Back in February, I wrote about how Citibank confirmed that all Citi PayAll transactions would count towards qualifying spend for welcome bonuses and card benefits, even if the no-fee option was chosen.

|

“All Citi PayAll transactions can be included in the minimum spend required to qualify for card-related benefits, such as Citi Prestige’s complimentary airport limousine rides and welcome offers on other Citi cards. This includes Citi PayAll transactions, with or without service fees included. Citi PayAll transactions made with zero service fees paid, however, will not qualify for any other rewards, such as base points, bonus points or miles. In line with industry practices, we reserve the rights to review and modify the relevant terms and conditions related to Citi cards as required.” -Citi Spokesperson |

In other words, a Citi PremierMiles Cardholder could make a no-fee PayAll payment of S$800 to qualify for their sign-up bonus, and a Citi Prestige Cardholder could make a no-fee PayAll payment of S$12,000 to qualify for two complimentary airport limo rides. I was deeply suspicious at first, but field tests confirmed it to be true.

Still, this always felt too good to last, and perhaps it should come as no surprise that Citi will be nerfing it from 2 May 2023.

No-fee Citi Payall no longer counts as qualifying spend

From 2 May 2023, Citibank has updated its definition of qualifying spend as follows:

| “Qualifying Spend” refers to any retail transactions (including internet purchases) which do not arise from (i) any Equal Payment Plan (EPP) purchases, (ii) refunded/disputed/unauthorised/fraudulent retail purchases, (iii) Quick Cash and other instalment loans, (iv) Citi PayLite/Citi Flexibill/cash advance/quasi-cash transactions/balance transfers/annual card membership fees/interest/goods and services taxes, (v) bill payments made using the Eligible Card as a source of funds, (vi) late payment fees and (vii) any other form of service/ miscellaneous fees. (vii) Citi PayAll transactions where the customer is not charged the Citi PayAll service fee |

The above T&Cs are in the context of welcome offers, but it stands to reason that if no-fee PayAll spend does not count towards qualifying spend for welcome offers, it also won’t count towards qualifying spend for card benefits.

In other words, you won’t be able to use no-fee Citi PayAll transactions to meet the:

- S$12,000 minimum quarterly spend for 2x Citi Prestige limo rides

- S$800 minimum monthly spend for bonus cashback on Citi Cash Back Credit Card

- S$800 minimum spend for welcome offers on Citi PremierMiles, Citi Rewards, Citi Prestige and other Citi cards

I am in the midst of confirming this understanding with Citi’s PR team, and will update this post if/when I get a response.

All no-fee Citi PayAll transactions up till 1 May 2023 will still be included for the purposes of calculating qualifying spend.

For the avoidance of doubt, fee-paying Citi PayAll transactions will still count towards qualifying spend for welcome offers and card benefits.

Should you still use no-fee PayAll?

While this nerf is unwelcome, it doesn’t mean that no-fee PayAll becomes pointless (well, it is pointless in the sense that you won’t earn points…). No-fee PayAll can be used as a way of deferring payments and conserving cashflow, as I’ve highlighted in this post.

Suppose your statement date is the 11th of each month, and you have an insurance premium due on 16 April. Citi PayAll charges your card up to four days in advance from the scheduled payment date, so the 16 April payment will just sneak past your current statement date (it gets charged on 12 April or later) and becomes part of the statement that arrives on 11 May.

Citi gives cardholders a 25-day period to pay their bill from the statement date, so my payment is only due on 5 June. My insurance premium gets paid (by Citi) on 16 April, but cash only leaves my pocket on 5 June, an interest-free period of 50 days!

In practice the dates may not always line up so nicely, but if your bills are due on a standard date (e.g. the 5th of every month), you can contact Citibank to change your credit card’s statement date such that the interest-free period is maximised.

The general idea here is to make your payments at the very start of your credit card statement period, giving you additional time to pay at no additional cost.

Churning your credit limit?

I’m sure this idea may have crossed some minds, with interest rates for savings accounts being as high as they are.

Could you use no-fee Citi PayAll as an effective free float? Citi PayAll allows you to transact with up to 95% of your credit limit, subject to the monthly caps below:

- Rent, electricity bills, condo MCST fees and miscellaneous: S$30,000 per category

- Education: S$100,000

- Insurance: S$200,000

Since some categories under miscellaneous (e.g. travel expenses) allow you to deposit money in any bank account you wish, I’ve heard it proposed that you:

- send as much money to yourself as your credit limit allows (capped at S$30,000 per month under misc. category)

- use it as capital to earn interest via a high-yield bank account

- pay back the capital when the credit card bill comes due

- send yourself more money, etc etc.

It’s an interesting thought experiment, but I’m not going to weigh in further beyond pointing out that paying yourself is a violation of the Citi PayAll T&Cs.

|

|

10.1 When accessing and using the Service, you must comply with any prescribed verification procedures, or other procedures, directions and instructions communicated by us to you. Further, you hereby represent and warrant that you shall not, in connection with your use of the Service: (b) send money to yourself or recipients who have not provided you with goods or services (unless expressly allowed by us); (c) provide yourself or any other party a cash advance from your card (or help other parties to do so); |

Do people get away with it? I’m sure they do. Can you get in trouble if Citi finds out? I’m sure you can.

That’s why I’ve said from the start that Citi PayAll isn’t a license to print miles (or churn credit limits). The underlying transaction needs to have some commercial substance, and may or may not attract tax for the receiver, depending on circumstances.

Citi PayAll’s current promotion

|

| Citi PayAll 2.2 mpd Promo |

From 20 April to 20 August 2023, Citi cardholders will earn a flat 2.2 mpd on Citi PayAll transactions, with a minimum combined spend of S$8,000 and a cap of S$120,000. Citi has also permanently increased the PayAll admin fee to 2.2%.

The following cards are eligible for this offer:

| Card | Earn Rate | Cost Per Mile (@ 2.2% fee) |

Citi ULTIMA Citi ULTIMA |

2.2 mpd (Base: 1.6 mpd Bonus: 0.6 mpd) |

1 cent |

Citi Prestige Citi Prestige |

2.2 mpd (Base: 1.3 mpd Bonus: 0.9 mpd) |

1 cent |

Citi PremierMiles Citi PremierMiles |

2.2 mpd (Base: 1.2 mpd Bonus: 1.0 mpd) |

1 cent |

Citi Rewards Citi Rewards |

2.2 mpd (Base: 0.4 mpd Bonus: 1.8 mpd) |

1 cent |

Payments must be set up by 20 August 2023 and charged by 24 August 2023. The S$8,000 need not be in a single transaction; it can be combined across multiple payments on a single card that fall within the promotion period.

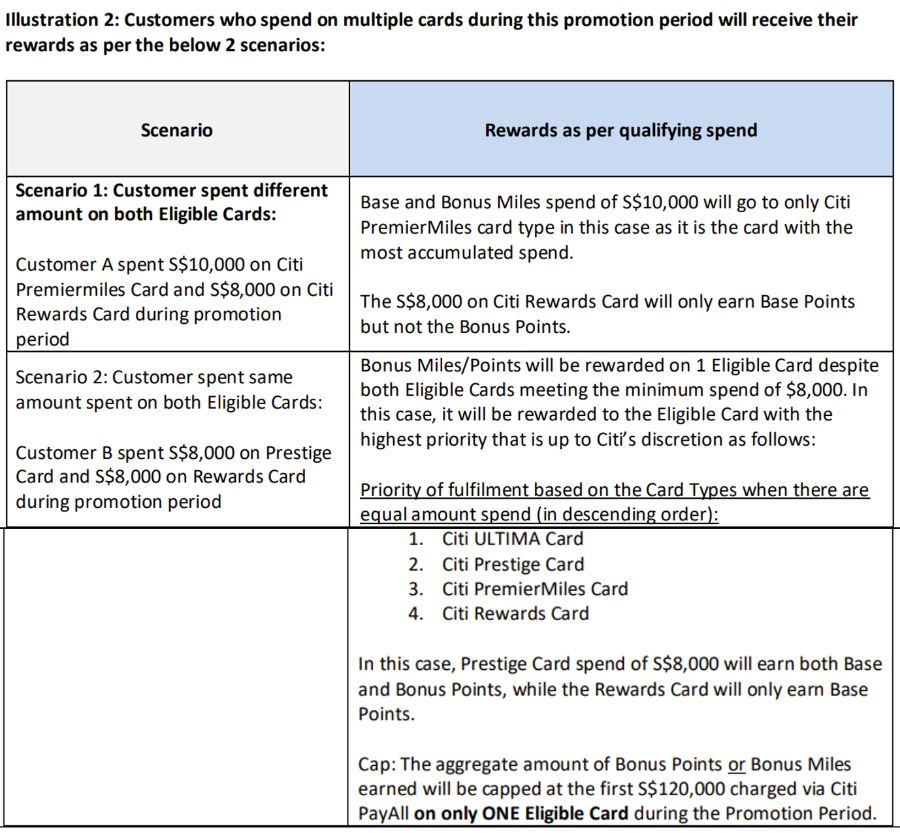

Note that if you spend on multiple cards, only the card with the highest accumulated spend will earn bonus points. In other words: stick to a single card! No matter how many Citi cards you have, the maximum bonus you can earn is capped at S$120,000 on a single card.

If you already have an existing recurring payment in place before 20 April 2023, you will need to cancel it and set it up again to benefit from this promotion.

Conclusion

From 2 May 2023, Citi PayAll transactions will only count towards qualifying spend if you pay the 2.2% admin fee. All no-fee payments will not count.

Good while it lasted, I guess!

Based on scenario 2 above, how can I clock the fee-paying $12K spend per quarter (for limo) AND get the 4mpd for Premiermiles on overseas spend? It seems to be a OR rather than AND because if I use PayAll on both before 20 Aug 2023, the bonus miles will only be accorded to one card and not both. May I ask if my interpretation is correct?

wow i made the citipayll transaction yesterday (1st May), however it will only be processed 5th May (after the 2nd). I wonder if that counts now..

Well there was an opportunity earlier in the year with UOB Pay Anything, where you could 100% “legally” pay yourself, AND collect miles! If you used the right savings account for the bank’s money, the cost of the miles ended up being ZERO! But if you did not maximise the interest earning, the miles might have still ended up costing 0.2 to 0.3cpm. What a pity they woke-up to this anamoloy and dramatically increased the costs of a Pay Anything transaction from February. Still, always be on the look-out – with interest rates high you never know when a “legal”… Read more »

There already is a way…

https://link.medium.com/0UhUSSsbuzb

I made a City payall transaction earlier on and it was processed 2nd May.. will that count for my city prestige welcome reward?

Would this count towards qualifying spend for the premiermiles 4 mpd promo?

That’s a good question, how come Aaron has no answer for this?

Don’t know why you keep mentioning Citi prestige benefits in the headline and then say later on that you’re not really sure and it’s tbc. Can we stick to facts instead of speculation? Prestige benefit tnc has not changed, so don’t see any need to fear monger like that.

hello sir!

thanks for spotting that- was confused at first because the headline makes no mention of card benefits, but later realised you were talking about the excerpt not the headline. have edited the part about card benefits out, pending confirmation. hopefully we’ll get some clarity soon- stay tuned!