While yesterday wasn’t a good day for the DBS tech team (nor many other companies, to be fair), amidst all the chaos at least something got fixed.

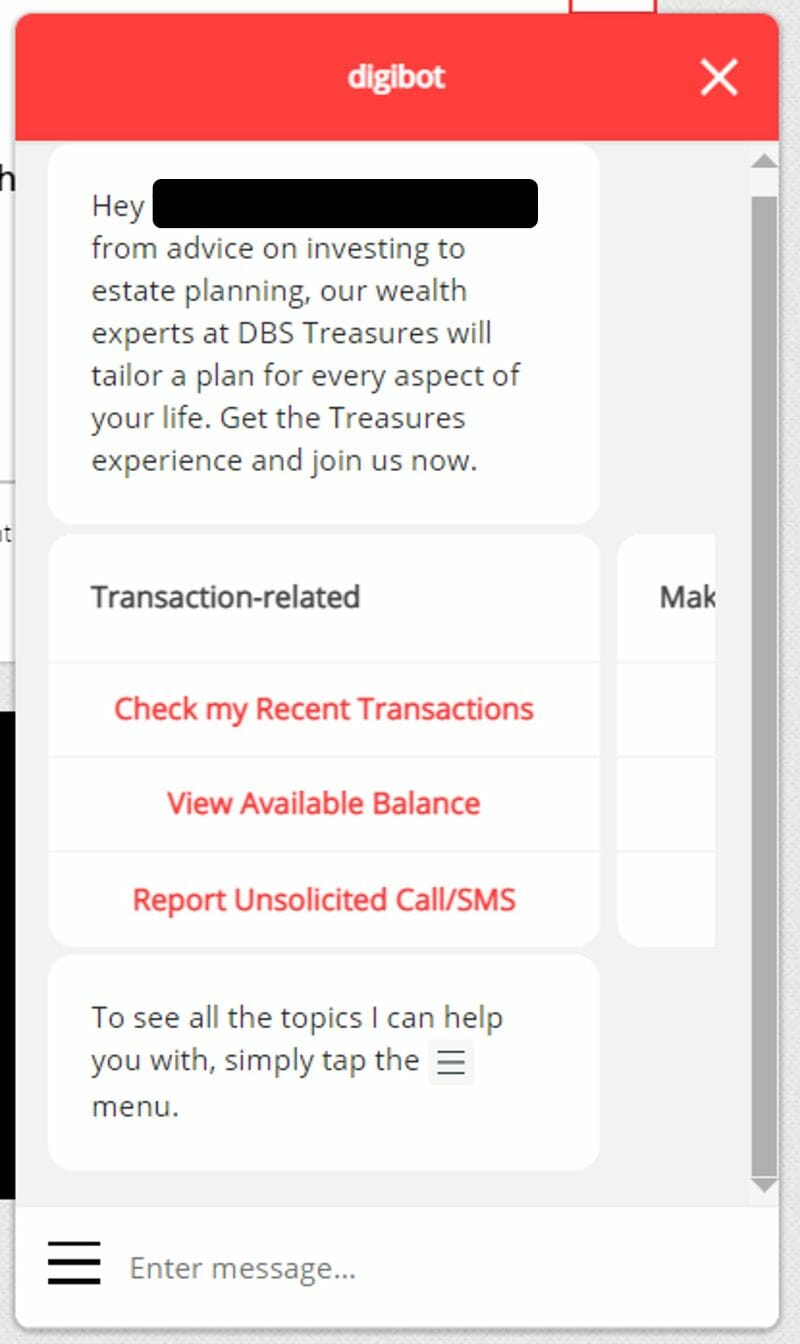

A week ago, the DBS digibot stopped displaying MCCs, which nerfed it as a means of finding out MCCs before spending. DBS later clarified that this was a temporary bug they were working on fixing, but did not provide a timeline for resolution.

Now, it’s back to all systems go.

DBS digibot restores MCCs

DBS and POSB cardholders can once again use the DBS digibot to look up the MCC for billed, unbilled, pending and declined transactions.

You can access the digibot via the DBS digibank app or DBS ibanking:

- For the app, tap the question mark on the top right corner and scroll down to tap “ask digibot”

- For desktop, click the icon at the bottom right corner

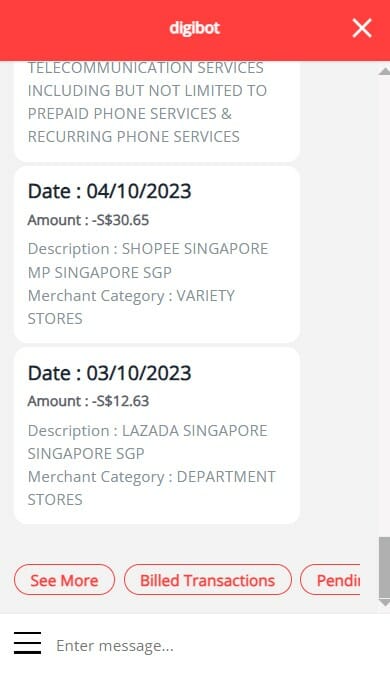

Navigate to Check my Recent Transactions > Credit Cards > Select the card you used > View Transaction History. You can then see pending, unbilled, billed or declined transactions, together with the MCCs.

This means you can once again use it to check MCCs before transacting.

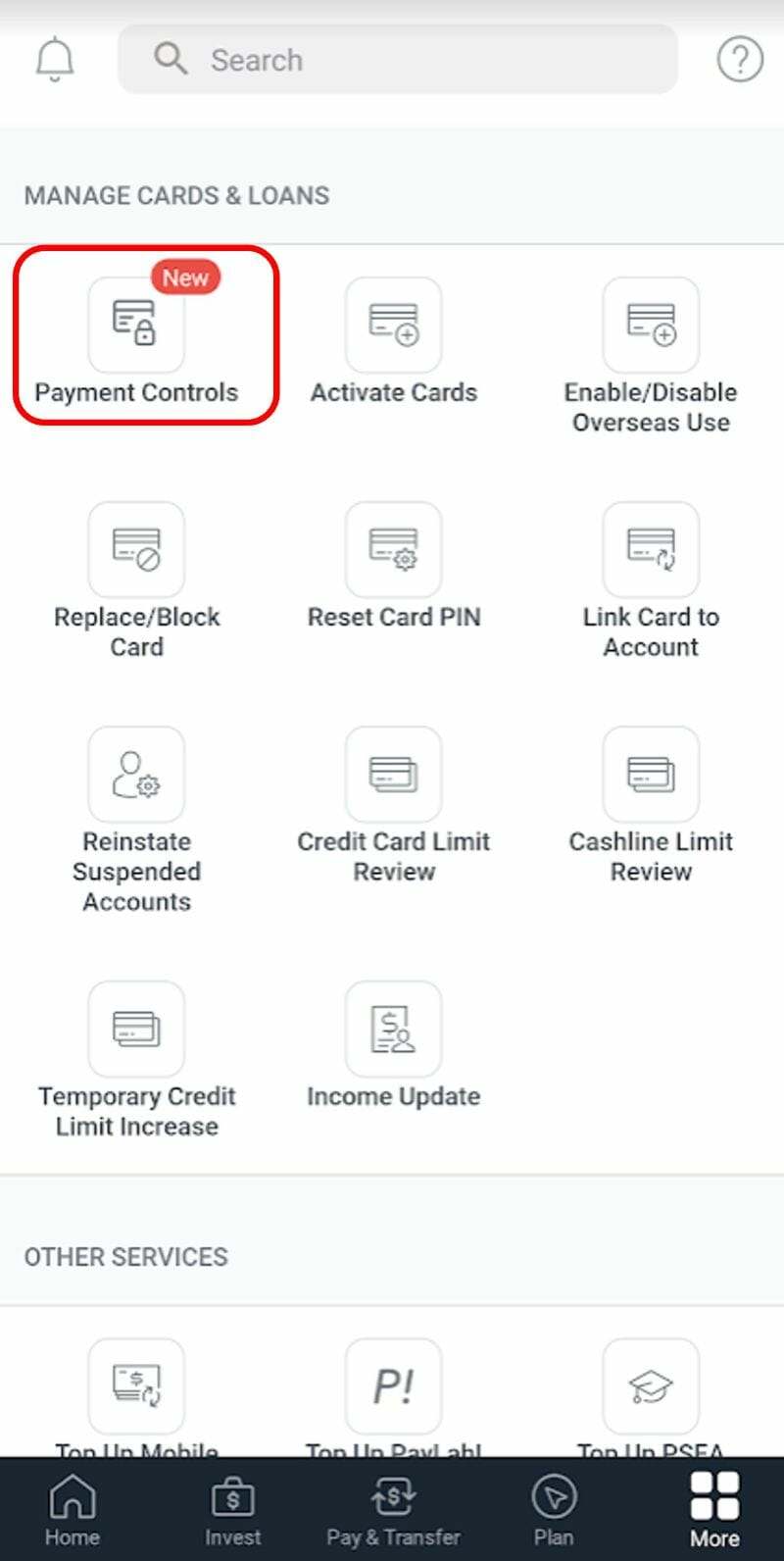

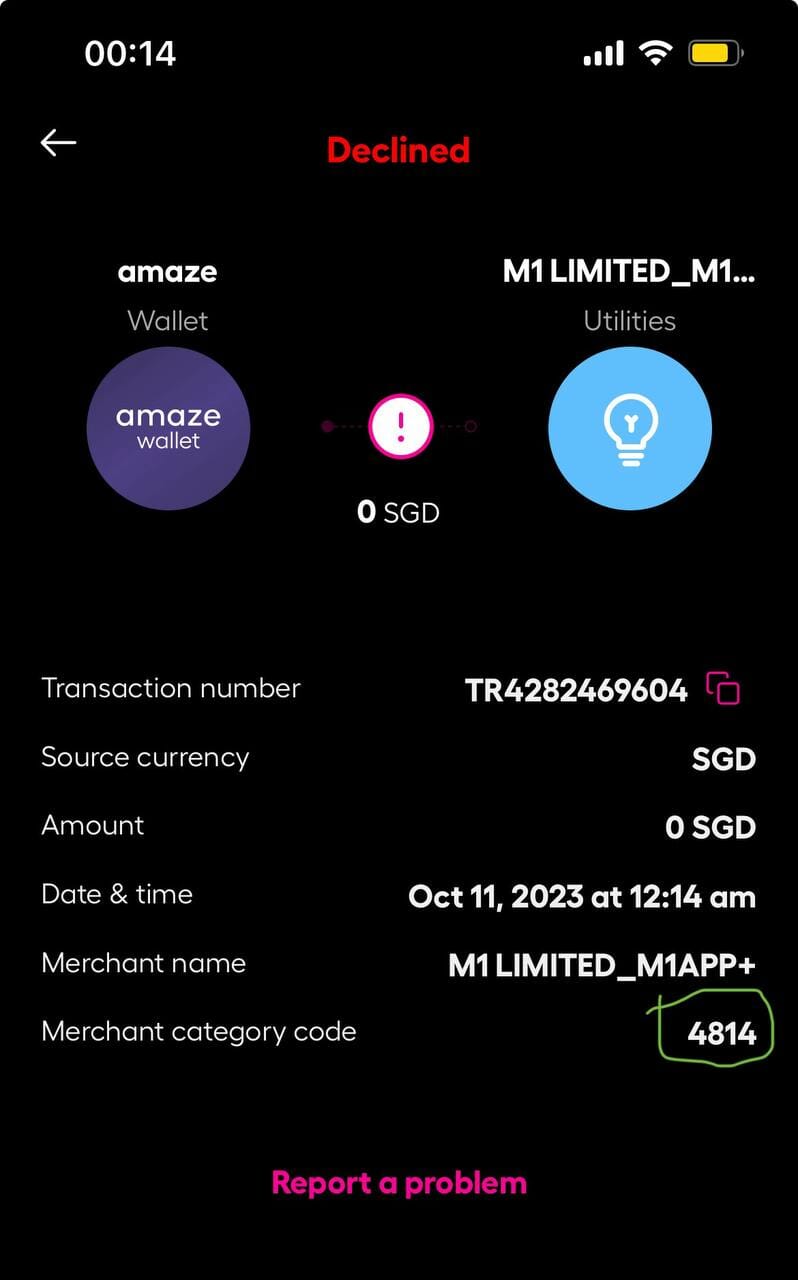

The first step is to temporarily block a DBS card via the DBS digibank app. You can do this by tapping More on the bottom right hand corner, then scrolling down until you see Payment Controls.

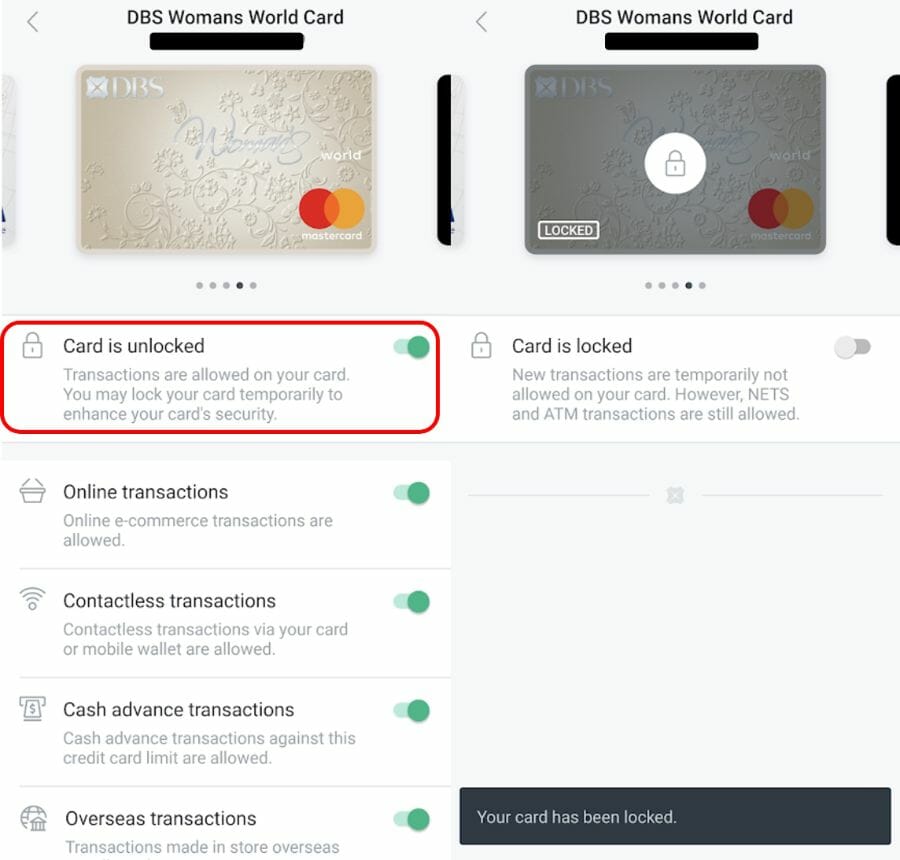

Select the card you wish to use, then toggle the card lock option.

Now go to the merchant and swipe your locked card (or enter your details online, as the case may be). The transaction will fail since your card is locked. That’s exactly what we want to happen.

Return to the DBS digibank app or login to DBS ibanking and summon the digibot. Repeat the steps we mentioned previously (Check My Recent Transactions > Credit Cards > Select the card you used > View Transaction History), and then select Declined Transactions.

You’ll then see your failed transaction, together with the MCC. You can match the description to the 4-digit code in this file if necessary.

Now that you know the MCC, you can proceed to unblock the card and make the transaction for real (or use a different bank’s card, whichever is more suitable).

Is the digibot method still useful?

Even if DBS didn’t fix this issue, something happened last week that could make the digibot method irrelevant.

The latest version of the Instarem app allows Amaze Cardholders to view MCCs for all their transactions, whether successful or declined. You can therefore block your Amaze Card, attempt a transaction at the merchant in question, then view the MCC under the Activity tab.

Since this involves fewer steps, is there any utility left in the digibot method?

Generally no, but someone did point out in the comments that Amaze is a Mastercard, and MCCs may sometimes differ between Visa and Mastercard. In that sense, there could still be a use case for the digibot if you plan to make a transaction with a Visa card, and want to be absolutely 100% sure of the MCC.

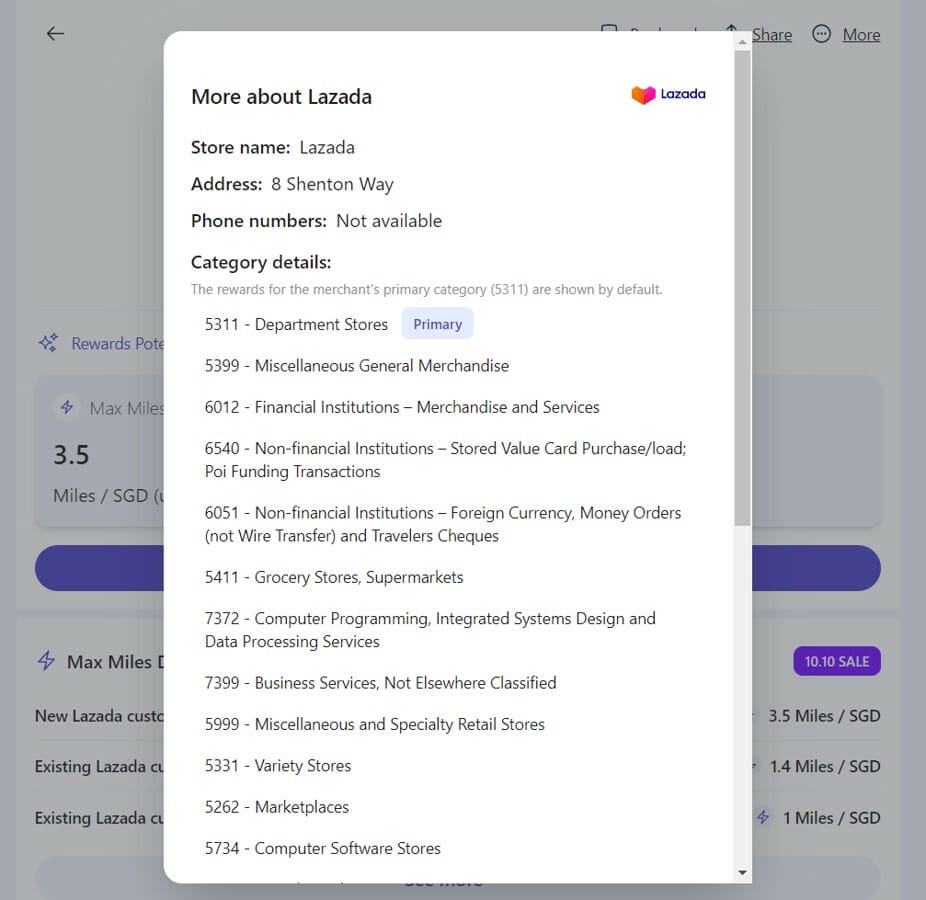

It’s very rare you’ll have a situation where Visa and Mastercard throw up different MCCs, but it’s not impossible. Cast your mind back to early 2020, when Mastercard classified GrabPay top-ups as MCC 6540 (POI Funding Transactions), but Visa classified it as MCC 7399 (Business Svcs. Not Elsewhere Classified). This meant you could earn 4 mpd on GrabPay top-ups with the Citi Rewards Visa, but not the Mastercard!

That didn’t last forever, of course, but it’s just an example of how the two card networks can sometimes sing a different tune.

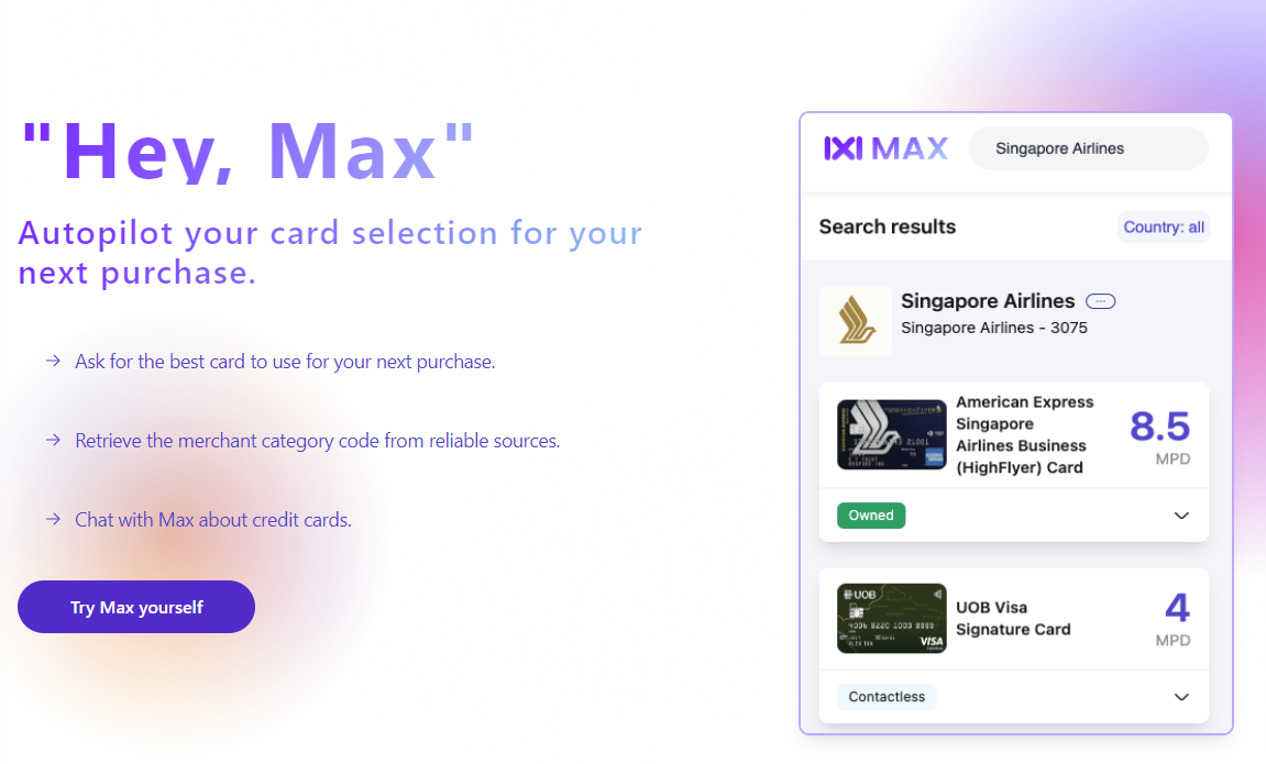

HeyMax alternative

|

| Max |

If you don’t have immediate access to the merchant you want to test, or if you’re simply looking at hypothetical scenarios, HeyMax.ai is another way to look up MCCs, whether in Singapore or overseas.

It’s certainly more straightforward than either the DBS digibot or Instarem app, but it’s not the most reliable. You will encounter problems when dealing with merchants that process transactions over a range of MCCs, such as e-commerce sites like Amazon, Lazada and Shopee. HeyMax can provide the full list of potential MCCs, but can’t tell you exactly which one it’ll be.

In those situations, the DBS digibot and Instarem app are the safer options to use.

To learn more about HeyMax, refer to the post below.

Conclusion

DBS has restored full functionality to the digibot, which is once again providing MCCs for billed, unbilled, pending and declined transactions.

This is a useful (if a little convoluted) way of checking MCCs before transacting. I might not bother doing this for a small expenditure, but if I’m buying a big ticket item, you can bet I’d take the time to make sure I’ve got the MCC right.

For a while you could also earn 7.6mpd for grabpay topups with CRMC but only 4mpd with CRV. Digibot just gives general descriptions, for example 5943 shows as Education in digibot but it’s actually “Stationary stores, office and school supply stores”. Since Education is excluded most everywhere you’d easily be misled into thinking it’d be excluded if you just relied on the Digibot description or for that matter the Instarem description it’s only the MCC itself which helps clarify.

if u ever do that in front of me when we are lining up to pay, i will actually smack you in the head…

waste of other’s people time…