| The following is a sponsored post by HSBC Singapore. The opinions are those of The MileLion. |

The HSBC TravelOne Credit Card has just passed the one month mark, and while I’ve already shared some detailed thoughts on the product, there’s a few things well worth reiterating.

HSBC TravelOne Credit Card HSBC TravelOne Credit Card |

||

| Apply | ||

| Income Req. | Annual Fee | FCY Fee |

| S$30,000 |

S$194.40* |

3.25% |

| Local Earn | FCY Earn | Lounge Visits |

| 1.2 mpd |

2.4 mpd | 4 per calendar year |

| Transfer Fee | Min. Transfer | Transfer Partners |

| Free till 31 Dec 2023 |

10,000 miles (beyond this, the min. block reduces to 2 miles) |

12 |

| *Waivable from 2nd year onwards with min. S$25,000 spend in a membership year | ||

HSBC now offers 12 airline and hotel transfer partners, the widest variety among any bank in Singapore, and they’re just getting started. The target is to have more than 20 by the end of 2023.

And even though most of these partners are currently TravelOne exclusives, the HSBC team has confirmed that points pooling is coming, which means that HSBC Visa Infinite and HSBC Revolution credit cardholders can soon join in the fun too.

Throw in instant conversions with no fees (till 31 December 2023), plus transfer blocks of just 2 miles after the first 10,000 mile block, and that was reason enough for me to hop onboard.

I applied for a HSBC TravelOne Credit Card on 12 May, one day after launch, and received approval on 18 May. The physical card arrived one day later, and I’ve been putting it through the paces over the past month.

Here’s a few pointers I hope you find useful for getting the most out of your card.

Secure your 20,000 miles welcome offer

One of the first things to do upon getting your HSBC TravelOne Credit Card is to figure out how you’re going to clock the minimum spend required for the 20,000 miles welcome offer.

This is valid for cardholders who:

- Apply by 31 August 2023

- Pay the annual fee of S$194.40

- Spend at least S$800 during the qualifying spend period (see below)

- Opt-in for marketing communications during the sign-up process

The offer is valid for both new and existing HSBC credit cardholders, which means that holding other HSBC credit cards does not disqualify you from participating.

The qualifying spending period is as follows:

| Card Account Opening Date | Qualifying Spend Period |

| 11-31 May 2023 | 11 May to 30 Jun 2023 |

| 1-30 Jun 2023 | 1 Jun to 31 Jul 2023 |

| 1-31 Jul 2023 | 1 Jul to 31 Aug 2023 |

| 1-31 Aug 2023 | 1 Aug to 30 Sep 2023 |

| 1-15 Sep 2023 | 1 Sep to 31 Oct 2023 |

Therefore, my advice would be to apply at the start of the month, in order to give yourself the most time to meet the S$800 minimum spend threshold. You’ll have anywhere from 1-2 months to do this, depending on approval date.

Now, given that the HSBC TravelOne Credit Card earns a flat rate of 1.2/2.4 miles per dollar (mpd) on local/overseas spend, it’s inevitable that there’ll be some opportunity cost in your spending (compared to using a 4 mpd card). That said, there are certain transactions which are more “worthwhile” to make, because you enjoy additional benefits on top of the miles.

(1) Buy airline tickets (or pay for taxes/surcharges on awards)

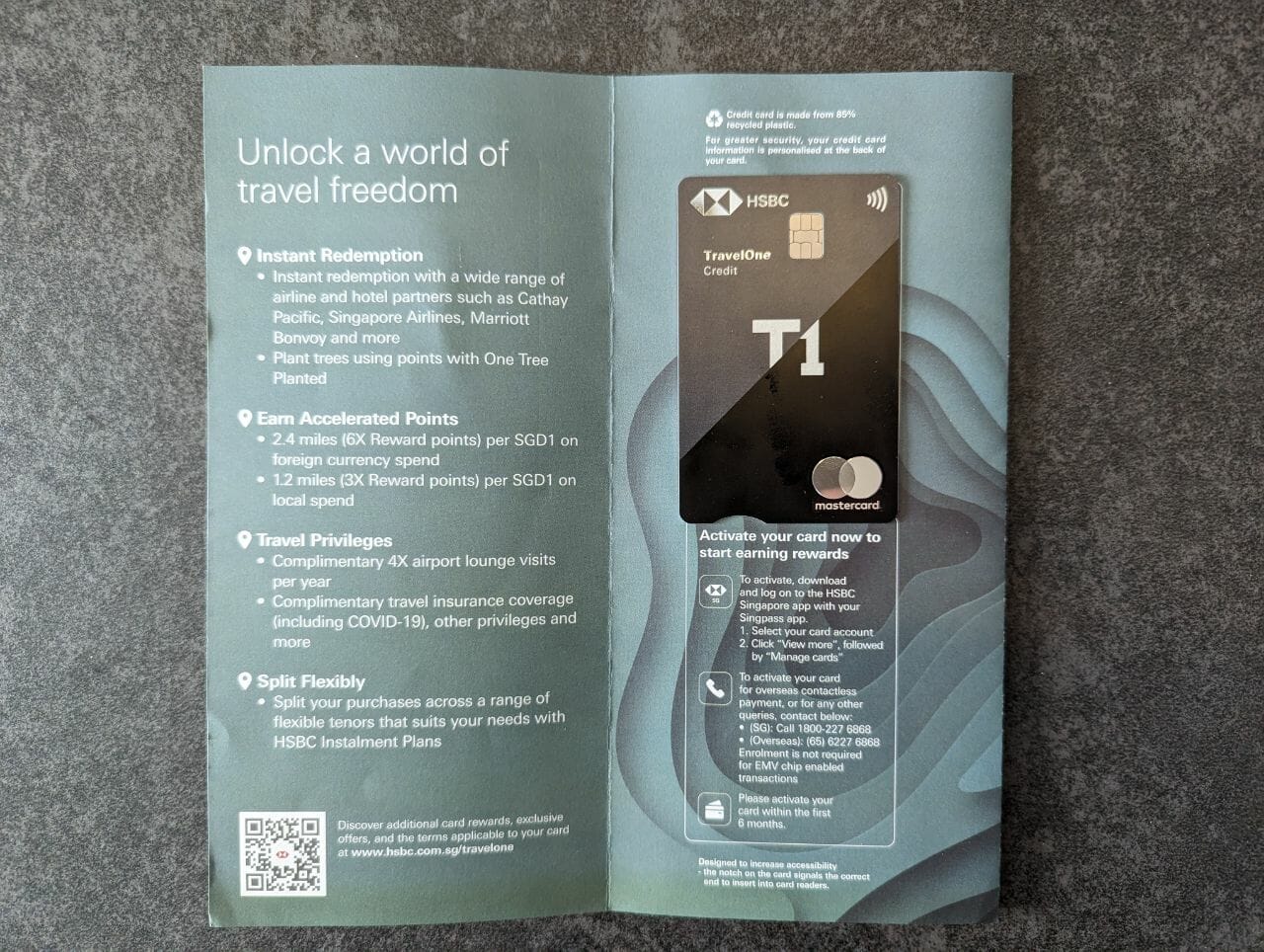

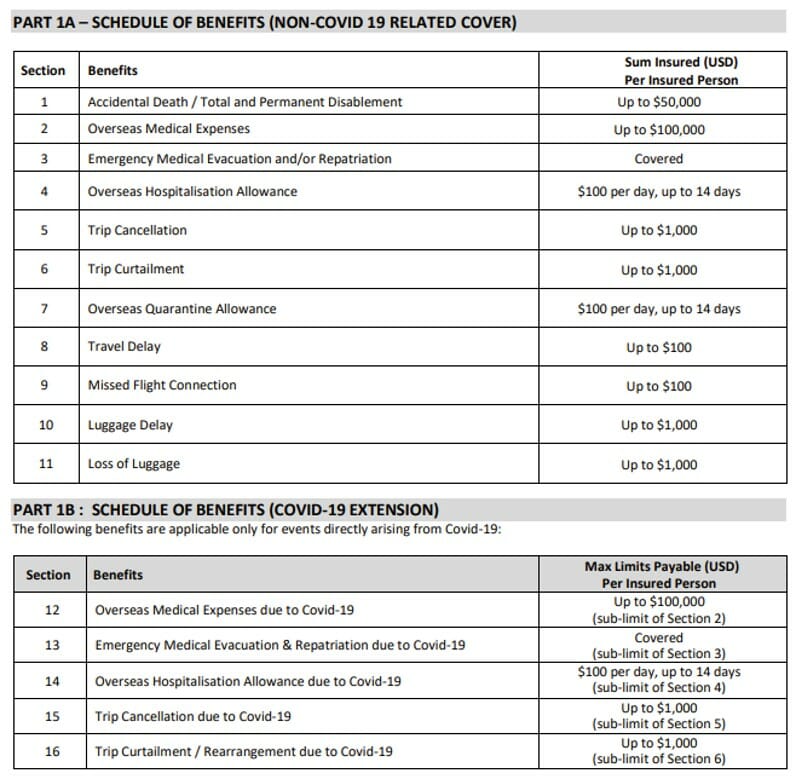

HSBC TravelOne credit cardholders receive complimentary travel insurance when they:

- Use their TravelOne Credit Card to purchase air tickets, or

- Use their TravelOne Credit Card to pay for the taxes and surcharges on a ticket redeemed with airline miles

This includes coverage of up to US$100,000 for both the cardholder and their family. COVID-19 related medical treatment and trip cancellation is also provided for.

| ☂️ Summary of Benefits |

|

| Please refer to the policy wording for the full details of coverage |

(2) Book HSBC WOW Weekend deals

|

| HSBC WOW Weekend |

HSBC WOW Weekends offer a range of 1-for-1 dining offers, discounted staycations, savings on attraction tickets and other retail perks.

Some examples of past and current deals include:

- S$120 off Cathay Pacific tickets, with a minimum spend of S$1,000

- S$50 off 15 Stamford by Alvin Leung, with a minimum spend of S$100 nett

- 20% off Agoda hotel bookings (capped at S$200 per booking)

- 50% off Singapore Zoo/Night Safari/River Wonders park admission tickets

Some deals are in limited quantity, so be sure to monitor the WOW Weekend page and act quickly when you see something you like.

All these deals must be booked with a HSBC credit card, so you could kill two birds with one stone by spending on the HSBC TravelOne Credit Card.

(3) ENTERTAINER with HSBC app redemptions

|

| ENTERTAINER with HSBC |

HSBC TravelOne Credit Cardholders receive a complimentary ENTERTAINER with HSBC app membership, which includes:

- 1-for-1 dine-in offers at more than 150 merchants across Singapore, including Sushi Jiro @ PARKROYAL COLLECTION, Bangkok Jam, Paul Bakery and more

- 1-for-1 takeaway offers at more than 50 merchants including Canadian 2 For 1 Pizza, Andersen’s of Denmark and more

- Up to 50% off leisure, attraction and wellness offers at BOUNCE Singapore, Spa Infinity, Virtual Room and more

- 1-for-1 stays in rooms at over 175 hotels around the world

Just like WOW Weekend, all deals must be paid for with a HSBC credit card, so this is another opportunity to clock that minimum spend while also enjoying additional savings.

Set up an HSBC Everyday Global Account (EGA) for bonus rewards

|

| HSBC Everyday Global Account |

| T&Cs apply. SGD deposits are insured up to S$75K by SDIC |

HSBC TravelOne credit cardholders can earn an additional 1% cashback on all eligible transactions when they open an HSBC Everyday Global Account (EGA) and meet the qualifying criteria for the Everyday+ Rewards programme.

This involves:

- Depositing the following fresh funds into an EGA each calendar month:

- HSBC Personal Banking: S$2,000

- HSBC Premier: S$5,000

- Performing at least five eligible transactions of any amount each calendar month on their card

Eligible transactions simply refer to anything not on the exclusions list (Point 3 of T&Cs), such as GrabPay top-ups, government transactions, insurance premiums, utilities bills. All other retail spend (e.g. dining, groceries, clothing and apparel) is fair game.

Cardholders who meet the eligibility criteria will earn 1% cashback, capped at S$300 per month for HSBC Personal Banking and S$500 per month for HSBC Premier.

This means your effective return for spending will be:

- Local Spend: 1.2 mpd + 1 % cashback

- Overseas Spend: 2.4 mpd + 1% cashback

All this requires is a one-time setup of the EGA, plus a recurring instruction to transfer the minimum fresh funds every month.

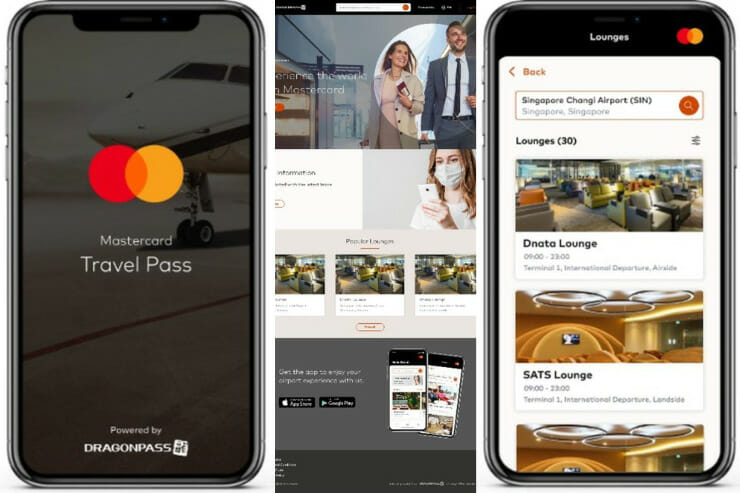

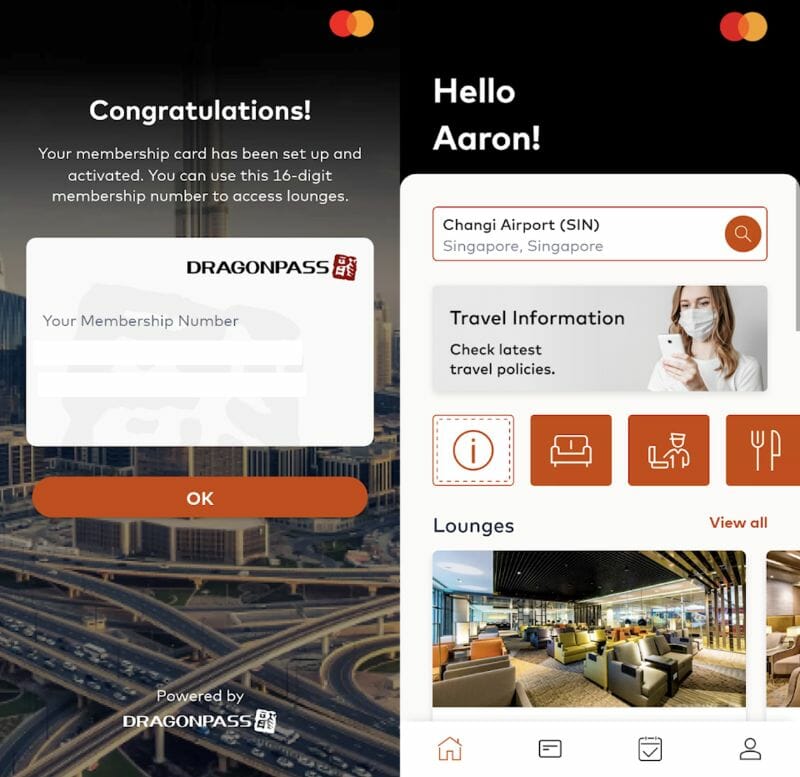

Register for DragonPass lounge visits

|

|

| Lounge Benefit T&Cs |

Principal HSBC TravelOne credit cardholders enjoy four complimentary lounge visits per year, provided via Mastercard Travel Pass by DragonPass.

Allowances are awarded by calendar year, which means you basically enjoy eight visits in your first membership year. For example, if your card is approved in June 2023, you will be awarded:

- On date of approval: 4 visits (expires 31 December 2023)

- On 1 January 2024: 4 visits (expires 31 December 2024)

Allowances cannot be rolled over, so be sure to fully utilise your visits by the end of the calendar year.

Here’s how to start enjoying the benefit:

- Step 1: Download Mastercard Travel Pass app (Android | iOS)

- Step 2: Select ‘Sign up’ to register for the programme, or log on to your account if you’re already a member

- Step 3: Enter your HSBC TravelOne Credit Card details for a one-time verification

- Step 4: Complete your personal details for Mastercard Travel Pass account registration (enter your name as shown in your passport)

- Step 5: Set your account password

Enjoy instant conversions

HSBC TravelOne Credit Cardholders can transfer their points to 12 different airline and hotel partners, with free conversions until 31 December 2023.

| ✈️ HSBC TravelOne Airline Partners | |

| Frequent Flyer Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC TravelOne Hotel Partners | |

| Hotel Programme | Conversion Ratio (HSBC Points : Partner) |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

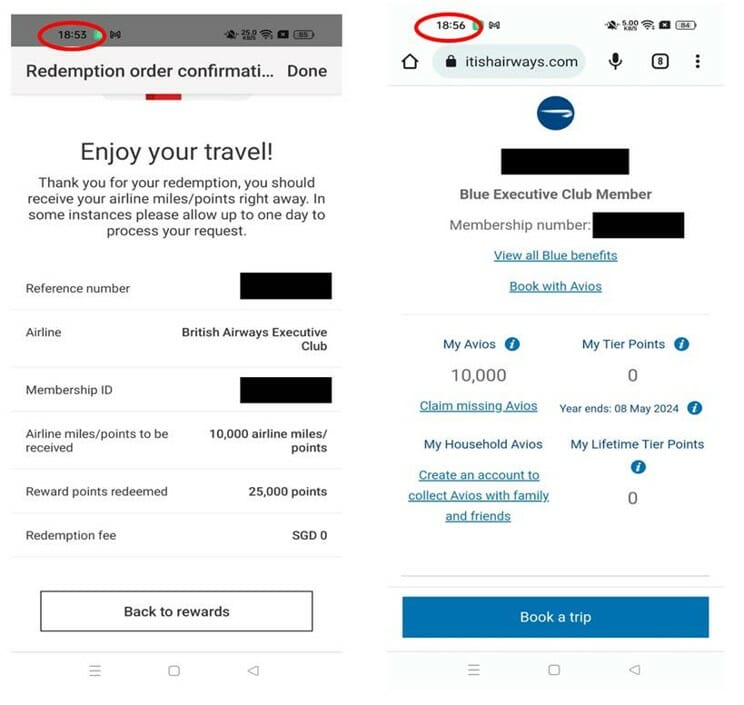

While HSBC advertises “instant reward redemption”, there’s been some concern because the footnotes on the website say “instantly or within one business day”. Obviously, the two aren’t one and the same, and could be all the difference between snapping up that last pair of award seats or narrowly missing out.

Some good news: I can confirm that, barring any technical issues, transfers are instant for all partners except Accor Live Limitless (which take up to five business days).

Here’s an example showing an instant transfer from TravelOne to British Airways Executive Club.

On a separate note, there’s another crucial detail that may have been overlooked initially: While HSBC has a minimum conversion block of 25,000 points (10,000 miles), the subsequent intervals are a mere 5 points (2 miles).

This is confirmed in the FAQs:

|

With my other HSBC credit cards, I need to redeem miles in blocks of 25,000 points to 10,000 airmiles. Does the same apply to my HSBC TravelOne Credit Card? To begin redemption of airmiles or hotel points on your HSBC TravelOne Credit Card, you will need a minimum of 25,000 Reward points to redeem 10,000 airmiles or hotel points. Thereafter, the redemption will be based on blocks of 5 Reward points to 2 airmiles or hotel points. |

For example, you could convert 25,005 points to 10,002 air miles, or 43,010 points to 17,204 air miles. More granular control means fewer orphan points, both on the bank and airline side.

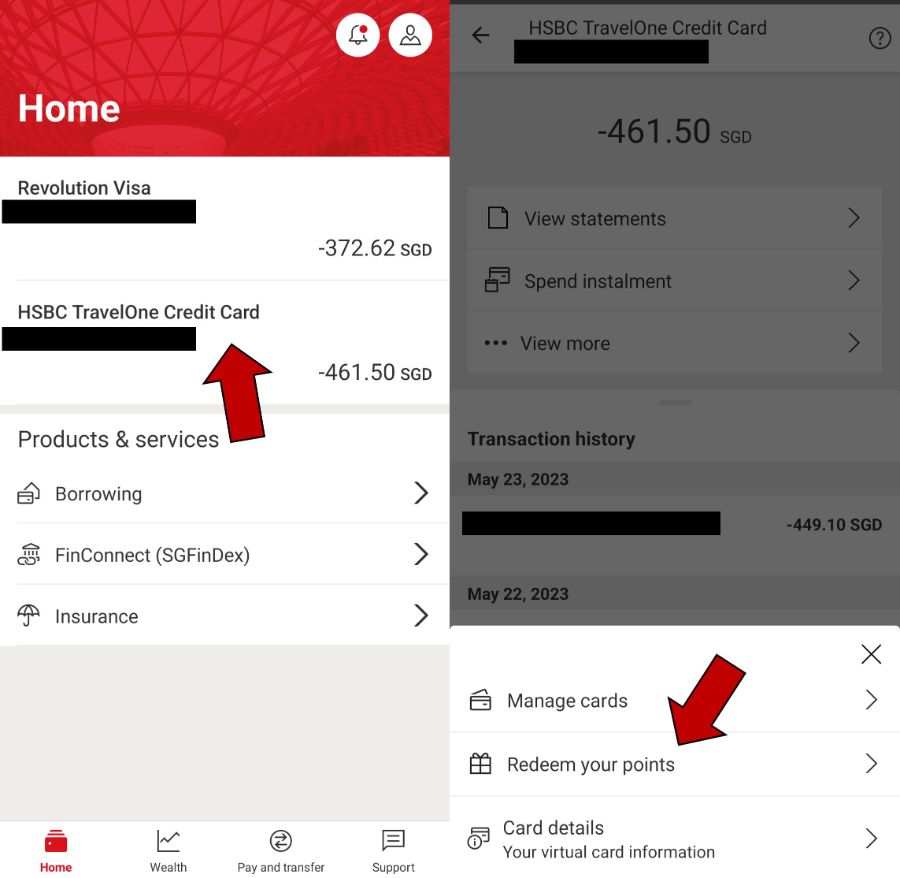

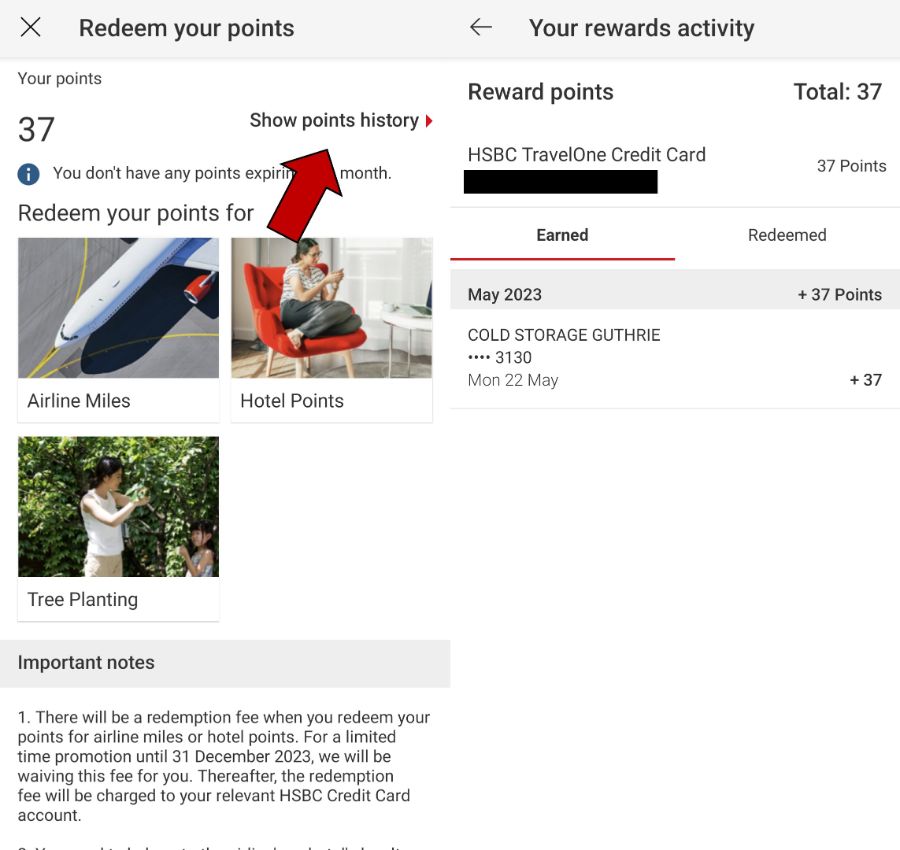

Monitor your points with transaction-level breakdowns

I’ve previously written about how regularly checking your points balance is part of good miles game hygiene, but depending on your bank, it can either be straightforward or a right pain.

HSBC previously only displayed total points balances, but with the launch of the TravelOne Card they’re now providing transaction-level points breakdowns.

To view this, login to the HSBC mobile app and tap on your HSBC TravelOne Credit Card > View More > Redeem Your Points

On the next screen, tap ‘Show points history’, and you’ll see a breakdown of points earned per transaction.

Points breakdowns are arguably not as essential for general spending cards, since you already know that all transactions will earn points at a fixed rate (unless they fall into the list of exclusions). Still, it’s nice to be able to track your points at this level, if only for reconciliation purposes.

Conclusion

HSBC TravelOne Credit Card HSBC TravelOne Credit Card |

||

| Apply |

The HSBC TravelOne Credit Card offers a wide range of transfer partners, complimentary travel insurance and lounge access, as well as instant conversions with no fees till 31 December 2023.

More exciting developments are on the horizon, as HSBC adds additional airline and hotel loyalty programmes, introduces points pooling, and makes features like transaction-level points breakdowns available to other HSBC credit cardholders.

There’s no point beating around the bush here: as a general spending card, the TravelOne will never offer the same kind of earn rates you could get with specialised spending alternatives. But the key here is knowing how best to integrate the TravelOne into an overall miles collection strategy, leveraging transfer partner variety and instant conversions while still enjoying the category bonuses offered by specialised spending cards like the Revolution. Think of it like adding another tool to your Swiss Army knife, as it were.

If you’re interested in signing up, be sure to do so by 31 August 2023 to enjoy the welcome offer of 20,000 miles.

Got your bonus points yet? Still waiting for mine…

Hi there, would like to know if I apply the card back in Jun, will I still be able to enjoy Dragonpass for 2024 if I cancel it in 2023?

Hi Aaron,

this is a great article! Quick questions for the EGA cashback eligibility, referring to HSBC EGA T&C art 5a (i), (https://www.hsbc.com.sg/content/dam/hsbc/sg/documents/accounts/everyday-global/terms-and-conditions-governing-everydayrewards-programme.pdf)

Eligible Customers shall receive a cashback of 1% of the spend amount for successful posted:

(i) transactions (excluding Excluded Transactions) in SGD made with a HSBC personal Credit Card

From above T&C, it seems only transactions in SGD are eligible for 1% cashback, not the FCY transactions. Kindly advise. Thank you!