Standard Chartered has launched a new premium credit card called Beyond, and on first glance, it’s beyond impressive indeed.

Publicity materials gush about a welcome bonus of “beyond 1 million miles”, uncapped earn rates of up to 8 mpd, free upgrades to Business Class, Michelin-starred birthday meals, unlimited lounge visits, free hotel nights and more- the very essence of a luxury card.

But when you scrutinise those claims a bit closer, the mask starts to slip. Some benefits come with serious strings attached. Others require maintaining an eye-watering amount of AUM, or are offered by alternative cards that charge significantly lower annual fees.

Annual fees? Oh yes. Did I forgot to mention that the StanChart Beyond Card has a non-waivable annual fee of S$1,635? That alone should give some serious reason to pause, and think about whether you’re ready to venture into…the great beyond.

Well come on, it was begging to be said.

Overview: StanChart Beyond Card

StanChart Beyond Card StanChart Beyond Card |

|||

| Apply | |||

| Income Req. | S$200,000 p.a. | Points Validity | No expiry |

| Annual Fee | S$1,635 |

Min. Transfer |

10,000 miles |

| Miles with Annual Fee |

N/A | Transfer Partners |

2 |

| FCY Fee | 3.5% | Transfer Fee | S$27.25 |

| Local Earn | Up to 2 mpd | Points Pool? | Yes |

| FCY Earn | Up to 4 mpd |

Lounge Access? | Yes |

| Special Earn | Up to 8 mpd on overseas dining | Airport Limo? | Yes |

| Cardholder Terms and Conditions | |||

The StanChart Beyond Card has a minimum income requirement of S$200,000 p.a., which should hint that Standard Chartered is trying to delineate a whole new market segment with this product.

On the one hand, it’s not quite the rarefied air of S$500,000 p.a. cards like the Citi ULTIMA or UOB Reserve. On the other, it’s clearly not in the same league as S$120,000 p.a. cards like the Citi Prestige or DBS Vantage.

Why do I say that? Take a look at the annual fee. The StanChart Beyond Card has a strictly non-waivable S$1,635 annual fee, about 3X what you’d pay for a card in the $120K segment.

Standard Chartered is well aware that the annual fee will be a stumbling block for a lot of people, and has pre-emptively addressed that in their FAQs:

While the annual card membership fee for the Beyond Credit Card is not eligible for waiver, it grants access to Privileges that provide value well beyond the fee.

-Standard Chartered

Does it though?

It depends. The most important thing to know about the StanChart Beyond Card is that it can be a completely different beast depending on your status with the bank. You see, the Beyond Card has a trinitarian nature of sorts: one product, three forms.

- Regular: No minimum AUM required

- Priority Banking: Minimum S$200,000 AUM

- Priority Private: Minimum S$1,500,000 AUM

The earn rates and benefits for the various tiers are summarised below.

| Regular | Priority Banking | Priority Private | |

| Local Earn | 1.5 mpd | 2 mpd | 2 mpd |

| FCY Earn | 3 mpd | 3.5 mpd | 4 mpd |

| FCY Dining | 8 mpd | ||

| Birthday Meal | Yes | ||

| Business Class Upgrades | Yes | ||

| Airport Lounge | ∞ + 6 guests (Principal & Supp.) |

||

| Airport Limo | – | 2x | 10x |

| Accor Plus | – | – | Yes (Explorer Plus) |

| Tier | World Elite Mastercard |

||

Earn rates

| Regular | Priority | Priority Private | |

| Local Earn | 1.5 mpd | 2 mpd | 2 mpd |

| FCY Earn | 3 mpd | 3.5 mpd | 4 mpd |

| FCY Dining | 8 mpd |

The StanChart Beyond Card offers some very eye-catching earn rates indeed.

Even at the base tier, you’re earning 1.5 mpd on local spend, and 3 mpd overseas. Priority Banking customers get upgraded to 2 mpd/3.5 mpd, while Priority Private customers get further upgraded to 2 mpd/4 mpd, with 8 mpd on overseas dining.

The best part? There’s no minimum spend necessary, and no cap on the maximum miles you can earn. So yes, a Priority Private client could earn an uncapped 8 mpd on overseas dining, simple as that.

While we have seen cards offering uncapped 4 mpd earn rates on a promotional basis, this is the first time we’ve seen an uncapped 8 mpd (fine, there was this one time…), let alone as an evergreen feature.

Birthday meal

Principal StanChart Beyond Cardholders, regardless of tier, are entitled to a complimentary birthday meal at Lerouy, a 1-Michelin Star restaurant serving French contemporary cuisine.

Cardholders will receive a promo code shortly before their birth month, which is valid for two months from the date of issuance. However, the free meal is only for one diner. Any additional guest(s) will receive a 15% discount.

For reference, lunch at this restaurant ranges from S$108 to S$198, while dinner ranges from S$158 to S$228.

Business Class upgrades

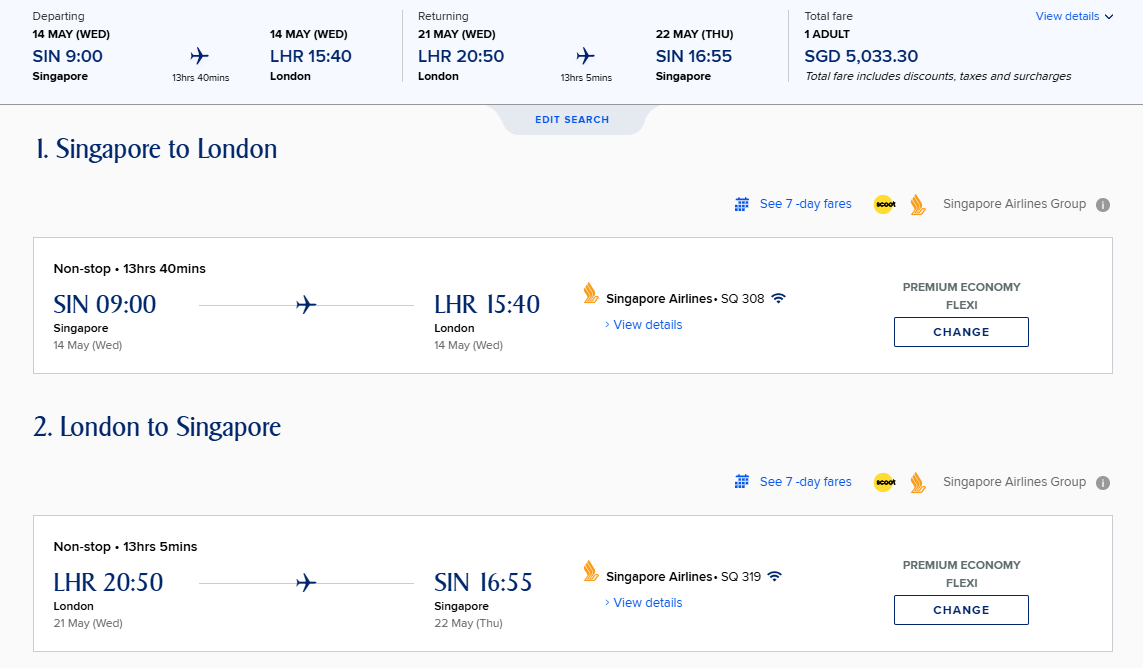

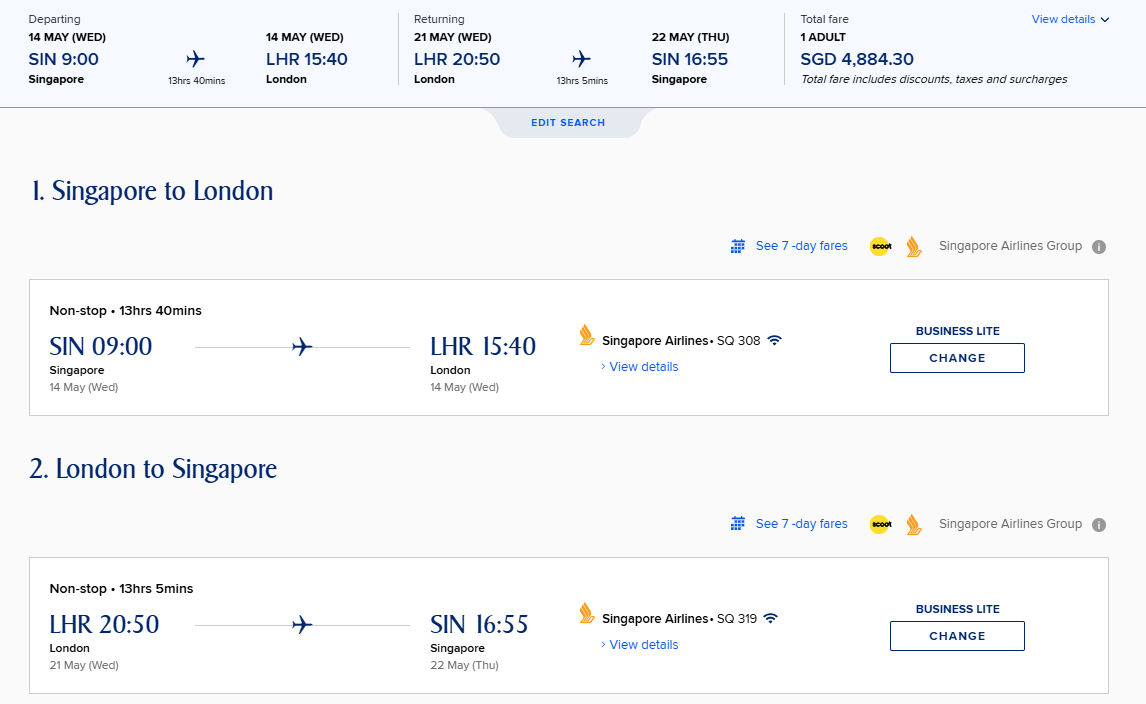

Principal StanChart Beyond Cardholders, regardless of tier, will be eligible for complimentary upgrades to Business Class. Don’t get too excited though, because this benefit isn’t nearly as good as it sounds.

To enjoy the upgrades, you must be travelling in a party of at least three and purchase (via the Beyond concierge):

- 2x paid Business Class tickets, and

- 1x paid Premium Economy Class tickets

The 1x Premium Economy Class ticket will then be upgraded to Business Class.

You can enjoy the upgrade for a maximum of two air tickets, so alternatively, you could also travel in a party of four and purchase:

- 2x paid Business Class tickets, and

- 2x paid Premium Economy Class tickets

The 2x Premium Economy Class tickets will then be upgraded to Business Class.

Here’s the catch. The paid Premium Economy Class ticket must be a non-restricted fare type, and the upgraded ticket can only be to the most restricted fare type for Business Class. In case you were wondering, non-restricted means the most expensive fare type, and most restricted refers to the least expensive.

Depending on the route and airline you’re choosing, this benefit may be effectively worthless. Take this example of a Singapore Airlines round-trip itinerary between Singapore and London. The cost of a non-restricted Premium Economy Class ticket is S$5,033.30- more expensive than a restricted Business Class ticket at S$4,884.30!

The upgrade benefit can be enjoyed for a maximum of two Premium Economy Class tickets per membership year.

Airport lounge access

Principal and supplementary StanChart Beyond Cardholders, regardless of tier, will enjoy unlimited Priority Pass lounge visits.

| ❓ How many supplementary cards can you get? |

| The annual fee for supplementary cards is waived, and StanChart has confirmed that cardholders can receive up to four free supplementary cards |

A total of six guests can be brought to the lounge per calendar year, a quota which is shared between the principal and all supplementary cardholders.

You can bring as many guests as you wish in one visit. For example, the principal cardholder could take along three guests and consume a total of three guest entitlements.

Airport limo rides

Principal StanChart Beyond Cardholders belonging to the Priority Banking and Priority Private tiers will enjoy complimentary airport limo rides as follows:

- Priority Banking: 2x rides per calendar year

- Priority Private: 10x rides per calendar year

| ❓ Why do T&Cs say otherwise? |

| The Beyond Cards T&CS (Part R8, point 80) mention that the allowance for Priority Banking and Priority Private clients is 2x rides. That’s because Priority Private clients already enjoy 8x rides by virtue of their status, without the need to get the Beyond Card. With the Beyond Card, their total allowance increases to 10X |

No minimum spend is required to unlock this benefit.

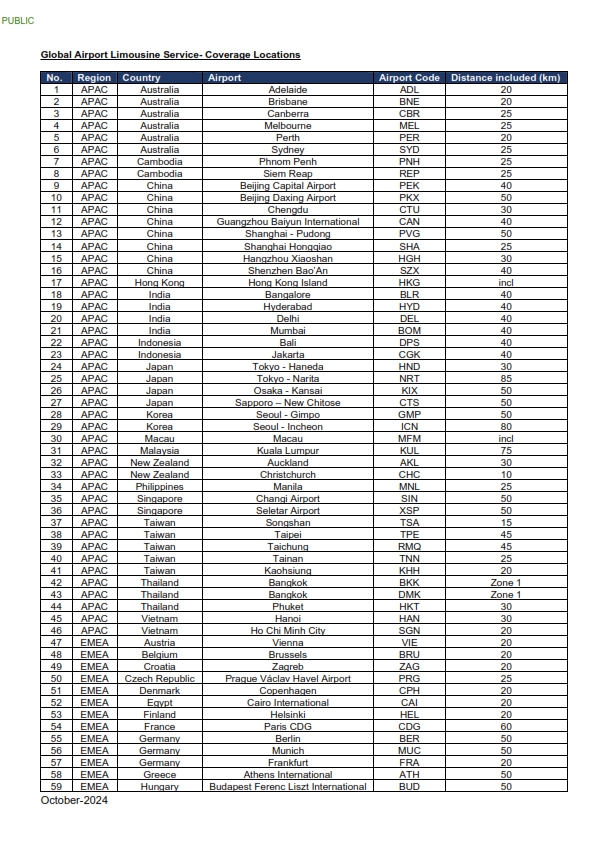

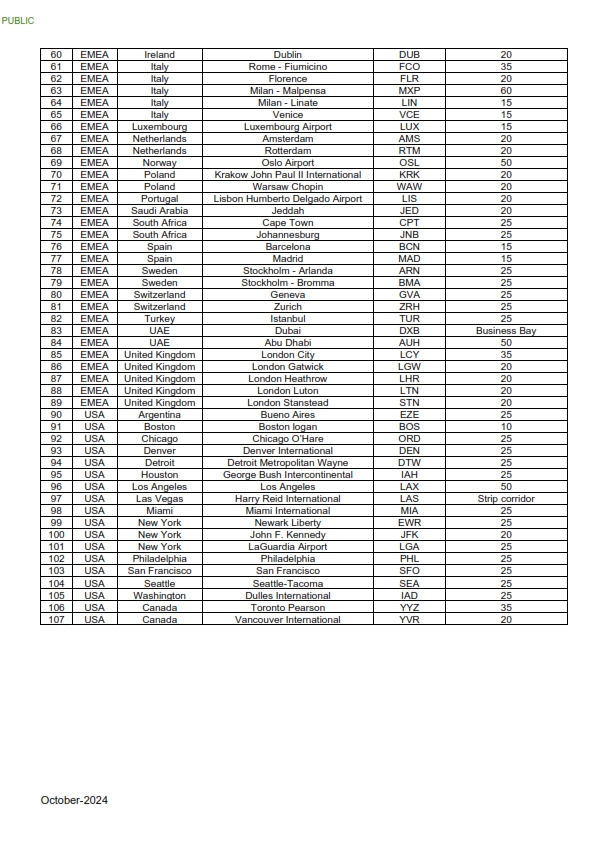

Unlike other cards with a limo benefit, the rides can be used both in Singapore and more than 100 destinations overseas. That’s a nice touch, but there’s a catch. Depending on city and vehicle chosen, a one-way trip may consume more than 1x entitlement.

List of cities and included distance

I know that’s a bit confusing, so think of your ride entitlements like a currency. Some cities will require you to spend 2x or more ride entitlements for a single journey. I’m guessing that’ll be the case in high-cost countries where the airport is far from the city, like Tokyo Narita.

Also note that blackout dates apply, so you might not be able to book the airport limo during popular periods.

Additional surcharges apply in the following scenarios:

| ⚠️ Additional surcharge for limo rides |

|

There is no airport limo benefit for regular Beyond Cardholders.

Accor Plus membership

Principal StanChart Beyond Cardholders belonging to the Priority Private tiers will enjoy a complimentary Accor Plus Explorer Plus membership, which includes:

- 2x Stay Plus certificates, each valid for a one-night free stay at participating hotels

- 10% off best available public rate

- Up to 50% off member exclusive room rates with with Red Hot Room offers

- Up to 50% off dining across 1,400 restaurants in Asia Pacific

- 15% off drinks bill in Asia

- Member exclusive More Escapes stay packages

- Early access to global Accor hotel sales

- Member exclusive experiences

- 20 status nights each year

This membership usually retails for S$538, though we do see periodic sales that reduce the price further (not to mention you can buy a membership for much less from another Accor Plus country!).

What about the other benefits?

The StanChart Beyond Card lists some additional benefits that I’ve not addressed in the sections above:

- GHA DISCOVERY Titanium status

- Wyndham Diamond status

- 4x complimentary golf games or golf lessons

- Held tables at top restaurants

- 3GB global data roaming

- Purchase protection

- ID theft protection

- Travel insurance with up to US$500,000 coverage

While these are good to have, I want to highlight that they’re all generic World Elite Mastercard benefits, which you could obtain from another card with a much lower (or even waived) annual fee.

In fact, you might even say that StanChart missed a few, because World Elite Mastercard customers also get Brilliant by Langham Ruby, CentaraThe1 Platinum, IPrefer Titanium, MyMillennium Prestige, ONYX Rewards, and Swiss-Belexecutive Platinum Connoisseur. There’s also complimentary Avis President’s Club status, for good measure.

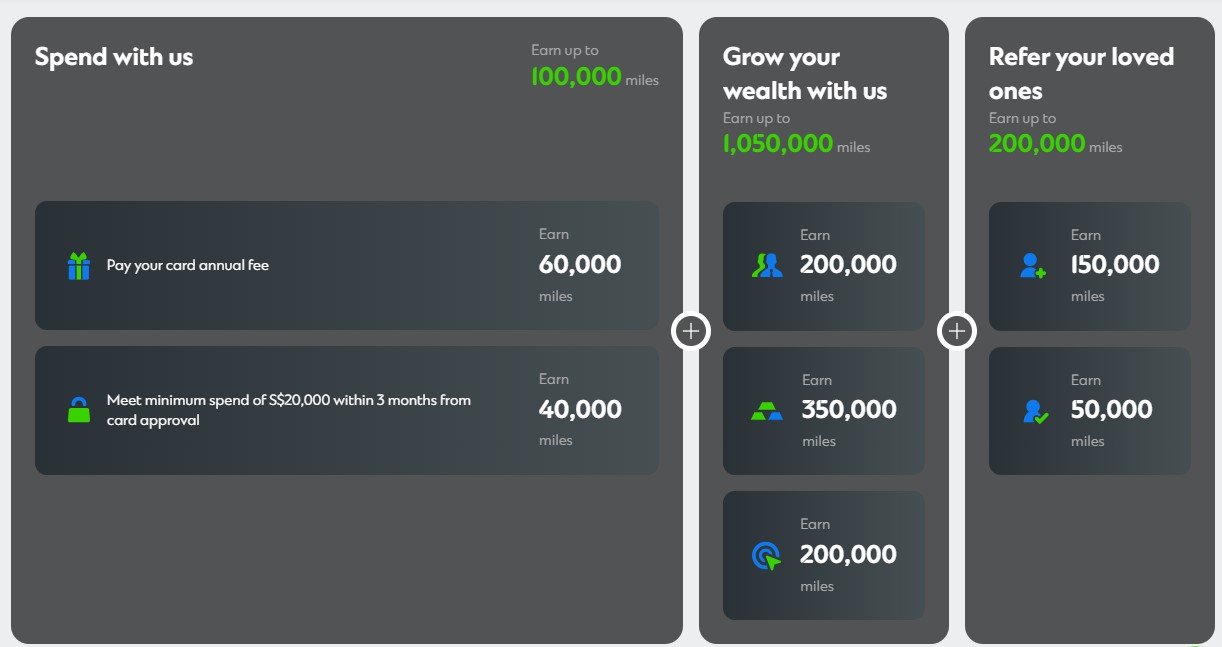

StanChart Beyond Card 100,000 miles welcome offer

Hands up, who’s got de ja vu?

Cast your mind back to July 2019, when Standard Chartered launched the X Card with an unprecedented 100,000 miles welcome offer. Pandemonium ensued, as applications came in so fast the bank ran out of metal cardstock.

The X Card is a distant memory by now, but the Beyond Card is offering a 100,000 miles welcome offer of its own.

StanChart Beyond Card StanChart Beyond Card |

|

| Apply Here | |

| Offer ends 30 June 2025 | |

| Reward | Criteria |

| 60,000 miles | Pay S$1,635 annual fee |

| 40,000 miles | Spend at least S$20,000 within 90 days of approval (or S$10,000 if you’re a StanChart employee) |

The usual spending exclusions apply, such as charitable donations, education, hospitals, insurance premiums, government transactions and utilities.

The welcome bonus will be credited within 60 working days of the end of the eligible transaction period, so for example, if you were approved on 1 December 2024, you’d have to meet the minimum spend by 1 March 2025, and then your bonus would be credited 60 working days later- roughly in June 2025.

There is no requirement that you must be new-to-bank; the offer is valid even if you already have another principal Standard Chartered credit card.

The T&Cs of this offer can be found here.

What about “beyond 1 million miles”?

Wait a minute, you say. 100,000 miles is not “beyond 1 million miles”. Where’s the rest gone?

Well, the bulk of this figure comes from the welcome rewards offered to new Priority Banking or Priority Private customers. The cash gifts have been effectively swapped out for miles, awarded for depositing fresh funds, purchasing unit trusts or signing up for insurance policies.

Priority Banking

| New to SC | Existing SC client |

|

|

|

|

|

|

Priority Private

| New to SC | Existing SC client |

|

|

|

|

|

|

How attractive this is really depends on your current investment strategy, where your funds are parked, and whether you prefer investing and insuring with a bank, or lowest cost DIY solutions.

The T&Cs of this offer can be found here.

Is it worth it?

If you’ve read till this point, your head is probably a bit fuzzy- and I don’t blame you. There’s a lot to digest here, and a lot of comparisons to be made before you can take the S$1,635 plunge.

I think this warrants further analysis, so stay tuned for a separate article addressing the all-important “is it worth it?” question.

But if you asked me for my 10-second hot take, I’d say that I’m leaning towards this being a one-year-only card, rather than something you retain for the long run. I’m particularly worried about a clause in the T&Cs which states:

|

7. In order for a Beyond principal cardholder to continue to be eligible for the programmes, or part thereof, that are specially offered to Beyond principal cardholders who have a Priority Banking, Priority Private or Private Banking relationship with the Bank, i.e. the programmes listed under Clauses 1.1, 1.4, 1.7, the Beyond principal cardholder must carry out at least one (1) Eligible Investment or Eligible Deposit with the Bank within 12 months after the first renewal of the Beyond Card and yearly thereafter. Further details of this requirement will be provided in due course. This requirement will not apply for the first 12 months after the Beyond Card is issued to you. |

tl;dr: it’s not enough to just be a passive Priority Banking or Priority Private client. From the second year onwards, Standard Chartered expects you to be buying investment products or making “eligible deposits” in order to retain your additional Beyond privileges. As someone who prefers to do low-cost roboinvesting, I don’t particularly relish the idea of that.

More on this to come.

Conclusion

Standard Chartered has launched an all new premium credit card called Beyond, and it looks to be going for a shock and awe approach, with headline-grabbing welcome offers and earn rates.

I need more time to analyse this product, and wouldn’t advise anyone to rush out to sign up just yet. After all, this costs about the same as an AMEX Platinum Charge, and while its earn rates are much better, the benefits and first year value proposition aren’t nearly as good.

What do you make of the new StanChart Beyond Card?

Is cardup income tax payment counted towards the 20K spend for the 40K miles?

Uhh, how dare they?

Since when did SQ offer round trip SIN-LON business class tickets for $3,500+? The fare shown is only for the outward flight. You will need to click through to the return trip and you will see the additional fare required if you wish to return in J class as well.

You should know better.

I was debating whether to show this as one screenshot or two, but since the story is the same either way, I just showed one. In case you were curious, the total cost of a round-trip premium economy flexi ticket is S$5,033.30. The cost of a round-trip business lite ticket is S$4,884.30. (dates: 14 may to 21 may 2025).

i have updated the screenshot to address your concern.

hope that clarifies, and it doesn’t hurt to ask more nicely.

Hi Aaron,

There will be some people who are rude in this world. Ignore them.

There seems to be a typo in below paragraph:

“Depending on the route and airline you’re choosing, this benefit may be effectively worthless. Take this example of a Singapore Airlines round-trip itinerary between Singapore and London. The cost of a non-restricted Premium Economy Class ticket is S$4,884.30- more expensive than a restricted Business Class ticket at S$5,033.30!”

S$5,033.30 should be for the non-restricted Premium Economy Class ticket and S$4,884.30 should be for the restricted Business Class ticket.

d’oh! thanks for spotting that. will correct it.

The benefits for the same annual fee seem to be only worthwhile for the private client category or at least the priority category (probably equivocal for the latter). Touching any unit trust or insurance product would wipe out any savings/benefits that the card might be worth compared to a low-cost investment approach. Also holding it in cash in any “bonus” savings account might just keep up with inflation after applying caps on bonuses? So non-starters. But I wonder if shares held in an SCB custodian account are included in AUM for this case. SCB charges no custodian fees even for… Read more »

You are confusing readers, beyond card is only publicly available for application from 3rd Jan 2025 onwards

From 22 Nov 2024 to 2nd Jan 2025, it is available for bank staff application

I’m aware of the document you’re referring to, but since the website is already live, why not cover it?

depending on the take up rates of staff, and feedback, maybe the offers might change for the public 🙂

A whole month for bank staff applications?Oh wow, SCB pays reaally well …

100,000 miles with paying $1,636 annual fees and $200,000 spending in first 90 days are worth a sign-up IMHO. Any other benefits are bonus.

But how to spend $20,000 in 90 days??

Just buy shopping vouchers and use them slowly. $20k = one cruise to Antarctica or one Birkin & one Kelly or one Rolex or one family holiday. 😛

Where to buy Rolex? Nowadays all boutiques had become museums.

those in the know will not be telling you for sure.

Hi

Any idea if AUM includes shares held in the trading/custody account with SCB? As I understand it, the common practice with all the banks is to include that as AUM. Can we just transfer shares in to qualify instead of cash?

yes

For the overseas limo entitlement in Chengdu, it’s weired that they only cover CTU (where only has domestic flights within mainland China) instead of TFU (where all international flights operate in). Think CTU vs TFU as HND vs NRT. This benefit is pretty useless if you are travelling to Chengdu from overseas.

On the right route, the PE to J upgrade might be worth it.

Too bad it doesn’t extend to buy J, get F.