The Maybank Horizon Visa Signature Card is receiving a major revamp from 1 November 2023, and I have to say: I like what I’m seeing.

Cardholders will soon be able to earn up to 2.8 mpd on all foreign currency (FCY) transactions, without cap. That could be useful for those who have maxed out the 4-6 mpd possibilities with other cards, even if there is an S$800 minimum monthly spend involved (though if the uncapped bit is what gets you excited, then the minimum spend is likely to be the least of your concerns).

There’s also the opportunity to earn 2.8 mpd on up to S$10,000 of air tickets each month, making this a potential replacement for the DBS Altitude Card, which offered 3 mpd on up to S$5,000 of air tickets until September 2023.

Unfortunately, the Maybank Horizon Visa Signature will be losing its 3.2 mpd earn rate on dining, petrol, taxi rides and Agoda hotel bookings in the process, so that’s something to note if you’ve been using the card for these categories.

Details: Maybank Horizon Visa Signature revamp

|

|||

| Current T&Cs | |||

| Revised T&Cs | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 mo. |

| Annual Fee | S$194.40 |

Fee Waiver | First 3 years free |

Current structure

Currently, Maybank Horizon Visa Signature Cardholders earn:

- 3.2 mpd on dining, petrol, taxi rides and Agoda hotel bookings

- 2 mpd on air tickets, cruise and travel packages, and FCY spend

- 0.4 mpd on all other transactions

The 2 mpd/3.2 mpd rates are contingent upon spending at least S$300 in a calendar month, with a cap of 12,000 miles shared between both categories.

Revised structure

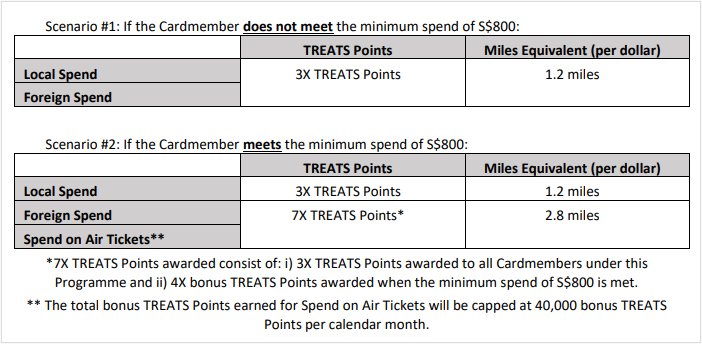

From 1 November 2023, Maybank will be changing how the Horizon Card earns points. Here’s how the changes are presented in the revised T&Cs:

Looks nice and simple, right?

Wrong.

It’s not a straightforward matter of “1.2 mpd all spend, and 2.8 mpd on FCY spend and air tickets if you spend at least S$800 a month”.

That’s because Maybank is defining “local spend” in a very specific manner with a specified whitelist, creating numerous permutations for cardholders to pay attention to!

Spend <S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities |

0.24 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Air Tickets Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other local spend | 0.4 mpd | |

| FCY | All FCY spend | 1.2 mpd |

Cardholders who spend less than S$800 per calendar month will earn at one of three different tiers:

- 0.24 mpd

- 0.4 mpd

- 1.2 mpd

Maybank has carved out a separate tier for education, insurance, medical and utilities. These will earn just 0.24 mpd, though it’s probably not a big loss, given that few people would be charging these at the current 0.4 mpd anyway (there’s better options!)

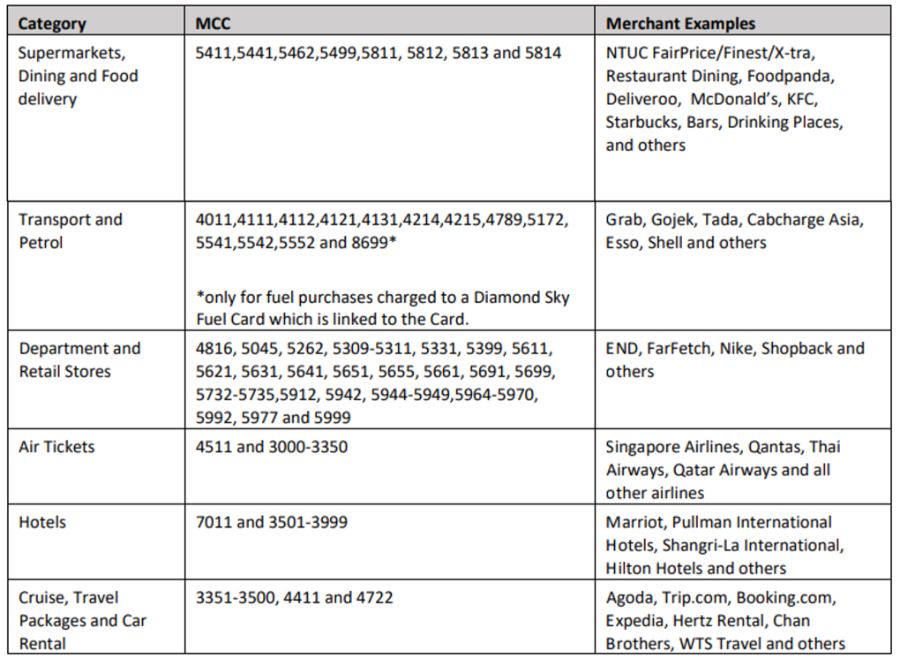

Maybank has also added an extensive list of local transactions that will earn 1.2 mpd.

Given the wide range of MCCs covered, I can’t help but wonder: why not just award 1.2 mpd on all local spend then? Isn’t this the bare minimum for a general spending card these days anyway?

I can understand not wanting to give 1.2 mpd on things like education and insurance, so by all means exclude that, but it just seems needlessly complicated to have this system.

Any local transaction that does not fall into the MCCs above will earn 0.4 mpd, while all FCY transactions will earn 1.2 mpd.

Spend ≥S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities |

0.24 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other local spend | 0.4 mpd | |

| Local or FCY | Air Tickets | 2.8 mpd* |

| FCY | All FCY spend | 2.8 mpd |

| *Capped at S$10,000 per calendar month; beyond which 1.2 mpd |

||

Cardholders who spend at least S$800 per calendar month will earn at one of four different tiers:

- 0.24 mpd

- 0.4 mpd

- 1.2 mpd

- 2.8 mpd

What’s changed between this and the previous section is that cardholders will earn 2.8 mpd on air tickets changed in local or FCY spend, capped at S$10,000 per calendar month. Any spending beyond this will earn 1.2 mpd.

They will also earn an uncapped 2.8 mpd on FCY spend, regardless of whether it’s online or offline.

Are these changes good?

My advice is that you ignore all the froth about 0.24 mpd, 0.4 mpd and 1.2 mpd, because there’s no reason why you should be using the Maybank Horizon in these categories anyway.

What you should be pondering is the fact that Maybank Horizon Visa Signature Cardholders who spend at least S$800 per calendar month will now earn:

- 2.8 mpd on air tickets, capped at S$10,000 per calendar month

- 2.8 mpd on FCY spend, with no cap

Are either of these rates compelling?

Air tickets

2.8 mpd on air tickets may not sound too exciting, when there’s many other cards ahead in the pecking order.

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

6 mpd | Max S$1K per c. month. Must choose travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

6 mpd | Max S$3K per c. month. Must choose travel as bonus category Review |

DBS WWMC DBS WWMCApply |

4 mpd | Max S$2K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month Review |

UOB Visa Signature UOB Visa Signature Apply |

4 mpd (if FCY) |

Min S$1K max S$2K FCY spend per s. month Review |

Maybank Horizon Maybank HorizonApply |

2.8 mpd | Max S$10K per c. month, min. retail spend of S$800 required |

You could earn up to 6 mpd with the UOB Lady’s Cards, and even if that cap is exhausted (or if you didn’t choose Travel as your quarterly bonus category), there’s still the DBS Woman’s World Card, HSBC Revolution, and UOB Visa Signature (if buying in FCY).

However, if you’ve maxed out the caps on all those cards, then the ability to earn 2.8 mpd on up to S$10,000 of spend will certainly come in useful. In a way, I see this as a direct replacement for the DBS Altitude Card. Yes, 2.8 mpd is slightly less than the 3 mpd the Altitude offered, but a S$10,000 monthly cap is double that of the Altitude.

FCY spend

Where FCY spend is concerned, an uncapped 2.8 mpd is certainly attractive, since the only uncapped card I can think of that performs better is the StanChart Visa Infinite with 3 mpd.

| 💳 FCY Earn Rates by Card (For general spending cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month |

Maybank Horizon Maybank HorizonApply |

2.8 mpd | Min. S$800 spend per c. month |

UOB PRVI Miles UOB PRVI MilesApply |

2.4 mpd | Review |

HSBC TravelOne HSBC TravelOneApply |

2.4 mpd | Review |

OCBC VOYAGE (Premier, PPC, BOS) OCBC VOYAGE (Premier, PPC, BOS)Apply |

2.3 mpd | Review |

HSBC VI HSBC VIApply |

2.25 mpd | With min. S$50K spend in previous m. year Review |

OCBC Premier VI OCBC Premier VIApply |

2.24 mpd | |

DBS Vantage DBS VantageApply |

2.2 mpd | Review |

OCBC VOYAGE OCBC VOYAGEApply |

2.2 mpd | Review |

OCBC 90°N Card OCBC 90°N CardApply |

2.1 mpd | Review |

| All other options earn 2 mpd or less | ||

Moreover, StanChart’s FCY fee of 3.5% is slightly higher than Maybank’s 3.25%, so on a cents per mile basis we’re looking at 1.17 cents (SC VI) versus 1.16 cents (Horizon).

I’d argue that the Maybank Horizon Visa Signature is superior, given its S$30,000 income requirement and three year annual fee waiver. In contrast, the StanChart Visa Infinite has a S$150,000 income requirement, a non-waivable S$594 annual fee, and requires you to charge at least S$2,000 per statement month to earn 3 mpd on FCY spend.

That said, we need to keep in mind that there are a lot of ways to earn 4-6 mpd on FCY spend, albeit with a cap.

Top-of-mind options include the UOB Visa Signature Card, the Citi Rewards Card (paired with Amaze), and the UOB Lady’s Cards.

Refer to the article below for a rundown of the options.

Potential use case: FCY donations, medical, education

While the T&Cs explicitly address local spending on insurance, medical, education and utilities, they’re silent on what happens if these are charged in FCY.

For local retail transactions charged to a Card on Insurance, Medical, Education and Utilities, notwithstanding anything to the contrary stated in the general Terms and Conditions Governing TREATS Points Rewards Programme, 3 TREATS Points will be awarded for every block of S$5 spent per transaction.

The T&Cs later go on to exclude insurance payments from earning TREATS Points, but without mention of medical or education (or donations), my assumption would be that you can earn an uncapped 2.8 mpd on these transactions should they be in FCY.

That could potentially be very useful for anyone with an overseas tuition bill to pay!

What can you do with TREATS Points?

TREATS Points can be transferred to the following airline partners:

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000: 10,000* | |

| 12,500: 5,000 | |

|

12,500: 5,000 |

| 4,000: 2,000 | |

| *You must convert KrisFlyer miles via the TREATS SG app (Android | iOS) to enjoy this rate. Manual conversion receive an inferior rate of 30,000 points = 10,000 miles | |

Neither Malaysia Airlines Enrich nor airasia rewards are worth considering in my opinion, so that leaves Asia Miles and KrisFlyer as the only realistic options.

TREATS Points earned on the Maybank Horizon Visa Signature normally expire one year from the quarterly period in which they were earned (i.e. 12-15 months’ validity).

| Points Earned | Expire On |

| 1 Jan to 31 Mar 2023 | 31 Mar 2024 |

| 1 Apr to 30 Jun 2023 | 30 Jun 2024 |

| 1 Jul to 30 Sep 2023 | 30 Sep 2024 |

| 1 Oct to 31 Dec 2023 | 31 Dec 2024 |

However, Maybank offers a Rewards Infinite (RI) programme that makes points evergreen.

Maybank cardholders who spend at least S$24,000 in a membership year will enjoy a complimentary RI membership.

The minimum spend requirement does not apply to Maybank Visa Infinite, Maybank World Mastercard and Catholic High Alumni Platinum Associates Cardholders, who enjoy a RI membership automatically (offering a Cat High boy an RI membership; someone’s trolling).

Even better, because Maybank TREATS Points are pooled, holding one of the above cards effectively makes your entire TREATS balance evergreen, regardless of which card they were earned on.

A S$27 conversion fee applies to all conversions. This is waived for Maybank Visa Infinite and Maybank World Mastercard Cardholders, and if you hold one of these cards then the TREATS Points earned on all other Maybank cards can be converted for free too.

Conclusion

Maybank Horizon Visa Signature Cardholders will be playing a very different game from 1 November 2023, when the card effectively ceases to be a dining, transport and petrol spend option, and transitions into an FCY and air ticket solution instead.

An uncapped earn rate of 2.8 mpd is impressive, even if the minimum spend to trigger bonuses will be hiked from S$300 to S$800 (but if you’re spending less than S$800 then you’d no doubt want to focus on a card with a capped 4-6 mpd rate anyway). My reading of the T&Cs is that this extends to overseas medical, donations and education transactions too, though real-world data points will be welcome.

Also, those who spend heavily on air tickets will welcome the opportunity to earn 2.8 mpd on up to S$10,000 of spend, making the Maybank Horizon Visa Signature a handy replacement for the DBS Altitude Card.

I wouldn’t mourn too much the loss of 3.2 mpd on dining, transport and petrol, given the abundance of alternatives we have for those categories anyway.

What do you make of the Maybank Horizon Visa Signature Card’s changes?

Think it should say 2.8 mpd in your FCY table!

fixed that, thank you

oh no, was using this for the 3.2 mpd you get on Dining … subject to a monthly cap of about $4,300 for this category earning that rate

have to find a replacement card for Dining of which there are several but most have low caps of $1,000 or so

Do you reckon the cost per mile vs SCB Journey during the “no FX fee” months still works out in favour despite the spread?

definitely not. i’d much rather use amaze + some other card.

Tried FCY payment for education. Does not pay bonus miles unfortunately.

You’re saying right now you’re not earning 1.2mpd for fcy education spend?