One of the great things about the AMEX HighFlyer Card is its “anything goes” approach to awarding miles. You won’t find a less fussy card on the market when it comes to rewards exclusions.

That, unfortunately, will change from 4 April 2023 when GrabPay top-ups, insurance premiums, public hospitals, SAM kiosks, SPC transactions and utilities bills all get added to the naughty list.

Naturally, this will have a huge impact on the utility of the AMEX HighFlyer Card, and whether it’s still worth getting or renewing. I’ll be covering this in a separate article, but for now, let’s look at the new exclusion categories in greater detail.

AMEX HighFlyer Card adds new exclusion categories

From 4 April 2023, American Express will be adding new rewards exclusions to the AMEX HighFlyer Card.

A total of six new exclusions have been added, though not all of them hit as hard…

GrabPay top-ups

The biggest loss by far are GrabPay top-ups, which I’ve discussed in this post. I would be much more sanguine if American Express added all the other exclusions but omitted GrabPay, since GrabPay is such an easy workaround (e.g. top-up GrabPay with AMEX HighFlyer Card, then use the GrabPay Card to pay for utilities)- though that’s probably why it’s been excluded!

Make no mistake: this nails shut the coffin on GrabPay as a payment method. Despite all the nerfs and Grab’s general tomfoolery, there were still certain use cases, so long as you could earn miles on the loading.

Now that you can’t, there’s no more avenues for earning free miles for bill payments. The only option going forward is to use a service like CardUp or Citi PayAll- thank goodness the latter is still running big promos!

SPC transactions

Back in March 2020, American Express added SPC transactions to the rewards exclusion list for most of its cards. The AMEX HighFlyer Card escaped the cut back then, but not any more. I suppose the thinking was that AMEX cardholders already enjoy 21% off SPC petrol, so offering 1.8 mpd on top of that was too generous.

That said, you can still enjoy up to 23% off petrol and 4 mpd when you visit Sinopec and pay with a UOB Preferred Platinum Visa, UOB Lady’s Card, UOB Visa Signature or Amaze + Citi Rewards Mastercard. Therefore, the loss of the AMEX HighFlyer Card is more annoying than anything else.

To read more about alternative options for earning miles on petrol, refer to the post below.

Public hospitals

Back in October 2022, American Express added public hospitals, healthcare facilities and polyclinics to the rewards exclusion list for most of its cards. Just like SPC transactions, the AMEX HighFlyer Card escaped the cut initially, but not any longer.

For avoidance of doubt, you’ll still earn miles for payments at private or not-for-profit hospitals, such as Mount Elizabeth (private) and Mount Alvernia (not-for-profit). You can also continue to earn miles at private healthcare providers like dentists or physiotherapists.

| Acute | Community | |

| Public (no miles) |

1. Alexandra |

1. Bright Vision 2. Jurong Community 3. Outram Community 4. Sengkang Community 5. Yishun Community |

| Not-for-Profit | 1. Mount Alvernia | 1. AMK- Thye Hua Kwan Hospital 2. Ren Ci Community 3. St Andrew’s Community 4. St Luke’s |

| Private | 1. Crawfurd 2. Farrer Park 3. Gleneagles 4. Mount Elizabeth 5. Mount Elizabeth Novena 6. Parkway East 7. Raffles Hospital 8. Thomson Medical Centre |

To read more about alternative options for earning miles on hospitals, refer to the post below.

Utilities

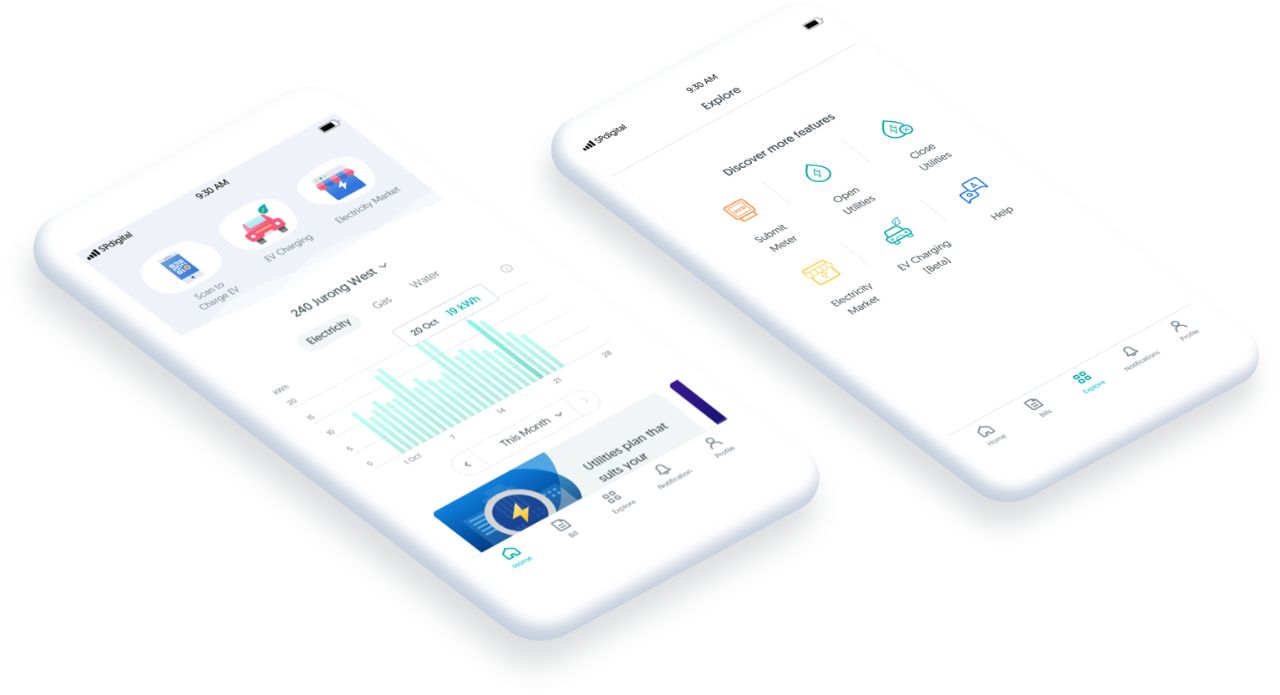

Last I checked, SP Group, Geneco, PacifcLight, Senoko Energy and Sembcorp Power all accept American Express, so the AMEX HighFlyer Card was a way of clocking an easy 1.8 mpd.

With the exclusion, alternatives are few and far between: only Maybank and Standard Chartered (plus a handful of UOB cards) offer rewards for utilities bills.

To read more about alternative options for earning miles on utilities, refer to the post below.

2022 Edition: Best Credit Cards for Electricity & Utilities Bills

Is it still worth getting/keeping an AMEX HighFlyer Card?

I’ll touch on this more in a separate article, but here’s the tl:dr.

In your first year, you pay a S$301.80 annual fee and get:

- Accor Plus Explorer membership with 1 free hotel night

- 2 lounge visits

- 40,000 HighFlyer Points with min. S$5,000 spend in first 3 months of approval

I think most people should be able to make that work, especially since GrabPay top-ups, hospital bills, and utilities all count towards minimum spend before 4 April 2023.

In your second year onwards, it’s a different story.

You may be eligible for a fee waiver, depending on how much you spend. If so, you’d be silly to cancel, since you still enjoy the Accor Plus Explorer membership and two lounge visits for basically nothing.

If you can’t get a fee waiver, then I’m leaning towards cancelling, unless you really want an Accor Plus Explorer membership- paying the S$301.80 annual fee is cheaper than paying the usual retail price of S$418.

While the AMEX HighFlyer Card remains a solid general spending option at 1.8 mpd, we need to remember that you’re capped at transferring out 150,000 HighFlyer Points per calendar year, and 30,000 HighFlyer Points per KrisFlyer account. This was historically mitigated by the fact that these were miles you wouldn’t otherwise have earned (the assumption was these came from GrabPay top-ups), but that no longer holds from 4 April 2023.

Conclusion

The AMEX HighFlyer Card will be adding new rewards exclusions from 4 April 2023, with GrabPay top-ups, insurance premiums, SPC transactions and public hospitals no longer earning miles.

As luck would have it, I just got around to writing my review of the AMEX HighFlyer Card. The assessment will obviously need to change in light of the latest developments, so I’ll be revising it in the weeks to come.

In the meantime: make as much hay as you can, though consider also the opportunity cost of tying up funds in GrabPay or other prepayments.

most people can’t get this card anyway, need to reg a biz. No loss

actually as long as you are willing to fork out the ACRA fee, anyone with a 30k income can

There are also legal requirements for maintaining a business. Filling annual returns, board meetings, P&L statements, taxes etc. you want to go through the hassle of all that just to get some 30k miles?

I wonder if AMEX had been the one to first stop award miles/cashback for grab top ups, would Grab still have banned AXS payments?

Anyone has any good reason for renewing? My renewal is coming up

is this card usable with Cardup?

sure, but amex fees are pricey (2.6%)