Back in March 2020, AXS launched a service called Pay+Earn, its attempt at a Citi PayAll/CardUp competitor. This app-only platform allowed customers to pay their bills with a credit card, earning miles, points or cashback in exchange for a small admin fee.

Now there’s another service called Pay Any Bills powered by SGeBIZ, which offers a much wider scope of payments.

AXS Pay Any Bills

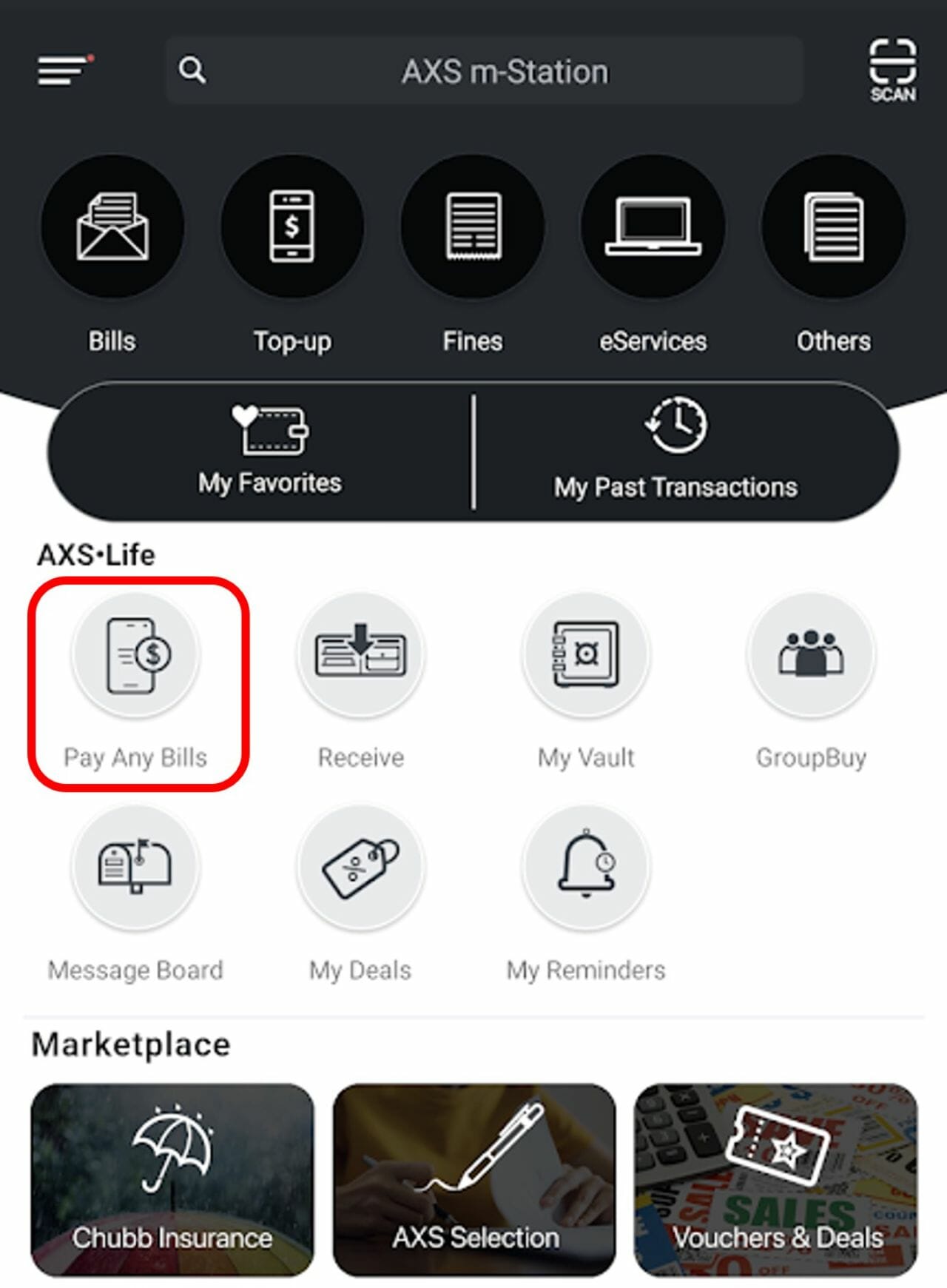

The AXS Pay Any Bills service can be accessed through the m-Station app (Android | iOS). You’ll see it on the home screen once the app is loaded.

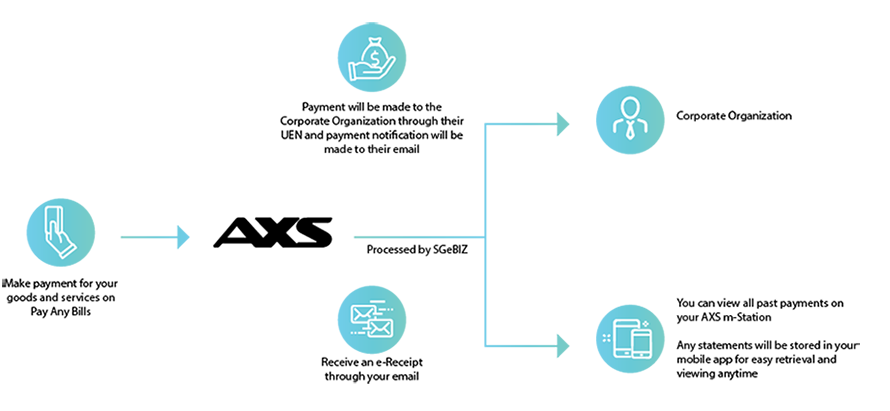

Pay Any Bills is very similar to CardUp or Citi PayAll, only that its scope is potentially much wider. You can use this service to pay any corporate organisation with a UEN, whether it’s IRAS or your friendly renovation uncle.

A few points to note:

- A 2.6% processing fee applies to all transactions

- A processing time of five working days is required for each payment

- Payments will be transferred by PayNow to recipient UEN

- Each payment must be a minimum of S$300

- Only Mastercard and Visa are accepted

AXS says that you will earn credit card points, miles or cashback with every successful payment transaction, but how they guarantee this I’m not quite sure. I do know that some banks (e.g. DBS, OCBC) have carved out specific exemptions for Pay+Earn, but I wonder whether others like HSBC will award points, given how they already exclude CardUp and ipaymy.

While Pay+Earn has a 2.5% processing fee, Pay Any Bills ups this slightly to 2.6%. Assuming all cards earn miles with Pay Any Bills, your cost per mile is as follows.

| Card | Earn Rate | Cost Per Mile (2.6% fee) |

DBS Insignia DBS Insignia |

1.6 | 1.58 |

UOB Reserve UOB Reserve |

1.6 | 1.58 |

Citi ULTIMA Citi ULTIMA |

1.6 | 1.58 |

DBS Vantage DBS Vantage |

1.5 | 1.69 |

SCB Visa Infinite SCB Visa Infinite |

1.4* |

1.81 |

UOB PRVI Miles UOB PRVI Miles |

1.4 | 1.81 |

UOB Visa Infinite Metal UOB Visa Infinite Metal |

1.4 | 1.81 |

Citi Prestige Citi Prestige |

1.3 | 1.95 |

HSBC Visa Infinite HSBC Visa Infinite |

1.25^ | 2.03 |

SCB X Card SCB X Card |

1.2 | 2.11 |

DBS Altitude Visa DBS Altitude Visa |

1.2 | 2.11 |

OCBC VOYAGE OCBC VOYAGE(Premier, PPC, BOS) |

1.0# | 2.53 |

OCBC VOYAGE OCBC VOYAGE |

1.0# |

2.53 |

OCBC 90°N Card OCBC 90°N Card |

1.0# | 2.53 |

| *1.4 mpd applies with minimum S$2K spend per statement month, otherwise 1.0 mpd ^With min. S$50,000 spend in the previous membership year, otherwise 1.0 mpd #The regular earn rate is superseded by a 1.0 mpd rate for AXS Pay Any Bills |

||

This would make Pay Any Bills the most expensive bill payment solution on the market, much higher than CardUp (2.25%), Citi PayAll (2%) or SC EasyBill (1.9%). I’m struggling to see a use case for it, quite frankly.

What’s behind Pay Any Bills?

The service powering AXS Any Bills is run by SGeBIZ, a company which offers its own bill payment solution called EzyPayment.

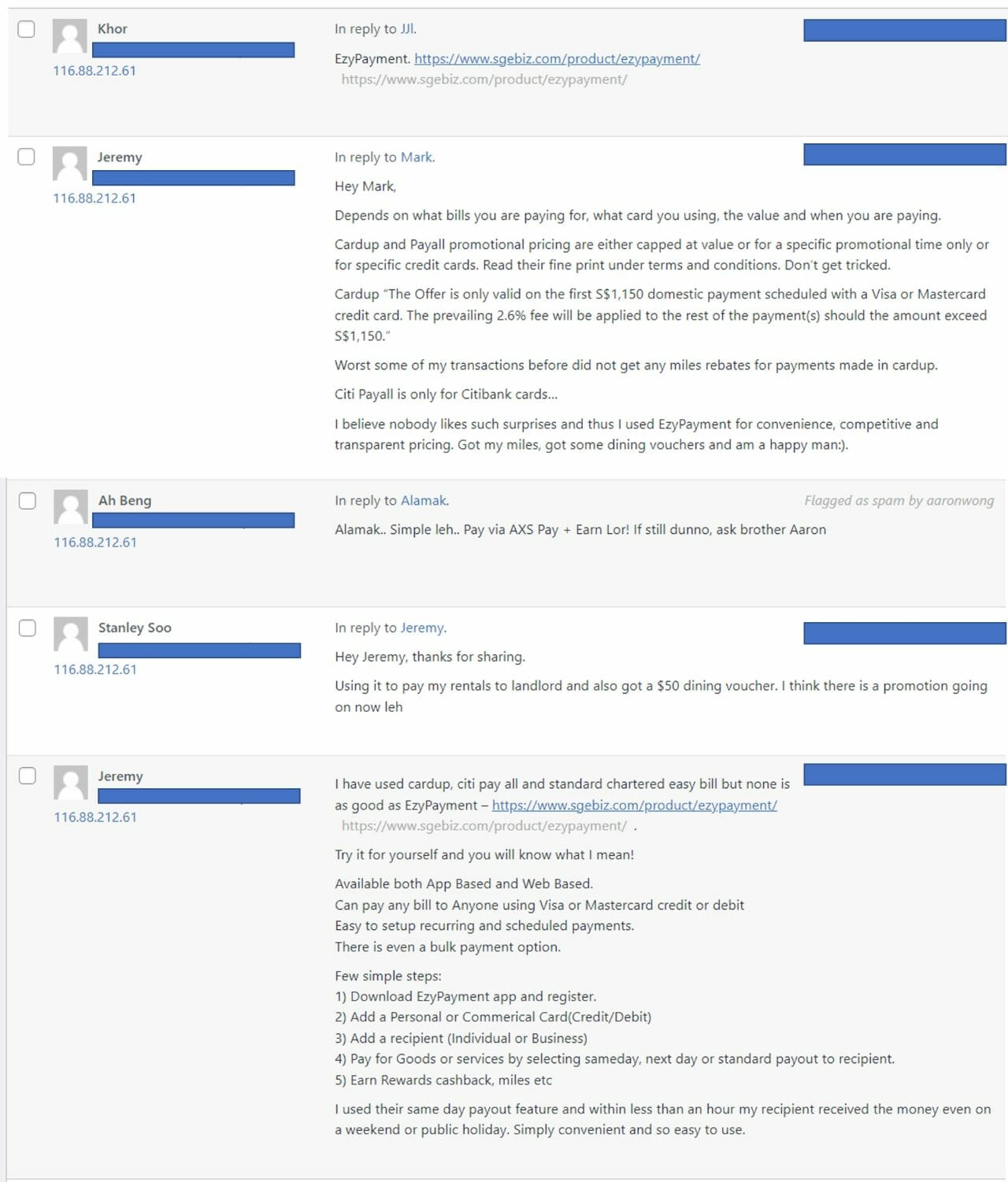

Let me start by saying that I’m less than impressed by their marketing tactics, having seen the most blatant case of astroturfing in the comments section of a CardUp article (but this being the internet, it’s impossible to verify if the posters were indeed from SGeBIZ, or just a rival trying to make them look bad).

Astroturfing aside, EzyPayment offers an app that allows customers to schedule bill payments with a fee starting from 0.9% (+0.5% for same day payment; +0.3% for next day payment). Based on comments in the Telegram Group, the fee may differ depending on bank, so you’ll need to add your card and see what pops up.

On top of this, EzyPayment is offering the following sweeteners till 31 January 2023 (“while stocks last”):

- Business Accounts: Pay a minimum of S$1,000 and get a S$100 Creative Eateries dining voucher

- Individual Accounts: Pay a minimum of S$500 and get a S$50 Creative Eateries dining voucher

Each company and/or individual is eligible for only one voucher.

I will say this much about EzyPayment: their app is a mess (it logs you out every time you hit the back button or minimise the app), the payments supported are limited (under individual I can only see rent and domestic helper), and I couldn’t add my card successfully. I’d say use it at your own risk, low fees notwithstanding.

And if the fees are really as low as 0.9%, I wonder what kind of spread AXS is making…

Conclusion

AXS has added a new bill payment service called Pay Any Bills. Unfortunately, the use case for this platform is even more marginal than before, since the admin fee has increased from 2.5% to 2.6% (not to mention that some banks like OCBC offer a nerfed earn rate for these transactions).

With superior solutions out there, it’s hard to see why anyone would use this service.

Is there any use case for Pay Any Bills I’m not seeing?

0.9% fee?

Dang.. I was using payall for my rent, should have used this instead.

“I’m struggling to see a use case for it, quite frankly.”.

That is because there is NO use. Anyone using that service has simply not bothered to look at the cheaper alternatives. It has no value at all.

As for EzyPayment, I have no idea how you get the 0.9%. I signed up for it, tried a variety of cards and a few different types of payment and it came up at 2.4% everytime. So gave up. At 2.4%, it has the same amount of use as AXS.

Any idea if we can pay income tax via this method?

iras has a UEN so you could, but why?

this is what i call a solution looking for a problem

How about paying of fines (ie. Parking fine) through this method?