| ⚠️ Note: This offer has expired. Refer to this post for the latest welcome gifts for AMEX Travel Insurance. |

If you’re in the market for a travel insurance plan, American Express has launched an offer for its My Travel Insurance plan that’s well worth considering.

From now till 30 June 2024, customers can enjoy an Accor Plus Explorer membership (which comes with up to 50% off dining and one free hotel night) or a Samsonite luggage & S$50 eCapitaVoucher when they purchase an annual policy, or S$30-50 eCapitaVouchers for a single-trip policy.

You can also enjoy an extra 5,000 MR points, 2,500 KrisFlyer miles or S$15 eCapitaVoucher when you make the purchase via my referral link, on top of the public gifts.

AMEX My Travel Insurance offer

|

| Apply here |

From 2 April to 30 June 2024, customers who purchase a My Travel Insurance policy can enjoy the following gifts:

| Single-trip | Annual multi-trip | |

| Essential | – | – |

| Standard | S$30 eCV | S$80 eCV |

| Superior | S$50 eCV |

|

| Applies to both Worldwide (ex USA, Canada and Cuba) and Worldwide (ex Cuba) |

||

You’ll receive one gift per plan purchased, so for example, someone who buys 2x single-trip Superior plans will get 2x S$50 eCV.

On top of this, American Express cardholders who purchase their plans (whether single-trip or annual) via my referral link will enjoy extra gifts.

For applications till 17 April 2024

| Card | Reward |

| All AMEX Platinum Cards (Plat Charge, Plat Reserve, Plat Credit Card) |

5,000 MR points |

| All AMEX KrisFlyer Cards (Solitaire PPS, PPS, Ascend, Blue) |

2,500 KrisFlyer miles |

5,000 MR points are worth 3,125 KrisFlyer miles (2,777 KrisFlyer miles if you have the Platinum Reserve or Credit Card), and you can convert them to hotel or other airline points if you wish, so I’d recommend going for that offer if you have one of the Platinum cards.

For applications from 18 April 2024

All applicants will receive a S$15 eCapitaVoucher as a referral bonus, regardless of which AMEX card they hold.

Which plan to buy?

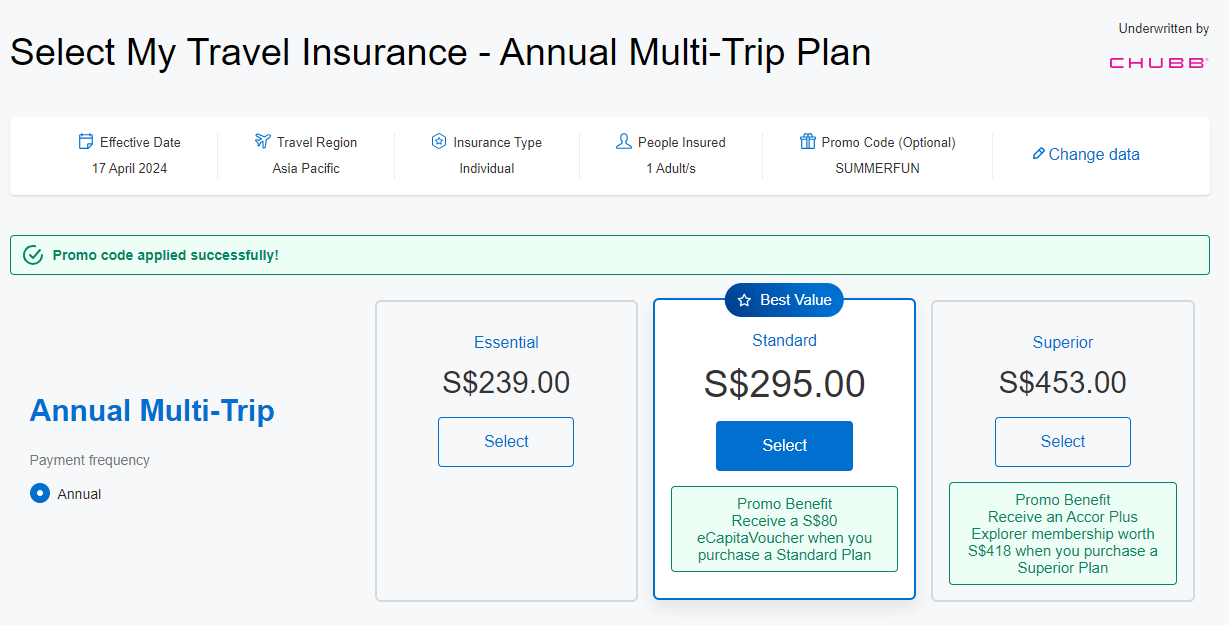

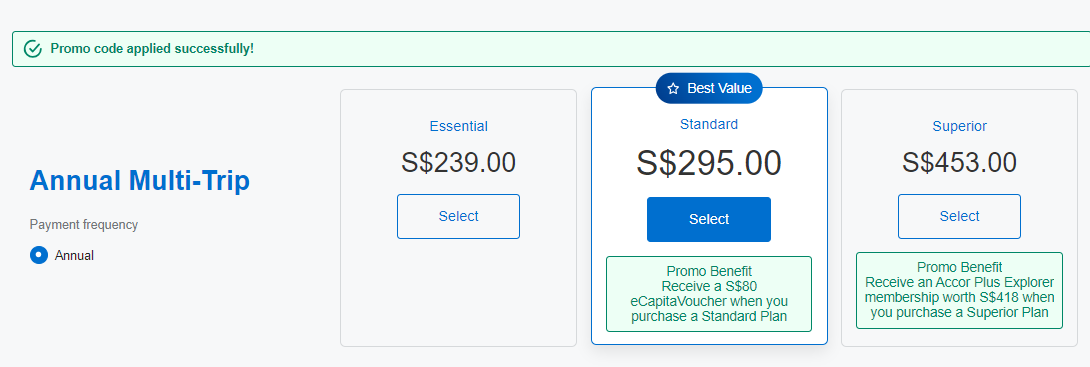

If you ask me, the sweet spot here is the Accor Plus Explorer membership offered for APAC plans. Here’s a quote for an annual Asia Pacific plan for one adult, which costs S$453.

The Accor Plus membership retails for S$418 (though there’s several sales a year where you can buy it for slightly less), so it’s like topping up a little to enjoy an annual travel insurance plan too.

The My Travel Insurance Superior plan offers up to S$500,000 coverage for accidental death and permanent disablement, up to S$2 million for overseas medical expenses or personal liability, S$20,000 for travel cancellation or curtailment, S$1,000 of rental car excess, as well as COVID-19 protection.

Miles chasers will be pleased to know that the plan also offers up to S$20,000 coverage for the loss of frequent flyer points, in the event your inability to travel leads to them being forfeited (e.g. if you book a KrisFlyer Spontaneous Escapes award, which cannot be refunded, or if you’ve booked a hotel with points and are inside the cancellation window).

Terms & Conditions

Below you’ll find links to the factsheet, policy wording, FAQs and T&Cs for this offer.

- My Travel Insurance Factsheet

- My Travel Insurance Policy Wording

- My Travel Insurance FAQs

- My Travel Insurance Promotion

The Accor Plus membership, Samsonite luggage and eCapitaVouchers will be fulfilled within eight weeks of purchasing the plan.

The bonus MR points, KrisFlyer miles or eCapitaVouchers from the MGM programme will take up to 12 weeks for fulfillment.

How to purchase a plan

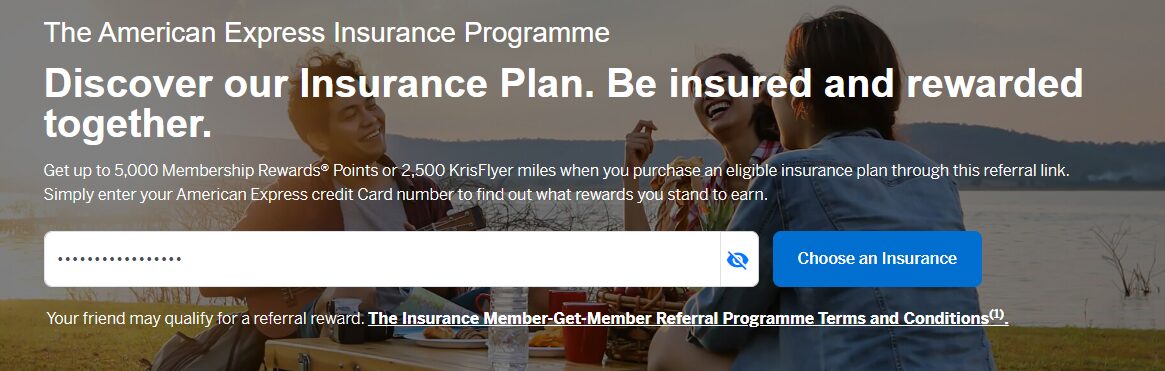

When you click on my referral link, you’ll be prompted to enter your AMEX card number. This will confirm which reward you qualify for.

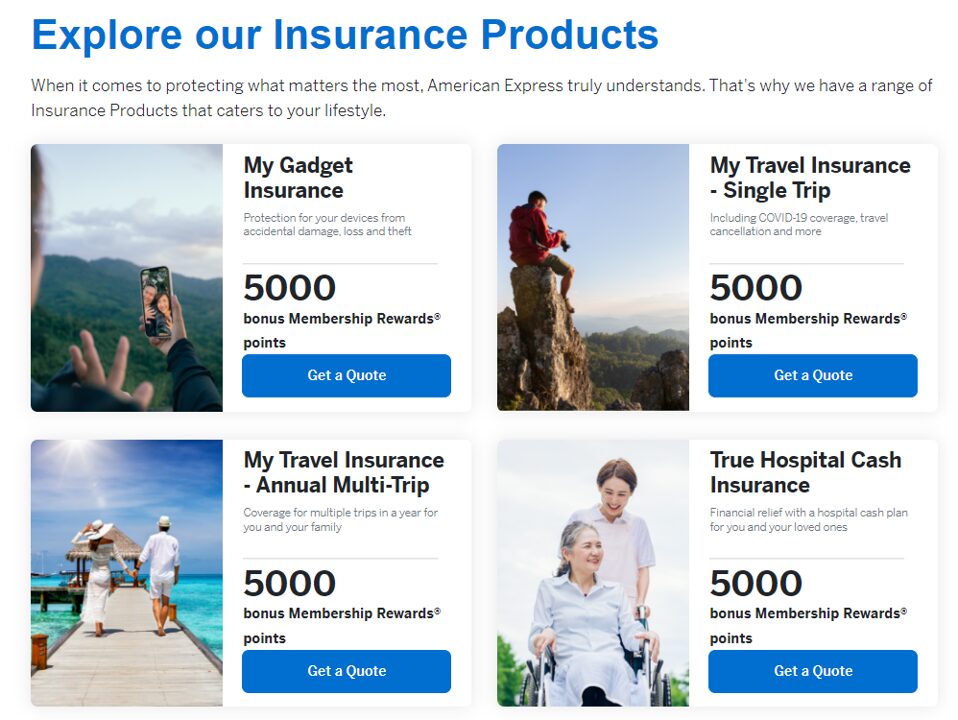

After that, you’ll be able to select the plan you wish to purchase- My Travel Insurance Annual Multi Trip in this case. Click on that and proceed as per usual.

The promo code field will be automatically populated with SUMMERFUN, and you’ll see that the regular gifts still apply, just as if you were going via the public website.

Do you earn miles or points on your purchase?

While American Express no longer awards points for insurance payments in general, there’s an exception carved out for “payments made for insurance products purchased through American Express authorised channel”.

My assumption would be that My Travel Insurance purchases qualify, and if that’s the case you’ll be able to earn your usual general spending rate, on top of the 5,000 MR points or 2,500 KrisFlyer miles bonus for referrals.

| Card | Earn Rate |

AMEX Solitaire PPS Credit Card AMEX Solitaire PPS Credit Card |

1.3 mpd |

AMEX PPS Credit Card AMEX PPS Credit Card |

1.3 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd |

AMEX Centurion AMEX Centurion |

0.98 mpd |

AMEX Platinum Charge AMEX Platinum Charge |

0.78 mpd |

AMEX Platinum Reserve AMEX Platinum Reserve |

0.69 mpd |

AMEX Platinum Credit Card AMEX Platinum Credit Card |

0.69 mpd |

What’s the benefits of Accor Plus?

Accor Plus is a dining and lifestyle membership that offers members discounts on hotel stays and restaurants across Asia Pacific.

Standard Accor Plus benefits include:

- 10% off best available public rate

- Up to 50% off member exclusive room rates with with Red Hot Room offers

- Up to 50% off dining across 1,400 restaurants in Asia Pacific

- 25% off dining: 1 member only

- 50% off dining: 1 member and 1 guest

- 33% off dining: 1 member and 2 guests

- 25% off dining: 1 member and 3 guests

- 15% off drinks bill in Asia

- Member exclusive More Escapes stay packages

- Early access to global Accor hotel sales

- Members’ exclusive experiences

- 20 status nights each year

Some examples of participating Accor Plus restaurants in Singapore include Prego, Mikuni and Asian Market Café at the Fairmont, SKAI, The Stamford Brasserie, CLOVE, at Swissotel and The Cliff and Kwee Zeen at the Sofitel Sentosa Resort.

Don’t forget that your dining benefits apply overseas too- even on breakfast. You’ll often find that it makes more sense to book a non-breakfast rate and then purchase breakfast at 50% off at the hotel itself.

Stay Plus certificates are offered to Explorer (1 certificate) and Explorer Plus (2 certificates) members Each Stay Plus certificate can be used for a one-night stay at participating hotels across Asia Pacific. Obviously, you’ll want to save this for a high-end chain like Sofitel or Mondrian, and steer clear of the cheaper ones.

Do note that Stay Plus nights are subject to blackout dates, and you may not always be able to get the hotel you want.

I’ve written a comprehensive guide to using your Stay Plus benefit, which can be found below.

Conclusion

|

| Apply here |

American Express is now offering an Accor Plus membership, Samsonite luggage or eCapitaVouchers to customers who purchase a My Travel Insurance plan, with the best gifts reserved for annual policies.

On top of this, you can enjoy 5,000 bonus MR points, 2,500 KrisFlyer miles or a S$15 eCapitaVoucher if you’re an AMEX cardholder.

With both COVID-19 and loss of miles and points covered under this policy, it’s a deal well worth considering if you’re in the market for an annual travel insurance plan.

What happens if i already have another Accor plus membership from Vantage?

Give it to a family member. By right you can only have one membership at a time

Does this apply to payment with HighFlyer card?

you can buy with highflyer if you want, but there’s no referral bonus in that case. just the accor plus/luggage.

If spouse and I buy Worldwide annual plan, can 1 person take Accor gift, 1 person take something else?

Meaningless to have 2 Accor membership in the household

Can use Amex True Cashback card to buy and get KF points?

A very honest friend who did got it from Chubb found it difficult to make a claim. When there is such nice embellishments, I wonder what is covered and not covered in the fine print. Sheep hair only grow on a sheep. Will give it a miss.

Claim what?

It was for an overseas accident with all the medical certificates and the cost was maybe USD 75. After many questions and rounds, they refused to pay. We have better experiences with AIA, AIG and Income. No questions just pay for a small amount. The impression we got was that they are just making it difficult. As what I said before, if they have a lot of goodies…I will be more careful with the fine print. The key to me is still the coverage and support to choose the insurer.

This is a good point. Some travel insurers make your life hell when you want to make a genuine claim. So far, I am good experience for FWD as well as Aviva (for injury and visiting TCM) claims.

seems apply single trip also make sense, you can get 50$ ecapita voucher. Is this only valid for one time or i can apply multiple times (have multiple trips this year)

you receive one gift per policy purchased

For Sup card members, will they also get the gift and free miles?

Aka the main card buy 1 policy and the sup card buy another policy?

would like to know this as well!

My Chubb experience:

A Jetstar flight of mine was 10 hours late, the airline provided a letter saying it was “late for operational reasons”, I went ahead and claimed.

Chubb: “Please provide the actual reason, we cannot accept operational reasons”

Jetstar: “Nope, that’s the best we can do”

The End.

Is there any point to this if you already get travel insurance with the Amex Charge card?

Has anyone received the complimentary Accor Plus yet?

Is Amex True Cashback card excluded from this promotion? I tried using the referral link but got this message “Unfortunately your Card is not eligible for an insurance referral”

not eligible. you will need an MR points or KrisFlyer miles earning card to enjoy the referral bonus

Noted, thanks for the clarification

can award the accor plus membership to other person?

let say buying with my card, and award the membership to my spouse?