchers-with-bill-payments/) seems to be in place since this Apr’22 campaign. I used CitiRewards & Citi Premiermiles cards, but they only give me bonus miles on my CitiRewards Payall transaction. I’m still arguing about my CitiPM bonus miles with the CSO until now. Sigh. Does anyone have the same experience?