While the digital banking trinity of GXS, MariBank and Trust have been taking deposits for some time now, they’ve been considerably slower in branching out into the credit card space.

Of the three, Trust was the only one to offer a credit card at the time of launch– though that was as much down to the fact that it was the only digital bank with a full bank license. GXS customers had to make do with a debit card (whose biggest accomplishment to date is hastening the demise of the GrabPay Card), while MariBank customers have had to…wait patiently and hope that the team was actually working on something more than vapour.

Well, MariBank has now unveiled the imaginatively-named Mari Credit Card, which it claims is Singapore’s “highest unlimited cashback card” with 5% rebates at Shopee, and 1.7% cashback everywhere else.

I may not be the best person to comment on the virtues and vices of a cashback card, but seeing as how I’ve run out of things to write about, here’s my take on the Shopee Mari Credit Card (and if it gives you palpitations that I’m devoting precious column space to cashback, you might not want to rummage around the archives, where similar missives on the AMEX True Cashback Card, DBS yuu, HSBC Live+, OCBC Infinity, Trust Card, UOB EVOL, and UOB Absolute are lurking).

Details: Mari Credit Card

Mari Credit Card Mari Credit Card |

|||

| Card T&Cs | |||

| Income Req. | S$30,000 p.a. | Earn Rate | 5% Shopee Coins on Shopee, 1.7% cashback elsewhere |

| Annual Fee |

None | FCY Fee | 3% |

The new Mari Credit Card has a minimum income requirement of S$30,000 per annum, and no annual fee. At the moment, the card is available on an invite-only basis. If you’re eligible to apply, you’ll see a widget on the home page of your MariBank app.

The card’s design is, um, let’s just say I hope they didn’t pay someone a lot of money for this. It looks like something made in MS Paint, and come to think of it, there’s some serious Joker energy going on here. I can’t look at it and not think of this:

Given the less-than-appealing aesthetic, it’s probably good news that the MariCard is, by default, a digital card. You can get a free physical card if you enjoy being an affront to good taste, but you’ll need to place an order via the MariBank app.

The Mari Credit Card currently does not have a debit card mode, and as such does not support ATM withdrawals either in Singapore or overseas. That’s a shame, because one way MariBank could take the fight to Trust is by offering no-fee ATM withdrawals overseas, useful in countries where cash is king.

In terms of rewards, the Mari Credit Card earns:

- 5% rebates (in the form of Shopee Coins) on Shopee transactions

- 1.7% cashback on everything else

Let’s look at each of these in turn.

5% rebates on Shopee

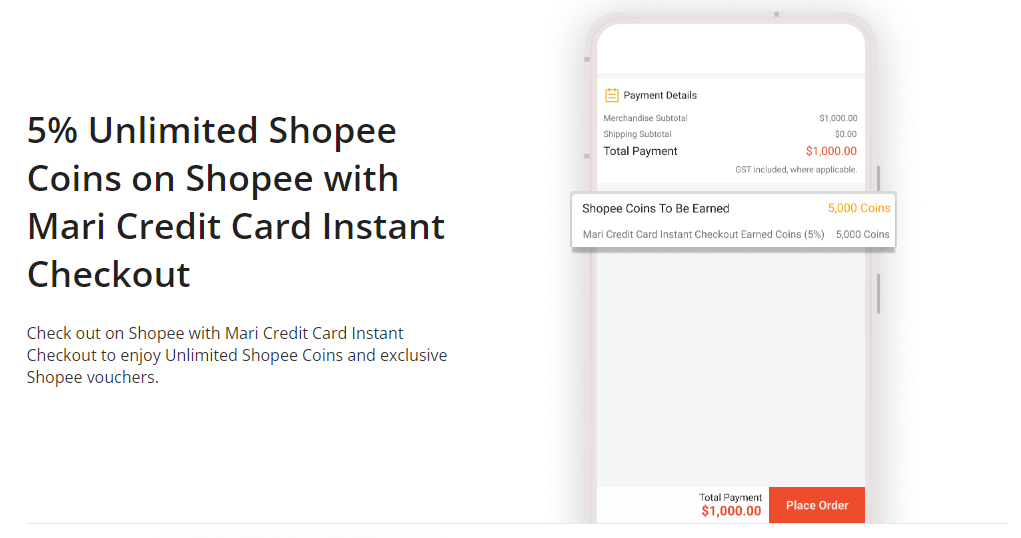

Mari Credit Cardholders will earn the equivalent of a 5% rebate on all Shopee transactions (excluding products under the Digital Products catalogue), in the form of Shopee Coins. No minimum spend is required, and there’s no cap on the maximum rebate that can be earned.

To receive this reward, they must use Mari Credit Card Instant Checkout and select the Pay In Full option on Shopee. If they choose to pay via instalments, Google Pay or Apple Pay, they will not receive the 5% rebate.

If a cardholder uses Google Pay/Apple Pay, manually enters the number of their Mari Credit Card, or selects a Mari Credit Card stored under the credit/debit card tab to make the purchase, they’ll earn a lower reward of 1.7% cashback (see the next section). The whole idea is that MariBank wants to avoid the interchange they’d have to pay if the transaction were processed via the Mastercard network.

In my opinion, a 5% rebate on Shopee probably won’t beat the 4 mpd you can earn with miles cards (unless your valuation of a mile is below 1.25 cents), or the 8% you can earn with the HSBC Live+ Card (albeit with a minimum spend requirement). However, that picture could change if Shopee chooses to offer special promo codes to Mari Credit Cardholders, the way they do for those who pay with their MariBank account.

It’s worth remembering that Shopee Coins are a captive currency only good within the Shopee ecosystem, and can’t be compared to cashback on a 1:1 basis as such. But given how ubiquitous Shopee has become to everyday life, you should be able to find something to spend them on.

This 5% rebate is positioned as a limited-time promotion, and is currently set to end on 30 September 2024. You can find the T&Cs for this promotion here.

When is this credited?

Shopee Coins will be credited once your order is completed, i.e. when you confirm via the Shopee app that the good you purchased have been received or when the payment is released to the Shopee seller.

Shopee Coins expire at the end of the third month after they were earned. For example, coins earned from 1-30 June 2024 expire on 31 August 2024. You’ll have anywhere from 2-3 months to use them, so don’t wait too long.

As a reminder, 100 Shopee Coins = S$1.

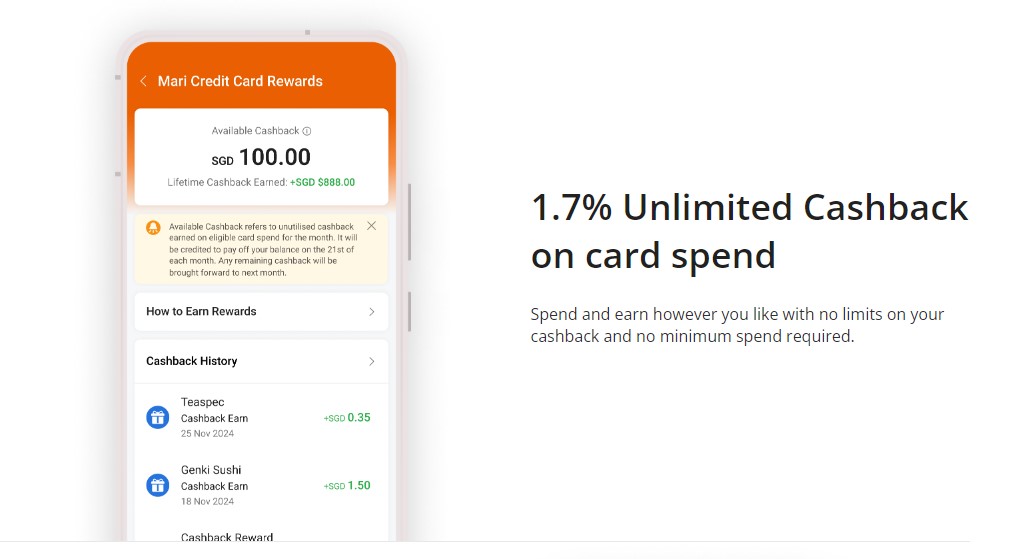

1.7% cashback everywhere else

Outside of Shopee, Mari Credit Cardholders will earn a flat 1.7% cashback on all other spend, whether local or overseas (you don’t want to be using this for the latter- more on that in a bit).

MariBank calls this the “highest unlimited cashback card”, and they’re technically correct, though in the neighbourhood are the DCS Ultimate Platinum Card (2% cashback, but capped at S$200 per month- not nearly enough for a Kate Spade bag) and the UOB Absolute Card (1.7% cashback, but less widely accepted on account of being an AMEX).

Here’s how 1.7% cashback measures up to the competition.

| 💳 General Spending Cashback Cards (without minimum spends) |

||

| Annual Fee | Cashback* | |

DCS Ultimate Platinum Card DCS Ultimate Platinum CardApply |

S$196.20 (FYF) |

2% (capped at S$200 per month) |

Mari Credit Card Mari Credit Card |

N/A | 1.7% |

UOB Absolute Cashback UOB Absolute CashbackApply |

S$196.20 (FYF) |

1.7% |

BOC Visa Infinite BOC Visa InfiniteApply |

S$381.50 (FYF) |

1.6% |

Citi Cash Back+ Card Citi Cash Back+ CardApply |

S$196.20 (FYF) |

1.6% |

OCBC Infinity Cashback OCBC Infinity CashbackApply |

S$196.20 (FYF) |

1.6% |

ICBC Chinese Zodiac Card ICBC Chinese Zodiac CardApply |

S$150 (F3YF) |

1.6% |

Maybank FC Barcelona Card Maybank FC Barcelona CardApply |

S$130.80 (F2YF) |

1.6% |

AMEX True Cashback Card AMEX True Cashback CardApply |

S$174.40 (FYF) |

1.5% |

SC Simply Cash Card SC Simply Cash CardApply |

S$196.20 (FYF) |

1.5% |

| FYF= First Year Free, F2YF= First 2 Years Free, F3YF= First 3 Years Free *For local SGD transactions |

||

1.7% unlimited cashback combined with the near universal acceptance of Mastercard strongly positions the Mari Credit Card, though I’m not sure how much of a difference an incremental 0.1-0.2% makes in practice (if you spent S$10,000 on your card over a year, you’d only be S$10-20 better off). I guess it’s psychological, if nothing else. Given the low cost of switching between cashback cards, why wouldn’t you take 1.7% cashback over 1.6% or 1.5% ?

For avoidance of doubt, this 1.7% cashback does not stack with the 5% Shopee coin rebates on Shopee. You’ll earn one or the other, depending on your payment method.

When is this credited?

All cashback earned will be reflected on the MariBank app within five business days of completing the transaction, and will be automatically utilised to offset your outstanding due amount in the following statement cycle.

Cashback cannot be withdrawn to your MariBank account.

3.77% FCY fee? Really?

| Update: Maribank will reduce the FCY fee to 3% with effect from 23 August 2024 |

I’ve always found it remarkable that in a market with more and more alternatives for overseas spending like Amaze, Revolut, Trust and YouTrip, banks are insistent on pushing their foreign currency (FCY) transaction fees higher and higher.

Five years ago, the average FCY fee was around 2.5-2.8%. Today, it’s 3.25% across most banks, with Standard Chartered the “market leader” at 3.5%.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| MariBank | 3.77% | N/A |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Not anymore. They’ve now been dethroned by the Mari Credit Card, which ups the stakes to a whopping 3.77%.

All foreign currency transactions (including overseas and online transactions) charged to the Card will be subject to: (i) a prevailing charge of 1% of the converted Singapore Dollar amount representing the charge imposed by MasterCard on the transaction; and (ii) a prevailing fee of 2.77% of the converted Singapore Dollars amount.

-T&Cs

Now, there’s absolutely no reason why you should be using a general spending cashback card for overseas spend in the first place. Even with the industry-standard 3.25% FCY fee, you’d still be on the losing end with 1.5-1.7% cashback.

But unfortunately, there’s bound to be someone who misses the memo and starts waving their Mari Credit Card around when on holiday. It’s your job to (1) warn them and (2) disown them if they don’t listen.

Given how Trust and GXS are trying to position their cards as zero FCY options for overseas spend, it’s surprising how MariBank is going in the opposite direction- and then some. Where they found the stones to do 3.77%, I’d certainly like to know.

Rewards exclusions

The Mari Credit Card’s rewards exclusion list reads like any other bank’s. You can expect the standard exclusion clauses, such as charitable donations, education, insurance premiums, hospitals, prepaid account top-ups (including ShopeePay, incidentally), and utilities.

Amaze transactions are also excluded from earning cashback, though given Amaze’s implicit FCY fee of ~2%, there’s no reason why you’d pair it with the Mari Credit Card in the first place.

The full list of exclusions can be found below.

Exclusions

(a) any top-up or payment of funds to payment service providers, prepaid cards, any prepaid accounts or purchase of prepaid cards/credits, including but not limited to GrabPay, YouTrip, ShopeePay, Singtel Dash, Razer Pay, NETS Flashpay, EZ-Link, and Transit Link);

(b) instalment payment plan purchases, preferred payment plans, balance transfer, fund transfer, cash advances, annual fees, interest, late payment charges, all fees charged by MariBank, miscellaneous charges imposed by MariBank (unless otherwise stated in writing by MariBank);

(c) any transaction with the transaction description “AMAZE”;

(d) any transaction related to cryptocurrencies;

(e) payments made via AXS, SAM and eNets;

(f) any transaction classified under one or more of the following Merchant Category

Code

| Merchant Category Code |

Category | |

| 4784 | Tolls and Bridge Fees | |

| 4829 | Wire Transfer Money Orders | |

| 4900 | Utilities – Electric, Gas, Water, and Sanitary | |

| 5047 | Certain Medical Equipment And Supplies | |

| 5199 | Nondurable Goods Not Elsewhere Classified | |

| 5960 | Direct Marketing – Insurance Services | |

| 6010 | Financial Institutions – Manual Cash Disbursements | |

| 6011 | Financial Institutions – Manual Cash Disbursements | |

| 6012 | Financial Institutions – Merchandises, Services, And Debt Repayment |

|

| 6050 | Quasi Cash – Financial Institutions, Merchandise, Services | |

| 6051 | Non-Financial Institutions – Foreign Currency, Money Orders, Stored Value Card/Load, Travelers Cheques, And Debt Repayment |

|

| 6211 | Securities – Brokers And Dealers | |

| 6300 | Insurance Sales, Underwriting And Premiums | |

| 6513 | Real Estate Agents And Managers – Rentals | |

| 6529 | Quasi Cash – Remote Stored Value Load – Financial Institute | |

| 6530 | Quasi Cash – Remote Stored Value Load – Merchant | |

| 6534 | Quasi Cash – Money Transfer – Member Financial Institution | |

| 6540 | Non-Financial Institutions – Stored Value Card Purchase/Load | |

| 7349 | Cleaning And Maintenance, Janitorial Services | |

| 7511 | Quasi Cash – Truck Stop Transactions | |

| 7523 | Parking Lots, Parking Meters And Garages | |

| 7995 | Betting, Including Lottery Tickets, Casino Gaming Chips, Off-Track Betting, And Wager At Race Tracks |

|

| 8062 | Hospitals | |

| 8211 | Elementary And Secondary Schools | |

| 8220 | Colleges, Junior Colleges, Universities, And Professional Schools | |

| 8241 | Correspondence Schools | |

| 8244 | Business And Secretarial Schools | |

| 8249 | Vocational And Trade Schools | |

| 8299 | Schools And Educational Services Not Elsewhere Classified | |

| 8398 | Charitable And Social Service Organizations | |

| 8651 | Political Organizations | |

| 8661 | Religious Organizations | |

| 8699 | Membership Organizations (Not Elsewhere Classified) For example – art clubs, historical clubs, labor unions | |

| 9211 | Court Costs Including Alimony And Child Support | |

| 9222 | Fines | |

| 9223 | Bail And Bond Payments | |

| 9311 | Tax Payments | |

| 9399 | Government Service Not Elsewhere Classified | |

| 9402 | Postal Services – Government Only | |

| 9405 | U.S. Federal Government Agencies Or Departments | |

| 9754 | Quasi Cash – Gambling – Horse Racing, Dog Racing, State Lotteries | |

Conclusion

The Mari Credit Card is now open for applications, offering 5% rebates at Shopee and 1.7% cashback on everything else. Unlike the yuu Card, however, these rebates aren’t high enough for a committed miles chaser to switch camps, and what’s more, the 5% Shopee rebate is till the end of September 2024 only.

But if cashback is all you care about, then a 1.7% cashback rate with Mastercard acceptance is compelling enough- though my first port of call would still be the DCS Ultimate Platinum Mastercard for 2% cashback on up to S$10,000 of spend each month.

Will you be using the Mari Credit Card?

OCBC INFINITY missing from the lineup?

Does Mari cashback exclude telco bills? The T&Cs weren’t so clear on that.

Yes, I use it to get cashback every month from Myrepublic bills.

I’m wondering whether the Shopee Instant Checkout plays nice with ShopBack, assuming I add the Mari card as a linked card in ShopBack. 🤔

The thought process for the FCY fee –

“We need 2.07 percent to make money”

“Eh, but we giving 1.7 percent Cashback leh”

“Oh. Liddat… We make the fee 3.7 lor! Ez”

Oh I love it when Aaron talks cashback….such snarky wits and oh soo taboooo

excerpt from his evol article “because millennials have short attention spans and often can’t complete a sentence without forgetting how it avocado”

Thanks for this article. I was looking forward to it when the Mari CC came out a few days ago. I agree with you that this is not a card you want to use for foreign buys. I have no idea how they can get away with a combined 3.77% charge rate. If I was a Shopee shareholder I might be happy to hear this on top of everything else. Outside of that, it is a nice easy maintenance card, ok as a backup card for SG use, but if you have better miles or DCS card, you may want… Read more »

i love this card

On 29 September 2024 I had applied a mari credit card

At 5 October 2024 I had saw $100 off for every $101 spend for new applications for mari credit card start from 9 October 2024 at 2000 hrs

On 9 october 2024 approx 1959hrs to 2000 hrs I brought something worth around $300 and expect only pay $200 at the end the voucher had fully redeemed at 2000 hrs

This mean there is not such thing of $100 for every $101 spend