One of the biggest annoyances in the miles game are orphan miles.

No, it’s not the name of Bruce Wayne’s loyalty programme (too soon?). Rather, it refers to credit card points that end up stuck in your account.

| ❓ Alternative definition |

| Orphan miles could also refer to small balances stuck in your frequent flyer account, but for the purposes of this article, we’ll look at things from the bank side. |

Here’s a simple illustration. Suppose there’s a card out there with an earn rate of 1.2 mpd and a sign-up bonus of 20,000 miles with S$2,000 spend. By meeting the minimum spend, you’ll earn a total of 22,400 miles (2,400 base + 20,000 bonus).

But if the bank has a minimum conversion block of 10,000 miles, you’ll only be able to transfer out 20,000 of those 22,400 miles. The balance? You either:

- Waste them

- Use them to redeem something else from the bank’s rewards catalogue, like shopping vouchers or cash rebates (typically poor value)

- Spend an additional S$6,333 to earn another 7,600 miles and reach the next block of 30,000 miles (incurring opportunity cost because that spend could have been put on a 4 mpd card instead)

That’s the challenge posed by orphan miles, and in this post we’ll look at how you can minimise the problem.

| 💳 Credit Card FAQs |

| Managing Points |

| Conversions |

| Calculations |

Ways of avoiding orphan miles

Using cards with smaller minimum conversion blocks

Minimum conversion blocks refer to the minimum number of miles that must be converted from credit card points at one go, and are the root cause of orphan miles.

Unfortunately, unless your credit card offers a minimum conversion block of 1 mile, then some degree of orphan miles are inevitable. How much depends on the block size, and can be anywhere from 1 mile to 10,000 miles:

| ✈️ Min. Conversion Blocks for KrisFlyer Miles | ||

| Currency | Points |

Miles |

| AMEX Membership Rewards (Plat. Charge, Centurion) |

400 | 250 |

| AMEX Membership Rewards (All other cards) |

450 | 250 |

| BOC Points | 45K | 10K |

| Citi Miles | 10K | 10K |

| Citi ThankYou Points | 25K | 10K |

| DBS Points | 5K | 10K* |

| HSBC Points (TravelOne) |

25K (+5 beyond this) |

10K (+2 beyond this) |

| HSBC Points (All other cards) |

25K | 10K |

| Maybank TREATS | 25K | 10K |

| OCBC$ | 25K | 10K |

| OCBC 90°N Miles | 1K | 1K |

| OCBC VOYAGE Miles | 1 | 1 |

| SC 360° Rewards Points (Visa Infinite Cards) |

25K | 10K |

| SC 360° Rewards Points (Non-Visa Infinite Cards) |

34.5K | 10K |

| UOB UNI$ | 5K | 10K^ |

| *Reduced to 500 DBS Points (1K miles) for those using the Auto Conversion Programme (S$43.20 per year), available for DBS Insignia, DBS Treasures Black Elite Card and DBS Altitude Card only ^Reduced to 2,500 UNI$ (5K miles) for those using the automatic conversion option, but only for UNI$ accumulated above 15,000 UNI$ |

||

| ✈️ What about other programmes? |

|

The table above assumes you wish to convert points to KrisFlyer miles. The minimum conversion blocks for Bank of China, Maybank and StanChart cards may be smaller for other programmes.

|

If you have a Bank of China, Citibank, DBS, Maybank, HSBC (except TravelOne), OCBC (except 90°N and VOYAGE), Standard Chartered or UOB credit card, your minimum conversion block is the equivalent of 10,000 miles.

If you have an OCBC 90°N Card, your minimum conversion block is 1,000 miles.

If you have an American Express Card that earns Membership Rewards points, your minimum conversion block is 250 miles.

If you have a HSBC TravelOne Card, your minimum conversion block is 10,000 miles, but beyond that the block reduces to just 2 miles. For example, you could convert 10,202 miles, or 20,408 miles.

If you have an OCBC VOYAGE Card, your minimum conversion block is 1 mile. Congratulations, this is as good as it gets! It’s just a pity they did away with free conversions…

Join an auto-conversion programme

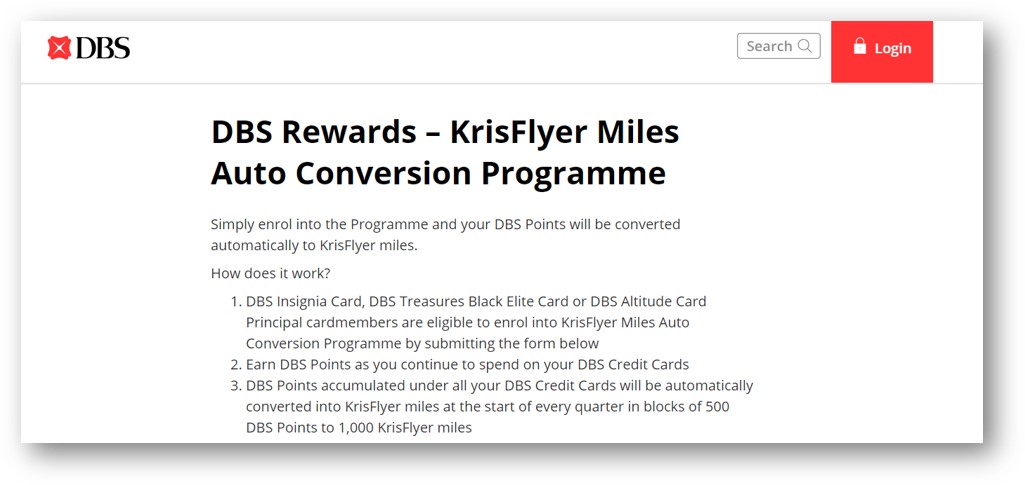

Both DBS and UOB offer an auto-conversion programme, which reduces the minimum conversion block required.

DBS Insignia Card, DBS Treasures Black Elite Card or DBS Altitude Card (but not DBS Vantage nor DBS Woman’s World Card) cardholders can enrol in the KrisFlyer Miles Auto Conversion Programme for S$43.20 per 12-month period.

DBS Points will be converted into KrisFlyer miles in blocks of 500 DBS Points to 1,000 KrisFlyer miles at the start of every quarter by the 10th day:

- By 10th January

- By 10th April

- By 10th July

- By 10th October

| Note: Because DBS Points pool, a DBS Altitude Cardholder could enrol in the KrisFlyer Miles Auto Conversion Programme and use that to cash out miles earned on the DBS Woman’s World Card. |

Cardholders enrolled in this programme can continue to make ad-hoc conversions to KrisFlyer with a waiver of the usual S$27 fee, but this will be subject to the usual blocks of 5,000 DBS Points (10,000 miles).

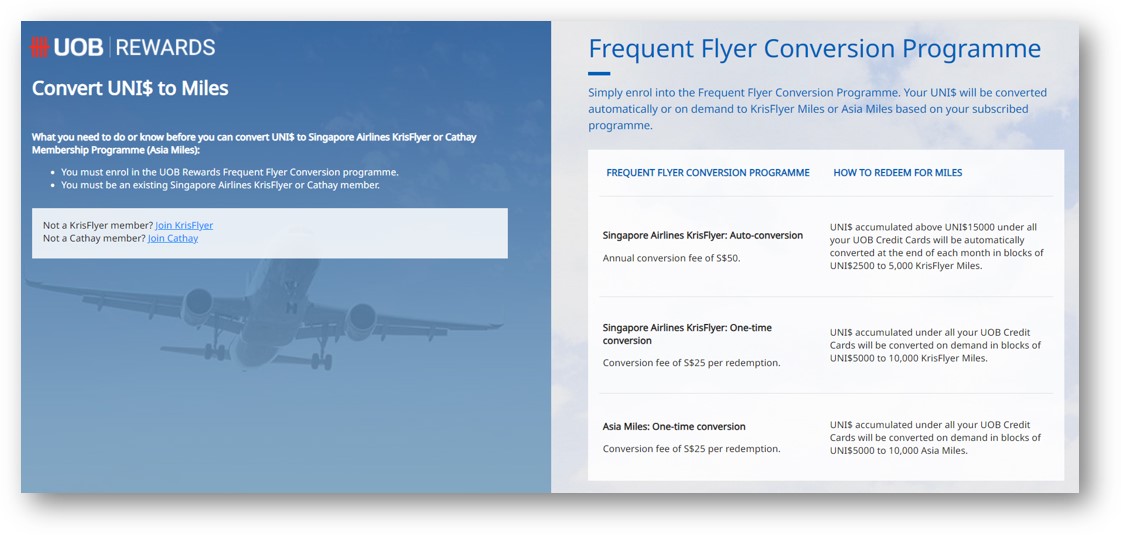

UOB cardholders can also enroll in an automatic conversion scheme for S$50 per 12-month period.

UNI$ will be converted into KrisFlyer miles in blocks of 2,500 UNI$ to 5,000 KrisFlyer miles at the end of each calendar month- note the higher frequency of conversion compared to DBS.

| ⚠️ Important Note |

| A temporary S$25 conversion fee will be charged to your account when UNI$ are auto converted to KrisFlyer miles. This will be reversed within seven working days. |

But there’s a catch! The automatic conversion will only be effected for UNI$ above UNI$15,000. For example, if I end the month with UNI$17,500, only UNI$2,500 will be automatically converted.

UOB offers a very lame reason for this, saying the minimum balance is so cardholders can enjoy conversions of other items within the UNI$ catalogue. Our whole point here is to minimise orphan miles, but UOB insists we keep at least 30,000 on hand- maybe it’s so they have something to deduct for those annual fee “waivers”…

Transfer miles via Kris+

|

| S$5 for new Kris+ Users |

| Get S$5 (in the form of 750 KrisPay miles) when you sign-up with code W644363 and make your first transaction |

Kris+ offers instant conversions from Citi, DBS, and UOB credit card points.

| Bank | Conversion |

| 4,000 Citi Miles = 3,400 miles 10,000 ThankYou Points= 3,400 miles |

|

| 100 DBS Points = 170 miles | |

| 1,000 UNI$ = 1,700 miles |

The rate entails a 15% haircut compared to converting points via the bank’s rewards portal (e.g. 1,000 UNI$ would be worth 2,000 miles based on UOB’s regular conversion rate, but only 1,700 miles via Kris+).

However, the key advantages are:

- No conversion fees

- Instant conversions

- A smaller conversion block

That last point is key: if you have an orphan balance with Citi, DBS or UOB, then converting those miles via Kris+ lets you salvage some value at least.

Use cards that pool points

While this does not eliminate the issue of orphan miles altogether, spending with credit cards that pool points can help reduce the frequency and quantum of the problem.

| Bank | Pools Points? |

|

✓ Yes |

| ✕ No | |

| ✕ No | |

| ✓ Yes | |

| ✕ No | |

|

✓ Yes |

| ✓ Yes (provided same currency)* |

|

| ✓ Yes (provided same currency)^ |

|

| ✓ Yes | |

| *OCBC$, Travel$ and VOYAGE Miles pool within each other, but not among each other ^Visa Infinite and non-Visa Infinite points pool within each other, but not among each other |

|

Here’s a simple illustration. Suppose I have:

| Miles | Min. Conversion | |

| Citi PremierMiles Card | 9,000 miles | 10,000 miles |

| Citi Rewards Mastercard | 9,000 miles | 10,000 miles |

| Citi Rewards Visa | 9,000 miles | 10,000 miles |

| Orphan Miles | 27,000 miles |

Since Citi does not pool points, I effectively have to deal with the orphan miles issue three times, giving me a total of 27,000 orphan miles.

| Miles | Min. Conversion | |

| UOB Pref. Plat. Visa | 9,000 miles | 10,000 miles |

| UOB PRVI Miles Card | 9,000 miles | |

| UOB Visa Signature | 9,000 miles | |

| Orphan Miles | 7,000 miles |

Since UOB pools points, I only need to deal with the orphan miles issue once, and in this case I have 7,000 orphan miles.

Mind you- I wouldn’t write off Citi cards just because points don’t pool. They do have their uses, and my Citi Rewards Card gets frequent use thanks to Amaze. However, if you’re determined to concentrate all your spending on a small number of cards, then all things being equal, it’d be better to do so with a bank that offers pooling.

Topping up your balance

Some credit cards allow you to top-up your balance to avoid orphan miles.

For example, the UOB Payment Facility allows cardholders to buy as many miles as they wish, at a price ranging from 1.7-2.2 cents per mile. Obviously, this is a bit on the high side, but the idea is to purchase just enough to complete the next block.

To illustrate, suppose I have 23,000 UNI$ on my UOB PRVI Miles Card. That works out to 46,000 miles, 4,000 miles shy of the next conversion block of 50,000 miles

- I charge S$4,000 to the UOB Payment Facility

- My UOB PRVI Miles Card will be billed S$4,084 (S$4,000 + 2.1% admin fee)

- S$4,000 will be deposited in my designated bank account

- I use these funds to pay the card bill, and my net out of pocket cost is S$84

- I receive 2,000 UNI$ (UNI$2.5 for every S$5 charged, excluding admin fee)

Basically, by spending S$84 I have received 4,000 extra miles, which prevents me from wasting the 6,000 miles that would otherwise be orphaned.

You can do similar things with the Citi PayAll and SC EasyBill facilities, although these require that you have an actual bill to pay like insurance premiums or a rental contract.

Use cobrand cards

If you want to avoid orphan miles altogether, your best bet is to get a cobrand card:

- AMEX KrisFlyer Ascend

- AMEX KrisFlyer Credit Card

- AMEX Solitaire PPS Card

- AMEX PPS Card

- KrisFlyer UOB Credit Card

Miles earned on cobrand cards are automatically transferred to your KrisFlyer account once per month, in their entirety.

On the flip side, this automatic transfer also means the three-year expiry countdown begins immediately. If you earned points with a bank, you’d enjoy two validity periods: once on the bank side, another on the airline side.

It’s also important to remember that cobrand cards, generally speaking, aren’t great for accumulating miles. The KrisFlyer UOB Credit Card is the best of the lot with an uncapped 3 mpd on dining, food delivery, shopping and travel, although you could earn 4-6 mpd with non-cobrand cards like the Citi Rewards and UOB Lady’s Card.

Therefore, I wouldn’t advocate switching to cobrand cards just to avoid orphan miles.

Conclusion

Orphan miles are a nuisance to deal with, and I was hoping we’d see a gradual reduction of minimum conversion blocks. Unfortunately, it seems like banks have been gravitating towards higher minimum conversion blocks over time- 10,000 miles now appears to be the “market standard”.

It’s possible to minimise the problem by avoiding cards which don’t pool points or switching to cobrand cards, but ultimately that may result in more lost miles due to the foregoing of category spending bonuses.

So there’s a bit of a balance to be struck here: while we want to optimise our spending, we don’t want to stretch ourselves so thin to the point that we get numerous piles of orphan miles.

How do you avoid orphan miles?