Back in August 2018, American Express relaunched the AMEX Platinum Charge and threw open the previously invite-only doors to the general public. But perhaps “threw open” is the wrong term to use, since they weren’t taking just anyone. The minimum income requirement was S$200,000, which would put cardholders at the 91st percentile of all resident taxpayers.

However, it soon became apparent that this figure was not set in stone. The website would process applications with declared income as “low” as S$150,000, and those who could demonstrate high net worth through other means were also accepted into the fold.

American Express has now gone one step further and unpublished the income requirement altogether.

AMEX Platinum Charge unpublishes income requirement

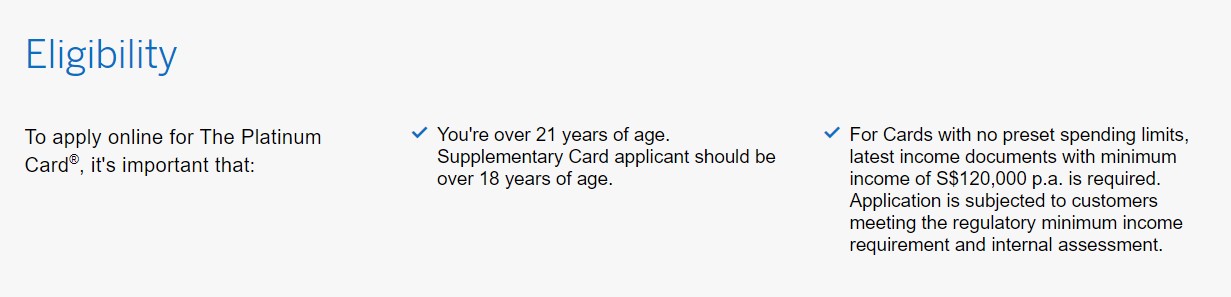

About a month or so ago, American Express updated the eligibility section on the AMEX Platinum Charge’s landing page.

Note the rightmost column relating to income requirements, which reads as follows:

“For Cards with no preset spending limits, latest income documents with minimum income of S$120,000 p.a. is required. Application is subjected to customers meeting the regulatory minimum income requirement and internal assessment.”

Some have taken this to mean that the AMEX Platinum Charge’s income requirement has been cut to S$120,000, but that’s an incorrect interpretation. Rather, S$120,000 is merely the MAS-mandated minimum for a credit cardholder to have no preset spending limit.

What this does imply that American Express is willing to consider applications with incomes below S$120,000, even though an AMEX Platinum Charge with a preset limit is kind of an oxymoron (since “Charge” implies that (1) there’s no preset spending limit, (2) the balance must be paid in full every month).

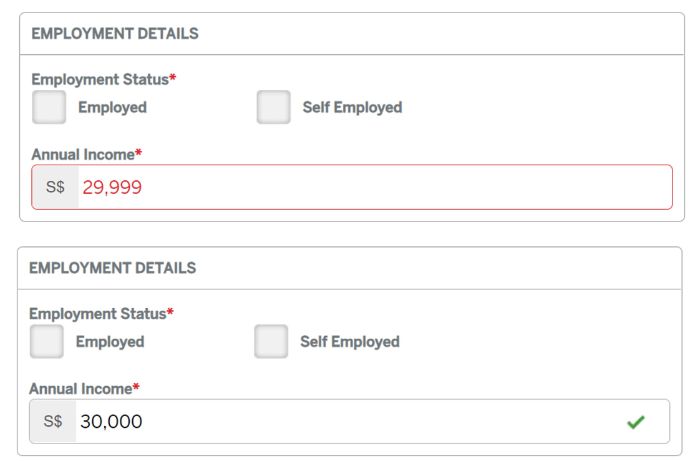

So in other words, it’d be more accurate to say that the AMEX Platinum Charge no longer has a published income requirement. The online application portal now allows the submission of applications with a minimum annual income of S$30,000 (it was previously hardcoded to give an error message for any figure below S$150,000).

I’ve heard some complaints that the AMEX Platinum Charge is “going mass market” by removing the income requirement, but that’s a strange thing to say for two reasons.

First, the filter for the AMEX Platinum Charge has always been the S$1,728 annual fee, not the income requirement. It’s challenging enough for someone earning six figures a year to justify, let alone less than that.

Second, even when the official income requirement was S$200,000, it was common knowledge that cash rich, income poor individuals could get approved by showing proof of other assets. The removal of the published income requirement has presumably been done with this group in mind, rather than a fresh graduate starting his first job.

That said, I think there are definitely legitimate concerns that American Express is taking on more cardholders at the expense of experience. I’ve noticed a decline in the quality of service over the past 12 months; longer hold times and forgotten call backs are two of my biggest peeves. Who knows, perhaps the larger ranks were also the reason why Platinum af’FAIR didn’t happen in 2022 (and what does that say about 2023?).

I really don’t care what the income requirement is, quite frankly. If you only sign up for a credit card because it has a six-digit income requirement, well, that’s some small PP energy right there. I do, however, care about experience, and that requires staffing up to maintain good service as card membership grows.

Current sign-up offer

If you’re considering signing up for an AMEX Platinum Charge, do refer to the article below for the latest sign-up offer which runs till 31 January 2023.

AMEX Platinum Charge offering 110,000 MR points sign-up bonus

In summary, applicants who get approved in January 2023 and spend S$20,000 in the first 3 months will get a sign-up bonus of 110,000 MR points. They will also be able to double dip on two sets of statement credits: the existing S$800 airline and hotel credits (remember to use them by 31 January), plus the upcoming S$1,200 dining, lifestyle and travel credits that are launching in February.

Conclusion

American Express has removed the published income requirement for the AMEX Platinum Charge, presumably to facilitate applications from asset-rich individuals who don’t draw a regular income. You can now submit an application online so long as you earn at least S$30,000 a year (though whether you’ll get approved at that level is another question).

Yes, why should Amex care what my income is if I can spend multiples of my income from my amassed riches?

That’s why your sign-off is “Whale”.

Actually, they care a LOT about your income – it is all that matters to their very primitive means of deciding whether to issue someone a card………. I had a case a few years back where I was getting hassled almost daily by this Amex lady wanting me to sign-up to their card. I was actually interested in signing up, but was quite busy at work at that time. So I did nothing. About 6 months later, I completed the work contract and decided to retire. Then, having some time on my hands at last, I replied the earlier email… Read more »

Don’t be upset.

mass market card = mass market criteria for efficiency.

No one bothers if an individual is wealthy or not. The qualifying criteria is to fit within a set of hardcoded rules.

try to apply as a business owner and you will get a different result. personal consumer credit is for the high risk that manage their debt very well. The business cards are for business owners that pay their debt off very well using consumer credit tradelines

Well I tried to apply via Singpass when the income said 120k last month and 40k definitely works in the form already back then. But I guess my IRAS wasn’t even showing 40k (I didn’t work for a long time last year) and they rejected it. Didn’t even have the courtesy to send me a rejection email/sms/mail at all, damn. Definitely didn’t ask me at all for my “assets” or even my latest salary. Been with them for 6+(?) years and they had my very old salary, and I thought my issue was the current salary, so I then asked… Read more »

Use your amex cards more, there are people who got invited to the platinum card with 40k income. Amex recognizes its members who spend with them.

If you were an American Billionaire that had moved and retired to Singapore, you still would not get an Amex card from the fools at Amex Singapore, because the retired American Billionaire would still, most likely, not have a salaried income, and therefore, most likely, would not have anything to show on the IRAS statement.

The IRAS minimum income statement is simply an easy way of filtering. Do you expect AMEX to personally email every single applicant with <120k to declare their assets? Your criticism of AMEX can be extended to every other bank with a 120k credit card as well…

Yes, I do expect Amex to email applicants. There should be an opportunity to be able to show sufficient assets – and not an immediate refusal. And no, it is not extended to every other bank – I know that from personal experience. Maybe you should get a job at Amex – those who think sub-par service is acceptable – and who are only able to follow very simple rules would fit their culture perfectly. And consider another case. Let’s say I do have an IRAS statement showing $120k. But I may have no savings. I may have many other… Read more »

Ha to be fair, that would indeed make you a perfect customer for a CC as they will then by able to earn tonnes of interest from your missed/late payments

IRAS NOA is only one of the criteria. Amex like any other banks do obtain credit profile from the credit bureau.

Amex Plat and other 120k range cards were targeted at applicants with decent income.

There are other cards meant for Billionaires, which based on dp, income may not even be a deciding factor.

A true Billionaire should not fuss over a mass card rejection. Their option should also be opened to other countries invitation-only cards, and not just Singapore.

A retiring US billionaire will unlikely have to apply for the Platinum Charge on their own. It’s likely they already have the Centurion in the US and Amex USA can arrange for them to receive the Centurion in Singapore without them lifting a finger. Also Amex does take into account personal wealth in this tier. People with private banking (AUM above S$5 m) can have their bankers write to amex on their behalf to confirm their standing with the bank. Of course such personal service is not extended to the mass affluent at $120k income, there are simply too many… Read more »

I think you must have been on their asshole blacklist.

Just for data point I applied with my old NOA also 120k and was approved. I have however put through huge spending last year through my cards.

Maybe they still review profiles based on combination of income/spend/tenure?

One of the issues with $200k income requirement was the risk of non-qualification in future if I cancelled the card (e.g. because offer poor value that year).

So lowering the income requirement actually makes it easier to cancel the card and reapply in future instead (when there’s better value). So seriously considering cancellation this year given the many devaluations and changes in view of lowered income requirement.

Amex as a brand seems to be cheapening on the whole. While I hate to admit this, (having grown up believing the great marketing amex has done and loving amex), I get much faster responses to my requests via Citi Ultima concierge than Centurion concierge nowadays.

To me, it’s very telling who they are letting into the Platinum membership when the telegram chat group has shifted from talking about Singapore Air and Emirates, now to Air Asia and Scoot.

Another reason not to renew with benefits being nerfed on top of poorer service. Time to look for an alternative “$120,000” card !

For Milelion, it makes sense to support the lower entry level. The more people signing up through his article the more revenue – nothing wrong with that, just not an unbiased advice.

As for the poor service not calling back, in my case, the concierge doesn’t even make the booking!

accusations of bias are inevitable i suppose, but for the record: i do not support a lower entry level. nor do i support raising it. i’m simply here to explain what’s going on.

Last week, I got a letter in the mail saying I was “pre-approved” for the US version…that probably explains why the DL skyclubs are like last train out of Warsaw in ’43. Thank god for OW Emerald…

I guess they’re willing to trade off brand equity for sign-up fees and maybe attract those cash rich and lower than 200k income. For other countries like Australia, the Amex plat income requirement is only 100k.

Also, this possibly fits in with the rumor that they were going to introduce the “Optio” card to slot between Plat and Centurion.

So getting a black card will be happening soon for most ppl since Amex dropped their standard?

This is officially the easiest platinum card to obtain in the platinum card series. You probably can get approved with 30k income requirement, much easier than the platinum credit card which has a minimum income requirement of 80k.

This is untrue. Applied last week with 90K annual income, AA credit score, with existing amex cards – got rejected 🙂

I can no longer find Basilico in Regent Hotel in the Platinum Love dining list 🙁

Amex trying to keep a dying product alive… Just give up .. Over the years the service the perks everything has gone down the drain. Every year spamming people with a packet of useless vouchers just killing the environment. To add insult to injury , amex is poorly accepted in asia.