It’s no secret that I’ve not been the biggest fan of the UOB Visa Infinite Metal Card. There’s no denying it’s a looker, but its tagline of “all style, all substance” seemed like a bad joke, given the lacklustre benefits and elevated annual fee.

But credit where it’s due, the bank has unveiled some enhancements that I’m very pleased to see.

Cardholders can now enjoy a higher earn rate on overseas spend (2.4 mpd) and unlimited lounge visits for themselves plus a guest. That, together with a generous sign-up bonus and a monthly drip feed of Grab vouchers, significantly improves the value proposition.

Enhancements to the UOB Visa Infinite Metal Card

Effective 1 June 2023, UOB has made the following changes to the UOB Visa Infinite Metal Card.

Income Requirement

Not that this was strictly enforced in the first place, but the minimum income requirement for the UOB Visa Infinite Metal Card has been lowered from S$150,000 to S$120,000 per annum.

Welcome Offer

A new welcome offer has been launched for the UOB Visa Infinite Metal Card, valid for applications from 1 June to 31 August 2023.

Cardholders who spend at least S$4,000 within 30 days of approval and pay the S$648 annual fee will receive:

| New-to-UOB customers | Existing UOB customers |

| 80,000 miles + 20 x S$10 GrabFood or GrabTransport vouchers | 40,000 miles + 20 x S$10 GrabFood or GrabTransport vouchers |

|

New-to-UOB is defined as a customer who:

|

|

Unlike most UOB sign-up offers, there is no cap on the number of eligible applicants. It actually represents very decent value; if you value a mile at 1.5 cents, that’s a healthy chunk of the first year annual fee already paid for.

The T&Cs of the welcome offer can be found here.

Earn Rates

| Till 31 May 2023 | From 1 Jun 2023 | |

| Local Spend | UNI$3.5 per S$5 charged (1.4 mpd) |

|

| Overseas Spend | UNI$5 per S$5 charged (2.0 mpd) |

UNI$6 per S$5 charged (2.4 mpd) |

The UOB Visa Infinite Metal Card now earns 1.4/2.4 mpd on local/overseas spend.

In other words, it matches the earn rates of the UOB PRVI Miles Card. It was always a little strange that the supposedly premium Visa Infinite Metal Card was outperformed by the entry-level PRVI Miles, so I’m glad they’ve fixed that.

Lounge visits

| Till 31 May 2023 | From 1 Jun 2023 | |

| Lounge Visits | 4 per membership year | Unlimited + 1 guest |

UOB Visa Infinite Metal Cardholders previously received a measly four free lounge visits per membership year. Four! That was laughably bad, considering other cards in its segment were offering unlimited visits.

That’s been rectified, and cardholders now receive unlimited visits (+1 guest) to DragonPass lounges worldwide.

It’s noteworthy that UOB is offering lounge access through DragonPass as opposed to Priority Pass or LoungeKey. The DragonPass network is arguably more useful given Plaza Premium’s divorce from The Collinson Group (which runs Priority Pass and LoungeKey). DragonPass members can still access Plaza Premium Lounges as per normal, and at some airports that’s the sole contract lounge option.

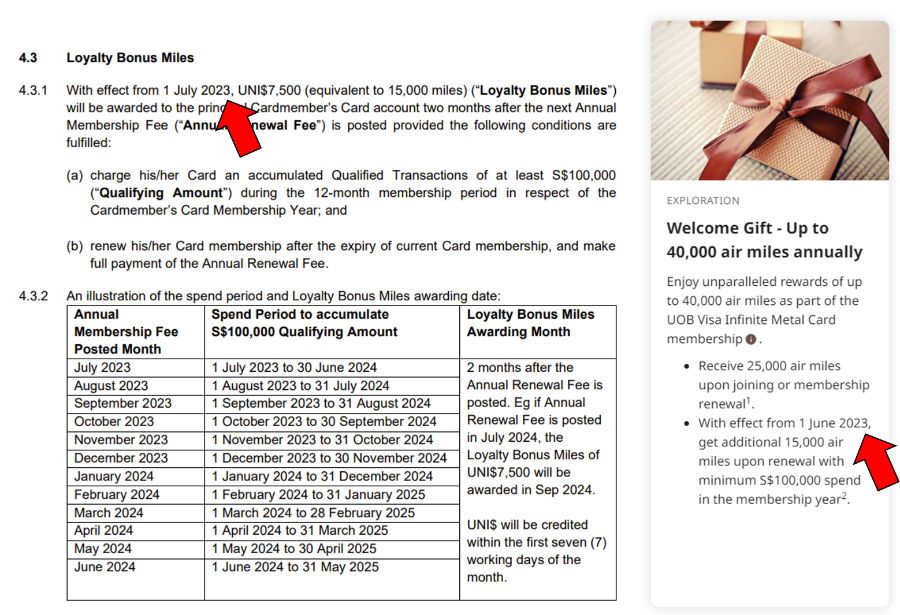

Annual Spending Bonus

| Till 31 May 2023 | From 1 Jun 2023* | |

| Annual Spending Bonus | N/A | 15,000 miles with S$100K spend in membership year |

| *Could be 1 Jul 2023; see note below | ||

UOB Visa Infinite Metal Cardholders who spend at least S$100,000 in a membership year will receive 15,000 bonus miles when they renew their card for the following membership year.

The bonus miles will be awarded two months after the annual fee is posted.

I don’t think much of this enhancement, since 15,000 bonus miles for S$100,000 spend is a pittance of a return, and there’s really no reason why you should be putting so much spend on a general spending card in the first place. But hey, if you’re going to do it anyway…

Do note that there’s a discrepancy between the T&Cs and landing page. The T&Cs say the benefit kicks in from 1 July 2023, while the landing page says 1 June 2023. It’s probably safer to assume the T&Cs are correct.

Grab Gift Vouchers

While this benefit actually started from 15 January 2023, I feel it’s worth highlighting nonetheless.

UOB Visa Infinite Metal Cardholders will receive two free S$5 GrabGift vouchers monthly via SMS, which can be redeemed for Transport, Food, Mart or Express services.

New cardmembers will receive the codes from the second month of card open date (e.g. if a card was opened in January 2023, the cardmember will start to receive the promo codes via SMS from February 2023 onwards).

Over the course of a year that’s S$120 of extra value- and yes, I know you probably shouldn’t take it at face value.

Overview: UOB Visa Infinite Metal Card

|

|||

| Apply | |||

| Income Req. |

S$120,000 p.a. |

Points Validity |

2 years |

| Annual Fee |

$648 | Min. Transfer |

5,000 UNI$ (10,000 miles) |

| Miles with Annual Fee |

25,000 | Transfer Partners |

|

| FCY Fee | 3.25% | Transfer Fee | Waived |

| Local Earn | 1.4 mpd | Points Pool? | Yes |

| FCY Earn | 2.4 mpd | Lounge Access? | Yes |

| Special Earn | N/A | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

In addition to the abovementioned benefits, here’s a few other perks of the UOB Visa Infinite Metal Card you should be aware of:

- UNI$ expire after two years, but the usual S$25 admin fee for miles conversions is waived

- 50% off weekday lunch bill at selected restaurants in Pan Pacific and PARKROYAL hotels in Singapore, plus Si Chuan Dou Hua (UOB Plaza)

- 4th night free with 3 nights booked at selected COMO Hotels and Resorts

- Up to US$1 million travel accident insurance

- Complimentary Pan Pacific DISCOVERY Platinum status

- Complimentary golf games at Sentosa Golf Club, and 50% off green fees at clubs across SEA

- Buy miles at 2 cents apiece via the UOB Payment Facility

It’s also noteworthy that the UOB Visa Infinite Metal Card still earns miles on hospital bills- while UOB added a general exclusion for this category in February 2021, the UOB Visa Infinite Metal Card was exempt. And as someone pointed out in the comments, education is also absent from the list of exclusions- that could be very interesting, assuming it’s not an oversight.

How does it compare to other $120K cards?

The UOB Visa Infinite Metal Card has been performing rather poorly in every edition of the $120K Credit Card Showdown so far, but with these enhancements, I reckon it could hold its own.

I’ll be doing up a comprehensive post within the next month or so, but my quick take is that its first year value proposition will be hard to beat, even if you’re an existing UOB cardholder. By paying S$648, you get:

- 40,000 bonus miles

- S$320 Grab vouchers (S$200 from sign-up, S$120 recurring)

- Unlimited lounge visits + 1 guest

Even if you take a haircut on the value of the Grab vouchers, most people should be able to make those sums work. Heck, I’d consider it myself if not for the fact I already have the AMEX Platinum Charge.

My gut sense is that the Citi Prestige Card is still a better choice, but this is definitely going to make the DBS Vantage Card start looking over its shoulder…

Conclusion

The UOB Visa Infinite Metal Card has received some noteworthy enhancements which dramatically improve the card’s value proposition, all while keeping the annual fee the same. Cardholders will now enjoy 2.4 mpd on overseas spend, and unlimited lounge visits including one guest. There’s also a constant flow of Grab vouchers to look forward to, and a 15,000 miles loyalty bonus (not that you should be trying to hit S$100,000 spend just for that!)

In many ways, this is what the UOB Reserve Card’s makeover should have been, instead of that underwhelming nothingburger.

Lord Barrington would be pleased.