The Standard Chartered Visa Infinite doesn’t have a lot going for it, but its income tax payment facility is a rare bright spot, allowing cardholders to buy miles from as little as 1.14 cents each.

Unfortunately, with income tax season just around the corner, Standard Chartered has decided to nerf this feature by hiking the admin fee from 1.6% to 1.9%.

This increases the lowest possible cost per mile to 1.36 cents– still good, but obviously not as good as before.

StanChart Visa Infinite hikes income tax payment facility fee

|

| Tax Payment Facility |

| The tax payment facility is not available to SC Priority Banking Visa Infinite, SC Journey or SC X Cardholders |

From 15 March 2024, the StanChart Visa Infinite will increase the income tax payment facility’s admin fee from 1.6% to 1.9%.

With effect from 15th March 2024, please note that the processing fees for Visa Infinite Income Tax Facility will be revised from 1.6% to 1.9% on the tax amount.

-StanChart

This, naturally, has implications for the cost per mile when paying income taxes with your StanChart Visa Infinite.

StanChart Visa Infinite StanChart Visa Infinite |

||

| 1.6% Fee | 1.9% Fee | |

| Charge ≥ S$2,000 per statement month 1.4 mpd |

1.14 cents | 1.36 cents |

| Charge < S$2,000 per statement month 1 mpd |

1.6 cents | 1.9 cents |

With a 1.6% admin fee, the lowest possible cost per mile is 1.14 cents, assuming the cardholder charges at least S$2,000 to his/her card per statement month.

| 👍 Income tax payments count towards minimum spend |

| I’ve previously confirmed with Standard Chartered’s PR team that amounts charged to the income tax payment facility will count towards the S$2,000 minimum spend required to trigger the 1.4 mpd earn rate. |

With a 1.9% admin fee, the lowest possible cost per mile increases to 1.36 cents. This, in and of itself, is not a bad price to buy miles. However, it’s curious that Standard Chartered, knowing full well the uncompetitiveness of the StanChart Visa Infinite, would decide to nerf one of its few remaining USPs.

In fact, this nerf creates the very real possibility that for income tax season 2024, Standard Chartered’s own tax payment facility won’t be the cheapest way for StanChart Visa Infinite cardholders to pay their taxes.

For the past few years, we’ve seen CardUp offering a discounted 1.75% admin fee for income tax payments charged to Visa cards. Assuming they continue that offer this year, the cost per mile for StanChart Visa Infinite cardholders would be lower at 1.23-1.72 cents, versus 1.36-1.9 cents with the bank.

StanChart Visa Infinite StanChart Visa Infinite |

||

| 1.9% Fee StanChart |

1.75% Fee CardUp |

|

| Charge ≥ S$2,000 per statement month 1.4 mpd |

1.36 cents | 1.23 cents |

| Charge < S$2,000 per statement month 1 mpd |

1.9 cents | 1.72 cents |

Of course, given that Standard Chartered’s tax payment facility does not pay IRAS directly (see next section), cardholders are perfectly at liberty to submit their NOA to the bank to buy miles at 1.36 cents, then make the actual payment via CardUp to buy additional miles at 1.23 cents.

How does the tax payment facility work?

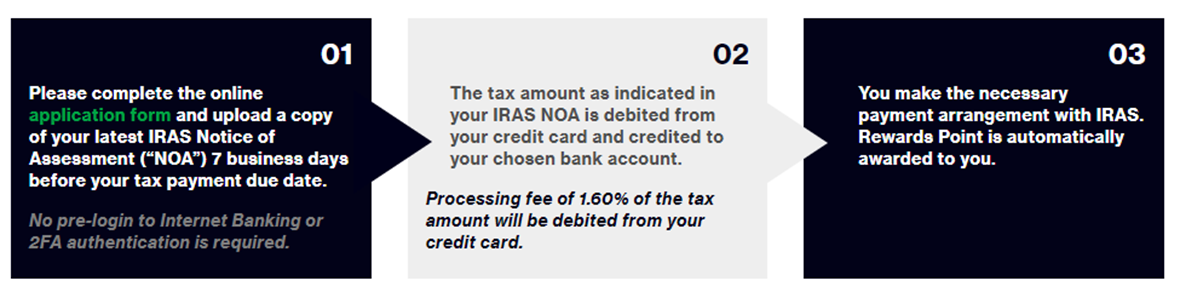

Here’s a quick refresher of how the StanChart Visa Infinite income tax payment facility works, using the example of a cardholder with a S$10,000 tax bill:

- Cardholder completes an online application form and uploads a copy of their IRAS NOA

- S$10,190 is charged to his StanChart Visa Infinite Card (S$10,000 tax due + S$190 admin fee @ 1.9%), for which he earns 14,000 miles (S$10,000 @ 1.4 mpd)

- S$10,000 will be deposited into his designated bank account within seven business days

- He uses the funds to pay IRAS

Step (4) is optional. Whether or not you pay IRAS with the funds credited in step (3) is your business. You’re perfectly at liberty to keep your current GIRO payment plan, or even use another bill payment platform like Citi PayAll or CardUp to buy more miles while paying IRAS.

The number of miles you can buy is only limited by the amount stated on your NOA. In our example of a taxpayer with a S$10,000 bill, the maximum miles he can buy is 14,000 (@ 1.4 mpd). Even if you’re more of a whale, a S$50,000 tax bill would yield 70,000 miles- not even enough for a one-way Business Class ticket to Europe!

For what it’s worth, you can’t pay someone else’s tax bill, but supplementary cardholders are also allowed to use the same tax payment facility.

FAQs for the tax payment facility can be found here.

Conclusion

The StanChart Visa Infinite will hike the admin fee for its income tax payment facility to 1.9% from March 2024, resulting in a higher cost per mile of at least 1.36 cents.

This is still a competitive rate, all things considered, but it is likely to be beat by the upcoming income tax season offers from rivals like Citi PayAll and CardUp.

With an annual fee just shy of S$600, I’m struggling to see any reason to hold this card over its $120K competitors.

This is deeply disappointing. I am probably one of the small minority of mile chasers that still used this card for things – tax payment most of all. I’d love to ditch this card now, but I have millions of points racked up over the last few years. Don’t know what to to TBH.

I had called SCB and they insisted that amounts charged to the income tax payment facility will not count towards the S$2,000 minimum spend required to trigger the 1.4 mpd earn rate. Can anyone confirm this?