| ⚠️ Story update: DBS has confirmed there was an error in the update to the DBS Rewards T&Cs. CardUp and ipaymy transactions remain eligible to earn DBS Points, so long as they do not fall under the MCC exclusions list. The T&Cs will be updated shortly. |

CardUp and ipaymy allow cardholders to earn credit card rewards on education, insurance premiums, rental, income tax and insurance transactions, which are normally excluded by the banks.

However, it’s not always been smooth sailing. HSBC became the first to exclude CardUp and ipaymy entirely in July 2020, UOB excluded ipaymy in August 2022, and now it seems like DBS is set to follow suit. Per an update to the DBS Rewards Programme T&Cs, both CardUp and ipaymy transactions no longer earn points.

This is a confusing development to say the least, given the lack of notice and recent confirmation from DBS that CardUp transactions continue to earn base rewards as per normal. I’m in the midst of seeking clarification from the bank, but in the meantime you should pause any planned payments with DBS cards for either of these two platforms.

DBS Rewards Programme updated T&Cs

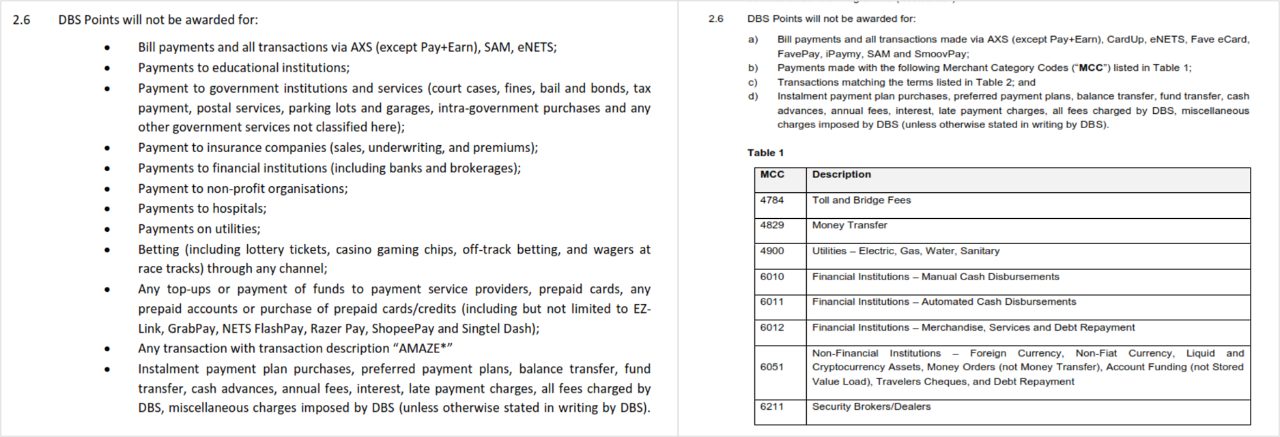

DBS has published a new set of T&Cs for the DBS Rewards Programme to its website. For the sake of easy comparison, I’ve uploaded both the old and new T&Cs to Draftable, but in summary there’s two key changes to note:

- New rewards exclusions have been added

- Rewards exclusions are now defined by explicit MCC ranges, instead of category descriptions

CardUp and ipaymy now on exclusion list

In the previous version of the T&Cs, Clause 2.6(a) stated:

| 2.6 DBS Points will not be awarded for bill payments and all transactions via AXS (except Pay+Earn), SAM, eNETs |

In the revised T&Cs, Clause 2.6(a) now states:

| 2.6 DBS Points will not be awarded for bill payments and all transactions via AXS (except Pay+Earn), CardUp, eNETS, Fave eCard, FavePay, ipaymy, SAM and SmoovPay |

Note the addition of CardUp, Fave eCard, FavePay, ipaymy, and SmoovPay.

Now, Fave eCard, FavePay and SmoovPay aren’t actually new. Even though these were not explicitly addressed in the DBS Rewards Programme T&Cs before, they were already known not to earn points.

What is new are CardUp and ipaymy, and I find it strange this comes so soon off the heels of DBS confirming that CardUp transactions will earn base points, though they will only count towards qualifying spend for welcome offers if they post under MCC 6513 (i.e. rental payments).

This then begs two questions:

- Is this simply an error?

- If it’s not an error, when does it take effect from?

(1) would be the ideal scenario, and I could see how this could happen. If you refer to the previous version of the T&Cs for the DBS Woman’s World Card, you’ll note on page 2 at point 2(ii) that payments made to CardUp, FavePay, ipaymy, SmoovPay and Fave eCard are excluded from 10X rewards.

That’s nothing new. The clause has been around for a long time now, if only to keep people from asking “CardUp is an online transaction no? Then where’s my 4 mpd?” Therefore, it’s not beyond the realm of possibility that when updating the T&Cs, someone mixed up their files and copied the wrong line over.

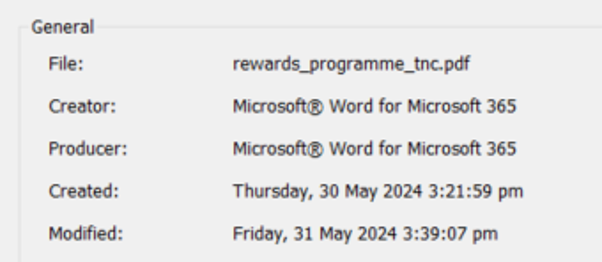

But if that turns out to be copium on my part, the question then becomes when the new T&Cs take effect. There’s nothing in the document that addresses this, but I can find some information in the PDF’s metadata, which shows a modification date of 31 May 2024.

So I’m guessing that if these changes are intentional and not a mistake, then they take effect from 1 June 2024.

Still, banks are supposed to provide a minimum of one month’s notice before making changes to their T&Cs, especially those which add new rewards exclusions. I may simply have missed it, but I don’t see any such notice on the DBS website, nor has it been mentioned in the MileChat (and trust me, nothing gets past that group). Needless to say, it’s very poor form if this is indeed a no-notice change.

I’ve sent some questions over to the DBS team, so let’s see what they have to say.

Exclusion categories are now defined by MCCs

Back in April, I noted that DBS had began updating its T&Cs to explicitly state which MCCs are excluded from welcome offer qualifying spend.

This has now been expanded to the DBS Rewards Programme T&Cs as well.

It’s a welcome, if long overdue move. Qualitative descriptions have the potential to create ambiguity (e.g. just how are you defining educational institutions?) and we should be aiming for less ambiguity, not more. A specific list of MCCs puts everything in black and white.

Thankfully, there’s no additional surprises here that I can spot.

Conclusion

The latest DBS Rewards Programme T&Cs explicitly excludes CardUp and ipaymy transactions from earning points, though this went live so quietly and suddenly that I can’t help but wonder whether it was intentional (“oh my sweet summer child”, I can just hear you saying).

If you have upcoming transactions with DBS cards on either of these platforms, I’d strongly advise holding off for now until we get greater clarity as to whether these changes are accurate, and if so, when they take effect from.

Stay tuned.

I downloaded the terms and conditions of DBS Vantage, then clicked to download the general DBS credit card terms and conditions linked there. No mention of CardUp and ipaymy.

Seems Google links to an older version of the Vantage terms and conditions. If you go to the actual DBS Vantage page on the DBS website, you will get the new version. Yes, no notice of this to card holders.

If this is correct then at the next annual fee my Vantage card goes in the bin. I only use it for CardUp.

+1, I would move all my cardup to UOB prvi miles (1.4mpd)

Can we still use pay+earn axs? Is it still valid? Thansk

following

Well if they do go ahead with this, then yes cancellation is gonna be the game

DBS has been nerfing and devaluing its rewards programme by taking reference to Delta. It’s hard to justify keeping any DBS cards besides the Yuu and Women’s. Poor form.

They reduced the 4mpd on woman’s card as well (from 2k to 1.5k per month)

Do you know if it also applies to RentHero? Thanks

DBS points are not awarded for tax payment – does this mean direct?

Is using CardUp still ok (as per the 2024 tax payment article)?

Using CardUp for tax payments is still okay.

So tax payment via CardUp still eligible for DBS points?

Yes.

Following keenly while readying application for other cc.

I think they have updated their tnc to correct it as of 4th June.. no more exclusion for cardup and ipaymy

Are tax payments under CardUp now excluded?

Still included.

‘“CardUp is an online transaction no? Then where’s my 4 mpd?” ‘

to cfm, there is no credit card that clocks 4mpd through cardup right?

I wrote to CardUp clarifying this issue. They reverted with the following email, which brings some peace to my heart. I wanted to upload the email screenshot for authenticity of the email but couldn’t see that option so pasting the email text:

Hi, I am confused. Does that mean that CARDUP transactions do not count towards welcome offers anymore (qualifying spend) OR does that mean that if I do tax, renovation payment via cardup I do not receive DBS points as well? Thanks

Is there a list of which cards still welcome cardup transactions that DBS excludes from their MCC list?

sorry to clarify. seems only the article title is updated with “Exclusion removed”.

does it mean ipaymy and cardup will cont to count towards elgible spend for min spending and also for rewards ?

Can check here: https://www.dbs.com.sg/iwov-resources/pdf/cards/rewards_programme_tnc.pdf

Looks like both ipaymy and cardup are good!