If you want to accelerate your miles accumulation but can’t be bothered to memorise which card to use when, then the UOB Preferred Platinum Visa and UOB Visa Signature are probably the two best options.

Instead of burdening you with a list of bonus-eligible Merchant Category Codes (MCCs), both cards adopt a simple blacklist approach for in-person payments: so long as a given transaction isn’t on the general exclusions list, you’ll earn 4 mpd when paying through contactless, simple as that.

This flexibility makes them a jack-of-all-trades solution. Whether you’re dining out, getting a haircut, shopping for clothes or buying pet food, don’t think; just tap.

On the surface, the two cards have very similar value propositions. However, there are some crucial differences that cardholders should take note of, which we’ll explore in this post.

| 💳 Summary: UOB Preferred Platinum Visa vs UOB Visa Signature | ||

|

|

|

| UOB PPV | UOB Visa Signature | |

| Min. Income | S$30K p.a. | S$30K p.a. |

| Annual Fee | S$196.20 (First Year Free) |

S$218 (First Year Free) |

| Contactless Spend | 4 mpd |

4 mpd |

| Min. Spend for Contactless Bonus | None | S$1,000 per s. month |

| Bonus Cap for Contactless | S$600 per c. month | S$1,200 per s. month |

| Other Bonuses | 4 mpd (Selected Online Trxns) |

4 mpd (Petrol & FCY) |

| Min. Spend for Other Bonus | None | S$1,000 per s. month |

| Bonus Cap for Other Bonus | S$600 per c. month | S$1,200 per s. month |

| Tracking Period | Calendar Month (posting date) |

Statement Month (posting date) |

| Points Awarding | Base and Bonus Together | Base and Bonus Separate |

| Rounding | Per transaction | Per month |

I’ve also written detailed reviews of both cards, which you can refer to in the links below.

Minimum income & annual fee

|

|

|

| UOB PPV | UOB Visa Signature | |

| Income Requirement | S$30K p.a. | S$30K p.a. |

| Annual Fee | S$196.20 (FYF) |

S$218 (FYF) |

Both the UOB Preferred Platinum Visa and UOB Visa Signature have a minimum income requirement of S$30,000 per year, the MAS-mandated minimum (the UOB Visa Signature’s income requirement used to be S$50,000 per year, but was recently lowered).

In terms of annual fees, the UOB Visa Signature is slightly more expensive at S$218 versus S$196.20 for the UOB Preferred Platinum Visa, but I wouldn’t worry about it. In my experience, getting an annual fee waiver has never been an issue.

Minimum spend & cap

|

|

|

| UOB PPV | UOB Visa Signature | |

| Min. Spend for Bonuses | None | S$1K per statement month |

| Bonus Cap | S$600 per calendar month | S$1.2K per statement month |

The UOB Preferred Platinum Visa awards 4 mpd on mobile contactless spending, with no minimum spend required, capped at S$600 per calendar month.

The UOB Visa Signature awards 4 mpd on contactless spending, with a minimum spend of S$1,000 in SGD per statement month, capped at S$1,200 per statement month.

Many people have difficulty understanding how the minimum spend for the UOB Visa Signature is computed, so I’ve written a detailed guide explaining how it works.

How does the UOB Visa Signature’s minimum spend requirement work?

Any spend beyond the cap (or below the minimum spend, in the case of the UOB Visa Signature) earns just 0.4 mpd, so it’s very important to monitor your spending closely.

Definition of contactless spend

|

|

|

| UOB PPV | UOB Visa Signature | |

| ✅ | ✅ | |

| ✅ | ✅ | |

| ✅ | ✅ | |

Tapping physical card Tapping physical card |

❌ | ✅ |

While both the UOB Preferred Platinum Visa and UOB Visa Signature award 4 mpd on contactless payments, there is a crucial distinction in definition.

With the UOB Visa Signature, you can either tap the physical card, or digitise it into a mobile wallet (Apple Pay, Google Pay and Samsung Pay) and tap your phone to pay.

With the UOB Preferred Platinum Visa, you must digitise the card into a mobile wallet and tap your phone to pay. Transactions made by tapping the physical card will not earn bonus miles, effective 22 May 2020.

Other bonus categories

|

|

|

| UOB PPV | UOB Visa Signature | |

| Other Bonus Categories | Online trxns. on shopping, electronics, supermarkets, food delivery, entertainment | Petrol, foreign currency spending |

While 4 mpd on contactless spending is the big draw for both the UOB Preferred Platinum Visa and UOB Visa Signature, both cards have a second bonus category that can be equally useful.

UOB Preferred Platinum Visa: Selected online transactions

The UOB Preferred Platinum Visa earns 4 mpd on the following transactions, provided they are made online.

| Category | MCCs |

| Department and Retail Stores | 4816, 5262, 5306, 5309, 5310, 5311, 5331, 5399, 5611, 5621, 5631,5641, 5651, 5661, 5691, 5699, 5732-5735, 5912, 5942, 5944-5949, 5964-5970, 5992, 5999 |

| Supermarkets, Dining and Food Delivery | 5811,5812,5814, 5333, 5411, 5441, 5462, 5499, 8012, 9751 |

| Entertainment and Ticketing | 7278, 7832, 7841, 7922, 7991, 7996, 7998-7999 |

This includes Amazon, Lazada, Redmart, FairPrice, Golden Village, SISTIC, Foodpanda, Deliveroo and GrabFood. You could also expand this to many other categories like electronics, travel agencies, ride-hailing and petrol by buying vouchers through HeyMax (MCC 5311).

This bonus is capped at S$600 per calendar month.

UOB Visa Signature: Petrol & foreign currency spending

The UOB Visa Signature earns 4 mpd on petrol and foreign currency spending, provided the following conditions are met:

- Petrol: Minimum SGD spend of S$1,000 per statement month

- Foreign Currency Spend: Minimum foreign currency spend of S$1,000 per statement month

Petrol shares the same bonus cap as contactless spending (and while you would probably be paying for petrol via contactless anyway, this could cover situations where you pay through an online app like Kris+ at Esso), but foreign currency spend has its own bonus cap of S$1,200 per statement month.

Tracking period

|

|

|

| UOB PPV | UOB Visa Signature | |

| Tracks By | Calendar month | Statement month |

The UOB Preferred Platinum Visa tracks its bonus cap based on the calendar month, so once you’ve exhausted the limit, you’ll need to wait until the 1st of the following month to spend again.

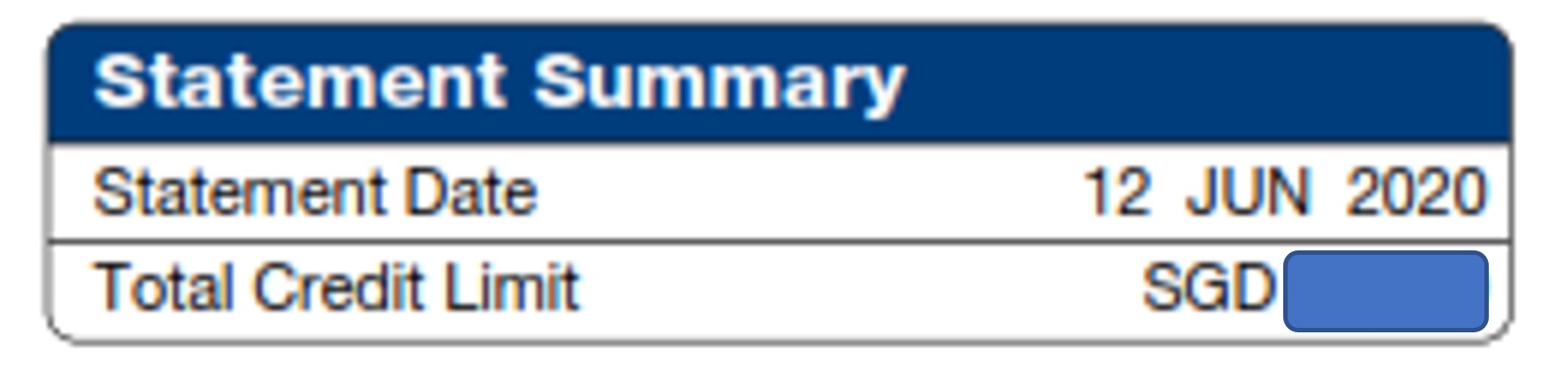

The UOB Visa Signature tracks its bonus cap (and minimum spend) based on the statement month, which will differ from cardholder to cardholder. To check your statement date, generate your eStatement and look for the statement date at the top right hand corner.

The statement date is the last day of your statement month, so in the example above, the bonus cap will reset on the 13th of each month.

However, both the UOB Preferred Platinum Visa and UOB Visa Signature use the posting date rather than the transaction date for tracking bonus caps (and minimum spend, in the case of the latter).

- For example, if I transact with my UOB Preferred Platinum Visa on 30th June and the transaction posts on 2nd July, that amount will count towards July’s bonus cap, not June’s

- Likewise, if my statement month ends on the 12th, and I transact with my UOB Visa Signature on 11th June and the transaction posts on 13th June, that amount will count towards the latter month’s (Jun-Jul) bonus cap.

Posting may take up to three days from transaction date, but could also be on the same day- it’s impossible to tell. Be careful with transactions made towards the end of the calendar or statement month!

Points awarding and rounding

|

|

|

| UOB PPV | UOB Visa Signature | |

| 1X Base Points | Awarded at time of trxn. | Awarded at time of trxn. |

| 9X Bonus Points | Awarded at time of trxn. | Awarded the following month |

UOB rounds transactions down to the nearest S$5 before awarding points, which can lead to lost points on every transaction. A S$9.99 transaction earns the same number of points as a S$5 transaction, and a S$4.99 transaction earns no points at all!

But the impact on the two cards is not the same.

With the UOB Preferred Platinum Visa, both the base 1X points and bonus 9X points are awarded at the time the transaction posts.

| 💳 UOB PPV | ||

| Spend | Rate | Calculation |

| Base | 1 UNI$ per S$5 | Round down transaction to nearest S$5, then divide by 5 and multiply by 1. Round down to the nearest whole number |

| Bonus | 9 UNI$ per S$5 | Round down transaction to nearest S$5, then divide by 5 and multiply by 9. Round down to the nearest whole number |

With the UOB Visa Signature, the base 1X points are awarded at the time the transaction posts, and the bonus 9X points are awarded the following statement period.

| 💳 UOB Visa Signature | ||

| Spend | Rate | Calculation |

| Base | 1 UNI$ per S$5 | Round down transaction to nearest S$5, then divide by 5 and multiply by 1. Round down to the nearest whole number |

| Bonus | 9 UNI$ per S$5 | Sum up all eligible transactions (including cents), round down transaction to nearest S$5, then divide by 5 and multiply by 9. Round down to the nearest whole number |

When calculating the bonus to award, all unrounded eligible transactions will be summed up. The consolidated figure is then rounded down once to the nearest S$5 before the 9X points are calculated. This means less “wastage”, because rounding only takes place once with the UOB Visa Signature, as opposed to on each transaction with the UOB Preferred Platinum Visa.

In other words, the effect of rounding is more benign for the UOB Visa Signature, compared to the UOB Preferred Platinum Visa.

For more details on this quirk, refer to the article below.

Conclusion

Even though the UOB Preferred Platinum Visa and UOB Visa Signature have overlapping use cases, there are important differences where minimum spend, contactless definitions, points calculation and other bonus categories are concerned.

If you’re a small spender, the UOB Preferred Platinum Visa is probably the better option due to its lack of a minimum spend requirement. Bigger spenders will benefit more from the UOB Visa Signature and its higher monthly 4 mpd cap.

But of course, there’s nothing stopping you from using both. In that case, I’d highly recommend spending on the UOB Visa Signature first, before switching to the UOB Preferred Platinum Visa. The last thing you want is to hit the UOB Preferred Platinum Visa’s cap, only to realise you have insufficient spending left to trigger the minimum spend on the UOB Visa Signature.

UOB Preferred Platinum Visa vs UOB Visa Signature: Which do you prefer?

If I’m just doing Paywave, the VS wins hands down as I hate pulling out my phone and selecting the PPV card on Google Pay (it isn’t the default payment method for me).

i mean sure, if you are certainly spending above $1k that month. But anyways, Apple, Samsung Pay and some others works too, not just Google

For contactless transactions, do transactions in foreign countries and / or foreign currencies qualify for 4mpd for both cards? Thanks.

I’ve read on other forums that ppl have tried it and it works, but personally I can’t confirm that. But based on the T&Cs, it should work.

For the UOB VS, do you know if the foreign currency spending can be shared as well? For eg: S$800 spend in foreign currency + S$800 in contactless spending; a total of S$1600 gets awarded 4mpd?

No.

If I made transactions with 9.50. Does 4.5 count towards 1110 or 2000 threshold?

Good qn. Remember that cap is based on uni$ issued, not $ spent. For ppv, the 4.5 won’t count because it’s rounded away. For uob vs, it will count because it’s added to your nett total and bonused accordingly

does the UOB professionals card share the same features as the PPV?

Nah. Absolutely useless

Hi Aaron, thanks for the write up. I seem to recall the PPV monthly 4mpd limit being $1,110 (due to a quirk in the way the bonus UNI$ cap is calculated), rather than $1,000. Is this no longer the case?

Sorry, just saw that this has now been updated in the article. Thanks!

I’d recommend the HSBC revolution to someone who wants the simplicity of one card. Especially if typical spend is under 1K.

Covers the most common categories both online + contactless with 4mpd, no UNI$ merchants or rounding rules, free HSBC entertainer account, and especially no need to look after annual fee waivers.

Hi, should I apply for 2 separate principal cards (me and partner) to maximise the caps or are the caps per cardholder (i.e. principal card at 2k plus supplementary card at 2k for the VS?)

I only use VS when travelling overseas as it is giving more miles for offline transaction (not all overseas merchant accepts contactless) like Dental in Bkk, hotels etc when charge in foreign currency than general card like PRVI.

I’m wondering if the article should be updated to mention that online recurring payments on UOB PPV do not give you the bonus points. I’m talking about recurring payments like Apple TV / HBO Go / YouTube Premium. LinkedIn still earns bonus points.

Spending on the UOB PPV card is strictly limited to the online merchants listed in the article’s whitelist. Consequently, streaming subscriptions, which fall under the “TV services” merchant code, are excluded from that whitelist.

I tried to apply online for PPV and the site gives error, in person at the branch and cannot sign up because it’s an older card. Anyone with the same issue seems like I can’t get the card XD

Hi ,

I am currently using UOB preferred platinum card. Reference to your website, this card allows users to earn 4 MPD. However , on my UOB app I cannot see this detail. Does it mean I need to translate the UNI$ to miles ? Kindly pls advise

1UNI$=2 Miles

Odd perspective. Most use both and use VS when they have a big purchase that month and are sure to hit the minimum.

If I spend 2k on sgd paywave and 0 on fcy, do I get 4mpd on 2k?

Thanks

Yes.

i don’t see the website for the card mentioning $1 = 4mpd . Is it this valid or im missing something .

It is valid because the total amount of UNI$ you earn is equivalent to 4mpd.

https://www.uob.com.sg/personal/cards/rewards/visa-signature-card.page

So if I spent at UOB$ merchant with preferred platinum visa, does this transaction takes up the 1.1k 4mpd cap?

Did anyone tried to book a Hotel booking overseas (e.g. Europe country) on Trip.com and paid in Euro using VS card? does that count as FYC spending and gets the 4mpd, assuming its >1k?

Can we earn mile in healthub by using UOB visa signature? I spent 2000sgd via healthhub last month, only able to get 400UNI (800mile).

I’m confuse

Online payment in an app with the visa signature will not earn any bonus points.

for contactless payment meaning im allowed to use for any transcation?

Yes as long as the merchant is not in the terms and condition exclusion list.