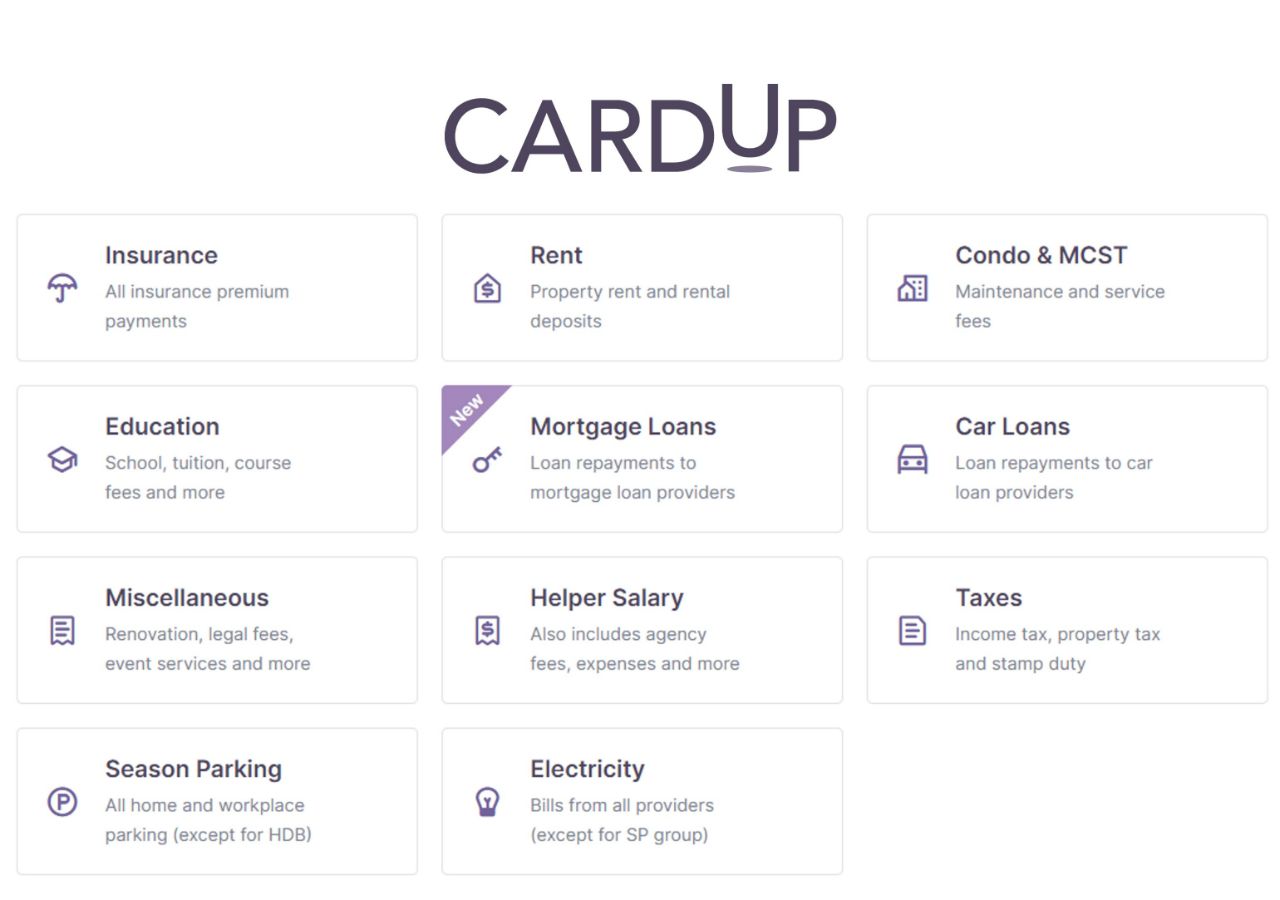

CardUp has launched a new deal for the Lunar New Year period, which offers existing customers a discounted 1.8% fee when paying a wide range of expenses including insurance premiums, property tax, education fees, mortgage payments, MCST fees and more.

This allows cardholders to buy miles from as low as 1.11 cents apiece, while also clocking spend towards sign-up bonuses and milestone rewards, depending on card.

New customers can continue to use the code MILELION to get S$30 off their first payment (free miles on a payment of up to S$1,154!), and will also receive a further promo code for a 0.88% fee on their next payment.

| ❓ What is CardUp? |

|

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. The standard CardUp fee is 2.6%, but is frequently lowered through various promotions. |

Pay bills via CardUp with 1.8% fee

|

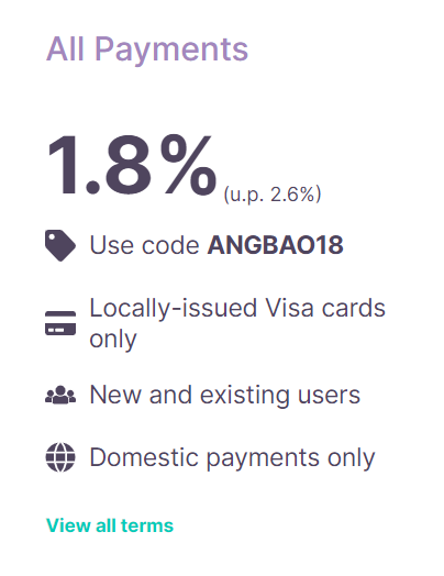

| ANGBAO18 T&Cs |

CardUp users can use the promo code ANGBAO18 to enjoy a 1.8% fee for all payments scheduled by 28 February 2023 with due dates on or before 3 March 2023.

This code is valid for all locally-issued Visa cards only.

With a 1.8% fee, you’ll be paying between 1.11 to 1.47 cents per mile, depending on card. Remember, both the payment and the CardUp fee are eligible to earn miles.

| Card | Miles per S$1 | Cost Per Mile (1.8% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.11 |

UOB Reserve UOB Reserve |

1.6 | 1.11 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.6 | 1.11 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.11 |

DBS Vantage DBS Vantage |

1.5 | 1.18 |

SCB Visa Infinite SCB Visa Infinite |

1.4* | 1.26 |

UOB PRVI Miles Visa UOB PRVI Miles Visa |

1.4 | 1.26 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.26 |

OCBC VOYAGE OCBC VOYAGE |

1.3 |

1.36 |

OCBC 90°N Visa OCBC 90°N Visa |

1.2 | 1.47 |

SCB X Card SCB X Card |

1.2 | 1.47 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 1.47 |

| *1.4 mpd applies with minimum S$2K spend per statement month, otherwise 1.0 mpd |

||

This promo code can be redeemed a maximum of once per user, and is capped at 200 uses. You’ll be able to see if the promo code is still valid before submitting your payment.

New Cardup users

If you have not made a CardUp payment before, you can use the code MILELION (T&Cs) to save S$30 off your first payment, with no minimum spend required. Based on the regular CardUp fee of 2.6%, that’s equivalent to free miles on a payment of up to S$1,154.

After that, you can proceed to use the ANGBAO18 code to enjoy a 1.8% fee on your next payment.

CardUp users who utilise the MILELION code will receive an additional promo code for 0.88% on their next payment of up to S$1,150. This will be sent via email by the 9th of the following month. For example, if your payment is set up by 31 January, you’ll get the promo code by 9 February, and if your payment is set up by 28 February, you’ll get the promo code by 9 March.

Other CardUp promos

Here’s a quick summary of the other CardUp promos on the market. These have all been extended for the rest of 2023.

| Code | Type | Rate | Eligible Cards |

| SAVERENT179 | Rent | 1.79% | Visa, MC |

| RECURRING185 | Recurring payments | 1.85% | Visa |

| GET225 | All payments | 2.25% | Visa, MC |

| AMEX19X | All payments | 1.9% | AMEX |

Other promotions, including those for business users, can be found on CardUp’s pricing page (toggle between personal and business at the top left).

The Citi PayAll alternative

While CardUp’s offers aren’t bad, in and of themselves, it’s hard to compete with the juggernaut that is Citi PayAll.

From now till 31 January 2023, Citi cardholders will earn 1.8 mpd on all Citi PayAll transactions with a fee of 2%, which works out to 1.1 cents per mile. This covers rental, income tax, insurance, education, utilities, you name it.

Citi PayAll offering 1.8 mpd on all payments; buy miles at 1.1 cents

The main catch for this promotion is that a minimum charge of S$5,000 is required to qualify, so if you’re planning to make smaller payments then CardUp can still come into play. CardUp can also come in useful if you’re trying to hit a sign-up bonus on a non-Citi card, such as the recent AMEX KrisFlyer Ascend offer.

Conclusion

CardUp is offering existing users a 1.8% promotional fee from now till the end of February 2023, which lets them purchase miles at a discount to the usual price. You’ll need to use a Visa card to pay, but there’s enough options out there to earn between 1.2 to 1.6 mpd.

Assuming you can’t meet the minimum spend for Citi PayAll, this can be a good backup option.

Hi guys,

Just wondering if payment of education fees in foreign currency for establishments outside Singapore by credit card (DBS Altitude Visa in my case), without using a service like CardUp, earns miles / points?

The 200 users were filled up about 3 days ago, well before this was published. Cardup is a waste-of-space. I tried within about 3 minutes of receiving their email “promotion” and it was unavailable even then.

i used it yesterday. check your facts.

I gave you facts. That was my experience. Interestingly, I tried it again just now and it works. Strange.

Sorry, that promo code has been fully redeemed – as of today 3 Feb 2023