If you’re trying to use an AMEX card to make bill payments via CardUp, you may have noticed that your transaction fails to go through.

That’s because American Express has its own internal compliance guidelines which restrict the types of cards and payments that can be made with CardUp.

|

| CardUp Pricing |

| First-time CardUp users save S$30 off their first payment with the promo code MILELION. No minimum payment required; for Visa and MC cards only |

Unfortunately, these guidelines are opaque to the cardholder- all we see is the end result, not the principle that got us there. Nonetheless, in this post I’ll try my best to explain the restrictions that AMEX places on CardUp, and whether it’s still worth using AMEX cards on the platform.

You can’t use the AMEX HighFlyer Card with CardUp anymore

The AMEX HighFlyer Card’s 1.8 mpd was the highest possible earn rate for CardUp.

Note I said was, because towards the end of last year reports started coming in on the MileChat that American Express was blocking CardUp transactions on the HighFlyer Card.

I reached out to American Express for an official comment, but unfortunately received this nothingburger:

CardUp remains our merchant partner, accepting American Express Cards. Following industry standards, every card transaction is reviewed and authorized or declined by American Express. Card Members can call the number at the back of their Card for support.

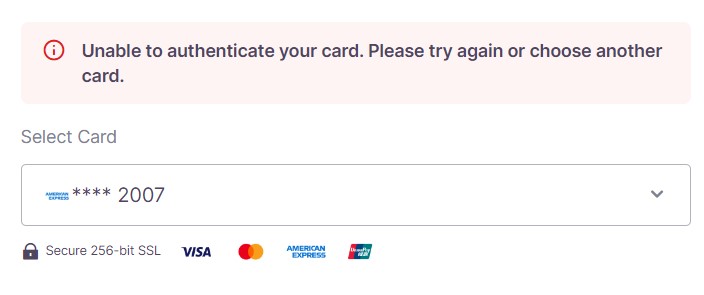

That said, my real-world testing confirms that the AMEX HighFlyer Card is indeed blocked. Attempts to add the card or process any transaction are met with an “unable to authenticate” message.

Why is it blocked? Well, the first thing you need to understand is that the primary purpose of a business card isn’t rewards; it’s cashflow and internal controls. In fact, most business cards earn crappy rewards. That’s why the AMEX HighFlyer Card is such an outlier- how often can you find a business card with a good earn rate and travel benefits?

But if we follow the letter of the law, then business cards are for business spending only (and I’m using “law” very loosely here; the police aren’t going to kick down your door). Good corporate controls require a clear demarcation of personal and business expenses.

The thing is, it’s usually very hard for American Express to tell from their side. Let’s say you spend at a supermarket. You could be buying groceries for yourself, or you could be restocking the office pantry. Let’s say you spend at a restaurant. You could be treating your family, or it could be a business lunch. Let’s say you visit Hotel 81. It could be for an invigorating round of Monopoly Deal, or it could be a business trip (I mean, that’s what you’ll tell IRAS right?).

| ❌ Using consumer cards for business spending |

|

In case you were wondering, this cuts the other way too. Some banks have explicit T&Cs forbidding the use of consumer cards for commercial spending. Here’s an example from UOB: 6.4 Should UOB deem a Cardmember’s spending to be for commercial, non-personal purposes, purposes prohibited by law, or purposes excluded by UOB from time to time, or if it deems that such UNI$ was not earned from qualifying spend of a Cardmember, UOB reserves the right to refuse to award any UNI$ for such transactions, and to cancel and void any UNI$ awarded at any time Again, it’s hard for banks to know for sure what you’re doing, but I’ve heard anecdotal reports of account shutdowns and points clawbacks for business-related spending (mainly PayPal Business transactions). In all the cases, however, the cardholders were regularly charging six digits a month- which probably sent up red flags. |

So even though I’m certain that in practice, a lot of AMEX HighFlyer Cardholders don’t use their cards for business spending exclusively, it’s simply not practicable for American Express to police such things.

CardUp, however, is a little different because the purpose of payment is so explicit- right down to supporting documentation. It’s hard to argue the case for why a business card should be used to pay someone’s personal taxes, rent, or water bill. And that’s probably what’s raised red flags with American Express’ compliance team, leading to the current situation.

I’m aware that CardUp also supports business accounts, for which the AMEX HighFlyer Card should be fair game. I can’t explain what happened there, so we’ll need to file that as a question for another time.

Restrictions for other AMEX cards

Keep in mind, the AMEX HighFlyer Card isn’t the only American Express card affected by compliance regulations.

Personal American Express cards (including those issued by DBS and UOB) can only be used to pay the following CardUp expenses:

- Rental payments

- Rental deposits

- Income tax, property tax, stamp duty

- Tuition and school fees (to Singapore-based schools/education centres)

- Condo maintenance fees

- Insurance premiums

- Season parking

Personal American Express cards cannot be used for the following:

| CardUp Personal Account | CardUp Business Account |

|

|

Again, the idea here is not mixing meat and milk- an AMEX personal card shouldn’t be used for company payroll, nor should it be used for business-related supplier invoices. I would assume the restrictions on mortgages stem from some other AML principle (since Citi has similar restrictions).

To learn more about AMEX restrictions, refer to this CardUp article.

Should you use AMEX with CardUp in the first place?

Perhaps a better question is whether you should using an AMEX card with CardUp in the first place. After all, promos are fairly rare, so most of the time you’ll need to pay the full, undiscounted 2.6% admin fee.

| Card | Earn Rate | Cost Per Mile (2.6% fee) |

AMEX HighFlyer Card AMEX HighFlyer Card(hypothetical) |

1.8 mpd | 1.41¢ |

AMEX Solitaire Card AMEX Solitaire Card |

1.3 mpd | 1.95¢ |

AMEX PPS Card AMEX PPS Card |

1.3 mpd | 1.95¢ |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 2.11¢ |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 2.30¢ |

AMEX Centurion AMEX Centurion |

0.98 mpd | 2.59¢ |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd | 3.25¢ |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd | 3.67¢ |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd | 3.67¢ |

With a 2.6% fee, the cost per mile (ignoring the now-hypothetical scenario of the AMEX HighFlyer Card) starts from a hefty 1.95 cents, and just keeps going up from there. Barring any promo codes, you certainly wouldn’t want to use an AMEX card with CardUp.

However, there is one exception: welcome offers

CardUp transactions will count towards the minimum spend for welcome offers (and if the CSOs tell you otherwise, they’re wrong), so even if you pay a higher-than-average cost per mile, the payoff from the bonus miles/gifts may make the overall equation worthwhile.

Here’s a simple example: suppose you’ve signed up for the AMEX Platinum Charge as a new-to-AMEX customer, and can earn 140,000 MR points and S$200 eCapitaVouchers with S$6,000 spend in the first 60 days.

If you use CardUp to meet the minimum spend, your admin fee is S$156 (2.6% of S$6,000), for which you get 87,500 miles (based on a rate of 400 MR points = 250 miles). The cost per mile is just 0.18 cents, before even taking into account the value of the vouchers.

| ❓ What about the annual fee? |

| I’m aware that you need to pay the S$1,744 annual fee with the AMEX Platinum Charge, but that’s offset by the first year perks, including more than S$2,000 worth of dining, airline and lifestyle credits, Comoclub birthday vouchers, a free hotel stay, and lounge access. |

Or consider the AMEX KrisFlyer Credit Card, which is offering 27,000 miles with S$1,500 spent in the first two months. The admin fee would be S$39 (2.6% of S$1,500), making the cost per mile 0.14 cents apiece.

So if your goal is to meet the minimum spend for a welcome offer, then by all means, use CardUp to get you over the line.

Conclusion

American Express cardholders face certain restrictions with CardUp, which limit the type of payments that can be made (or in the case of the HighFlyer Card, the ability to use the platform altogether).

In most cases, however, you probably shouldn’t be using AMEX cards with CardUp since the cost per mile is prohibitive. The exception are periods with promo codes, or if you’re gunning for a welcome offer.

How about ipaymy with Amex ?

does it count as eligible spend and earn miles ?

My SC journey card isn’t working on CardUp for some reason. Get this error – Unable to process your request. Please check the card details and try again.

Is anyone else facing the same issue?