Maybank has launched a new spend and redeem promotion, which offers an American Tourister luggage, or Samsonite luggage and an Accor Plus Explorer membership to cardholders who spend at least S$3,000 on travel and foreign currency (FCY) bookings between now and 31 October 2024.

While the gifts aren’t guaranteed, it’s still worth registering just in case, since you’re likely to be using the Maybank Horizon Visa Signature anyway if you’re spending the amounts required for this offer.

That’s all the more since Maybank has a very generous definition of eligible spending, even covering charitable donations, education and utilities– the type of transactions that other banks have long ago excluded.

Maybank Cards spend and redeem promotion

|

| Promo Details |

From 1 September to 31 October 2024, registered Maybank cardholders will receive the following gifts when they meet a minimum spend of S$3,000 or S$8,000.

| Spend Tier | Gift | Quantity |

| S$3,000 and above | American Tourister LINEX Spinner 24″ | 800 |

| S$8,000 and above | Samsonite ORFEO Spinner 25″ and Accor Plus Explorer Membership | 150 |

For avoidance of doubt, you can only receive a maximum of one gift from this promotion, so it’s either the S$3,000 or S$8,000 tier gift.

The minimum spend must be made on travel bookings and/or FCY transactions, defined as the following.

| Category | Definition |

| Travel bookings |

|

| FCY spending |

|

| *Maybank explicitly excludes some travel agencies, which can be found in point 14 of the T&Cs |

|

This would cover all your major airlines, hotel chains, car rental companies, as well as Airbnb, Klook and Pelago (though I’d only recommend using your Maybank Horizon Visa Signature for air tickets, or FCY spending since those are its bonus categories).

If you’re ever in doubt about the MCC, remember that there’s three easy ways of checking it before making a transaction.

| Method | Ease of Use | Reliability |

| ❓HeyMax | ●●● | ● |

| 📱 Instarem app | ●● | ●● |

| 🤖 DBS digibot | ● |

●●● |

Now, some of you will look at the “first X” cap and shake your heads, and though it’s true that there’s no guarantee you’ll get a gift, the way I see it is that you’ll probably be using your Maybank Horizon Visa Signature for big-ticket travel bookings or FCY spend anyway.

While there are 4 mpd-earning alternatives available, such as the UOB Visa Signature or the UOB Lady’s Cards, these all have bonus caps of S$2,000 or less per month, and earn just 0.4 mpd after that.

In contrast, the Maybank Horizon Visa Signature cardholders who spend at least S$800 in a calendar month earn:

- An uncapped 2.8 mpd on FCY spend

- 2.8 mpd on air ticket spend, capped at S$10,000 per month

If you’re spending S$3,000 or even S$8,000, then it’s possible you may have already bust the caps on your 4 mpd cards, in which case the Maybank Horizon Visa Signature is one of the best options for uncapped general FCY spending.

| 💳 FCY Earn Rates by Card (For general spending cards with uncapped earn rates only) |

||

| Card | Earn Rate | Remarks |

StanChart Visa Infinite StanChart Visa InfiniteApply |

3 mpd | Min. S$2K spend per s. month Review |

Maybank Horizon Maybank HorizonApply |

2.8 mpd | Min. S$800 spend per c. month Review |

UOB PRVI Miles UOB PRVI MilesApply |

2.4 mpd | Review |

HSBC TravelOne HSBC TravelOneApply |

2.4 mpd | Review |

OCBC VOYAGE (Premier, PPC, BOS) OCBC VOYAGE (Premier, PPC, BOS)Apply |

2.3 mpd | Review |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

2.24 mpd | |

DBS Vantage DBS VantageApply |

2.2 mpd | Review |

OCBC VOYAGE OCBC VOYAGEApply |

2.2 mpd | Review |

OCBC 90°N Card OCBC 90°N CardApply |

2.1 mpd | Review |

| All other options earn 2 mpd or less | ||

It’s true that the StanChart Visa Infinite slightly edges it with an uncapped 3 mpd on FCY spend, but this:

- Has a higher FCY fee of 3.5% (compared to 3.25% for Maybank)

- Requires a higher minimum spend of S$2,000 per statement month (compared to S$800 for Maybank)

- Has an income requirement of S$150,000 (compared to Maybank’s S$30,000)

- Has a non-waivable annual fee of S$594 (compared to Maybank with the first three years free)

Besides, the Maybank Horizon Visa Signature still offers 2.8 mpd for FCY spend on charitable donations, education and utilities. That in itself is the X-factor, since almost every other card has long excluded these transactions.

So in that sense, the possibility of getting an extra luggage or Accor Plus Explorer membership is just the icing on the top, and you might as well register to give yourself a shot. I see it as a lucky draw more than anything else.

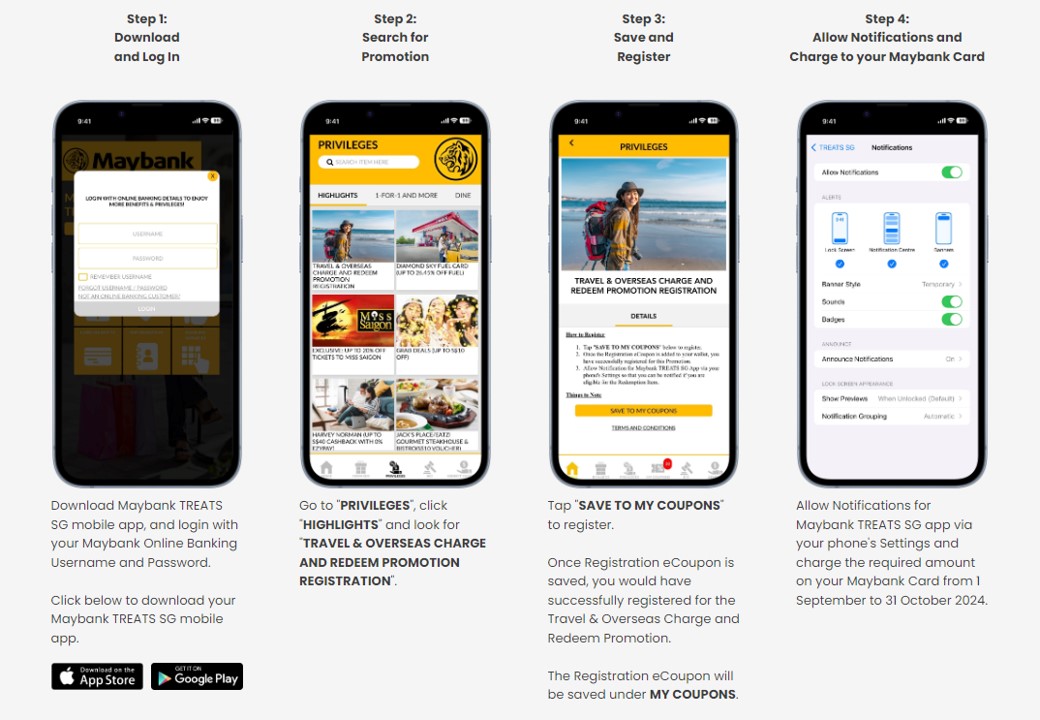

How to register

Registration is required, and can be done via the Maybank TREATS app.

Go to Privileges > Highlights > Travel & Overseas Charge and Redeem Promotion Registration > Save to My Coupons, and you’re done.

Detailed instructions can be found in the screenshot below.

When are gifts awarded?

I’m quite pleased by how fast Maybank is with fulfilling these promotions (my welcome gift was awarded within five days of meeting the minimum spend), and this one is similarly snappy.

Cardmembers who are eligible to receive the gifts will be informed via the TREATS mobile app, and receive an eCoupon for redemption by 30 November 2024.

Terms & Conditions

The T&Cs for this offer can be found here.

Overview: Maybank Horizon Visa Signature

|

|||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 months |

| Annual Fee | S$192.60 (3 yrs free) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 0.4 mpd | Points Pool? | Yes |

| FCY Earn | 2.8 mpd |

Lounge Access? | No |

| Special Earn | 1.2 mpd on selected local spend 2.8 mpd on air tickets |

Airport Limo? | No |

| Cardholder Terms and Conditions | |||

The Maybank Horizon Visa Signature has a minimum income requirement of S$30,000, and offers a three year waiver of its S$192.60 annual fee.

Where this card excels is for air ticket and FCY spending, where cardholders can earn up to 2.8 mpd (capped at S$10,000 per month for air tickets, and uncapped for FCY spending) subject to a minimum spend of S$800 per calendar month.

For more on this card, refer to my detailed review below.

Conclusion

Maybank has launched a new spend and redeem promotion for cardholders who make travel bookings and FCY spend between now and 31 October 2024.

To the extent that you’d be using your Maybank Horizon Visa Signature card for these transactions anyway, you might as well register and see whether you get a nice surprise in November.

(HT: Matthew)

Can I ask if someone already have the Accor Plus Explorer membership from DBS Vantage card, how will this stack on with the existing membership? Or have to register with a new email address?

Because there is an expiry date (usually 1 month from date of receipt of the code) to register, you will have to register a new email. It doesn’t stack.

Yes it doesn’t stack. I have both the Vantage and Amex HF, you need 2 emails for each Accor account.

Agree it is something extra but not compelling enough to choose over say a 4 or 5 mpd card (current dbs travel promo) or even a 3 mpd sia krisflyer card that has uncap limits. Don’t we all have enough luggages to last for 3- 5 years and the accor plus membership is over rated with redemption options hard to realise for 4/5 star hotels.

Luggage bag is already flooding the market and not easy to get rid of even with half the suggested price. The target is not hard to hit anyway with the hotel point purchase or airline mile purchase all in USD. But the real question is whether it is worthwhile.

Ugh. The trouble with Maybank is its insistence that I cannot use my mobile the way I want to (Android developer functions). To use the annoying Maybank apps I have to disable developer then restart then use the Maybank app then re-enable developer…no other bank has this issue and since Maybank doesn’t pay me for my mobile I have cashed out all my points.

I actually do have FCY spend coming up – but frankly its going on UOB Privi because I can no longer be bothered with Maybank.

can stack with luggage from official page? spend $1300 for first two months?