Last week, American Express unveiled the highly-anticipated new statement credits for AMEX Platinum Charge cardholders, which offer up to S$1,204 each year for air travel, dining, entertainment and lifestyle spending.

|

| New Benefits: AMEX Platinum Charge |

Quite frankly, I was underwhelmed at first. I figured I’d get at best ~S$800 of value, similar to the old credits- just with more hassle and strings attached. However, two important things have changed since then, which have impacted my valuation for the better:

- Disney+ has been added to the list of eligible merchants for the Entertainment Credit

- Grand Cru has launched its portal for Lifestyle Credit redemptions, and the much-feared bundles have not come to pass. Cardholders can pick and choose whatever wines they want, with options starting from S$21

Because of this, I feel a lot better about my ability to extract maximum value from the new credits. Here’s how I personally plan to utilise my stash.

Overview: AMEX Platinum Charge statement credits

AMEX Platinum Charge cardholders now receive S$1,204 of annual statement credits, compared to S$800 prior to February 2023.

| New Credits (From Feb-23) |

Old Credits (Ended Jan-23) |

|

| Total Amount | S$1,204 | S$800 |

| Use For | Airline, Entertainment, Lifestyle, Local & Overseas Dining | Airline, Hotel |

| Allowance | Calendar Year | Membership Year |

| Min. Spend | Applies to certain categories | N/A |

| Availability | Principal cardholder only |

|

Here’s a brief summary of the five new statement credits and their key terms:

| Credit | Amt. | Min. Spend | No. of Trxns. |

| Airline | S$200/yr. | S$600 | Multiple |

| Entertainment | S$17/mo. | N/A | Multiple |

| Lifestyle | S$400/yr. | S$600 | Single |

| Local Dining | S$200/yr. | N/A | Multiple |

| Overseas Dining | S$200/yr. | N/A | Multiple |

Registration can be done via the AMEX Offers portal, and once completed, is valid till 31 December 2024. This means there is no need to re-register come 1 January 2024.

The T&Cs say that statement credits will appear on your billing statement within 30 days from the date of transaction, but in practice they’re appearing within 1-2 days for most users.

Also, you will earn MR points on the full amount spent, not the nett amount (e.g. if you spend S$600 and get a S$200 statement credit, you earn points based on S$600).

S$200 Airline Credit

|

|

| SIA Credit | |

| Awarded | Per calendar year |

| Minimum Spend | S$600 |

The S$200 Airline Credit can be used at Singapore Airlines or Scoot, with a minimum spend of S$600 in one or more transactions.

The following terms apply:

- Tickets must be purchased in-app or online at the Singapore Airlines or Scoot websites

- Tickets must be purchased in Singapore Dollars for flights departing from Singapore

- Transactions on KrisShop, Kris+ and any purchase of trip add-ons or purchases via phone, email, or other payment links do not count

The credit can also be used for paying taxes and fees on award tickets, provided it meets the above criteria (e.g. a one-way ticket from Bangkok to Singapore would not work, since the taxes and fees are in THB, but a one-way ticket or round-trip from Singapore to Bangkok would).

This should be fairly straightforward to use, since over the course of a year I’m almost certain to hit S$600 worth of taxes and fees on award tickets alone. What’s more, paying with the AMEX Platinum Charge will take care of my travel insurance needs, as coverage (which includes COVID-19) is activated even when you pay for award tickets.

Don’t forget, the AMEX Platinum Charge earns 1.95 mpd on Singapore Airlines and Scoot transactions, instead of the usual 0.78 mpd.

S$200 Local Dining Credit

|

|

| Local Dining Credit | |

| Awarded | Per calendar year |

| Minimum Spend | None |

The S$200 Local Dining Credit can be used at any of the following restaurants in Singapore:

| 🍽️ Participating Restaurants (Singapore) | |

|

|

| *Love Dining merchant ^10Xcelerator merchant |

|

While it’s tempting to go for maximum value by choosing Lawry’s, Mikuni, Si Chuan Dou Hua or Wooloomooloo and stacking the credits with Love Dining benefits (ordering S$337 of food would come up to ~S$200 after Love Dining discounts, service charge and GST), I think I’m going to take this opportunity to try Basque Kitchen by Aitor.

The lunch menu is a whopping S$178++ per person, but after deducting the S$50 Basque Kitchen voucher included in the AMEX Platinum Charge welcome pack and the S$200 credit, my nett damage for two people will be S$173. Don’t get me wrong, that’s still a lot of money, but much more palatable than paying full price.

Alternatively, I might choose to stretch the credit by trying set lunches at Osteria BBR (S$48++), FIRE at 1-Atico (S$58++), and Sol & Luna (S$42++). Remember, you don’t need to spend the S$200 all at once.

S$200 Overseas Dining Credit

|

|

| Overseas Dining Credit | |

| Awarded | Per calendar year |

| Minimum Spend | None |

The S$200 Overseas Dining Credit can be redeemed at over 1,400 restaurants in 20 countries, so you’ll have a lot of flexibility in how you use it.

My plan is to redeem it in Japan, where the SOP is slightly different from other countries. In other countries, you simply make a reservation and pay when you’ve finished your meal. In Japan, you need to make a prepaid reservation via Pocket Concierge; the credit is valid at any restaurant offered on the platform.

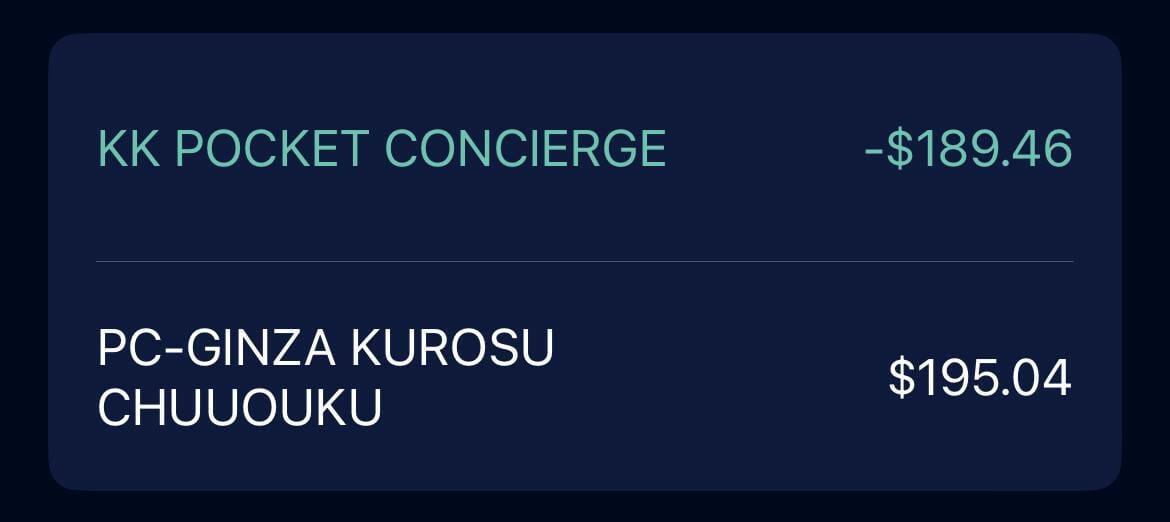

As a side note: don’t be surprised if your reimbursement is slightly less than the amount actually charged, as the screenshot from a community member shows. The difference is due to the FX fees (2.95%), which are not covered under the T&Cs.

S$204 Entertainment Credit

|

|

| Entertainment Credit | |

| Awarded | Per calendar month |

| Minimum Spend | None |

The S$204 Entertainment Credit is awarded as S$17 each calendar month, and can be used for the following merchants:

- Audible

- Eventbrite

- Disney+

- Netflix Singapore

- SPH Media (Straits Times, Business Times, Lianhe Zaobao, Shin Min Daily News, Berita Harian, Tamil Murasu, Tabla!)

- Ticketmaster

Disney+ was not in the initial list, but was belatedly added a few days later. I’m hoping that other popular services like Apple TV, HBO Max, Spotify and YouTube Premium will eventually be added too.

In the meantime, however, my plan is to use the credit for Disney+ and Netflix, which will offset S$17 of a total monthly bill of S$24.97.

| Service | Monthly Subscription |

| Netflix | S$12.98-S$21.98 |

| Disney+ | S$11.99 |

| Business Times | S$9.90 |

| Straits Times | S$9.90 |

| Lianhe Zaobao | S$9.90 |

| 👍 Newspapers are free! |

| Enjoy your tax dollars at work! All SPH newspapers can be accessed free of charge, from home, via the NLB website. Simply sign up for a free myLibrary account to get access. |

It’s important to remember the Entertainment Credit is awarded on a monthly basis, which has two implications:

- You need to start using it immediately, because every month that goes by without utilisation is S$17 wasted

- An annual subscription may be cheaper than a monthly one, but if it’s billed upfront you’ll only enjoy a one-time credit of S$17 in the month it’s charged

| ⚠️ Important Note |

| The statement credit will only be awarded if you sign up via the channels mentioned in this document. In particular, Disney+ subscriptions via the Apple or Google app stores will not be reimbursed! |

S$400 Lifestyle Credit

|

|

| Lifestyle Credit | |

| Awarded | Per calendar year |

| Minimum Spend | S$600 (single trxn) |

The S$400 Lifestyle Credit can be used at the following merchants, with a minimum spend of S$600 in a single transaction.

- Adeva Spa

- Follicle at Adeva

- Spa Rael

- The Ultimate

- The Spa by The Ultimate

- Grand Cru Wine Concierge (for purchases via this page)

I initially had a visceral reaction to the Lifestyle Credit, because (1) I have no interest in paying inflated spa prices, and (2) past collaborations with Grand Cru forced cardholders to buy bundles with stuff they may or may not want. Add the fact you needed to spend all S$600 in a single transaction, and I was ready to write it off altogether.

But Grand Cru has now launched their dedicated website for Platinum Charge cardholders, and it’s much better than I thought. There’s more than 100 wines available for selection, and cardholders can pick and choose exactly what they want.

Regular readers will know I’m partial to champagne, so I’m going to take this opportunity to try some labels I normally wouldn’t cross paths with.

| 🍾 Grand Cru Champagne Options |

||

| Wine | Price | Vivino Rating |

| NV Miraval – Fleur de Miraval Exclusivement Rose | S$533 | 4.4/5 |

| 2018 Champagne Savart – Extra Brut Premier Cru Le Mont Benoit | S$412 | 4.4/5 |

| 2018 Champagne Savart – Le Mont des Chretiens | S$275 | 4.3/5 |

| NV Jeaunaux-Robin – Fil de Brume Brut Nature | S$156 | 4.0/5 |

| NV Francoise Bedel – Brut Entre Ciel et Terre | S$130 | 4.1/5 |

| NV Champagne Savart – L’Ouverture Premier Cru Brut | S$113 | 4.2/5 |

| NV Lancelot-Pienne – Assemblage Brut Accord Majeur | S$87 | 3.9/5 |

Buying S$600 worth of wines would cost you only S$200, so if you were going to buy wine anyway, you might be tempted to take this credit at the full S$400 value. However, there’s something important to highlight: the prices on the Platinum portal (RHS in the screenshot below) may be inflated compared to the Grand Cru official website (LHS), because the latter offers discounts that the former does not.

I’d highly recommend that you do comparison shopping between the two and make sure you’re not overpaying by too much. To be conservative, I’d take a 25% haircut on the value of this credit, which means a value of S$300.

One final point to note: even though Grand Cru is a 10Xcelerator merchant, the bonus only applies to purchases at the physical outlet; online purchases do not earn any bonus.

How much value will I get?

So with that in mind, based on my personal usage patterns I could see myself getting S$1,087 out of these statement credits each year.

| Credit | Published Value (Annual) |

My Value (Annual) |

| Airline | S$200 | S$200 |

| Entertainment | S$204 | S$187* |

| Lifestyle | S$400 | S$300 |

| Local Dining | S$200 | S$200 |

| Overseas Dining | S$200 | S$200 |

| Total | S$1,204 | S$1,087 |

| *S$187 because we’ve missed out on January’s S$17 credit already |

||

Keep in mind your situation could be very different- if you’re not the spa or drinking sort, then the Lifestyle Credit is useless to you in its current form. Likewise, those who don’t use streaming services wouldn’t find the Entertainment Credit useful, and those who don’t dine out a lot won’t find the Dining Credit worthwhile (although if that isn’t your kind of thing, it does raise the question why you’re getting a lifestyle card like the AMEX Platinum Charge in the first place).

Conclusion

The AMEX Platinum Charge’s new statement credits will no doubt require more attention and planning than before, since two categories has now increased to five. I can see how absent-minded individuals could be worse off, since the cognitive load has increased significantly.

However, the good news is that it’s possible for dedicated users to get more value than before, and I’m hopeful that American Express will expand the list of eligible merchants where the credits can be spent.

Don’t forget that a new cardholder will enjoy two sets of credits in their first year, since they’re awarded based on calendar year instead of membership year (except the Entertainment Credit, which is based on calendar month). You can check out the details of the latest sign-up bonus below.

AMEX Platinum Charge offering 95,000 MR points sign-up bonus

So get cracking on your planning, keeping in mind it’s relatively more important to sort out the Entertainment Credit first (because it’s awarded based on calendar month).

How are you planning to spend your credits?

Really helpful explanations. The old credits were so painful to use — inflated hotel prices, inflated wine prices, restrictions on airfares… The cumulative nature of some of hotel and dining really helps. Thank you for the thoughtful details!

25% haircut on the lifestyle voucher credit, or the spend? Because if you are paying more by going through the portal, you are paying more on the total spend, not just your credit portion. So if youve spent $600 estimating that 25% of your spend has no additional value (implying you couldve bought it for $450 elsewhere) then your cost of using the voucher is effectively $150 (25% x &600), not $100 (25% x $400), which you should discount off the face value of the voucher. Unless you’ve already averaged it out already…

25%, honestly, is a POOMA figure. all i know is that it isn’t right to take it at face value, so there has to be some kind of haircut!

Too marfan. Not only many people are not dedicated to extracting max value from each card they have, not everyone drinks or can gift away alcohol for personal or religious reasons. So Amex Plat benefits is less than previous $800 for many. I just booked a flight to KL for June. No travel benefit as less than min spend. Amex….how can like this?

If expenditure is made on a supplementary card, will the credit still be applied, even though it is saved only to the primary card?

T&Cs:-

Just wanna highlight that my experiment with Netflix charged in MYR (then converted to SGD) doesn’t get recognized, despite in statement it’s shown as NETFLIX SINGAPORE. Will have to switch country from MY to SG I guess.

Guess the credits are ok value but more tedious to fully utilize.

The entertainment category is probably the most welcome addition and the local dining overlaps with the vouchers/love dining restaurants so no complaints there.

Overseas dining slightly more effort required along with the lifestyle spend but thankfully the Grand Cru selection is decent enough to justify the $200 top-up.

What do you mean get to enjoy two sets of credits in the same year for new members?

To be honest, how dare they are? The America AMEX provides a lot of benefits ($200 Uber Credits, $200 FHR Hotel Credit and some other benefits that worth $695 US dollars) and the SG AMEX asks for $1728 …. what a shame

Hi Aaron,

Does a new cardholder enjoy two sets of credits in their first year only if he/she applies through the sign-up promotion in the article above as that has since expired?

offer extended till 31 march, have updated article. statement credits have nothing to do with offer

I’m only getting $6.43 instead of $17 for both Feb and Mar for my Entertainment Credit when I’m subscribed to Netflix. I don’t have a subscription for any other services under the category. Is there a cap on each one?

nope. you might want to call customer service.

After some procrastination, I called, they said they’d check but I haven’t heard back after 2 weeks. But I think I have just figured it out, I get credited for my Audible subscription, so I figure they add up to $17. It’s just that when looking under the Savings section, it only list Netflix and not Audible.

“Don’t forget that a new cardholder will enjoy two sets of credits in their first year, since they’re awarded based on calendar year instead of membership year (except the Entertainment Credit”

Means that after end of 2023, I will get another $1204 to use until april 2024 comes? assuming I do not renew