Here’s The MileLion’s review of the KrisFlyer UOB Credit Card, aimed at those who want a co-branded Singapore Airlines card with broader acceptance than American Express.

While I’m not a fan of its debit card sibling, the credit card offers two compelling features: uncapped bonuses on Singapore Airlines and Scoot tickets, KrisShop, Kris+, and Pelago, as well as dining, food delivery, online shopping, travel and transport (known as “Accelerated Miles”).

Unfortunately, the Accelerated Miles feature was recently nerfed. Previously, it offered an uncapped earn rate of 3 mpd, but this was reduced to 2.4 mpd from 1 June 2025. In addition, the minimum annual spend on Singapore Airlines Group transactions required to unlock this rate was increased from S$800 to S$1,000.

Despite these changes, the card remains a solid option for high spenders who regularly exceed bonus caps on other cards, or for those who prefer the convenience of using a single card for most of their spending.

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

|

| What do these ratings mean? |

|

| The KrisFlyer UOB Credit Card may not offer the highest earn rates in every category, but its uncapped bonuses make it a great choice for big spenders, or those who prefer to stick to a single card. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: KrisFlyer UOB Credit Card

Let’s start this review by looking at the key features of the KrisFlyer UOB Credit Card.

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 3 years |

| Annual Fee | S$196.20 (FYF) |

Min. Transfer |

N/A |

| Miles with Annual Fee |

10,000 | Transfer Partners |

1 |

| FCY Fee | 3.25% | Transfer Fee | N/A |

| Local Earn | 1.2 mpd | Points Pool? | N/A |

| FCY Earn | 1.2 mpd | Lounge Access? | No |

| Special Earn | 3 mpd (SIA Group, Kris+, Pelago), 2.4 mpd (dining, online shopping & travel, transport) | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

Be careful not to confuse the KrisFlyer UOB Credit Card with the KrisFlyer UOB Debit Card. The two sport similar designs and names, but the value proposition is altogether different.

Credit Card Credit Card |

Debit Card Debit Card |

|

| Min Income Req. | S$30,000 | N/A |

| Annual Fee | $196.20 | S$54.50 |

| Base Earn Rate | 1.2 mpd | 0.4 mpd |

| Requires KrisFlyer UOB Savings Account? | No | Yes |

Simply put: if you earn enough to qualify for a credit card, there’s very little reason to consider the debit card option.

In fact, the only thing that debit card does that the credit card can’t is to earn miles on insurance premiums– and even then, just 0.4 mpd.

How much must I earn to qualify for a KrisFlyer UOB Credit Card?

The KrisFlyer UOB Credit Card has a minimum income requirement of S$30,000 per year, the MAS-mandated minimum.

If you do not meet the minimum income requirement, it may be possible to place a S$10,000 fixed deposit with UOB to get a secured version. Contact your nearest UOB branch for more details.

What welcome offers are available?

|

| Apply |

New-to-UOB customers who apply and are approved for a KrisFlyer UOB Credit Card will enjoy up to 25,000 bonus miles when they spend at least S$2,000 in the first 60 days of approval.

This offer is currently scheduled to end on 28 February 2025, but has been renewed every month for more than a year now.

| ❓ New-to-UOB definition |

|

New-to-UOB is defined as customers as those who:

|

The welcome bonus is broken down as follows.

| Bonus | Min. Spend | Cap |

| 5,000 miles | S$5 on first trxn. | No cap |

| 20,000 miles | S$2,000 in 60 days | First 100 per month |

5,000 miles will be awarded to cardholders who make their first spend of at least S$5.

20,000 miles will be awarded to the first 100 applicants each month (based on approval date) who spend at least S$2,000 within the first 60 days of approval.

The first year’s annual fee of S$196.20 is automatically waived, so assuming you have spend coming up, these bonus miles are essentially “free”.

On top of this, SingSaver is offering S$60 cash or S$70 Lazada vouchers for customers who apply by 28 February 2025, with no minimum spend necessary.

How much is the KrisFlyer UOB Credit Card’s annual fee?

| Principal Card | Supp. Card | |

| First Year | Free | 1st free, S$98.10 for 2nd onwards |

| Subsequent | S$196.20 | 1st free, S$98.10 for 2nd onwards |

The KrisFlyer UOB Credit Card has an annual fee of S$196.20 for the principal cardholder, which is waived for the first year. The first supplementary card is free, but the second onwards will cost S$98.10 each.

Paying the principal card’s annual fee nets you 10,000 miles, which means buying miles at ~1.96 cents each. In my experience, it’s not too difficult to get an annual fee waiver either- refer to the article below for more details.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 1.2 mpd | 1.2 mpd | 3 mpd on SIA, Scoot, KrisShop, Kris+, 2.4 mpd on dining, food delivery, online shopping & travel, transport |

General spend

KrisFlyer UOB Credit Card members earn:

- 6 KrisFlyer miles for every S$5 spent in Singapore Dollars

- 6 KrisFlyer miles for every S$5 spent in foreign currency (FCY)

That’s an equivalent earn rate of 1.2 mpd for both.

It’s a bit unusual to see a general spending card without an FCY spending bonus (although to be fair, neither do the AMEX Singapore Airlines cobrand cards), and that puts it at the bottom of the pack. But, as we’ll see in the next section, this isn’t a card you get for general spending.

| 💳 Earn Rates for General Spending Cards (income req.: S$30K) |

||

| Cards | Local Spend | FCY Spend |

UOB PRVI Miles Card UOB PRVI Miles Card |

1.4 mpd | 3 mpd IDR, MR, THB, VND 2.4 mpd All Others |

HSBC TravelOne Card HSBC TravelOne Card |

1.2 mpd | 2.4 mpd |

DBS Altitude Card DBS Altitude Card |

1.3 mpd | 2.2 mpd |

OCBC 90°N Card OCBC 90°N Card |

1.3 mpd | 2.1 mpd |

Citi PremierMiles Card Citi PremierMiles Card |

1.2 mpd | 2.2 mpd |

StanChart Journey Card StanChart Journey Card |

1.2 mpd | 2 mpd |

BOC Elite Miles Card BOC Elite Miles Card |

1 mpd | 2 mpd |

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Ascend AMEX KrisFlyer Ascend |

1.2 mpd | 1.2 mpd |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit Card |

1.1 mpd | 1.1 mpd |

All FCY transactions are subject to a 3.25% fee, so using your KrisFlyer UOB Credit Card overseas represents buying miles at an unattractive 2.71 cents apiece- unless of course you spend in its bonus categories.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

Kris+, Pelago & SIA Group

|

|

KrisFlyer UOB Credit Cardholders will earn 15 KrisFlyer miles for every S$5 spent (3 mpd) on:

- Kris+

- Pelago

- SIA Group transactions, defined as:

- Singapore Airlines

- Scoot

- KrisShop

This includes using your KrisFlyer UOB Credit Card to pay for taxes and surcharges on a KrisFlyer award redemption, or paying for add-on services with Scoot like luggage, seat selection and meals.

The bonus rate applies to both online and offline transactions, whether in SGD or FCY. No minimum spend is required, and there is no cap on the maximum bonus miles that can be earned.

Dining and food delivery, online shopping, online travel, transport

KrisFlyer UOB Credit Cardholders are eligible to earn 12 KrisFlyer miles for every S$5 spent (2.4 mpd) on the following transactions:

- Dining and food delivery

- Online shopping

- Online travel

- Transport

The extra 6 KrisFlyer mile for every S$5 spent (1.2 mpd) over the base rate is referred to as the “Accelerated Miles bonus”, and applies to both SGD and FCY spending.

To be eligible for Accelerated Miles, cardholders must satisfy the following minimum spend on SIA Group transactions.

| Card Membership Year End | SIA Group Min. Spend |

| April 2023 to October 2025 | S$800 |

| November 2025 onwards | S$1,000 |

Do note that for cardholders whose membership years end from November 2025 onwards, the minimum SIA Group spend has been hiked by 25% to S$1,000.

| ❓ When does my membership year end? |

| If you’re not sure when your membership year ends, simply look at the expiry date on your card. For example, if your expiry month is March, then your membership year runs from 1 March to 28 February each year. |

The last increase to the SIA Group minimum spend was in 2022, when it rose from S$500 to S$800. Now, it’s being raised again, and just like last time, the way it’s being implemented will likely frustrate some cardholders.

To put it another way, the new minimum spend applies to anyone whose membership year starts from December 2024 onwards. That means if you recently applied for or renewed the card expecting the S$800 threshold to remain in place, you’re now faced with a higher requirement mid-cycle. If you’re unhappy about the change, your only options are to spend the additional S$200, or forgo the Accelerated Miles benefit for this year.

While a S$200 increase isn’t catastrophic, a more equitable approach would have been to apply the new threshold starting from membership years ending May 2026 onwards. That way, all applicants would know upfront that the minimum spend is S$1,000, instead of having the rules shift after the fact.

Accelerated Miles will be awarded on these transactions from the start of the membership year, not just from the time the minimum spend was met.

While you could earn 4 mpd on most of these categories with other cards, the key advantage of the KrisFlyer UOB Credit Card is the absence of a cap. This makes it ideal for big ticket purchases that would bust the cap of other cards like the DBS Woman’s World Card or UOB Lady’s Card.

For more on how the Accelerated Miles feature works, refer to the post below.

How does the KrisFlyer UOB Credit Card’s Accelerated Miles feature work?

Dining & Food Delivery

| MCC | Examples |

| 5812 Eating Places and Restaurants |

Crystal Jade, Imperial Treasure, Paradise Dynasty, Deliveroo*, Food Panda*, GrabFood* |

| 5813 Bars, Cocktail Lounges, Discotheques, Nightclubs and Taverns |

Brewerkz, Harry’s, Jigger & Pony |

| 5814 Fast Food Restaurants |

Burger King, KFC, McDonald’s, Subway, |

| *Deliveroo, Food Panda and GrabFood may also code as MCC 5814 | |

Dining is defined as restaurants, bars, and fast food outlets. The bonus also applies to food delivery platforms such as Deliveroo, Food Panda and GrabFood.

However, the KrisFlyer UOB Credit Card’s definition of dining is more narrow compared to other cards on the market, and does not include MCC 5811 (Caterers), MCC 5441 (Candy, Nut, Confectionary Stores), MCC 5462 (Bakeries), or MCC 5499 (Misc. Food Stores). Restaurants within hotels may also not qualify for this bonus, to the extent they code as hotel spend.

Online Shopping

| MCC | Examples |

| 4816 Computer Network/ Info Services |

GoDaddy, Twitch, Peatix |

| 5309 Duty Free Stores |

DFS, KrisShop, The Shilla |

| 5310 Discount Stores |

N/A |

| 5311 Department Stores |

Taobao, Isetan, Marks & Spencer |

| 5331 Variety Stores |

Muji, Mustafa, Miniso |

| 5399 Misc General Merchandise |

Iuiga, Japan Home, Comgateway |

| 5611 Men’s Clothing |

Benjamin Barker, Dockers, Superdry |

| 5621 Women’s Ready to Wear |

bYSI, Coast, Forever21 |

| 5631 Women’s Accessories |

Bimba Y Lola, Chomel, Coach |

| 5641 Children’s and Infants’ Wear |

Abercrombie Kids, Cotton On Kids, Kidstyle |

| 5651 Family Clothing |

ASOS, Bossini, Desigual |

| 5661 Shoe Stores |

ALDO, Bata, Birkenstock |

| 5691 Men’s and Women’s Clothing |

Prada, G2000, Ezbuy |

| 5699 Accessory and Apparel |

LeSportsac, Crumpler, Esprit |

| 5732-5735 Electronics, Music Stores, Computer Software |

Apple, Audio House, MealPal |

| 5912 Drug Stores and Pharmacies |

Guardian, NTUC Unity, Watsons |

| 5942 Book Stores |

Book Depository, Kinokuniya, Books Actually |

| 5944-5949 Jewelry, Watches, Toys, Camera, Gift Cards, Leather Goods, Sewing |

Cartier, Action City, Canon |

| 5999 Misc. and Specialty Retail |

Atome, Amazon, eBay |

Online shopping covers a wide range of MCCs, including Amazon, Ezbuy, Lazada, Qoo10, Shopee, and Taobao for instance. You can also expect most major fashion retailers to be on this list, along with some unexpected ones like MealPal and hosting providers.

Remember, these transactions must be carried out online. In-store spending will not count. It used to be possible to circumvent this restriction by pairing the card with Amaze, but unfortunately Amaze was excluded in 2024.

Online Travel

| MCC | Examples |

| Online Travel | Agoda, Airbnb, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, UOB Travel |

Unlike the other categories, online travel is not defined by specific MCCs, but rather a specific list of merchants.

The whitelist includes Agoda, Airbnb, Hotels.com and Trip.com. For obvious reasons, the KrisFlyer UOB Credit Card can’t explicitly let you earn bonus miles with any airline outside the SIA Group, but you can still book them indirectly via Expedia or UOB Travel instead.

Transport

| MCC | Examples |

| 4111 Local Commuter Transport |

BUS/MRT only |

| 4121 Taxi and Limo |

Grab, Gojek, Comfort |

Transport refers to Grab, gojek, Comfort and other taxi operators. It also includes SimplyGo transactions made on buses and the MRT.

Do note that you won’t earn any bonus miles (or base miles for that matter) if you use your card to top-up your EZ-Link balance, or pay at the General Ticketing Machines. You must tap your card (or phone, if you’ve added your card to your mobile wallet) at the gantry in order to qualify for the bonus.

When are KrisFlyer miles credited?

The full 3 mpd from Kris+, Pelago and SIA Group transactions will be directly credited to your KrisFlyer account once per month. In my experience, this usually happens on the 4th of every month.

It’s a different story for the Accelerated Miles, i.e. the bonus miles from dining, food delivery, online shopping, online travel and transport transactions. Of the 12 KrisFlyer miles per S$5 spent:

- 6 KrisFlyer miles per S$5 (1.2 mpd) will be credited on the 4th of the following calendar month (just like all other regular transactions)

- 6 KrisFlyer miles per S$5 (1.2 mpd) will be credited two months after the end of the membership year, assuming the minimum spend on SIA Group transactions has been met

This means you could be waiting up to 14 months to receive your bonus! The delayed crediting arrangement gives rise to four problems. I’ve expounded on them in this post, but to summarise:

- You’re locked into the card, because all pending bonus miles are forfeited if you cancel.

- Reconciling bonus points will be a nightmare. It’s already hard enough to check transactions on a month to month basis. Imagine doing it for an entire year’s worth.

- Because your pending bonus miles take anywhere from 2-14 months to reach you, you’re especially exposed to devaluation risk. If Singapore Airlines announces an award chart devaluation, other cardholders can rush out to burn their miles before it happens. You can’t, because they’re in limbo.

- Your miles will age at different rates. Some will be credited each month and start their 3-year expiry countdown immediately, the rest will follow in 2-14 months

UOB will argue that this is necessary because there’s no way of knowing, at the point of transaction, whether the cardholder will go on to hit the specified minimum spend required for the bonus. But there surely has to be a better way of doing this, because the current mechanism holds you hostage- if you cancel your card early, you lose your pending bonuses.

How are KrisFlyer miles calculated?

Here’s how you can work out the KrisFlyer miles earned on your KrisFlyer UOB Credit Card.

| Local & FCY Spend | Round down transaction to nearest S$5, then divide by 5 and multiply by 6 |

| Bonus Component | Round down transaction to nearest S$5, then divide by 5 and multiply by 6 |

Since all transactions are rounded down to the nearest S$5, the minimum spend required to earn miles is S$5. Anything less than that earns nothing!

A simple illustration: Suppose you spent S$9 on your KrisFlyer UOB Credit Card. You might figure that’s 10.8 miles (@ 1.2 mpd), but in reality:

- The S$9 is rounded down to S$5

- S$5 is divided by 5 and multiplied by 6 to yield 6 miles

You actually earn 6 miles, yielding a mere 0.67 mpd.

This is an extreme example, of course, and the effect of rounding gets smaller as your transaction size increases. But it’s exactly why you should think twice about using your KrisFlyer UOB Credit Card for small transactions that aren’t in S$5 blocks.

To show how rounding affects you, let’s compare the KrisFlyer UOB Credit Card to the Citi PremierMiles Card. On paper, both of them earn the same 1.2 mpd on all local spending. In reality, however, the Citi PremierMiles performs much better because of its favourable rounding policy.

KrisFlyer UOB KrisFlyer UOBEarn rate: 1.2 mpd |

Citi PremierMiles Citi PremierMilesEarn rate: 1.2 mpd |

|

| S$5 | 6 miles | 6 miles |

| S$9.99 | 6 miles | 11 miles |

| S$15 | 18 miles | 18 miles |

| S$19.99 | 18 miles | 23 miles |

| S$25 | 30 miles | 30 miles |

| S$29.99 | 30 miles | 35 miles |

| S$35 | 42 miles | 42 miles |

| S$39.99 | 42 miles | 47 miles |

If you’re an Excel geek, here’s the formulas you need to calculate points:

| Local & FCY Spend | =ROUNDDOWN (X/5,0) *6 |

| Bonus Component | =ROUNDDOWN (X/5,0) *9 |

| Where X= Amount Spent |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for KrisFlyer miles?

A full list of transactions that do not earn KrisFlyer Miles can be found in the T&Cs. I’ve highlighted a few noteworthy categories below:

- Amaze

- Charitable Donations

- Education

- Government Services

- GrabPay top-ups

- Insurance

- Real Estate Agents & Managers

- SPC Service Stations

- Utilities

The KrisFlyer UOB Credit Card will earn miles for CardUp transactions (1.2 mpd), but not ipaymy.

What do I need to know about KrisFlyer miles?

| ❌ Expiry | ↔️ Pooling | ✈️ Transfer Fee |

| 3 years | N/A | None |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| N/A | 1 | Automatically transferred each month |

The KrisFlyer UOB Credit Card credits KrisFlyer miles directly to your account on a monthly basis, with no conversion fees.

This is a mixed blessing. On the one hand, you save on the usual S$25 conversion fee that most banks charge. On the other, direct crediting means the three-year KrisFlyer expiry countdown starts immediately (contrast this to non-cobrand cards where you enjoy “two validities”: one on the bank side, and one on the airline side).

In case you were worried, cancelling your KrisFlyer UOB Credit Card has no impact on KrisFlyer miles already in your account.

Other card perks

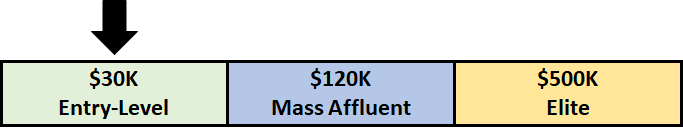

Instant KrisShopper Insider status

|

| KrisShopper Insider status |

KrisShopper is KrisShop’s free-to-join loyalty programme, and awards a bonus of 2-4 mpd on KrisShop purchases depending on membership tier.

KrisFlyer UOB Credit Cardholders will enjoy instant KrisShopper Insider status, which awards a bonus 2.5 mpd on all KrisShop purchases. Be advised, however, that this upgrade only applies if you have not already signed up for KrisShopper.

| KrisShopper Tier | Qualifying Spend* | Earn Rate |

Non-KrisShopper Non-KrisShopper |

N/A | 1.5 mpd |

Member Member |

N/A | 2 mpd |

Insider Insider |

S$5,000 | 2.5 mpd |

| S$10,000 | 3 mpd | |

Ambassador Ambassador |

S$15,000 | 4 mpd |

| *Qualifying spend includes purchases on KrisShop.com, KrisShop on Kris+, KrisShop on KrisWorld, Inflight purchases on Singapore Airlines. Excludes GST, duties and delivery charges | ||

Registration is required, and can be done via this link. Status will be upgraded within three months of registration, and valid for a 12-month period following that. You will subsequently need to requalify through regular means, i.e. spending S$5,000 on KrisShop within a membership year.

The T&Cs of the status match can be viewed here.

Discounts for KrisFlyer Experiences

KrisFlyer Experiences is a platform that allows members to redeem their KrisFlyer miles for money-can’t-buy-experiences. We’ve seen F1 Sky Suites, a KrisFlyer cruise-to-nowhere and a specially-chartered points plane to Langkawi.

KrisFlyer UOB Credit Card members occasionally enjoy a 10% rebate on the number of miles required, which can be substantial depending on the experience. This is normally offered in limited quantity, so subscribe to The MileLion’s Telegram Channel and get alerted when new deals go live.

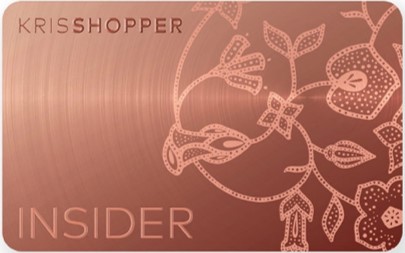

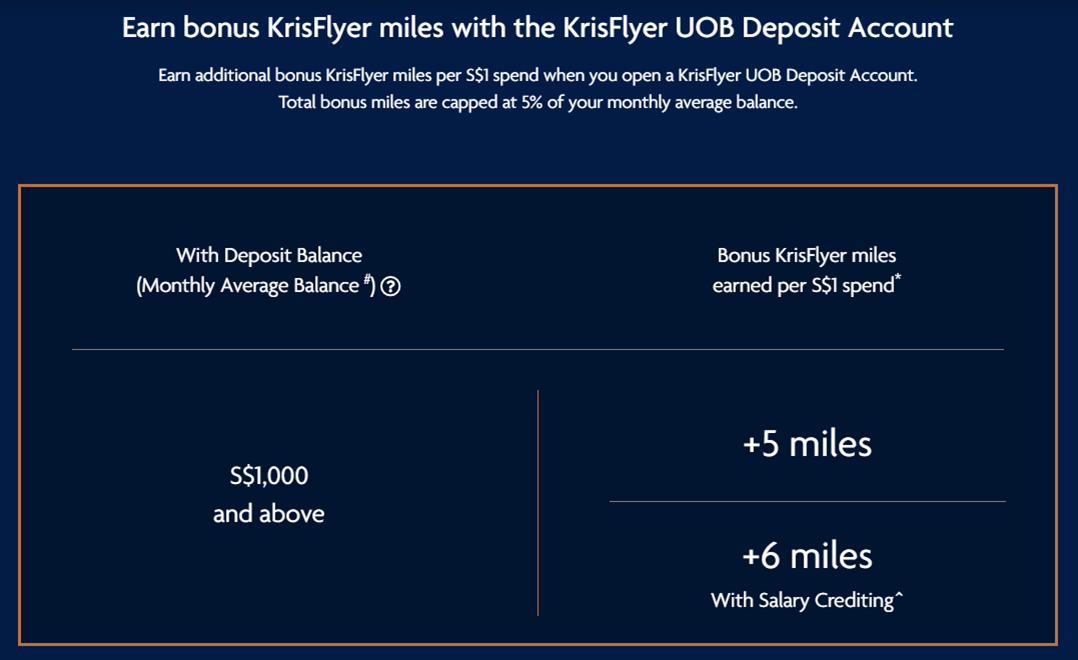

KrisFlyer UOB Account

The supposed “killer feature” of the KrisFlyer UOB Credit Card is its ability to earn a bonus 5-6 mpd when paired with the KrisFlyer UOB account. This sounds phenomenal, but I’d strongly advise you against it.

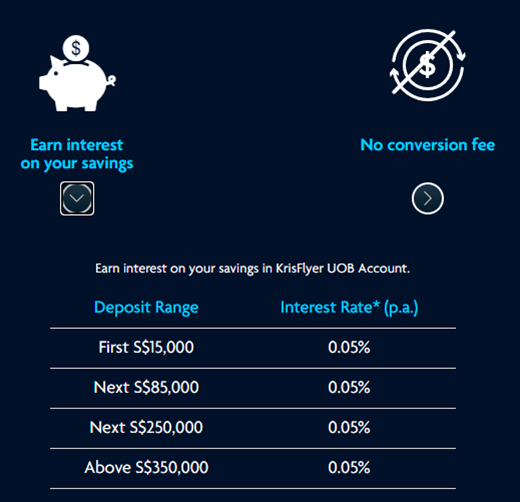

First of all, this account pays a measly 0.05% interest. That’s an almost derisory rate.

Second, you should know that the KrisFlyer UOB account caps the bonus miles you can earn at a mere 5% of your monthly average balance.

For example, if you put S$50,000 inside the account, the maximum bonus miles you could earn each month is just 2,500 (5% of 50,000), which you’d hit after spending just S$500 on your KrisFlyer UOB Credit Card.

| MAB | Monthly Cap (5% of MAB) |

Card Spending Cap | |

| No Salary Credit (5 mpd) |

With Salary Credit (6 mpd) |

||

| S$1,000 | 50 miles | S$10 | S$8.33 |

| S$10,000 | 500 miles | S$100 | S$83.33 |

| S$20,000 | 1,000 miles | S$200 | S$166.67 |

| S$50,000 | 2,500 miles | S$500 | S$416.67 |

| S$100,000 | 5,000 miles | S$1,000 | S$833.33 |

This means that unless you have a ridiculously high miles valuation figure, the opportunity cost is simply too high to be worth considering.

To learn more about the KrisFlyer UOB Account, refer to the article below.

Fast track to KrisFlyer Elite Silver

The AMEX KrisFlyer Ascend has a fast track to KrisFlyer Elite Gold, but KrisFlyer UOB Credit Card members will have to settle for KrisFlyer Elite Silver.

Cardmembers who open their cards from 1 May 2022 and spend a minimum of S$5,000 on SIA Group transactions (excluding Kris+) within the first card membership year will receive an upgrade to KrisFlyer Elite Silver.

This is referred to as a “fast track”, but in reality is anything but. Qualifying cardholders will receive their status upgrade within 6 weeks from the last month of the first membership year. You could hit the qualifying spend on your first day, and still have to wait 13+ months to get your status!

Status earned through this “fast track” scheme is only valid for the first year; subsequently, you’ll have to requalify by flying at least 25,000 elite miles in a 12-month membership period.

KrisFlyer Elite Silver received a small upgrade to benefits in 2024, with members now enjoying:

- A 25% bonus on KrisFlyer miles

- Complimentary Standard Seat selection on Singapore Airlines and Scoot

- Priority check-in

- Priority boarding

- Extra 10kg baggage allowance

- Discounted service fees

Unfortunately, there’s no lounge access nor priority baggage handling.

Scoot Privileges

KrisFlyer UOB Credit Cardholders enjoy the following benefits when booking Scoot tickets with their card.

| ✈️ Scoot Privileges for KrisFlyer UOB Cards |

||

| For Principal Cardholder | For Companions (on same booking) |

|

| Complimentary Priority Check-in and Boarding | ✅ | ✅ |

| Extra 5kg Luggage Allowance (with purchase of min. 20 kg allowance) |

✅ | ❌ |

| Complimentary Standard Seat selection | ✅ | ✅ |

| One-time Booking Flexibility Waiver | ❌ | ❌ |

These benefits used to include a one-time booking flexibility waiver, but this was removed in June 2024.

To enjoy these benefits, you need to book your Scoot tickets via this dedicated portal.

KrisShop Privileges

KrisFlyer UOB Credit Cardholders enjoy a single-use promo code KFUOBKS2024 that gives S$20 off a minimum spend of S$120 (before GST).

Unfortunately, there is an extensive brand exclusions list. It might be easier to just publish a list of inclusions instead!

2x S$15 Grab voucher to/from Changi Airport

KrisFlyer UOB Credit Cardholders will receive a biannual S$15 Grab voucher valid for rides to/from Changi Airport.

This can be redeemed once per half yearly (i.e. Jan to Jun/ Jul to Dec), with the promo code KFUOBCC. Redemptions are capped at the first 1,000 uses per month.

2x S$15 off Changi WiFi

KrisFlyer UOB Credit Cardholders will receive a biannual S$15 ChangiWiFi voucher.

This can be redeemed once per half yearly (i.e. Jan to Jun/ Jul to Dec). Cardholders can generate a e-redemption code by SMSing KFUOBCC<space>16-digit card number to 77862.

Redemptions are capped at the first 1,000 uses per month.

Complimentary travel insurance

| Accidental Death | Medical Benefits | Travel Inconvenience |

| S$500,000 | S$50,000 | None |

Customers who use their KrisFlyer UOB Credit Card to book their air tickets will enjoy complimentary personal travel insurance which covers up to S$500,000 for accidental death or permanent disablement, and S$50,000 for emergency medical assistance.

However, there is no coverage for things like lost luggage, flight delays, damaged bags or personal liability. Therefore, I’d highly advise you to get alternative coverage instead.

Do note that you must activate your complimentary coverage at least five working days before travel, which can be done via this link.

Summary Review: KrisFlyer UOB Credit Card

KrisFlyer UOB Credit Card KrisFlyer UOB Credit Card |

|||

| Apply | |||

| 🦁 MileLion Verdict |

|||

| ☑ Take It ☐ Take It Or Leave It ☐ Leave It |

If you’re the type who regularly exceeds the bonus caps on specialised spending cards, the KrisFlyer UOB Credit Card might be the answer. The catch is that 50% of your miles (1.2 mpd) will only arrive 2-14 months later, but those who are willing to wait will be richly rewarded. I can’t think of any other card on the market that will pay out its full bonus rate on a S$30,000 handbag or watch (assuming you buy it online!).

Alternatively, if you’re someone who insists on using one card for everything, then this would be the best form of damage minimisation. I can’t think of any other general spending card with so many different bonus categories: dining, food delivery, online shopping & travel and transport will cover the bases for a lot of people.

Throw in the other perks like the ability to save on KrisFlyer Experiences and the occasional discount on Grab airport rides, and I’d reckon this is a solid “Take it”.

Interesting point about the Krisflyer UOB account. It does link with the UOB PRVI too if you use that as your general spend card. I did some calculations and assuming a valuation of 1.8 cpm, your breakeven point for the Krisflyer UOB account is actually just over 1% interest p.a. (meaning to say, if your interest in your bank account is less than 1%, you could potentially earn enough miles with the Krisflyer UOB account to make up for it). At this falling interest rate environment, this could look more and more enticing. Calculations (I’m assuming you hit the 5%… Read more »

Isn’t the most important value of the UOB Deposit account that you get 5mpd on total annual card spend, if you maintain a balance of S$1000 per month? Yes the interest is tiny but the 5mpd on total annual card spend is >> than anything else I’ve seen period for losing interest on $1000 only — seem like the best miles deal. But I may be missing something?? https://www.uob.com.sg/personal/krisflyer-uob/credit/account.html?i_cid=pfs:sg:owned:int:site:na:li:na:na:na-evergreen:direct:na&vid=none

Hi Aaron,

If I link this Krisflyer Card to Amaze Card, would I still get the 3mpd if I use it for dining overseas (FCY)? This is because the dining spent would have been converted to “Online Spending”.

And I assume paying for hotels & car rental overseas (FCY) would also not get us the accelerated bonus miles of 3mpd?

Thanks

No need to convert dining to online as it would get 3mpd(provided min 800 spend on SIA group). Not sure about hotel and car rental. Have to check the exclusion terms.

Ok, just read “No foreign currency spending bonus”. Now I’m confused. I say no.

Regarding rounding, in my experience with the card, it’s at the calendar month level and not at the transaction level, regardless of what the T&Cs say. This applies at least for base miles – my accelerated miles are not in yet.

Miles are awarded based on the sum of all transactions posted in a calendar month, rounded down to the nearest $5, then divided by 5 and multiplied by 6.

Thanks for the data point! That would indeed be better. I do find it curious that uob says to receive the 3k first spend miles, you need to spend at least $5. That would suggest their system is set up in a way that it won’t recognise a transaction of less than $5 as a trigger for miles.

That said I don’t actually have the card so you probably know better than me… I suppose the ultimate test would be to make all your transactions for a given month less than $5!

That actually did happen, thanks in part to CB since I mainly use this card for SimplyGo. I had a few SimplyGo transactions last month, each individually less than $5, but in total more than $5. Miles still awarded.

that would make sense, otherwise transport via Bus and MRT would never earn miles as bus and MRT is always less than $5?

I was wondering the same. So we do earn 3mpd for our transport via Bus and MRT even though they are usually less than $5? UOB will tabulate our SimplyGo spending on a monthly basis and not based on each single transaction? I called UOB last week, they told me that SimplyGo transactions earn 1.2mpd only, so I am confused.

KF UOB Credit Card: Terrible proposition made worse by UOB’s poor customer support. My wife has been struggling to get her bonus miles. After 3 calls and paying the annual renewal fee, 2 months later they “manually adjusted” 3000 bonus miles against what CS confirmed was a 18,000+ eligible spend. Here’s the problem with deferred bonuses when the system doesn’t work and CS is rubbish! 3 calls x 20 mins each, frustration of having to walk a different through the problem each time and despite promises to get back, no one does. Not worth the effort. Any suggestions on what… Read more »

Regarding the $20 rebate for Krisshop, I had to endure a horrific month to chase for it. At the time when I got my card and made the Krisshop spend, the terms were exactly as you quoted: “Cardholders enjoy an annual S$20 rebate on KrisShop purchases with a minimum spend of S$100 nett in a single transaction.” (I fortunately had kept a copy of the actual terms as proof). My spend fully met this condition. After making the purchase but before my rebate was credited, UOB (presumably at the behest of KF) unilaterally changed the qualifying spend to “S$100 nett… Read more »

Hi Aaron – on the “online shopping” qualifying spend, am I right in thinking that this must relate to “fashion” websites only falling within the merchant codes, rather than just general shops within the merchant codes (although hard to see how fashion falls into some of the merchant codes), so might exclude things like Amazon and Lazada? Reason being that the T&Cs define “Online Shopping Card Transactions” as those “Card Transaction(s) made at fashion websites that sells clothes, shoes, jewellery, accessories and bags as its main business activity including card-not-present transactions like ecommerce/mail/phone order transactions in local and foreign currencies,… Read more »

as long as it’s within the MCC it’s fine.

ok cheers!

Wondering if the amaze card does “convert” the spending at offline retail shops to online for UOB KF card?

I’m interested to know too about pairing Amaze and UOB KF. This is in the T&C: W.e.f. 1 March 2022, please be informed that transactions with transaction description “AMAZE* TRANSIT*” will be excluded from the awarding of KrisFlyer miles on the KrisFlyer UOB Credit Card.

Clearly *TRANSIT* is there, don’t you see ? Only exclude MRT transaction through Amaze.

Isn’t the most important value of the UOB Deposit account that you get 5mpd on total annual card spend, if you maintain a balance of S$1000 per month? Seems like the best miles deal (if you can spend $800 on SIA stuff + maintain $1000 balance on trivial interest). But I may be missing something?? https://www.uob.com.sg/personal/krisflyer-uob/credit/account.html?i_cid=pfs:sg:owned:int:site:na:li:na:na:na-evergreen:direct:na&vid=none

there’s a cap on the bonus miles of 5% of monthly balance in the account. so if you have 1000$ balance, you can only get bonus 50 miles lol.

it’s mentioned in the article itself above, did you even read it?

Is the UOB application process so pathetically slow? I applied more than 3 weeks ago and have heard nothing since.

I thought i was the only one… sigh.. I applied on 01 March and no card yet. 3 weeks later I received an SMS saying due to high volume of application, the review is delayed. hopefully i receive the card before 30APR so I can join the current pormo..

I applied for one last week, on Tuesday this week I got an SMS to say my application is successful. But nothing has happened since. I’m still waiting for an email or a physical letter with the credit card.

Can we earn 3mpd on hotels like marriott and hilton?

I would like to know as well, especially if I link this card with Amaze. Thanks

Also interested to know. Anyone can answer regarding use for hotels using Amaze?

I did this recently (charged via Amaze at a Singapore hotel) and called up UOB. only earned 1.2 mpd for that transaction.

ofcourse it will not. no need to think so much.

which part of the article did it mention it will?

I think Aaron English is pretty straight forward

Hi for hotel wedding banquet, will it be considered as part of the spend or excluded? Thank you

For the UOB Travel part, does it have to be with UOB Travel online booking only OR can it be via Phone/email booking as well?

Hi,

For the minimum SIA group spend, in 2023 does everyone has the same to fulfill the min $800 regardless of your card membership year ending??

Thanks to confirm

So if i use the Amaze card (linked to kf uob credit card) on Kris+ at Harvey Norman does that mean i get for each dollar spent:

1.2 mpd for local spend

3 mpd for kris+ spend

1 mpd for Harvey Norman earn partner

3 mpd for online mcc 5732

For a total of 8.2mpd?

Does anyone know if bonus categories earn the 3mpd rate if the transaction is in foreign currency, or is it just local spend? For instance if I book SQ flights in USD or if I order online fashion in GBP will that earn the base 1.2mpd for FCY spend, or the 3mpd for bonus categories? Thanks

Not sure whats so complicated or you making it unnecessarily complicated.

TLDR; is the merchant you are purchasing from have the MCC listed above?

YES=bonus

NO=no bonus

re “5309: Duty Free StoresDFS, KrisShop, The Shilla” , apparently when making payment online (so via ichangi) the mcc is “MCC 4582 – Airports, Airport Terminals, Flying Fields” which is not covered. It is only 5309 when making payment offline physically at the store, but then it’s not considered online transaction. Does that mean actually there is no way to get the 3 MPD at duty free stores using this card?

You can use Amaze card to convert physical payments to an online transaction. It is mentioned in the article.

Is this sign up offer for new to UOB cards or for those who are new to UOB Krisflyer card?

Hi, do we earn 3mpd if we pair it with Amaze and spend on dining, be it in Singapore or overseas? Or does the 3mpd on dining can only be using the actual card itself?

Yes it does.

amaze only change offline to online, does not change MCC

UOB look at MCC and dont care where you spend it on (well unless its under the Online Travel section that is clearly stated by Aaron)

Hi Aaron, I’ve been going through your reviews on various cards such as this one, AMEX Plat, UOB VS, UOB Ladys, AMEX PPS, with the goal of identifying a card which can maximise earn rate on multiple sizeable single charges on SQ. For instance, if one had to purchase return SQ J fares SIN-LHR or SIN-EWR multiple times a year at S$8-10k per txn. Most of the 4-6mpd have caps which max out at 2-3k per month (with measly 0.4mpd thereafter), and out of the general spend cards it seems like the AMEX Plat Charge offers the best at 1.95… Read more »

That’s my understanding too.

Image of Krisflyer credit card was disappointed . I was impressed the look of the card online and thinking to start my journey with this card and apply for it.

After I receive the Krisflyer card the first look was terrible…it look exactly like all my debit because of the printing details on the card it wasn’t embossed.

Credit card should have it own prestige image like emblem detail on name, card number and expiry dates instead of painting.

I better use my prvimiles oub card instead of Krisflyer card.

Vast majority of CCs aren’t embossed now. Even the premium ones like DBS Vantage, Citi Prestige all use painting

bruh we apply cards for their benefits and perks for miles here. If your after looks just apply the 120k income celling cards to hao lian ah.

For the Instant KrisShopper Insider status, am I right to say that the insider provides a bonus of 2.5 on top of the base 1.2 giving a total of 3.7mpd?

Just saw on their official website that it is 3 + 2.5 = 5.5

The article says that Cardup transaction counts but assuming only at base rate of 1.2mpd?

FEB 25, 2024

Mind letting us know what updated?

Are the base miles credited on a delayed basis? I had around 300 miles credited & posted on the same statement that has a single $700+ retail transaction (along with other smaller ones). Just basing on $700, that’s 140 blocks of $5, which should work out to be 800+ miles…. I am missing a minimum of 500 miles..

Base miles come at the end of each month, credited in a lump sum to kf account

Thanks for replying. That’s quite odd then. The $700+ is from a fashion boutique, it can’t be that it’s not awarded miles. My other random smaller retail purchases add up to another ~500 miles (calculated transaction by transaction of rounddown $5 blocks). I’m short 1K miles. Leaving this info here for others who may have had a similar issue.

Do you get 3 mpd for Kris+ regardless of the MCC?

For example, if a merchant has MCC 5499 and I pay via Kris+ would I still get the 3 mpd?

Hi Aaron, you may wish to highlight that the UOB bonus mile sign-up promo is one of their usual ‘capped at first 100 pax’ gotchas (clause 2.1 on the T&C). Nothing worse than signing up and charging a large expense only to not get the promo. Feels scammy and dishonest. But that’s UOB

this first 100 cap was only added on 1 april 2024, and applies to 1-30 april 2024. anything before that is unaffected and uncapped

I tried to pair my UOB KF card to amaze and have been declined a few times. Anyone face this problem and how to resolve?

yeah it’s a known issue that’s been going on for a few days. have to wait till someone fixes it.

Ohh it’s only recently? So I have hope?

If I pair the UOB KF card with Amaze and charge my overseas hotel stay directly at the hotel, eg Waldorf Bangkok. Is that considered as Online Travel to earn the 3mpd?

Is the Online Travel only for those mentioned above of Agoda, Airbnb, Booking.com, Expedia, Hotels.com, Kaligo, Traveloka, Trip.com, UOB Travel?

Read the article or the card T&Cs

If you just applied for the Amex Platinum Charge promotion, you need to spend $1,200 on Singapore Airlines to get the first year airline credits. If you are not buying tickets for multiple people, have people postponed applying for UOB Krisflyer because they cannot meet the minimum airline spend for both cards? Or is the UOB Krisflyer that useful that you should find a way to meet its minimum spend?

If you apply for UOB Krisflyer, you need to shift $800 of Singapore Airlines spend from UOB Lady Solitaire (if set to travel) or DBS Woman’s World, which loses 800 miles (from 4 to 3 mpd). Assuming your general spend card is UOB PRVI Miles (1.4 mpd), you gain 1.6 mpd (1.4 to 3.0 mpd) by having UOB Krisflyer. This makes it worth having if you can meet the $800 minimum spend, then you spend at least $500 on UOB Krisflyer after maxing out your 4 mpd cards (800 miles = $500 / 1.6 mpd). This probably happens to every… Read more »

https://www.uob.com.sg/assets/pdfs/kf_credit_card_full_tnc.pdf

Note: WEF 1 July 2020, please be informed that any online payment made to Computer Software Stores (5734) , Direct Marketing Merchants (5964 – 5969), Artist Supply Stores, Craft Shops (5970) and Florists (5992) will be excluded from the awarding of Accelerated Miles.

Can the UOB Krisflyer card be paired with Amaze and used overseas at hotels in person? From the article it seems only whitelisted vendors allowed for hotels?

PSA: I would advise being careful with big ticket purchases as they may not code with the MCC you’d expect. I just learned the hard way that Cartier in Paris codes as 5094 (ineligible), not 5944 (eligible). Would have probably used Revolut had I known. Slightly more painful but the Amaze-block method is worth the extra hassle to find the MCC for big purchases.

Hi Aaron, regarding the minimum SIA Group spend of S$800 per membership year, can we spend the S$800 in SIA Group via Amaze? The flight tickets that I plan to purchase are in foreign currency (one way ticket depart from overseas and arrive in Singapore), if I am to use the UOB KF card to pay directly I will suffer the FCY fee.

Quote MT from telegram group:

Amaze + Uob kf for Singapore airlines booking.

Confirm can clock $800 spend. I did it and live chat with Uob.

Is MCC applicable for foreign spend too? For example, do I get 3 mpd for dining at an overseas restaurant?

How do we find out what dates lie within our membership year?

look at the expiry month of your card. that’s the start of your membership year

Thank you!

Hi Aaron, may I know if the $5 rounding policy is still applicable now? I saw from the uob website now it says ‘Krisflyer miles earned per S$1 spend on…’.

So is it true although it states the miles earned is based on ‘per S$1 spend’, the actual underlying calculation is still rounding with $5?

Hi, Just sharing this in case anyone ever falls in the same situation. Travelling for a meeting hence I needed a quote from the travel agent (Plover) for company reimbursement. The cost was $600 cheaper via the agent hence I had to buy from them (rather than buy the tickets online myself) otherwise I would have to fork out the difference. I checked with Plover cos the tix were $4000, to max the most miles I had wanted to use the UOB Krisflyer card (vs the Lady’s card), but they said for Singapore airlines group, best to buy from SQ… Read more »

Hi

With the amaze nerf can use the krisflyer uob for transaction in physical store (via Samsung pay) would that be considered as online shopping? Which other card would be best if it’s not.

This article needs to be updated. MCC 5734 (online) was excluded in 2020.

Does the $800 spend on SIA Group includes anything paid through Krispay? Also with pairing of this card to Krispay, does it earn additional miles via the app on top of what’s awarded? Thanks.

Would an online club med booking count under the online travel category?

No longer able to pair with amaze 🙁

the grab voucher has been removed from the latest Jan 2025 version T&C of UOB KF Credit Card

hmmm it’s still mentioned on the website. will need to test it out

Does the charges tied to SQ redemption tickets count towards $800 qualifying spend?

Does anyone know if the condition to receive the accelerated miles for the Krisflyer UOB card will require payment of the annual membership fee? I waived mine and it seems like I did not receive the accelerated miles 2 months after the membership year.

Hi! Just wanted to check, is there a way to check/track on the S$800 on SIA Group transactions? Like the bonus miles on dining etc. will be valid from when to when after I have hit the minimum spending, or how much more I have to spend to hit the S$800?

Thanks!

Purchased air tix from Expedia with UOB KF, apparently the UOB transaction description shows “Air New Zealand” instead of “Expedia”. Apparently, the underlaying payment was process directly through the airline and not Expedia, although there are no clear signs/indications (e.g. redirection to different payment site) from Expedia.

In short, based on above experience, it doesn’t seem like we can earn bonus/special miles(3mpd) from air tix purchases indirectly via Expedia, as mentioned in this article.

A kind soul from milelion telegram highlighted that an appeal (with proof of purchase from Expedia) needs to be raise with UOB nearing the end of membership year.

Dear Aaron and Team, If I am able to hit the minimum spend of 800SGD with Scoot/Singapore Airlines, then charge my card to education bills with CardUp payments, will I be receiving 3MPD or still 1.2MPD? Please advise, Thank you so much!

Still 1.2mpd. Cardup txn doesn’t earn bonus miles.

Hi Aaron. Will you know if the 20,000 miles will be awarded to the first 100 applicants promo is extended? I don’t see any mention of this extension in the UOB website

I think they have ended it

Dear Aaron and Team, If I am able to hit the minimum spend of 800SGD for UOB Krisflyer with Scoot/Singapore Airlines, then charge my card to education bills with CardUp payments, will I be receiving 3MPD or still 1.2MPD? Please advise, Thank you so much!

Anybody know how to get the UOB KrisFlyer World Elite Credit Card?