| 💬 A note from The MileLion |

|

To get an insider’s perspective on the miles and points game, I’ve asked Mark Mullinix, a travel loyalty expert who’s built programmes with banks, airlines and hotels, to share his insights on what goes on behind the scenes. The following opinions are Mark’s. Be sure to check out Mark’s other post, covering how airlines structure frequent flyer programmes. |

While KrisFlyer and Asia Miles are the two most common transfer partners in Singapore by far, there are other airlines and hotels available through various banks, ranging from regional names (AirAsia Rewards, Malaysia Airlines Enrich) to the more “exotic” (United MileagePlus, Turkish Miles&Smiles). And as we’ve seen from recent announcements (see: OCBC’s eight new transfer partners), the trend is accelerating.

How does it work in the background? What makes banks add partners (or remove them)? Why do we see so few hotel programmes? And why on earth do banks still charge fees for a simple one-click transfer process?

In this post, I’ll delve into the background of these transfer partner agreements, providing some perspective on how the landscape in Singapore has and will continue to evolve.

A brief history of transfer partnerships

Way back in the mists of time (OK, the ’80s), Diners Club and American Express separately launched in the United States what are believed to be the first credit card/travel rewards programmes.

On the one hand, these were mere shadows of the sophisticated programmes we see from the banks today, free of the terms and conditions that make our lives so difficult. On the other, American Express already had seven US airline partners at launch. How did they convince the airlines to sign onto this idea?

Simple: it’s all about the money.

Back then, just as today, American Express held a disproportionate share of high spending travellers and businesspeople. In fact, the travel card market was even more consolidated; co-brand cards had only just been introduced to the market, and current powerhouses such as Chase and Capital One hadn’t built their travel card empires yet.

Airlines were just beginning to realise the value of their miles programmes in general, both as a source of new business and (less so in the beginning) as a potential revenue stream. For American Express, the pitch to airlines was simple- they had the right customers and could drive their business to the airlines through a transfer partnership.

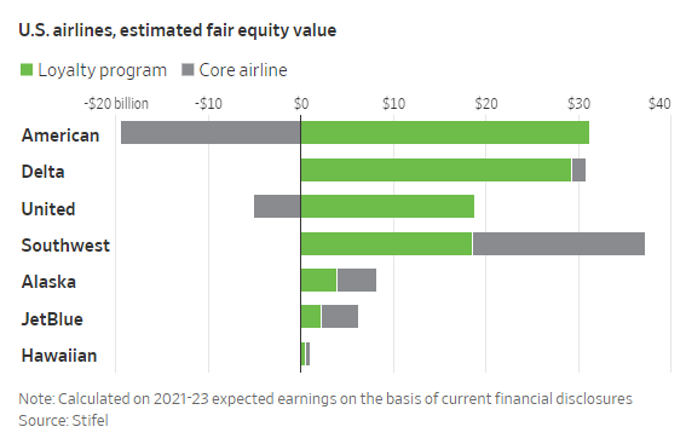

Fast forward to today, and it’s clear that the pitch worked for all concerned. Banks were able to use juicy interchange revenue (the service fee charged to merchants for credit card acceptance) to fund the rewards, consumers loved the ability to top up their accounts with credit card miles transfers, and airlines had plenty of seats to give away. Frequent flyer programmes expanded to the point where by the last decade or so, revenue from the sale of miles far outpaced other income streams, and in some cases, even revenue from the entire airline’s operation!

Along the way, American Express expanded its miles programme with new international partners and rolled it out in their non-US markets. Other banks started to compete aggressively in both co-brands and transfer partnerships. For any carrier with a captive home market audience, building transfer partnerships with local banks became a no-brainer way to unlock revenue from the sale of miles, and ensure that they were reaching as many local customers as possible.

| ❓ Why Transfer Partnerships and not Co-brand? |

|

Co-brands and transfer partnerships attract very different segments for banks. For airlines, especially outside of the USA, it took longer for them to be convinced of the value of a “fickle” transfer customer as opposed to a loyal co-brand customer. There was a belief that transfer customers were one-time redeemers and therefore represented a cost to the airline, whereas co-brand customers were core revenue generating passengers. This belief is rooted in the misconception (or bad programme design) that frequent flyer rewards redemptions represent a net cost to the airline, which is almost definitely not the case in a well-designed programme. Most airlines have started to embrace transfer partnerships as a new source of revenue that can augment, rather than replace, co-brands, although this has only happened at scale in the last decade or so. |

Negotiations and Complexity

As more airlines started to embrace banks in their home markets, transfer partnerships became a huge source of income from infrequent flyers, who were able to turn their credit card spend into miles without having to commit to an exclusive relationship with an airline via a co-brand card.

These partnerships, however, come at a significant cost to banks. Not only are there the commercial negotiations as to the cost per mile that the banks will pay, but there’s a substantial investment in technical integration.

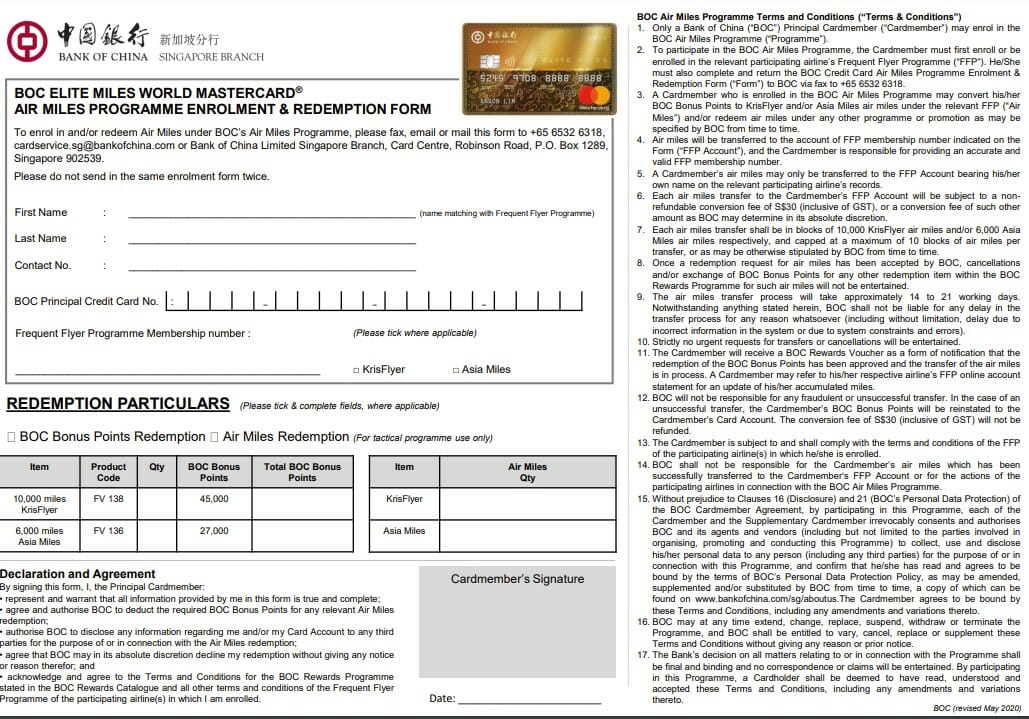

While partnerships may have started with offline forms and call centres arranging the transfers for customers, this is a resource-intensive, slow, and error-prone way to transfer points to miles. Customers and airlines both prefer instant, automated transfers.

This requires building web and mobile interfaces, validating that the frequent flyer numbers and names on the airline side match the customer name on the bank side, ensuring that there are adequate safeguards against fraud, etc. To add further complexity, each airline is likely to have a different set of systems and processes which have to be accommodated by the banks.

We can see how willing banks are to invest in these processes just by looking at how airline miles transfers work:

- in some cases, miles are available instantly or near-instantly (American Express, Citibank and OCBC do a good job of this)

- in other cases, miles may take up to 30 days to credit (nearly always put in the terms and conditions to protect the banks against a process failure—usually even in semi-manual processes, the records are sent to the airlines 1 or 2 times a week)

There is a cost on the airline side as well. While selling miles generates revenue, tracking the transactions, auditing, reconciling and invoicing incurs costs, especially when the transactions are cross-border. In short, the partnerships revenue has to be worth the cost of implementation for an airline to bother working with a bank.

American Express and Citibank could claim that their worldwide customer base justified the efforts required for integration. For instance, Thai Airways might be happy to work with American Express because of the miles volumes in the Thai market, and accept being added as a transfer partner in other markets because the incremental work wasn’t much relative to the benefits in marketing visibility and transfer volumes. You can envision, then, less miles-savvy customers from Singapore, Europe or North America planning their once-in-a-lifetime trip to Thailand and thinking “hey, Thai Airways is the obvious choice for my miles transfer.”

For most other banks, reaching beyond home market or regional carriers to add additional transfer partners simply wasn’t worth it. If one assumes that the addition of another miles transfer partner isn’t going to significantly change the spend of customers, then the cost of those miles would have to be significantly cheaper than other rewards options for adding another partner to make sense for a bank.

Since banks also have to build relationships with airlines outside of their home markets, in addition to the technology to facilitate the integration, it’s hardly worth it to the banks if only a small volume of miles are going to be transferred to that programme.

More choices

You’ll notice I’ve used the past tense above, because in the past several years we’ve seen a virtual explosion of additional airline options.

In the US alone, at least 4 of the top 5 banks offer diversified suites of transfer partners including airlines such as British Airways, Emirates, KLM, EVA, Qantas and others, in addition to the usual large US carriers.

In Singapore, while Citibank and Amex led the way, OCBC, Standard Chartered and others have expanded or announced their intentions to expand the transfer options available to customers.

Two major factors have helped banks add additional partners.

First, the state of technology in general has improved massively. While in the past, many airlines weren’t set up to provide easy tech integrations for their bank partners, the vast majority of them now have simple APIs which allow banks to validate frequent flyer numbers and other information. Therefore, the bar has been lowered in terms of the cost to integrate.

Second, technology partners (e.g. Ascenda) which power bank rewards programmes have started to integrate more partners which can be accessed by the banks. This enables banks to get a one-stop shop for their partnership needs, integrating several airlines through one connection to Ascenda, who then sort out all the messy details in the background.

Strategically, the landscape has changed as well. Consumers are a lot more educated about the value of miles than they used to be, and the number of customers who potentially might transfer to a “foreign” programme is much higher than it used to be.

When coupled with the ever-increasing cost of miles from the local carriers who think they have a captive market, the non-home carriers start to look like a better option for banks when it comes to controlling costs within the rewards programmes.

In summary, both the cost and the benefit of adding non-home carriers have shifted in favour of the consumer, and so we see increased choices from many local banks.

There is still a substantial difference between the banks, of course. Some banks have products better matched to frequent travellers and therefore are more likely to have knowledgeable customers who would take advantage of increased choices. Some have a better grasp of the economics of miles transfers and are therefore better able to forecast the costs and benefits of adding new partners.

Remember that each airline likely charges a different miles rate to each bank based on the market, expected volumes, and marketing visibility. Therefore, it’s not a completely level playing field even if, say, both OCBC and Standard Chartered are looking at adding the same airline in the Singapore market. It’s even possible that some banks negotiate for an exclusive transfer relationship within a market, though they would almost certainly have to pay a lot for that privilege.

Managing Transfer Costs

Once the banks have a transfer relationship and a price per mile negotiated, they have to consider another factor—the value to the consumer. Bank rewards points vary tremendously in terms of how easy they are to earn, and how much cost per point the bank puts against them. Getting the ratio of bank points to airline points right is critical for the partnership to succeed.

Most banks aim for just one simple transfer ratio, for instance 2.5 bank points to 1 airline mile, regardless of the airline the customer chooses. In this case, you can assume there is some averaging going on in the background and the bank has tried to model customer behaviour such that the average cost across all airlines comes out within the bank’s risk tolerance.

| 🏠 The house always wins |

| Of course, the easiest way to do this is to lock that ratio to the highest cost of miles, ensuring that even if customers transfer exclusively to that partner, the bank doesn’t lose money (and if customers transfer to other partners, the bank wins). |

A more nuanced approach is to set up a few transfer tiers, as we’ve seen in the Singapore market with Standard Chartered.

| 💳 Example: Standard Chartered Transfer Partners | |

| Frequent Flyer Programme | Conversion Ratio (SC Points: Partner) |

| 2,500: 1,000 | |

| 2,500: 1,000 |

|

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 2,500: 1,000 | |

| 3,000: 1,000 | |

| 3,500: 1,000 | |

| 3,500: 1,000 | |

|

3,500: 1,000 |

| 5,000: 1,000 | |

While this doesn’t map directly to the cost of those miles to the bank, you can bet it has a fairly strong directional correlation. In other markets, we’ve even seen every partner with its own transfer ratio, but this tends to be extremely confusing for the consumer even though it provides ultimate cost certainty for the bank.

A complication comes in when the airline rewards programmes are massively different in value to the consumer. As you probably know, transferring 50K miles to KrisFlyer opens up different possibilities compared to transferring 50K miles to Qatar Privilege Club. So even though the transfer ratio might not be as favourable on paper, the actual value you receive from the award might still be higher.

Ultimately, the entire bank rewards programme is an exercise in optimising costs. It bears a lot of resemblance to the insurance business as you look at liability, the cost of the rewards redeemed by consumers, the number of bank points that will expire before redemption, and the share shift between various rewards. All those toasters and NTUC vouchers in the rewards catalogues are effectively competing with the airline transfers and cash back options for the customer’s “spend” on rewards.

One of the ways the banks can ensure that the economics work for them is to introduce additional fees, such as the miles transfer fees we’re so familiar with in the Singapore market.

| ✈️ Conversion Fees by Bank |

||

| Bank | Per Conversion | Annual Option |

|

N/A (waived for Platinum cards) |

N/A |

|

S$30 | N/A |

| S$27 | N/A | |

| S$27 | S$43.20* | |

| N/A | S$43.20 | |

| S$27 | N/A | |

| S$25 | N/A | |

| S$27 | N/A | |

| S$25 | S$50^ | |

| *Automatic conversions in blocks of 500 DBS points (1,000 miles) each quarter. Addition ad-hoc redemptions can be done for free ^Automatic conversions in blocks of UNI$2,500 (5,000 miles) each month for balances above UNI$15,000. Additional ad-hoc redemptions cost S$25 |

||

These fees give a revenue boost to each transfer and penalise those who transfer small amounts repeatedly, but given the state of technology today, have little to no correlation to the cost of processing a transfer.

Policies such as the rounding down of transactions, and minimum transfer sizes all have more or less the same effect, which is to shave at the margins and give a little extra boost to the bank’s finances—which enables them to offer better headline transfer rates even if the headline value isn’t actually achievable.

Looking ahead

So where does all this information leave us? It’s clear that in terms of choice, consumers are in better shape than they’ve ever been. The number of transfer partners in Singapore is large and growing, meaning that nobody has to be locked into KrisFlyer.

Is it easier to accumulate KrisFlyer miles in Singapore, given Kris+ and other options? Undoubtedly. But when it comes to bank points, it’s not the only choice for your transfers, and given the continued devaluations we’ve seen across many programmes, it is certainly nice to have options.

Hotel programmes are starting to gain popularity as transfer options, although in general hotel programmes don’t offer such outsized value as traditional first and business class airline redemptions. As more and more airlines move towards revenue based redemptions, however, this is something to watch. IHG, Marriott and Accor, in particular, have been aggressively marketing their partnership options, so we might expect to see more banks adding these partnerships in future.

The key, as always, to maximising your personal miles utility is to think carefully about your situation and what will serve you best. It’s an individual game and the more options we have, the better off we all will be.

I do on the occasions think about the value of the air miles. The air miles for SQ keeps devaluing and I counted at least 4 devaluations. Just thinking to myself where is the tipping point to a cashback card.

You realise that cash keeps devaluing as well right?

When BCM is now $6.20 per bowl with two small pcs of liver…certainly. Everyone’s need is different so one has to do your own sum.

Yes for sure if your need has you looking at cash, you should be using cashback cards instead.

Premium travel is a nice thing to have, not a neccessity. Make sure you are cash-secure before chasing miles.

I agreed.

How much easier has it become during the past years to rack up those miles?

Yes and No in my humble opinion and depends on your expenditure pattern. A lot of credit card expenditures are no longer accruing miles and what accrue or not accrue is at least a mystery to me. I used to get miles from hotel expenditure and I am not getting it anymore. I do find most loyalty programs have delvalued (or at least the ones I am using). For example HH claims 0.5 US cents per point but when you redeem, most of the value of the points seems to be less than 0.5 cents per point. At least for… Read more »

In the beginning of the article, a question piqued my interest “why are there so few hotel programmes?” Read on intently to find that it is never addressed.

Because the article title states “Airlines”, not Hotels.

the penultimate paragraph, more or less, address your concern?

This is what I call a fluff article. A lot of words but basically not saying anything.

What are you even on about? Did we read the same article?

Would love to learn more about real life nego economics examples and separately the structures of alliance and other partner redemptions, as well as interlining.