While Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles are probably the two most popular mileage programmes in Singapore, there’s a much bigger world out there.

Cardholders can transfer their points to 17 airline and five hotel loyalty programmes, or 25 airlines and eight hotels if we include HeyMax (which is a bit of a special case). It’s a far cry from the scene when I first started collecting miles more than 10 years ago!

But not all partners represent a good use of your points, and with so many to choose from, it’s easy to get overwhelmed. In this guide, I’ll explain the various transfer options available by bank, as well as some important things you should know.

| 💳 Credit Card FAQs |

| Managing Points |

| Conversions |

| Calculations |

Where can you transfer your credit card points?

The following table summarises the various airline and hotel loyalty programmes available to cardholders in Singapore.

HeyMax (21 airlines, 8 hotels) has the most partners. It’s technically not a card issuer, though you can earn 1 Max Mile per S$1 spent on the Chocolate Visa Debit Card. However, most cardholders will be capped at earning 1,000 miles per month, as spending beyond the first S$1,000 earns just 0.4 mpd.

Next up is HSBC (16 airlines, 4 hotels), which grew its portfolio exponentially with the launch of the TravelOne Card, before rolling it out to all cardholders. Next comes Citibank (10 airlines, 1 hotel), American Express (8 airlines, 2 hotels), and OCBC (6 airlines, 3 hotels).

Beyond that, the rest of the banks have rather limited options, mainly featuring Singapore Airlines KrisFlyer and Cathay Pacific Asia Miles.

Important things to know

Not all transfer ratios are the same

For the majority of banks in Singapore, all airlines share the same transfer ratios. Not only does this make things simpler, it also means you can take the headline earn rates at face value.

For example, when the Citi PremierMiles Card advertises 1.2 mpd on local spend, we know this applies regardless of which of the 10 airline partners you choose, since they all share the same transfer ratio.

But when the HSBC TravelOne Card advertises 1.2 mpd on local spend, we need to take a step back and ask “for which programme?” Depending on which mileage programme you transfer to, the actual earn rate could be anywhere from 0.6-1.2 mpd (for KrisFlyer, it’s actually 1 mpd)!

| Transfer Ratio (Points : Miles) |

HSBC T1 (SGD)* |

HSBC T1 (FCY)^ |

| 25,000 : 10,000 | 1.2 mpd | 2.4 mpd |

| 30,000 : 10,000 | 1 mpd | 2 mpd |

| 35,000 : 10,000 | 0.86 mpd | 1.71 mpd |

| 50,000 : 10,000 | 0.6 mpd | 1.2 mpd |

| *3 points per S$1 on SGD spend ^6 points per S$1 on FCY spend |

||

Here’s a summary of the arrangement for each bank.

| Same ratio for all airline partners* | Different ratios for different airline partners* |

|

|

| *Ignoring AirAsia rewards, which is more of a rebates scheme than a traditional frequent flyer programme | |

There are two banks where the ratios are not uniform across programmes: HSBC and OCBC.

HSBC

| ✈️ HSBC Airline Partners | |

| Mileage Programme | HSBC Points : Partner |

| 50,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 35,000 : 10,000 | |

| 30,000 : 10,000 |

|

|

30,000 : 10,000 |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 |

|

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

|

25,000 : 10,000 |

| 🏨 HSBC Hotel Partners | |

| Hotel Programme | HSBC Points : Partner |

|

30,000 : 10,000 |

| 25,000 : 5,000 | |

| 25,000 : 10,000 | |

| 25,000 : 10,000 | |

OCBC

| ✈️ OCBC Airline Partners | ||

| Mileage Programme | 90°N Miles & VOYAGE Miles : Partner | OCBC$ : Partner |

| 1:1 (VOYAGE) 1,000 : 1,000 (90°N) |

25,000 : 10,000 |

|

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 900 | 10,000 : 3,600 | |

| 1,000 : 750 | 10,000 : 2,900 | |

| 1,000 : 700 | 10,000 : 2,800 | |

| 🏨 OCBC Hotel Partners | ||

| Hotel Programme | 90°N Miles & VOYAGE Miles : Partner | OCBC$ : Partner |

| 1,000 : 500 | 10,000 : 2,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

| 1,000 : 1,000 | 10,000 : 4,000 | |

Minimum transfer amounts may be different

Even if a bank has the same transfer ratio for all partners, the minimum transfer amount may vary depending on partner.

| Same minimum for all airline partners* | Different minimum for different airline partners* |

|

|

| *Ignoring Air Asia rewards, which is more of a rebates scheme than a traditional frequent flyer programme ^2 mile blocks after the first 10,000 miles |

|

There are two banks where the minimum transfer amounts differ across programmes: Maybank and OCBC.

| Bank | Minimum Transfer Amounts |

|

| Maybank |

|

|

| Bank | 90°N Miles & VOYAGE Miles | OCBC$ |

| OCBC |

|

|

Look for sweet spots

At the risk of stating the obvious, 1 KrisFlyer mile is not the same as 1 Asia Mile, and 1 Asia Mile is not the same as 1 Qatar Avios etc. etc. Think of them as different currencies, each with their own rules, redemption partners, and award pricing.

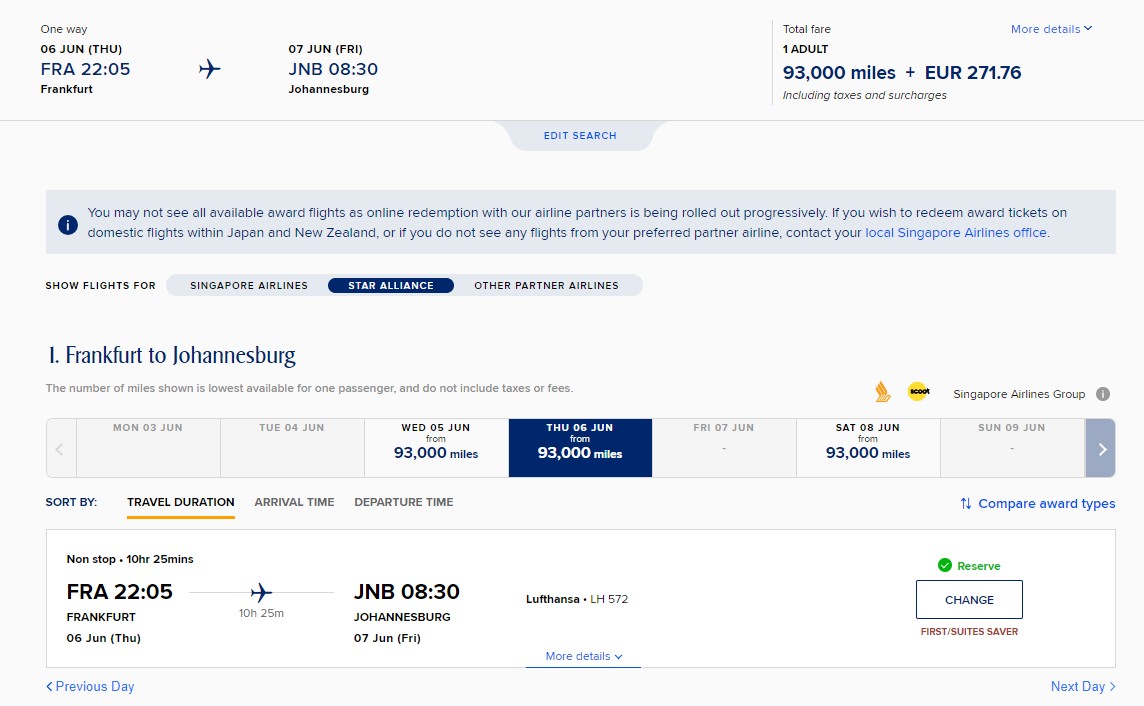

These differences give rise to what we call “sweet spots”, routes where the price with one particular frequent flyer programme is much lower than others.

For example, suppose I want to fly from Singapore to Bangkok in Business Class on Singapore Airlines. I could redeem this flight through:

| Programme | Miles Required (one-way Business Class) |

| Air Canada Aeroplan | 20,000 miles |

| THAI | 20,000 miles |

| KrisFlyer | 24,000 miles |

| EVA Air | 27,500 miles |

| United MileagePlus | 45,000 miles |

| Turkish Miles&Smiles | 50,000 miles |

Note how the cost ranges from 20,000 to 50,000 miles, though you get exactly the same flight. To the extent that your credit card points can be converted at the same ratio to all programmes, of course you’d pick the one with the lowest redemption costs!

| ⚠️ Important Note |

|

One assumption we’re making here is that the airline does not add fuel surcharges to its tickets. If it does, then you need to consider whether the frequent flyer programme absorbs them or passes them on. For example, if FFP A absorbs fuel surcharges but FFP B does not, then FFP A may be the better choice even if it charges more miles than FFP B. The exact trade-off depends on your relative valuation of miles for FFP A/B. American Airlines AAdvantage, Air Canada Aeroplan, Alaska Mileage Plan, Avianca LifeMiles and United MileagePlus do not pass on fuel surcharges. Unfortunately, these programmes are either unavailable via credit cards in Singapore, or have very poor transfer ratios. |

It’s beyond the scope of this article to highlight all the sweet spots out there, suffice to say that understanding and finding these are key to stretching your miles.

To add further complexity, a sweet spot can be offset by a poor transfer ratio. Going back to our previous example, Air Canada Aeroplan may require fewer miles for the Singapore to Bangkok award, but transfers take place at a rate of 35,000 points = 10,000 miles, versus 25,000 points = 10,000 miles for other partners. Once you’ve adjusted for that, the sweet spot might not be so attractive anymore!

British Airways Club and Qatar Privilege Club are effectively the same

|

|

Both British Airways and Qatar Airways use Avios as their frequent flyer currency. Members can make free, instant 1:1 conversions between programmes.

Therefore, if a bank offers British Airways Club, it effectively offers Qatar Airways Privilege Club (and vice versa). Take note of this if you have a HSBC card, as it’d be silly to transfer points to Qatar Privilege Club at a 3.5:1 ratio when you could do it via British Airways Club at a 2.5:1 ratio!

Which alliance is the airline part of?

The benefit of transferring miles to a frequent flyer programme that’s part of an alliance is the ability to redeem them for flights on any member airline. For example, Asia Miles can be used not just for Cathay Pacific flights, but for flights on oneworld partners like American Airlines and Qatar Airways.

| ❓ Where do I redeem my miles? |

| The correct website to visit depends on which miles currency you’re using to redeem. For example, if I have KrisFlyer miles and want to redeem a flight on ANA, I visit the KrisFlyer website, not the ANA website. |

Here’s a rundown of the three major airline alliances and their members.

|

|

| Star Alliance | |

|

|

|

|

| oneworld | |

|

|

|

|

| SkyTeam | |

|

|

But there’s more than just the three main alliances. Frequent flyer programmes can also have non-alliance partners, where agreements are worked out bilaterally. For example, KrisFlyer members can also redeem miles for Alaska Airlines, Malaysia Airlines, Garudan Indonesia, Virgin Atlantic, and Virgin Australia, despite the fact that none of them are part of Star Alliance.

| FFP | Non-Alliance Partners |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Do note that partner awards may only be available on selected routes. For example, Asia Miles allows redemptions on SWISS, but only for flights between Zurich and Berlin, Brussels, Florence, Geneva, Hamburg, Hong Kong, Stuttgart, and Venice.

Moreover, you may not be able to book all partner awards online, so if you don’t see what you want on the website, try calling up customer service.

Check the respective websites for the full details and restrictions.

A word about fuel surcharges

Fuel surcharges are basically junk fees that airlines tack onto award tickets, in an attempt to squeeze some additional cash out of members. It’s an absurd concept if you think about it, kind of like going to a restaurant and having to pay an “ingredient surcharge”.

The good news is that Singapore Airlines no longer imposes fuel surcharges, ever since March 2017. The bad news is that KrisFlyer will continue to pass them on wherever applicable, and these can be substantial on carriers like Lufthansa.

Unfortunately, most mileage programmes will pass on fuel surcharges, with the exception of American Airlines AAdvantage, Air Canada Aeroplan, Alaska Mileage Plan, Avianca LifeMiles and United MileagePlus.

Qatar Privilege Club does not charge fuel surcharges for Qatar Airways flights, but has an “award segment fee” that costs US$180 to US$250 per segment in Business Class- just as bad as a fuel surcharge if you ask me.

All you can do in that case is focus on redemptions on airlines with modest or no fuel surcharges, such as Finnair, Qantas (excluding departures from Europe) or United, or originate from countries that ban or regulate fuel surcharges such as:

- Australia

- Brazil

- Hong Kong

- New Zealand

- Philippines

- South Korea

- Taiwan

- Thailand

- Turkey

- Vietnam

Flights originating from these countries should have considerably lower fuel surcharges.

What about hotels?

You may have noticed that I haven’t addressed hotel loyalty programmes at all in this post. There’s a reason for that: it almost never makes sense to convert credit card points to hotel programmes.

For example, suppose you’re a Citi cardholder with 25,000 ThankYou points. You could convert that to 10,000 KrisFlyer miles, or 10,000 IHG points. I personally value a KrisFlyer mile at 1.5 cents, and an IHG point at 0.67 cents (since you can easily buy them at 0.5 cents when they go on sale). Therefore, by choosing the IHG points, you’re taking a haircut of more than 50%!

Fundamentally, the problem can be summarised this way:

- On a 1:1 basis, most hotel points are worth less than airline miles

- Most banks in Singapore offer the same conversion ratios to hotel points as airline miles

There have been some cases when I converted credit card points to hotel programmes, but they were almost always exceptional. For example, I cashed out my entire StanChart X Card welcome bonus on Accor Live Limitless points, because of an excellent 100% transfer bonus offered at the start of COVID (giving me the equivalent of 3 cents per mile). Likewise, back in 2018 American Express offered a transfer bonus of 3 Hilton points per MR point, which was clearly an error. It was still honored, however.

If you really want hotel points, you’re better off buying them when they go on sale.

| Chain | Typical Price During Sale |

| Hilton | 0.5 US cents (100% bonus) |

| IHG One Rewards | 0.5 US cents (100% bonus) |

| Marriott Bonvoy | 0.89 US cents (40% bonus) |

| World of Hyatt | 1.8 US cents (25% discount) |

Conclusion

KrisFlyer and Asia Miles are useful programmes, but you shouldn’t limit your horizons to just these two. Over the past few years we’ve seen banks adding more and more “exotic” partners to their rosters, which can open up great redemption opportunities.

Before you decide on yet another KrisFlyer or Asia Miles transfer, think about where you want to go, which programme offers best value for that particular route, transfer bonus opportunities, as well as alliance and non-alliance partners. It’s not always a straightforward exercise, but can be the difference between taking one free trip or several!

Which programmes do you usually transfer your credit card points to?

Hello Aaron, how do you value 1 Asia Miles?

Don’t forget how each programme treats lap infants.

Maybe can come out with an article for sweet spot to destination that are popular and originate from SIN?