If you want to collect miles, then I’d argue that UOB cards are practically essential. I’m a big fan of the UOB Preferred Platinum Visa, UOB Visa Signature and UOB Lady’s Card, and would recommend them to anyone starting out in the miles game. Heck, even the general spending UOB PRVI Miles Cards can come in useful during their periodic bonuses for overseas shopping and dining.

At the same time, however, I’m well aware that lurking in the T&Cs are some very nasty gotchas. These may be familiar to veterans, but can easily trip up first-time cardholders. You might not earn any miles on small transactions. Your UNI$ may be automatically deducted for an annual fee waiver. Your overseas spend might not be overseas. I could go on and on.

So every time I recommend a UOB card to a family member or friend, I make a point of attaching this article too, if only so they can’t say I didn’t warn them!

| ⚠️ What’s in the UOB T&Cs? |

S$5 earning blocks & double rounding

Pop quiz: what’s the local earn rate on your UOB PRVI Miles Card? If you answered “1.4 miles per S$1”, well, you might want to check your points balance. UOB has one of the strictest rounding policies on the market, which can lead to a lot of lost miles especially on small transactions.

Suppose you make a S$9.99 transaction on your UOB PRVI Miles Card. You might think that earns you S$9.99 * 1.4 mpd = 13.99 miles, but you’d be wrong.

What happens is:

- S$9.99 is first rounded down to S$5

- S$5 is divided by 5 and multiplied by 3.5 (since the UOB PRVI Miles Card awards UNI$3.5 per S$5 spent)

- UNI$3.5 is rounded down again to the nearest whole number

In other words, you earn just UNI$3 (6 miles) on this S$9.99 transaction, which is an effective earn rate of 0.6 mpd.

| ⚠️ OCBC and Maybank do it too! |

|

For the sake of fairness, I should point out that even though UOB started this S$5 earning blocks nonsense, it’s not the only bank with such a policy. OCBC decided to follow suit in June 2020, and Maybank in January 2023. Contrary to popular belief, DBS does not have S$5 earning blocks, as explained in this article. |

How to protect yourself

S$9.99 is an extreme example, but the fact remains that because of this rounding policy, the UOB PRVI Miles Card may earn fewer miles than a card with an ostensibly lower earn rate, such as the Citi PremierMiles Card.

| 💳 Miles Earned for SGD Spending | ||

UOB PRVI Miles UOB PRVI Miles1.4 mpd |

Citi PremierMiles* Citi PremierMiles*1.2 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 6 miles | 11 miles |

| S$15 | 20 miles | 18 miles |

| S$19.99 | 20 miles | 23 miles |

| S$25 | 34 miles | 30 miles |

| S$29.99 | 34 miles | 35 miles |

| S$35 | 48 miles | 42 miles |

| S$39.99 | 48 miles | 47 miles |

| *For Citi PremierMiles, round transaction down to the nearest S$1, then multiply by 1.2 and round to the nearest whole number | ||

Therefore, a good heuristic would be to avoid using the UOB PRVI Miles Card for small transactions (<S$25) that aren’t in blocks of S$5.

Alternatively, you can focus your spending on cards like the UOB Visa Signature, UOB Lady’s Card or UOB Lady’s Solitaire, where the impact of rounding is relatively muted because of the way in which UOB calculates points.

| Rounding more of a concern | Rounding less of a concern |

|

|

To understand why that’s the case, refer to the post below.

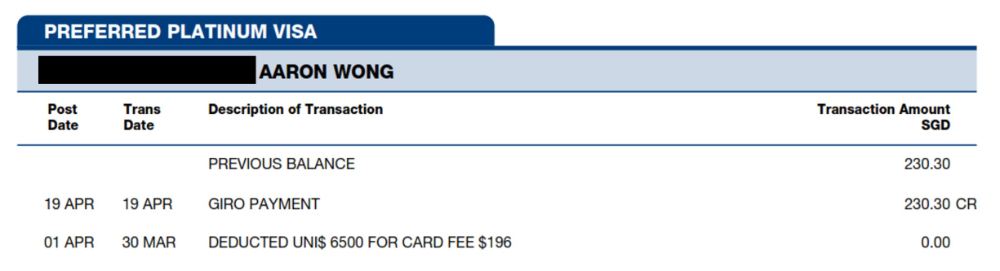

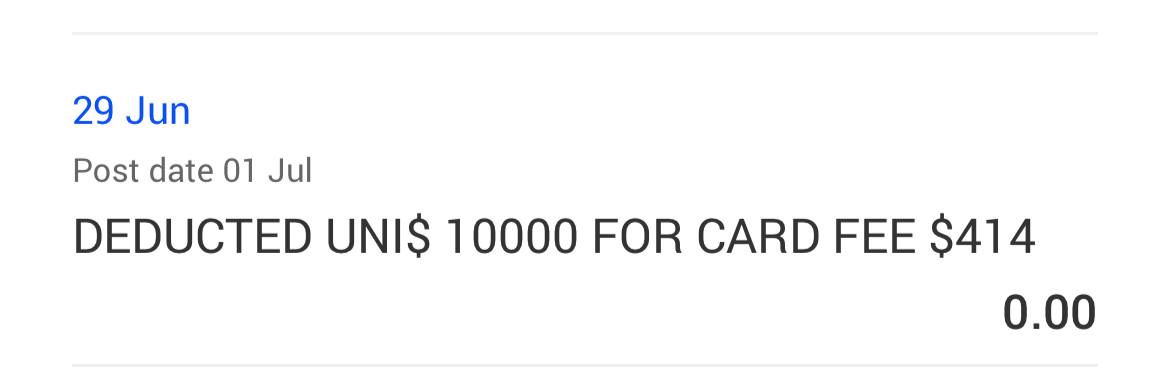

Automatic UNI$ deductions for annual fees

UOB cardholders need to be on their toes every 12 months, because buried in the T&Cs is a clause that gives UOB the right to automatically deduct UNI$ to cover their annual fee.

| 📝 UOB Rewards Terms & Conditions |

|

14. Priority will be given for the deduction of UNI$ for full or half waiver of your UOB Credit Card annual fees. UNI$ for a full or half waiver of the UOB Credit Card annual fees will be automatically deducted on the first day of the following month when your annual fees are due upon the annual renewal of Card membership. … To enjoy the fee waiver, the Cardmember has to set aside sufficient UNI$ in reference to UOB Cardmembers Agreement under Fees and Charges Guide/ Annual Fees and Waiver with UNI$. |

UOB is the only bank in Singapore with such a practice, and those not in the habit of monitoring their statements may find themselves mysteriously short of miles come redemption time.

Here’s the logic behind how deductions work:

- If you have sufficient UNI$ for a full waiver, the full waiver option will be automatically selected

- If you do not have sufficient UNI$ for a full waiver but have sufficient UNI$ for a half waiver, the half waiver option will be automatically selected

- If you do not have sufficient UNI$ for a full or half waiver, the annual fee will be billed in cash

How to protect yourself

There’s two things to do here.

The first is to know when your annual fee will be charged- check the expiration date printed on your card; the month corresponds to the month the annual fee will be billed.

The second is to carefully monitor your UNI$ balance each month. This can be done through internet banking, or via the UOB TMRW app. You can also check your eStatement for a line relating to the UNI$ deduction.

Once you’ve spotted a UNI$ deduction, you should request a waiver through the UOB TMRW app.

- Tap Accounts at the bottom of the screen

- Select the card you wish to request a fee waiver for

- Tap Settings, then Waive Fees

- Select Annual Fee and confirm

For avoidance of doubt, you can request a fee waiver this way regardless of whether you’ve been billed in cash, or via a deduction of UNI$.

Do note that you must wait for the for UNI$ deduction to change from “pending” to “posted” before you can request for a fee waiver. If you try to attempt a fee waiver before the status changes to “posted”, you will get an error message saying “there is no fee to waive”.

If it’s any consolation, should UOB grant you an annual fee waiver, your UNI$ will be reinstated with a fresh 2-year validity.

Read more about this practice below.

How do UOB’s automatic UNI$ deductions for annual fees work?

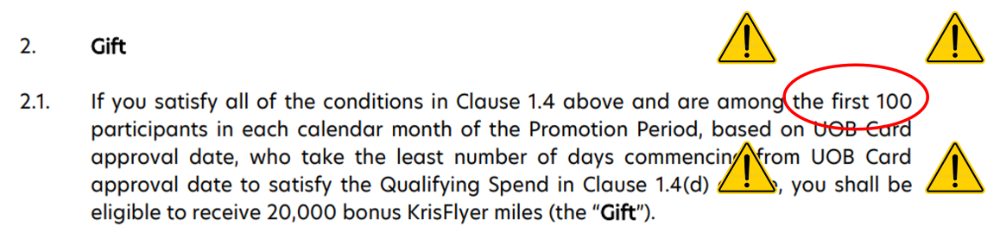

“First X” welcome offers

UOB dangles some great-sounding welcome offers: Apple Watches, Michelin-starred dining experiences for two, S$350 cash and so on.

But before you get excited and hit the apply button, give those T&Cs a read! UOB is infamous for “first X” welcome offers, which cap the maximum number of eligible participants. That’s of course their prerogative, but it stacks the deck against the customer, given the information asymmetry.

There’s no way of knowing whether the cap has been hit yet at the time of application, so you’re basically gambling. You apply, spend, and pray that the gift shows up sometime down the road (let’s not forget those UOB Reserve Cardholders who had to spend S$150,000 for a non-guaranteed reward…). And if it doesn’t, there’s no second chance. You’re already considered an existing UOB customer, and therefore not eligible for further welcome gifts!

How to protect yourself

The best way of protecting yourself is to read the T&Cs for every welcome offer carefully. Do a quick search for “first”, and if that’s followed by a number, run far far away.

If, for some reason, you want to apply for a “first X” offer, there isn’t much you can do short of improving your odds by applying and meeting the minimum spend the day the promotion launches.

To be fair, UOB occasionally runs uncapped welcome offers on certain cards, though these are the exception rather than the rule. If you meet the new-to-bank criteria, that’s when you should hop onboard.

Definition of overseas spend

Many general spending cards offer a higher earn rate for overseas spending, in order to encourage cardholders to spend on holiday.

For most banks, overseas spending is simply defined as any transaction not in SGD. That’s intuitive enough.

For UOB, it’s not so simple. Overseas spending is defined as any transaction not in SGD, and processed by a payment gateway outside of Singapore. Here’s an example from the UOB PRVI Miles T&Cs:

| 📝 UOB Terms & Conditions |

|

1. (ix) You will earn UNI$6 per S$5 spend overseas, which is equivalent to 2.4 miles for every S$1 spent. For the avoidance of doubt, card transactions made overseas but effected/charged in Singapore dollars and online transactions effected in Singapore dollars or in foreign currencies at merchants with payment gateway in Singapore will not be treated as overseas transactions and will earn UNI$3.5 per S$5 spend. |

How do you know where a merchant’s payment gateway is located? You don’t. Even if you called up the merchant, I doubt a frontline customer service officer would be willing or able to divulge that information.

How to protect yourself

If you’re physically overseas and using your card at a brick-and-mortar merchant, you have nothing to worry about. The payment gateway will definitely be overseas.

If you’re shopping online, that’s when you need to take heed. Generally speaking, if you’re dealing with a transaction that has no nexus with Singapore (e.g. buying United Airlines tickets for domestic travel within the US), you should be safe. However, there are other sites like Hotels.com which may show prices in foreign currency, yet process transactions locally. That’s when you get dinged.

I’m sorry I can’t be more specific than that, because just like you, I’m in the dark as to whose payment gateway is where.

Definition of contactless spend

The UOB Preferred Platinum Visa earns 4 mpd on all contactless transactions, and is an excellent tool to have in your arsenal.

But be careful! UOB’s definition of “contactless” is probably different from yours. Ever since May 2020, the UOB Preferred Platinum Visa has only awarded 4 mpd on mobile contactless transactions, where the card is digitised into Apple Pay, Google Pay or Samsung Pay. Tapping the physical card does not qualify.

| 📝 UOB Terms & Conditions |

|

1. (vi) “Mobile Contactless Transactions” refers collectively to: Card Transactions made via Apple Pay, Google Pay and Samsung Pay (or such other payment or mobile wallet services as UOB may from time to time approve at its sole discretion), that is effected at any Visa payWave Readers by waving the mobile device against the Visa payWave Readers. For the avoidance of doubt, Mobile Contactless Transactions shall exclude any Card Transactions that are performed using the Card via Visa payWave, Magnetic Secure Transmission Transactions, all transactions at SPC Service Stations and Shell Service Stations, UOB$ participating merchants and SimplyGo (ABT) transactions performed on public bus and train readers. |

Now, I’m a bit more hesitant to criticise UOB in this respect, because I understand merchant fees vary depending on whether a customer taps his/her physical card or uses his/her phone to pay. If the reduced fees are what enables UOB to continue offering 4 mpd on the Preferred Platinum Visa, then fair enough.

However, it’s still something to be aware of, and the situation is further complicated by the fact that the UOB Visa Signature, which also earns 4 mpd on contactless spending, does include transactions made by tapping the physical card.

How to protect yourself

An easy way to avoid this pitfall is to digitise all cards onto your phone by default. This saves bulk in your wallet, and ensures you’ll always have them with you.

Statement month vs calendar month

Most specialised spending cards will cap the maximum spending on which you can earn 4 mpd every month. That’s fair enough; 4 mpd is a generous return, and they can’t just offer it uncapped (or can they…)

But where it gets confusing with UOB is that the bank uses different definitions of “month” depending on card.

| Card | Bonus Cap Based On |

UOB Lady’s Card UOB Lady’s CardApply |

Calendar month |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

Calendar month |

UOB Pref. Plat Visa UOB Pref. Plat VisaApply |

Calendar month |

UOB Visa Signature UOB Visa Signature Apply |

Statement month |

The UOB Lady’s Card, Lady’s Solitaire and Preferred Platinum Visa cap 4 mpd by calendar month, which is intuitive enough. The UOB Visa Signature caps 4 mpd by statement month, which is slightly more difficult to remember.

Granted, other banks cap bonuses by statement month as well (e.g. Citi Rewards), but at least they’re internally consistent.

How to protect yourself

Fortunately, it is possible to call up UOB customer service and ask them to adjust your statement month for the UOB Visa Signature.

It can’t be a perfect match for calendar month (because some months have 30 days, others 31), but at least there’ll be a closer correspondence. If I recall correctly, the latest date you can put is 28th of each month.

“Accelerated miles” for KrisFlyer UOB Card that aren’t

I like the KrisFlyer UOB Credit Card. How can you not like an uncapped 3 mpd for Singapore Airlines, Scoot and KrisShop, as well as dining, food delivery, online shopping, online travel and transport?

But be careful! Even though UOB refers to the 3 mpd as “accelerated” miles, in reality they’re anything but.

| 📝 UOB Terms & Conditions |

|

1.5 For avoidance of doubt, Accelerated Miles earned will be awarded within two (2) months after the annual fee is posted and it will be automatically credited to your KrisFlyer membership account that is linked to your Card in the following month after the Accelerated Miles have been awarded. Expedition of Accelerated Miles is not allowed. |

Of the 3 mpd earned on dining, food delivery, online shopping, online travel and transport, only 1.2 mpd is credited upfront. The remaining 1.8 mpd is credited two months after the end of the membership year!

| Earn Rate | Remarks | |

| Base Miles | 1.2 mpd | Earned on all SGD/FCY spend, no min. spend and no cap |

| Accelerated Miles | 1.8 mpd | Earned on selected SGD/FCY spend, min. spend S$800 on SIA Group, no cap |

| Total | 3 mpd |

The delayed crediting mechanism gives rise to several important issues.

First, any pending Accelerated Miles will be forfeited if you cancel the card before they post. This effectively locks you into the card, which I’m quite certain is deliberate.

Second, because Accelerated Miles are credited as one lump sum, it will be very tricky to reconcile your points with transactions. I mean, it’s hard enough doing this on a month to month basis; imagine doing it for 12 months’ worth.

Third, you will be more exposed to devaluation risk. If SIA announces an award chart devaluation in, say, two months, other cardholders can rush out to convert their points and burn their miles before it happens. You can’t, because your Accelerated Miles are in limbo.

Fourth, your miles will all be of different vintages. The Base Miles will be credited each month, and start their 3-year expiry period immediately. The Accelerated Miles will follow two to 14 months later.

Refer to the article below for more information.

How does the KrisFlyer UOB Credit Card’s Accelerated Miles feature work?

How to protect yourself

Short of avoiding the card altogether, there isn’t a lot you can do her- and I still think the KrisFlyer UOB Credit Card has a role to play, since an uncapped 3 mpd can come in useful for big spenders once their 4 mpd caps have been burst.

You’ll just need to remember that if you do want to cancel your card, you’ll need to stop spending anything further and wait till the Accelerated Miles from the current membership year get credited.

But at least UOB$ merchants aren’t a problem anymore!

And just to show I’m perfectly capable of giving credit where it’s due, here’s something that’s no longer a gotcha: UOB$ merchants.

|

| UOB$ Programme |

UOB runs two different card rewards programmes, with very similar sounding names:

- UNI$: A points currency which can be converted to airline miles

- UOB$ (formerly known as SMART$): A merchant-specific cashback scheme where cashback can only be used on a return visit

These two programmes used to be mutually exclusive, so you wouldn’t earn any UNI$ for transactions at UOB$ merchants. That led to a lot of nasty surprises for first-time cardholders, especially since most UOB$ rebates are rather miserly.

But in November 2024 that policy changed, and cardholders can now double dip on UOB$ cashback and UNI$ points at UOB$ merchants.

This means that UOB$ merchants are no longer something to be avoided; on the contrary, you have added incentive to use UOB cards here to get some extra cashback you wouldn’t otherwise have received with alternate cards!

Conclusion

I’m not here to hate on UOB cards. They have some excellent miles earning options, and there’s a reason why they feature heavily in my annual credit card strategy posts.

It’s just frustrating that every time I recommend a UOB card, I have to throw in so many “but take note of the following…” caveats. It’s almost as if UOB gets some kick out of making things as convoluted as possible for customers (case in point: their 2021 miles extension perk, which required you to send an SMS in…January 2024).

So by all means, continue spending on those UOB cards, but also keep your wits about you. There’s gotchas in the T&Cs that can trip up unsuspecting cardholders, and it’s important to go in with both eyes open.

Any other tricky UOB T&Cs to look out for?

UOB PRVI Miles Card

UOB PRVI Miles Card

Great article Aaron. It’s for this reason that I don’t bank with UOB or have a single UOB credit card. Sure, I may be missing out on some extra perks but their ridiculous terms and conditions require too much brainpower that it’s simply not worth it for me.

100% agreed with you – too many hoops to jump through for UOB

I agree. Credit cards are for convenience and safety (vs debit cards) and maybe some cheaper travel. For anyone who is not fully invested in this (e,g. super-busy jobs, caregivers etc) it’s probably just going to bring unnecessary headaches. I cancelled all my UOB cards too. DBS Citi HSBC are more than enough for my spending.

Agreed with you, which is why I don’t have UOB cards/account too

Just too much of a hassle and gotcha

It’s not just the hassle of having to think thru these terms and conditions. What bugs me the most is the mindset behind it. It’s almost like UOB just wants to be able to make these ridiculously good claims on advertising, but doesn’t actually want to give the benefits. I don’t feel like being a sucker, thank you.

Can report to MAS alr

Nothing to report if it’s in T&C. It’s a willing buyer willing seller open market capitalism. Too bad you didn’t read or understand the conditions is a not reason. So not much MAS can and will do. It’s sad but true

Exactly sentiments with the first 2 post. I stop banking with UOB because of the shenanigans. Hopefully more will follow suit and UOB will hear consumers out. But until then …

can write to ASAS.. the disclaimer in dark blue font is scummy

As always. UOB. Singapore’s worst bank

I suppose this post was not sponsored 😬

Other pain points:

1. Definition of month for usage caps differs from card to card. Calendar month for Visa Preferred Platinum; statement month for Visa Signature.

2. Contactless transactions (a term the bank uses) excludes use of the physical card to tap.

I do think UOB gives extra bonus to the credit card teams for coming up with these Ts&Cs because the cost savings must be significant. I have lost count of the number of miles not earned because of the fine print.

Upvote these 2 points! This article should be made mandatory reading for every miles junkie. Thanks Aaron, this is great stuff as usual.

I tend to be a bit more forgiving on these 2 points because citibank uses statement month for Citi rewards, and re: contactless, there is a difference in fees paid for tapping physical card and tapping phone. If these lower fees allow uob to continue offering 4 mpd nearly everywhere then it’s a relatively minor annoyance

edit: although that said, at least citi is consistent with the application, versus UOB which uses statement month for some and calendar month for others. might be worth an edit to the article, thanks!

Actually, come to think of it, iirc, time of crediting of bonuses are also a bit of issue for PP vs VS? One credits immediately and the other is delayed by +1SM or something like that? Not exactly a gotcha and to be fair there the practice varies across banks, but it’s annoying when

splitting the atomreconciling miles balances (or, maybe, when you urgently need miles to transfer).I suppose this post was not sponsored 😬

That’s because Aaron has written sponsored posts for Dbs……

+ ocbc + amex + hsbc +scb too, if we’re keeping score!

as always, sponsored posts are disclosed upfront.

And one further convoluted UOB process follows. Once, I had the rare occasion, where I did want to sign-up to a UOB offer. However I had to register. To register I had to send an SMS. But I was out of Singapore. So I called UOB and said how to send a message to that 7776 number (or whatever it was) when I am not in Singapore? How to register? Short and long of it was, I couldn’t !! They could not even do it manually for me on the call. Unbelievable. Other banks, like Citi, allow registration through the… Read more »

When paying monthly card bill by GIRO.

UOB always debit 1 day before the actual date.

and much earlier if it ‘s weekend or holidays

i think amex deducts almost 10 days earlier (or could be slightly shorter)

In Australia, this is call fake advertisements and is illegal

UOB Lady’s Card has this feature which allows card holder to select a category to earn 10X UNI$ (or 20 miles) per S$5 spent on your chosen category (with no minimum spend required. The part which confused me is if I select the category “Family” which includes Giant & Cold Storage, do I earn that 20 miles per $5 spent or 1% UOB$ cashback subject to $50 min spend?

Based on data points I have seen so far, you will not earn the 1x when trxn posts, but will receive 9x when the bonus posts the following month

Pair with Amaze and you’d get both the 1X and 9X

Great article calling out all these classic uob nickel and dime-ing BS tactics.

Truly the most awful kiasu bank in SG

UOB PPV was my fav 4mpd card few years back until I learnt of how much I can get shortchanged!

The real solution is just to steer clear of UOB, period. My blood pressure has improved ever since I cancelled my PPV card. Imagine having all your UNI$ earned for the year taken away for the annual membership renewal and they refuse to waive the annual fee.

Things will never change as long as there are sheep willing to jump through the never-ending hoops UOB continually comes up with. There are better cards out there.

This is truly scummy. I have moved spending away from my PPV as much as possible and am all the happier now.

omg that’s a nightmare scenario. If they don’t waive your annual fees and the points are deducted, you’re left with the option of cancelling the card. But if you cancel the card, you can’t get use the points if you get it refunded anyway!!

guess that’s why i’m not one of their users

Can also include how different cards consider posting date vs transaction date. Eg Transaction date for PPV, vs posting for VS.

I FK**IN HATE UOB- WORST BANK OF THEM ALL

Retroactive change of T&C. For the UOB Krisflyer card, you’re supposed to earn a rebate for shopping $100 on Krisshop. Then they changed it to $100 before GST on Krisshop. I didn’t receive my rebate, and even when I sent them a screenshot of the T&C before they changed it, they didn’t budge. Incorrigible.

UOB imo is one of the bank that is not really sincere in its offerings to the customers. there are many hoops to jump to get the marketed goodies.

Once i cancel a UOB card 2 weeks before the annual deduction payment for a certain regular subscription for a certain private membership club and i even received the termination letter.Yet later 2 weeks ,i still received a statement saying the deduction was made and i had to pay for it subscription.So i wonder how successful would i be if i had the energy and tenacity to bring my right to dispute to FIDReC ?

never ever getting a UOB card. period.

They don’t feel as convoluted as Standard Chartered cards in my opinion.

Hi Aaron, thanks for the summary but isn’t this old news? Think you mentioned these points before already. I’m not a fan of uob but would assume other banks also have dirt for u to dig and share with your followers rather than repeating the same content?

Also other banks also offer caps and t&cs but don’t see you flagging those out so explicitly?

Eg for this it appears you gotta reg n spend n wait for it to happen:

https://cardpromotions.hsbc.com.sg/christmas/

hi bruce

this article was last updated 2 years ago, and some things have changed since then (e.g uob$ merchants), so i figured it was time for an update. if you regularly read the articles on this website, you’ll see that i do indeed flag these things out regardless of who does it.

and to your point about hsbc, the simple requirement to register for a promotion is several magnitudes different from what’s described in this post. i think that should be very obvious.

Others banks might try to imitate UOB’s convoluted T&Cs and gotchas but UOB is the champion of convoluted T&Cs and gotchas.