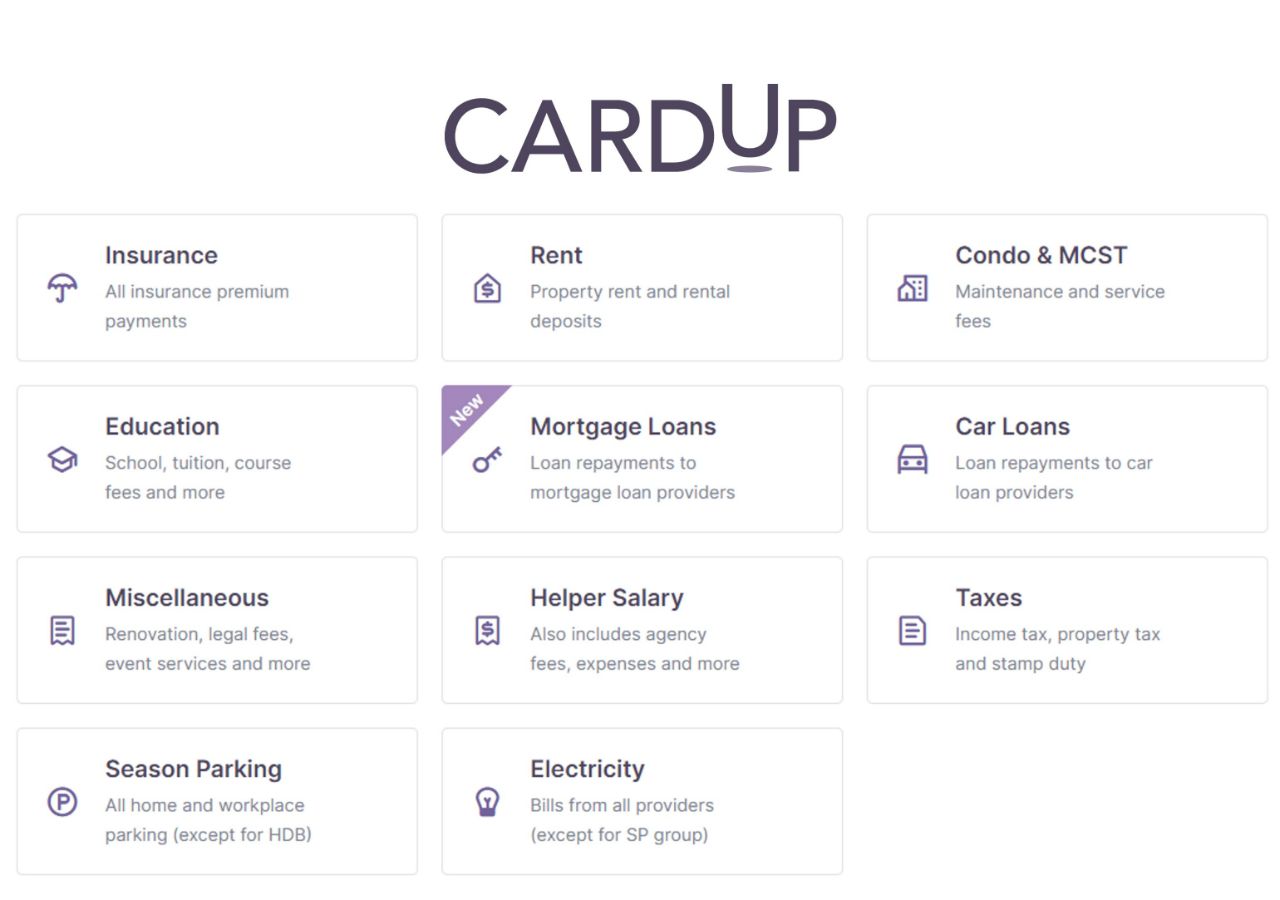

CardUp is a bill payment platform that allows users to earn credit card rewards on insurance premiums, tuition fees, income tax, rental, utilities, and other categories of spend which are usually excluded by banks.

If you’re looking to make such payments, here’s some good news: CardUp has just extended its ongoing promotions for rent, recurring, international and all other payments till January 2025, allowing cardholders to buy miles from as little as 1.1 cents each.

Unfortunately, these promotions are for Mastercard or Visa cardholders only. American Express cardholders will need to wait till another promotion gets launched, with the most recent offer lapsing on 11 February 2024 without renewal.

As a reminder, first-time CardUp users can use the promo code MILELION to save S$30 off their first payment, with no minimum payment required. This means free miles on a payment of up to S$1,154, which is none too shabby indeed.

| ❓ What is CardUp? |

|

CardUp is a bill payment platform that allows users to pay rent, income tax, insurance premiums, MCST fees, season parking, mortgage installments and more with their credit card, earning miles in exchange for a small fee. The standard CardUp fee is 2.6%, but is frequently lowered through various promotions. |

Rental (1.79%)

|

|

| Code | SAVERENT179 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 1.79% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa, Mastercard, UnionPay |

| SAVERENT179 T&Cs | |

CardUp users paying rent can use the promo code SAVERENT179 to enjoy a 1.79% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

With a 1.79% fee, you’ll be paying between 1.1 to 1.76 cents per mile, depending on card.

| Earn Rate | Cost Per Mile (1.79% fee) |

| 1.6 mpd | 1.10 cents |

| 1.5 mpd | 1.17 cents |

| 1.4 mpd | 1.26 cents |

| 1.3 mpd | 1.35 cents |

| 1.2 mpd | 1.47 cents |

| 1.1 mpd | 1.60 cents |

| 1.0 mpd | 1.76 cents |

Recurring Payments (1.85%)

|

|

| Code | RECURRING185 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 1.85% |

| Min. Spend | None |

| Cap | S$20,000 per month |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa |

| RECURRING185 T&Cs | |

CardUp users making recurring payments can use the promo code RECURRING185 to enjoy a 1.85% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

The code is only valid for locally-issued Visa cards, and applies to the first S$20,000 of payments per calendar month. CardUp’s regular fee of 2.6% will apply to the portion of the payment that exceeds S$20,000.

Payments can be set up with weekly, monthly or quarterly frequencies. Remember, CardUp supports mortgage payments for both bank and HDB loans, so this could be useful for anyone looking to repay a housing loan.

With a 1.85% fee, you’ll be paying between 1.14 to 1.82 cents per mile, depending on card.

| Earn Rate | Cost Per Mile (1.85% fee) |

| 1.6 mpd | 1.14 cents |

| 1.5 mpd | 1.21 cents |

| 1.4 mpd | 1.30 cents |

| 1.3 mpd | 1.40 cents |

| 1.2 mpd | 1.51 cents |

| 1.1 mpd | 1.65 cents |

| 1.0 mpd | 1.82 cents |

International Payments (1.85%)

|

|

| Code | GLOBE185 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 1.85% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa |

| GLOBE185 T&Cs | |

CardUp users making international payments can use the promo code GLOBE185 to enjoy a 1.85% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

The code is only valid for locally-issued Visa cards.

With a 1.85% fee, you’ll be paying between 1.14 to 1.82 cents per mile, depending on card.

| Earn Rate | Cost Per Mile (1.85% fee) |

| 1.6 mpd | 1.14 cents |

| 1.5 mpd | 1.21 cents |

| 1.4 mpd | 1.30 cents |

| 1.3 mpd | 1.40 cents |

| 1.2 mpd | 1.51 cents |

| 1.1 mpd | 1.65 cents |

| 1.0 mpd | 1.82 cents |

Given that this is an international transfer, you should also check whether the rate CardUp is offering is competitive compared to the alternatives, because otherwise that implicitly increases your cost per mile.

All other payments (2.25%)

|

|

| Code | GET225 |

| Limit | No cap on individual or overall redemptions |

| Admin Fee | 2.25% |

| Min. Spend | S$130 |

| Cap | None |

| Schedule By | 31 January 2025 |

| Due Date By | 5 February 2025 |

| Validity | Visa, Mastercard, UnionPay |

| GET225 T&Cs | |

For all other payments, CardUp users can use the promo code GET225 to enjoy a 2.25% fee, for payments scheduled by 31 January 2025 with due dates on or before 5 February 2025.

This code is valid for all locally-issued Visa, Mastercard and UnionPay cards.

With a 2.25% fee, you’ll be paying between 1.38 to 2.2 cents per mile, depending on card.

| Earn Rate | Cost Per Mile (2.25% fee) |

| 1.6 mpd | 1.38 cents |

| 1.5 mpd | 1.47 cents |

| 1.4 mpd | 1.57 cents |

| 1.3 mpd | 1.69 cents |

| 1.2 mpd | 1.83 cents |

| 1.1 mpd | 2.00 cents |

| 1.0 mpd | 2.20 cents |

OCBC cards have their own offers too

OCBC cardholders can enjoy admin fees of 1.5-2% with CardUp, depending on card and whether they’re a new or existing CardUp user. This allows the purchasing of miles from as little as 0.92 cents each.

Refer to the article below for the full details.

Citi PayAll alternative

While CardUp’s offers aren’t bad, Citi cardholders may want to wait for another Citi PayAll offer to come along. Citi runs a few of these each year, and no doubt has one brewing for the upcoming income tax season.

The most recent promotion (which ended in February 2024) brought the cost per mile down to 1.22 cents, and historically it’s been as low as 0.8 cents.

We usually see a Citi PayAll promotion launching in April, so if you don’t need to make your payments just yet, it could be worth waiting for.

CardUp FAQ

I’m attaching the usual CardUp FAQ below. Be sure to have a read, because it answers commonly asked questions like whether CardUp payments count towards sign up bonuses (they mostly do) and whether there are any 10X opportunities (there aren’t).

| ❓ CardUp FAQ |

|

Q: What cards earn miles with CardUp?

Q: Do any specialised spending cards earn bonuses with CardUp? Q: Does CardUp spending count towards welcome offers/promotional bonuses? Q: Do I earn miles on the CardUp fee too? |

Conclusion

CardUp has extended its offers for rental, recurring, international and all other payments till January 2025, allowing cardholders to buy miles from as little as 1.1 cents each.

Whether it’s worth buying miles through CardUp boils down to how much you value a mile, but on the whole there’s certainly situations where it can make sense. The higher your mpd, the lower your cost per mile, so try and use a higher-earning general spending card as much as possible.

Nothing specific for income tax payments? should I expect something tax related soon based on their historical promos? Or GET225 is the best we’d get?

cardup will almost certainly have their own income tax promo, but you’ll need to wait till april at least.

Typo for admin rate under get225.

thanks! fixed.

Is it safe to use like 100-200k for a single transaction with card up?

I was going to use Amex Business SIA Highflyer for a CardUp business account to take advantage of their 1.8 Highflyer points for $1 spend. Then I realise that this may not make sense since Highflyer points are capped at 30k per year for conversion to Krisflyer miles. Correct me if I am wrong. Any suggestion for other business credit cards that may be an alternative?