Last month, I revealed that Scoot was planning to reintroduce payment processing fees, five years after eliminating them with much fanfare. According to my sources, the airline had been considering this move for some time already, and was just waiting for the right moment to pull the trigger.

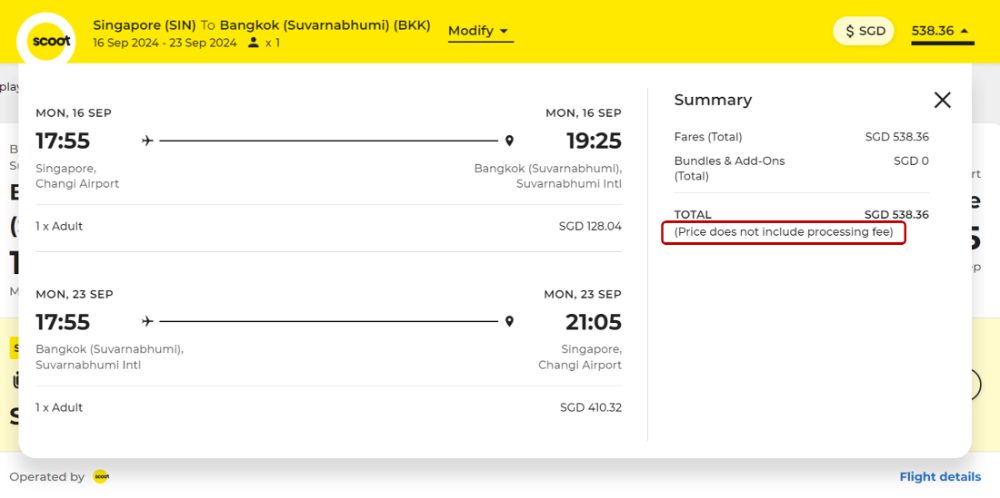

Mind you, there have already been hints of this happening. In August, a note mentioning a processing fee began to appear in all booking dialogues on Scoot’s website, and Scoot webpages referring to the removal of processing fees began to be taken down.

Scoot declined to comment on the matter at the time, but now the cat’s out of the bag and there’s good news and bad news.

The good news is that flights departing from Singapore have dodged the bullet- for now. The bad news is that flights departing from Australia, Japan, Taiwan and Thailand will now be subject to a payment processing fee of up to 2.48%, effective immediately.

Scoot restores payment processing fees

From 18 September 2024, Scoot customers booking flights originating from Australia, Japan, Taiwan and Thailand will be subject to a processing fee for the following payment methods, ranging from 1.05% to 2.48%.

| Card Type | Payment Processing Fee (per transaction) |

| Visa and Mastercard | Between 1.05% to 2.48% |

| American Express | 1.93% |

| Japan Credit Bureau (JCB) | 1.81% |

| UnionPay | 1.40% |

American Express, JCB and UnionPay fees are fixed regardless of point of departure. Visa and Mastercard fees vary depending on country, but based on my checking I can confirm the fees are structured as follows.

| Visa | MC | |

| 🇦🇺 Australia | 1.05% | 1.05% |

| 🇯🇵 Japan | 2.37% | 2.37% |

| 🇹🇼 Taiwan | 2.48% | 2.48% |

| 🇹🇭 Thailand | 2.16% | 2.16% |

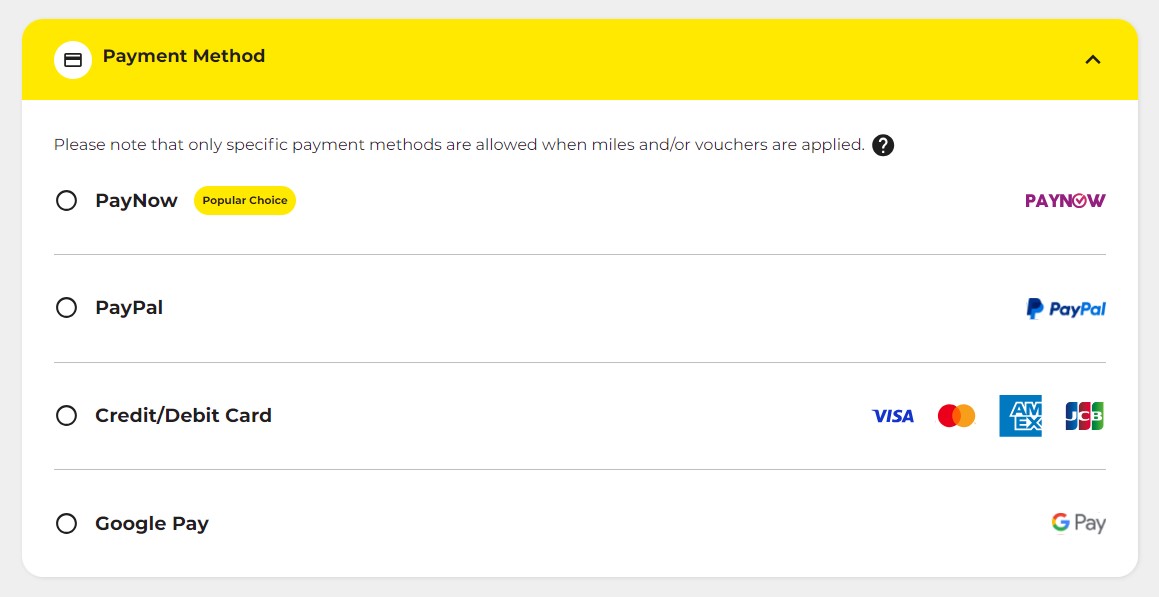

Apple Pay, Google Pay and PayPal are not subject to this fee yet, but I understand that this is only a temporary reprieve, and fees are coming to these methods in the near future.

Eventually, the plan is that the only fee-free payment options will be:

- Bookings paid entirely with Scoot vouchers

- Bookings paid entirely with KrisFlyer miles

- Local PayNow-type solutions like PromptPay

It’s no secret that Scoot has always been trying to nudge passengers towards these methods, given the lower costs they incur. For example, even before this announcement Scoot was already labelling PayNow and PromptPay as a “popular choice”, whatever that means.

Travellers departing from Singapore will not incur payment processing fees for now, but keep in mind that if you purchase a one-way ticket to Singapore from these countries (maybe you’re redeeming miles for the outbound leg, or flying with a different carrier), you will be affected.

If you’re a reader in Australia, Japan, Taiwan or Thailand, one way of minimising the fee would be to break up to your trip into two separate one-way bookings, so you only incur the fee on the outbound ticket. Of course, this assumes that the price of two separate one-way bookings is comparable to a round-trip, so be sure to check this.

All payment processing fees are non-refundable, but in any case Scoot fares are almost always non-refundable except in situations of medical emergencies, bereavement, or a schedule change of more than two hours. It’s unclear what happens to payment processing fees in those scenarios.

Why reintroduce payment processing fees?

Let’s turn the clocks back to September 2019, when Scoot removed its payment processing fees worldwide. I distinctly remember reading a press release about this, but even though it still shows up on Google…

…Scoot has attempted to scrub it from existence.

Nice try, but the internet never forgets.

The evolution of payment systems over the years, driven by technological improvements, has helped to significantly defray the associated costs required to support and maintain the payment infrastructure.

…

Mr Lee Lik Hsin, Scoot’s Chief Executive Officer, said, “When Scoot first started, we offered a limited range of payment methods at a higher implementation and maintenance cost. As we expanded globally and heard our customers’ feedback, we took advantage of advances in payment technology to implement many more payment methods to improve our customers’ experience.

In order to pass on the savings to our customers as our costs came down, we have since March 2018 progressively removed payment processing fees in selected markets. Now, we are ready to do away with it globally. We hope this gives our customers better value and more reasons to escape the ordinary with us.”

-Scoot Press Release

So, what are we to make of all this? Has there been some sort of global technological regression that necessitates the reintroduction of processing fees? Have payment systems deteriorated to an extent that the only way to escape the ordinary now is by paying a surcharge?

Well, no. Scoot simply saw that competitors like Air Asia and Jetstar didn’t follow suit (though AirAsia no longer has processing fees for flights starting and ending in Malaysia), and has decided it might as well improve its margins.

The only silver lining I can see here is that Scoot has not reverted to its previous system of imposing a flat fee per passenger, per flight. That, quite frankly, was extortive and a clear money grab, since it had little to do with the actual cost of processing payments.

| 💰 Scoot’s Former Payment Processing Fees (as of 1 March 2018) |

|

| Payment Processing Fee (Per passenger, per segment) |

|

| 🇦🇺 Australia | A$10 |

| 🇯🇵 Japan | JPY 800 |

| 🇹🇼 Taiwan | TWD 240 |

| 🇹🇭 Thailand | THB 200 |

Of course, I’m under no illusions that payment processing fees were always there, just baked into the fare. But so long as they were, Scoot had to adjust its fares to ensure the overall price remained competitive, or lose out on business from OTA search results. As you can imagine, the LCC market is extremely price-sensitive.

By charging payment processing fees separately, Scoot is able to show a lower price upfront during the all-important search stage, before increasing it later in the booking process (a similar analogy would be resort fees charged by hotels). It’s really a kind of drip pricing, which makes prices less transparent to the consumer.

Should you still use a credit card with Scoot?

While flights from Singapore are currently exempt from payment processing fees, Singapore residents may still face this question when purchasing a one-way ticket back home.

With the reintroduction of payment processing fees, you’re basically paying for the privilege of earning credit card miles. Whether or not that makes sense boils down to how many miles you earn, and how much you value a mile.

Here’s the cards which earn the most miles for Scoot tickets.

| Card | Earn Rate | Remarks |

UOB Lady’s Card UOB Lady’s CardApply |

4 mpd | Max S$1K per c. month. Must choose Travel as bonus category Review |

UOB Lady’s Solitaire UOB Lady’s SolitaireApply |

4 mpd | Max S$2K per c. month. Must choose Travel as bonus category Review |

DBS WWMC DBS WWMCApply |

4 mpd | Max S$1.5K per c. month Review |

HSBC Revolution HSBC RevolutionApply |

4 mpd | Max S$1K per c. month Review |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit CardApply |

3 mpd | No cap Review |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | Min. retail spend of S$800 per c. month, capped at S$10K of air tickets per c. month Review |

Assuming a 4 mpd card and a valuation of 1.5 cents per mile, a surcharge of 2.48% can still be justified. It offsets the value of the miles somewhat, but you should still come out ahead.

In any case, rewards are not the only benefit of paying with a credit card. I can think of at least three other reasons:

- Paying with a credit card has cashflow benefits, since you have up to 55 interest-free days to pay (versus PayNow where deductions are instant)

- Paying with a credit card gives you chargeback protection, in case something goes wrong with your trip and you want to raise a dispute (just witness how slow airlines were to offer refunds for cancelled flights during COVID-19)

- Paying with a credit card can give you complimentary travel insurance

Remember: Apple Pay, Google Pay and PayPal are exempt from these fees at the moment, so your best bet would be to pair these with one of the cards in the table above. You’ll still earn the same rewards as if you used a “naked” card.

Will the fees come to Singapore?

Singapore has escaped the payment processing fees for now, but brace yourself, because this is just phase 1. Over the next few months, we’ll see the fees gradually expand to other payment methods such as digital wallets, before rolling out to other countries.

I don’t have any insight as to the exact date this is planned for Singapore, but put it this way: barring any sort of backtracking, I’d be very surprised our Scoot flights will still be fee-free this time next year.

Conclusion

Scoot has reintroduced payment processing fees for debit and credit cards on flights departing from Australia, Japan, Taiwan and Thailand, ranging from 1.05% to 2.48%. You can still dodge these fees by paying through Apple Pay, Google Pay and PayPal, but that loophole will eventually be closed.

There are no fees for flights departing from Singapore or any other destination, but I’d be watching this space very carefully in the months to come.

Payment processing fees are annoying, but unfortunately they’re a reality of the LCC market and in that sense, Scoot isn’t doing anything out of the ordinary. That said, given the praise the airline lavished on itself back in 2019 when eliminating these fees, you can’t help but be a little disappointed that #escapingtheordinary now comes at an extra 2.48%.

What do you make of Scoot’s reintroduction of payment processing fees?

Shameful that regulators in Australia, Japan, Taiwan and Thailand allow for airlines to charge these unfair junk fees that allows airlines to advertise fake fares that are lower than what they can be realistically purchaded for. It’s up to them to enforce customer protections.

If the regulator don’t do their job to protect competitors, I can’t blame Scoot for matching what its competitors do in the market. They simply can’t be showing a price of $102.48 against a competitor advertising $100.00 (plus a hidden 2.48% junk fee).

Agreed. We just want to see a final price at the headlined numbers. My guess is that Airlines do not pay the same amount of fees as say a small retail or restaurant due to their volume. Just another semi hidden profit making venture. Scoot has a very good load and better than SQ. It maybe that this additional fee applied overseas currencies do help them hedge against currency fluctuations.

Not that I’m for the processing fees or defending Scoot’s money grab, but there’s no fees if you choose to pay using a non-credit card method. So technically, they can advertise the prices before processing fees are added.

Alternatively, can try their competitors.

Bit of a stupid comment given that Singapore’s regulator has done nothing to prevent this sort of garbage fees, as evidenced by other airlines doing it. If you want to know why Australia’s surcharge is significantly lower than the other countries, it is precisely because regulators in Australia limit credit card surcharges to reflect actual cost incurred (bear in mind, local rules there permit credit card surcharges), and also regulate the amount of the merchant discount rate itself. In addition it is a requirement to have a surcharge-free payment alternative to be able to charge the surcharge in the first… Read more »

Probably also applies to scoot plus. Which, frankly, is one reason to fly scoot on shorter flights.

Also it removes an inconsistency, in Australia at least, where the “premium” (SQ) airline was charging credit card fees but not the low cost (TR) subsidiary.