| ⚠️ Warning: Based on real-world testing, only DBS and HSBC cards earn rewards with AXS Pay Any Bills. Proceed at your own risk! |

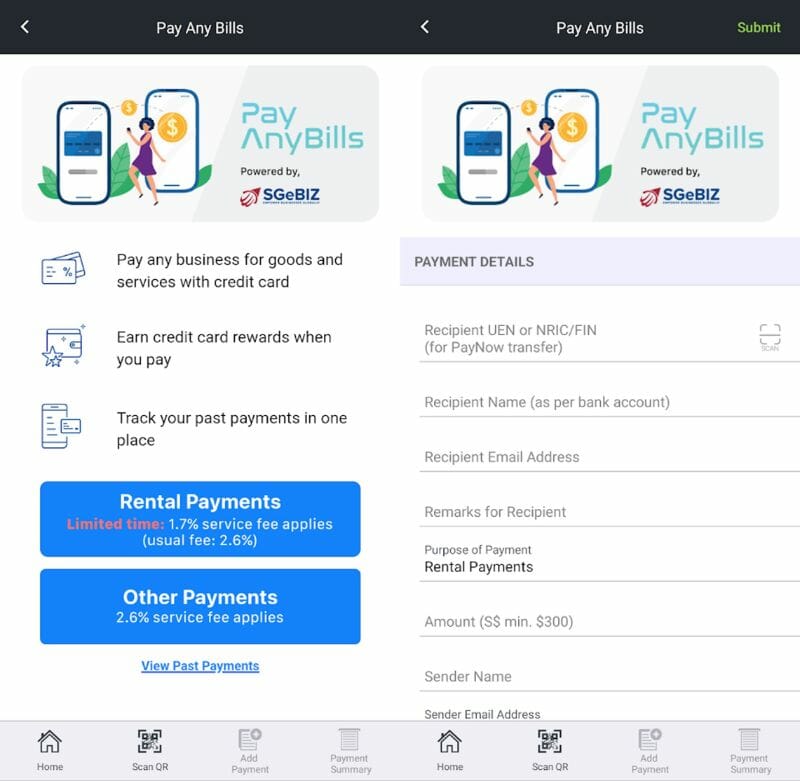

Back in January, I wrote about the AXS Pay Any Bills service, which allows customers to pay any organisation with a PayNow-linked UEN and earn credit card rewards in the process, since Pay Any Bills codes in a different way from standard AXS transactions.

The problem was the admin fee of 2.6%. Even if you had a credit card earning 1.6 mpd on general spending, your cost per mile would be much higher than using competing services like CardUp or Citi PayAll.

But AXS has now expanded its Pay Any Bills service to allow for payments to individuals with PayNow-linked NRIC/FIN numbers, and added a promotional rate of 1.7% for rental payments.

This is a potentially enticing offer, and perhaps not for reasons that AXS originally envisioned…

AXS Pay Any Bills rental offer

From now till 31 December 2023, customers can enjoy a 1.7% service fee when using the AXS Pay Any Bills feature to make rental payments.

This is a public offer that can be accessed through the AXS m-Station app (Android | iOS). Tap on Pay Any Bills on the home screen, and you’ll see the special rate for rental.

AXS has updated the app so that it now supports PayNow-linked NRIC/FIN numbers. In other words, this works like a regular bank transfer, and there is no need for your landlord to register for any service. A minimum payment of S$300 applies, but seriously, what kind of place are you going to rent for less than S$300?

Here’s the thing: the “purpose of payment” field is prefilled as rental, but no supporting documentation (e.g. tenancy agreement) is required. I suppose AXS reserves the right to request it later on if they suspect any funny business, but I could certainly see how people might use this for purposes that AXS may not have originally intended.

In any case, here’s what the cost per mile will look like based on a 1.7% admin fee and various earn rates (both the amount charged and the admin fee will earn miles).

| 💳 AXS Pay Any Bills Rental Offer | |

| Earn Rate | Cost Per Mile (1.7% fee) |

| 1.6 mpd | 1.04 cents |

| 1.5 mpd | 1.11 cents |

| 1.4 mpd | 1.19 cents |

| 1.3 mpd | 1.29 cents |

| 1.2 mpd | 1.39 cents |

| 1.1 mpd | 1.52 cents |

| 1.0 mpd | 1.67 cents |

While most credit cards will earn their usual general spending rate for AXS Pay Any Bills transactions, OCBC credit cards will only award 1 mpd for such transactions (which means you can safely rule them out).

|

⚠️ Note: There have been multiple reports that UOB cards do not earn rewards for AXS Pay Any Bills service, so exercise caution. Refer to the article below for more.

|

Most cardholders should be looking at a cost per mile in the 1.19-1.39 cents range, which is actually pretty decent, all things considered.

How does this compare to other offers?

Obviously we can’t look at this offer in isolation, because other bill payment services are offering promotions for rental payments too.

CardUp rental offer

|

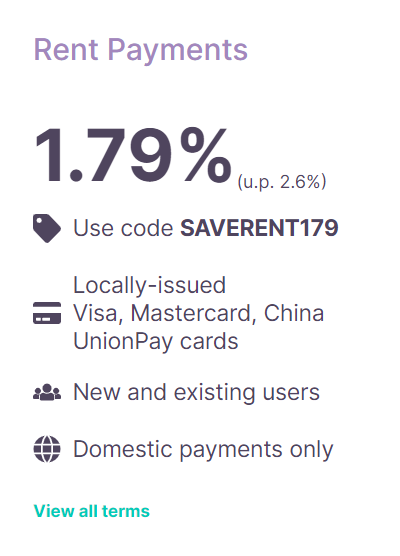

| SAVERENT179 T&Cs |

CardUp users paying rent can use the promo code SAVERENT179 to enjoy a 1.79% fee for payments scheduled by 31 January 2024 with due dates on or before 5 February 2024. This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

With a 1.79% fee, you’ll be paying between 1.1 to 1.76 cents per mile, depending on card. Both the payment and the CardUp fee are eligible to earn miles.

| 💳 CardUp Rental Offer | |

| Earn Rate | Cost Per Mile (1.79% fee) |

| 1.6 mpd | 1.1 cents |

| 1.5 mpd | 1.17 cents |

| 1.4 mpd | 1.26 cents |

| 1.3 mpd | 1.35 cents |

| 1.2 mpd | 1.47 cents |

| 1.1 mpd | 1.60 cents |

| 1.0 mpd | 1.76 cents |

| Note: HSBC cards do not earn rewards with CardUp |

|

In general, the AXS Pay Any Bills offer is superior, unless perhaps you have an OCBC credit card (OCBC cards earn their regular rates on CardUp, but only 1 mpd with AXS Pay Any Bills).

Citi PayAll offer

|

| Citi PayAll 2.2 mpd Promo |

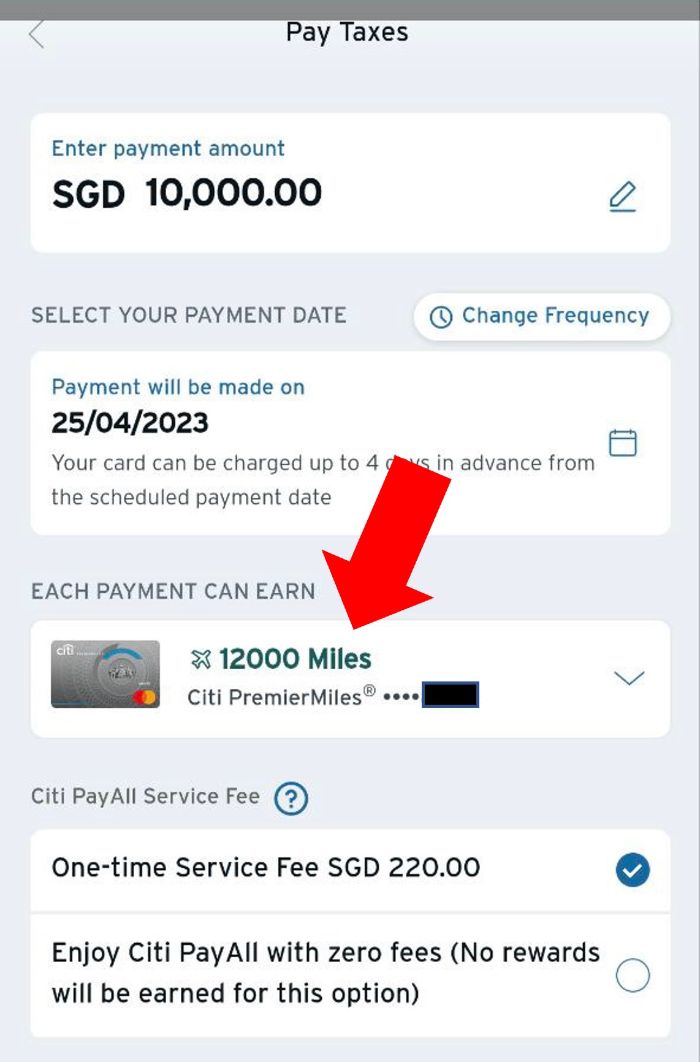

From 20 April to 20 August 2023, Citi cardholders will earn a flat 2.2 mpd on all Citi PayAll transactions (including rent), with a minimum combined spend of S$8,000 and a cap of S$120,000.

An admin fee of 2.2% applies, which means a standard cost of 1 cent per mile across Citi cards:

| Card | Earn Rate | Cost Per Mile (@ 2.2% fee) |

Citi ULTIMA Citi ULTIMA |

2.2 mpd (Base: 1.6 mpd Bonus: 0.6 mpd) |

1 cent |

Citi Prestige Citi Prestige |

2.2 mpd (Base: 1.3 mpd Bonus: 0.9 mpd) |

1 cent |

Citi PremierMiles Citi PremierMiles |

2.2 mpd (Base: 1.2 mpd Bonus: 1.0 mpd) |

1 cent |

Citi Rewards Citi Rewards |

2.2 mpd (Base: 0.4 mpd Bonus: 1.8 mpd) |

1 cent |

| ⚠️ Citi app shows regular rates! |

|

Be advised that the Citi Mobile App (where Citi PayAll payments are set up) shows the regular earn rates by default.

For example, it tells me a S$10,000 payment on my Citi PremierMiles Card will earn 12,000 miles (based on 1.2 mpd), when in fact it should be 22,000 miles (based on 2.2mpd). You’ll just have to take it on faith that the bonus miles will show up later. |

This is a superior offer to AXS, with the caveat that a minimum spend of S$8,000 is required. That said, your rental from now till August is almost certainly going to be at least S$8,000, so the minimum spend should be quite attainable.

However, the Citi PayAll offer only lasts till 20 August 2023, after which the cost per mile increases to 1.38-1.83 cents (based on an admin fee of 2.2%). The Pay Any Bills offer would then become more attractive.

Conclusion

For the rest of 2023, AXS is offering a special admin fee of 1.7% for customers who pay their rent via the Pay Any Bills service. This allows them to buy miles from 1.04 to 1.67 cents apiece, which could prove useful in some situations.

Fair warning: I don’t have any first-hand experience with Pay Any Bills. I’m assuming that AXS has done its diligence in ensuring that credit card points are awarded (because if not, what’s the point of all this?), but if you have real-world data points feel free to report them.