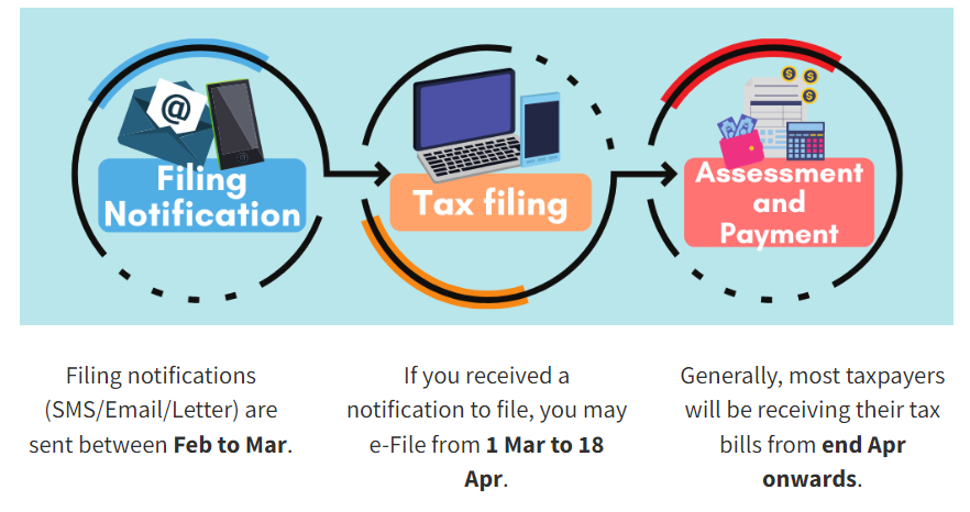

The YA 2025 income tax season is now underway, and individuals will need to file their taxes by 18 April 2025. They’ll subsequently receive their tax bill (NOA) in batches between April to September 2025 (if you haven’t received yours yet, don’t worry— I promise you they haven’t forgotten!).

While I don’t think anyone will be jumping for joy to receive their NOA, there’s some good news: if you don’t mind paying a small admin fee, tax season is a great opportunity to earn some extra miles.

In this guide, I’ll walk you through the various methods of doing so, as well as the all-important cost per mile.

|

| Tax Season 2025 |

| 💰 The MileLion’s Income Tax Guide 2025 |

How do I pay my income tax bill with a credit card?

IRAS does not accept credit card payments. In their own words:

Credit card payments are not offered by IRAS directly because of the high transaction costs charged by the credit card service providers. This is to keep the cost of collection low to preserve public funds.

-IRAS

However, this doesn’t mean you can’t use your credit card to pay taxes. Banks and bill payment platforms offer tax payment facilities, which allow cardholders to earn rewards on taxes in exchange for a small fee.

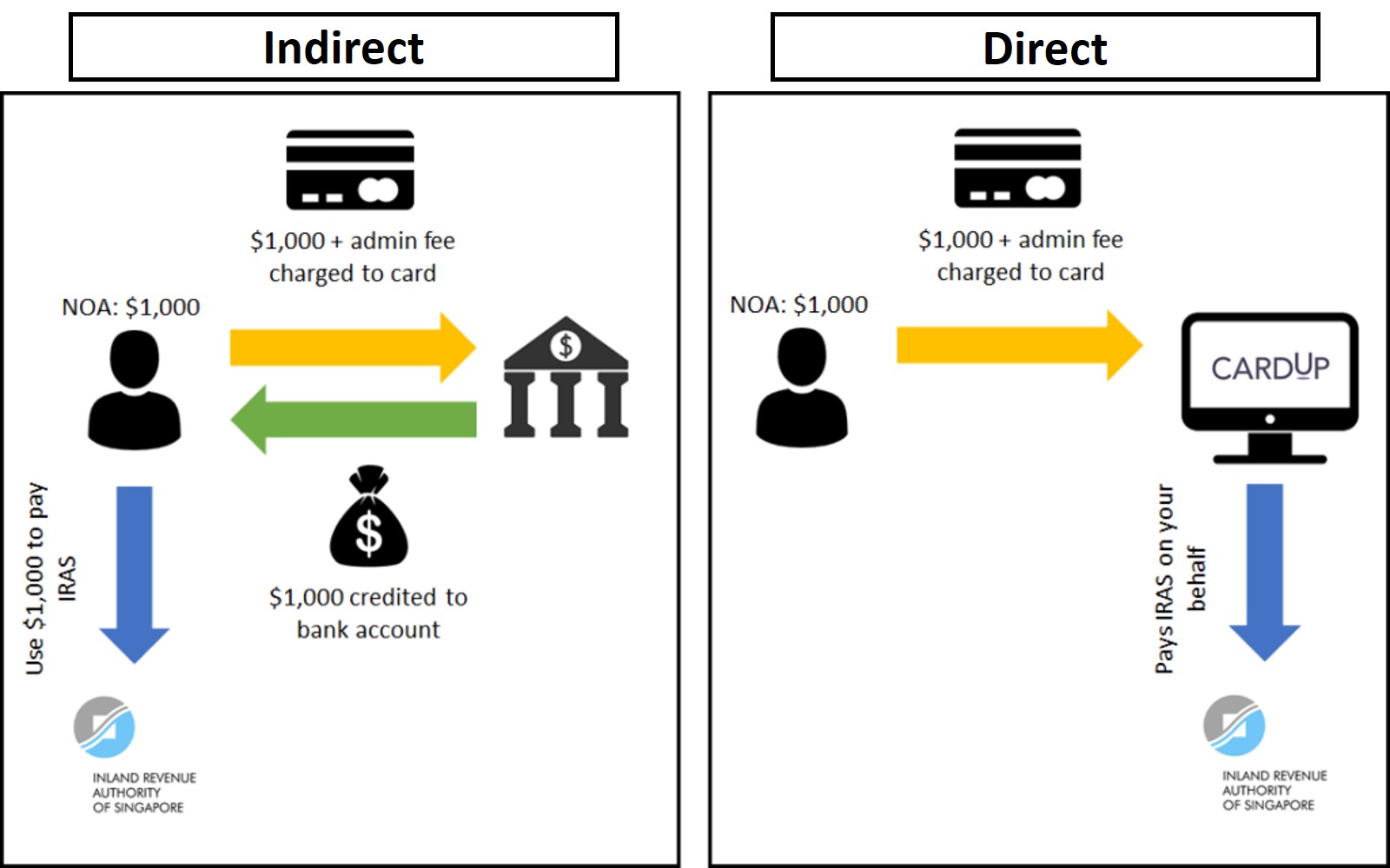

I divide these into “indirect” and “direct”.

| Indirect Payment Facilities | Direct Payment Facilities |

|

|

|

|

Both indirect and direct facilities work the same in the sense that your credit card is charged for the tax amount due plus an admin fee, earning miles in the process.

Where they differ is that:

- An indirect payment facility deposits the amount due into your designated bank account, in cash. You’re still responsible for paying IRAS

- A direct payment facility pays IRAS on your behalf

Whether it’s better to use an indirect or direct facility all boils down to the cost per mile: the admin fee, divided by the miles earned.

What are the fees involved?

Here’s a list of the various payment facilities and the applicable fees.

| 🧾 List of Payment Facilities |

||

| Bank | Applicable Cards | Admin Fee |

Direct |

All cards except HSBC | 1.5%-2.6% |

Indirect |

UOB PRVI Miles, Visa Infinite Metal, Reserve, KF UOB | 1.6-1.8% |

Indirect |

OCBC VOYAGE | 1.9% |

Link LinkDirect |

All StanChart cards | 1.9% |

Indirect |

StanChart Beyond, Visa Infinite | 1.9% |

Direct |

All DBS cards | 2.5% |

Link LinkDirect |

All Citi cards | 2.6% |

| There is an additional option called ipaymy, but for reasons outlined in this post, I neither endorse nor comment on their services. However, I’ll mention them in the cost per mile table later on to the extent it offers the lowest cost per mile for a given card. | ||

While I’ve sorted the table above on the basis of admin fees, that’s only half the story. A lower fee doesn’t necessarily mean cheaper miles; you need to also consider the earn rate.

This can be confusing, because banks may offer different earn rates for income tax payments as opposed to regular retail spend. For example:

- The UOB PRVI Miles Card earns 1 mpd for payments via the UOB Payment Facility (versus 1.4 mpd normally)

- The OCBC VOYAGE Card earns 1 mpd for payments via the OCBC VOYAGE Payment Facility (versus 1.3 mpd normally)

- All DBS cards earn a flat 1.5 mpd for income tax payments, instead of their usual rates

To illustrate why it’s insufficient to just compare options on the basis of admin fees, the OCBC VOYAGE Payment Facility has an admin fee of 1.9%, and an earn rate of 1 mpd. This means the cost per mile is 1.9 cents.

In contrast, Citi PayAll has a higher admin fee of 2.6%, but the Citi ULTIMA Card earns 1.6 mpd. This means the cost per mile is lower than VOYAGE, at 1.63 cents.

If this is too complicated for you, I’ve done the calculations later on in this article for every major miles-earning card.

What’s changed for YA 2025?

Here’s a summary of the key changes that have taken place since last year’s article.

Chocolate Visa Card: Nerfed too soon

When the Chocolate Visa Card launched its “2 mpd on almost everything” partnership with HeyMax, I’m sure the game plan for many was to pay income taxes with AXS.

Unfortunately, that didn’t last very long. Chocolate removed support for AXS in early March 2025, and it looks unlikely that will ever come back. This was the only way of earning truly free miles on income tax, so it’s a shame it died so early!

You can still use the Chocolate Visa Card to pay income taxes through CardUp, but with the earn rate now nerfed to just 1 mpd — and a 100 miles/month cap on bill payments including CardUp — there’s very little point.

StanChart Beyond Card: Time to shine

The newly-launched StanChart Beyond Card offers an uncapped earn rate of up to 2 mpd on local spending, making it the highest-earning option for income taxes.

For example, using the Standard Chartered Tax Payment Facility to pay your income taxes can earn you miles at a cost of just 0.95 cents per mile (based on a 1.9% admin fee and 2 mpd earn rate). If you’ve recently received the card and are working towards the 100,000 miles welcome offer, keep in mind that payments made through both the Standard Chartered Tax Payment Facility and SC EasyBill count towards the S$20,000 minimum spend requirement.

UOB One Account: Cashback ain’t bad!

The UOB One Account is set to nerf its interest rates from May 2025, but as a consolation prize, the bank has also launched a new promotion that offers account holders a 6% rebate on GIRO income (and property) tax payments made between 1 April 2025 and 31 March 2026.

The rebate cap depends on the monthly average balance (MAB) in your UOB One Account.

| UOB One MAB | Monthly Cap (Equivalent deduction based on 6% rebate) |

Total Cap |

| ≥S$30K and <S$75K | S$10 (S$167) |

S$120 |

| ≥S$75K and <S$150K | S$25 (S$417) |

S$300 |

| ≥S$150K | S$50 (S$833) |

S$600 |

To earn this rebate, customers will need to complete the following three steps:

- Register your mobile number for PayNow on UOB TMRW

- Activate Money Lock on UOB TMRW (minimum S$1 lock amount)

- Apply for GIRO Monthly Tax Payment Plan through IRAS portal, selecting UOB One Account for deduction

No further actions are required if you’ve already performed the above three activities prior to 1 April 2025.

You can enjoy this rebate and still earn miles, to the extent that your tax bill is high enough. For example, if my tax bill were S$1,000 per month, I could pay S$167 via CardUp (to earn miles) and S$833 via GIRO (to earn 6% rebates).

What promotions are available?

CardUp

CardUp’s promo codes for income tax payments can be found below.

OCBC cards

| Code | OCBC155 |

| Eligible Cards | OCBC VOYAGE & Premier Visa Infinite |

| Type | One-off or first payment in a recurring series |

| Limit | New customers only |

| Admin Fee | 1.55% |

| Min. Spend | None |

| Cap | S$20,000 |

| Schedule By | 31 March 2026, 6 p.m SGT |

| Due Date By | 3 April 2026 |

| OCBC155 T&Cs | |

| Code | OCBC90N155 |

| Eligible Cards | OCBC 90°N Visa and Mastercard |

| Type | One-off or first payment in a recurring series |

| Limit | New customers only |

| Admin Fee | 1.55% |

| Min. Spend | None |

| Cap | S$10,000 |

| Schedule By | 31 March 2026, 6 p.m SGT |

| Due Date By | 3 April 2026 |

| OCBC90N155 T&Cs | |

| Code | OCBCTAX173 |

| Eligible Cards | OCBC VOYAGE & Premier Visa Infinite |

| Type | One-off or recurring |

| Limit | No limit on redemptions |

| Admin Fee | 1.73% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 August 2025, 6 p.m SGT |

| Due Date By | 25 March 2026 |

| OCBCTAX173 T&Cs | |

Mastercard

| Code | MCTAX25N |

| Limit | 1x redemption per user 300 redemptions overall New customers only |

| Admin Fee | 1.55% |

| Min. Spend | None |

| Cap | S$3,500 |

| Schedule By | 31 August 2025, 6 p.m |

| Due Date By | 3 September 2025 |

| Eligible Cards | Mastercard |

| MCTAX25N T&Cs | |

| Code | MCTAX25 |

| Limit | 1x redemption per user 1,500 redemptions overall |

| Admin Fee | 1.67% |

| Min. Spend | None |

| Cap | S$5,000 |

| Schedule By | 31 August 2025, 6 p.m |

| Due Date By | 3 September 2025 |

| Eligible Cards | Mastercard |

| MCTAX25 T&Cs | |

Visa

| Code | MLTAX25R |

| Eligible Cards | All Singapore-issued Visa Cards |

| Type | Recurring Payments |

| Limit | 2x redemptions per user; no overall redemption cap |

| Admin Fee | 1.75% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 31 August 2025, 6 p.m |

| Due Date By | 25 March 2026 |

| MLTAX25R T&Cs | |

| Code | VTAX25ONE |

| Eligible Cards | All Singapore-issued Visa Cards |

| Type | One-Off Payment |

| Limit | 2x redemptions per user; no overall redemption cap |

| Admin Fee | 1.75% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 23 May 2025, 6 p.m |

| Due Date By | 26 May 2025 |

| VTAX25ONE T&Cs | |

If you have a large tax payment to make, it’s worth contacting CardUp (hello@cardup.co) to see if they will offer a special rate. In previous years, customers reported receiving a rate as low as 1.7%.

Citi PayAll

Citi PayAll is offering:

- 1.6 mpd on non-tax payments

- 1.8 mpd on tax payments

A minimum spend of S$6,000 on non-tax payments is required to unlock the rates above, though this requirement is waived if you have a banking relationship with Citi.

Citi PayAll offering 1.8 mpd on tax & 1.6 mpd on non-tax payments

The cost per mile will range between 1.44 to 1.63 cents each, depending on the overall mix of tax and non-tax payments.

Standard Chartered Payment Facility & EasyBill

Standard Chartered is offering two different promotions: one for its Income Tax Payment Facility, and another for SC EasyBill.

StanChart Beyond and Visa Infinite Cardholders who pay their taxes via the Income Tax Payment Facility will receive a 100% rebate of the 1.9% admin fee, capped at the first 50 applications each month and S$300 per customer.

StanChart Visa Infinite offering S$300 cashback on tax payment facility

All other StanChart cardholders can pay their taxes via SC EasyBill instead. The first 50 applications each month will receive a 100% rebate of the 1.9% admin fee, capped at S$200 per customer.

UOB Payment Facility

The UOB Payment Facility is currently running a promotion that allows cardholders to purchase unlimited miles from 1.6 to 1.8 cents each, depending on card. As this is a “pay anything” facility, however, UOB doesn’t really care what you use the funds for, and it doesn’t matter what size your tax bill is.

Think of this as a way of topping up your account further, after you’ve exhausted the cheaper options.

Buy unlimited miles from 1.6 cents with the UOB Payment Facility

What’s the cost per mile?

In the table below, I’ve ranked credit cards by the lowest possible price you can pay for miles, denoted by CPM (cost per mile, in cents).

| 💰 Summary of Tax Payment Options |

|||

| Card | Pay Via | Fee (MPD) |

CPM |

StanChart Beyond StanChart Beyond(PB/PP) Apply |

CardUp (New) |

1.55% 2 mpd |

0.76¢ |

| CardUp (Existing) |

1.67% 2 mpd |

0.82¢ | |

Citi ULTIMA MC Citi ULTIMA MCApply |

CardUp (New) |

1.55% 1.6 mpd |

0.95¢ |

| CardUp (Existing) |

1.67% 1.6 mpd |

1.03¢ | |

OCBC VOYAGE OCBC VOYAGE Premier, PPC, BOS Apply |

CardUp (New) |

1.55% 1.6 mpd |

0.95¢ |

| CardUp (Existing) |

1.73% 1.6 mpd |

1.06¢ | |

StanChart Beyond Card StanChart Beyond Card (Regular) Apply |

CardUp (New) |

1.55% 2 mpd |

1.02¢ |

| CardUp (Existing) |

1.67% 2 mpd |

1.10¢ | |

Citi ULTIMA Visa Citi ULTIMA VisaApply |

CardUp | 1.75% 1.6 mpd |

1.07¢ |

DBS Insignia DBS InsigniaApply |

CardUp | 1.75% 1.6 mpd |

1.07¢ |

UOB Reserve UOB ReserveApply |

CardUp | 1.75% 1.6 mpd |

1.07¢ |

UOB PRVI Miles MC UOB PRVI Miles MCApply |

CardUp (New) |

1.55% 1.4 mpd |

1.09¢ |

| CardUp (Existing) |

1.67% 1.4 mpd |

1.17¢ | |

DBS Vantage DBS VantageApply |

CardUp | 1.75% 1.5 mpd |

1.15¢ |

OCBC VOYAGE OCBC VOYAGEApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.73% 1.3 mpd |

1.31¢ | |

OCBC 90°N MC OCBC 90°N MCApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.67% 1.3 mpd |

1.26¢ | |

OCBC 90°N Visa OCBC 90°N VisaApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.75% 1.3 mpd |

1.32¢ | |

Citi Prestige Citi PrestigeApply |

CardUp (New) |

1.55% 1.3 mpd |

1.17¢ |

| CardUp (Existing) |

1.67% 1.3 mpd |

1.26¢ | |

OCBC Premier Visa Infinite OCBC Premier Visa InfiniteApply |

CardUp (New) |

1.55% 1.28 mpd |

1.19¢ |

| CardUp (Existing) |

1.73% 1.28 mpd |

1.33¢ | |

UOB PRVI Miles Visa UOB PRVI Miles VisaApply |

CardUp | 1.75% 1.4 mpd |

1.23¢ |

UOB Visa Infinite Metal UOB Visa Infinite MetalApply |

CardUp | 1.75% 1.4 mpd |

1.23¢ |

StanChart Visa Infinite StanChart Visa InfiniteApply |

CardUp | 1.75% 1.4 mpd* |

1.23¢ |

KrisFlyer UOB KrisFlyer UOBApply |

CardUp (New) |

1.55% 1.2 mpd |

1.27¢ |

| CardUp (Existing) |

1.67% 1.2 mpd |

1.37¢ | |

Citi Premier Miles MC Citi Premier Miles MCApply |

CardUp (New) |

1.55% 1.2 mpd |

1.27¢ |

| CardUp (Existing) |

1.67% 1.2 mpd |

1.37¢ | |

DBS Altitude Visa DBS Altitude VisaApply |

CardUp | 1.75% 1.3 mpd |

1.32¢ |

Citi Premier Miles Visa Citi Premier Miles Visa |

CardUp | 1.75% 1.2 mpd |

1.43¢ |

Maybank Visa Infinite Maybank Visa InfiniteApply |

CardUp | 1.75% 1.2 mpd |

1.43¢ |

StanChart Journey StanChart JourneyApply |

CardUp | 1.75% 1.2 mpd |

1.43¢ |

Citi Rewards Citi RewardsApply |

Citi PayAll | 2.6% 1.8 mpd |

1.44¢ |

AMEX PPS Card AMEX PPS CardApply |

IPM | 1.99% 1.3 mpd |

1.50¢ |

AMEX Solitaire PPS Card AMEX Solitaire PPS CardApply |

IPM | 1.99% 1.3 mpd |

1.50¢ |

DBS Altitude AMEX DBS Altitude AMEXApply |

IPM | 1.99% 1.3 mpd |

1.50¢ |

AMEX KrisFlyer Ascend AMEX KrisFlyer AscendApply |

IPM | 1.99% 1.2 mpd |

1.63¢ |

AMEX KrisFlyer Credit Card AMEX KrisFlyer Credit CardApply |

IPM | 1.99% 1.1 mpd |

1.77¢ |

UOB PRVI Miles AMEX UOB PRVI Miles AMEXApply |

CardUp | 2.6% 1.4 mpd |

1.81¢ |

AMEX Centurion AMEX CenturionApply |

IPM | 1.99% 0.98 mpd |

1.99¢ |

AMEX Platinum Charge AMEX Platinum ChargeApply |

IPM | 1.99% 0.78 mpd |

2.50¢ |

AMEX Platinum Credit Card AMEX Platinum Credit CardApply |

IPM | 1.99% 0.69 mpd |

2.83¢ |

AMEX Platinum Reserve AMEX Platinum ReserveApply |

IPM | 1.99% 0.69 mpd |

2.83¢ |

| *With a minimum spend of S$2,000 in a statement month. Minimum spend includes CardUp payments (and SC EasyBill/StanChart Tax Payment Facility for that matter). | |||

| ❓How is this calculated? |

|

For CardUp, both the admin fee and the tax payment earn miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,221 miles (S$1,017.50 x 1.2 mpd, ignoring rounding). This works out to 1.43 cents per mile (S$17.50/1,221 miles) For bank facilities, only the tax payment earns miles, so a S$1,000 payment with a 1.75% fee placed on a 1.2 mpd card earns 1,200 miles. This works out to 1.46 cents per mile (S$17.50/1,200) |

| ❓ Where’s my card? |

| If you don’t see your card mentioned above, e.g. HSBC Revolution or UOB Preferred Platinum Visa, there’s a good reason. These cards either don’t earn miles on tax payments (e.g. HSBC), or earn such a low rate that the cost per mile becomes prohibitive. |

Of course, the lower the cost per mile the better, but everyone will have to decide for themselves what “ceiling price” they’re willing to pay, based on their personal mile valuation.

Other important points

Apply for as many facilities as you want

There’s nothing stopping you from applying for multiple tax payment facilities in order to buy more miles (otherwise known as churning).

For example, someone with a S$24,000 tax bill and a StanChart Visa Infinite Card could set up an arrangement with both the Standard Chartered Income Tax Payment Facility and CardUp.

- With the Standard Chartered Income Tax Payment Facility, he could earn 33,600 miles (S$24,000 x 1.4 mpd) at a cost of S$456 (1.9% x S$24,000).

- With Cardup, he could pay his taxes in 12-month installments of S$2,000 each, earning 2,849 miles per month (S$2,000 x 1.0175 x 1.4 mpd) at a cost of S$35 (1.75% x S$2,000).

There’s no interaction between the two here, because the Standard Chartered Income Tax Payment Facility is indirect, and CardUp is direct.

However, take care if you’re applying for two or more direct payment facilities, because overpaying your tax bill can create issues. Over the years, there have been many people who overpaid their taxes to buy additional miles, in the knowledge that IRAS will refund the excess anyway. However, this creates additional administrative work, and IRAS has made its displeasure at such activity known.

|

“Where we have determined in our discretion exercised reasonably that your Payment(s) to IRAS exceed the amount of taxes which you are required to pay to IRAS, we shall be entitled to claw back any rewards credited to your card account in connection with any amount so overpaid to IRAS using the Service. In such an event, we will refund the relevant portion of Fee in respect of such overpaid amount.” |

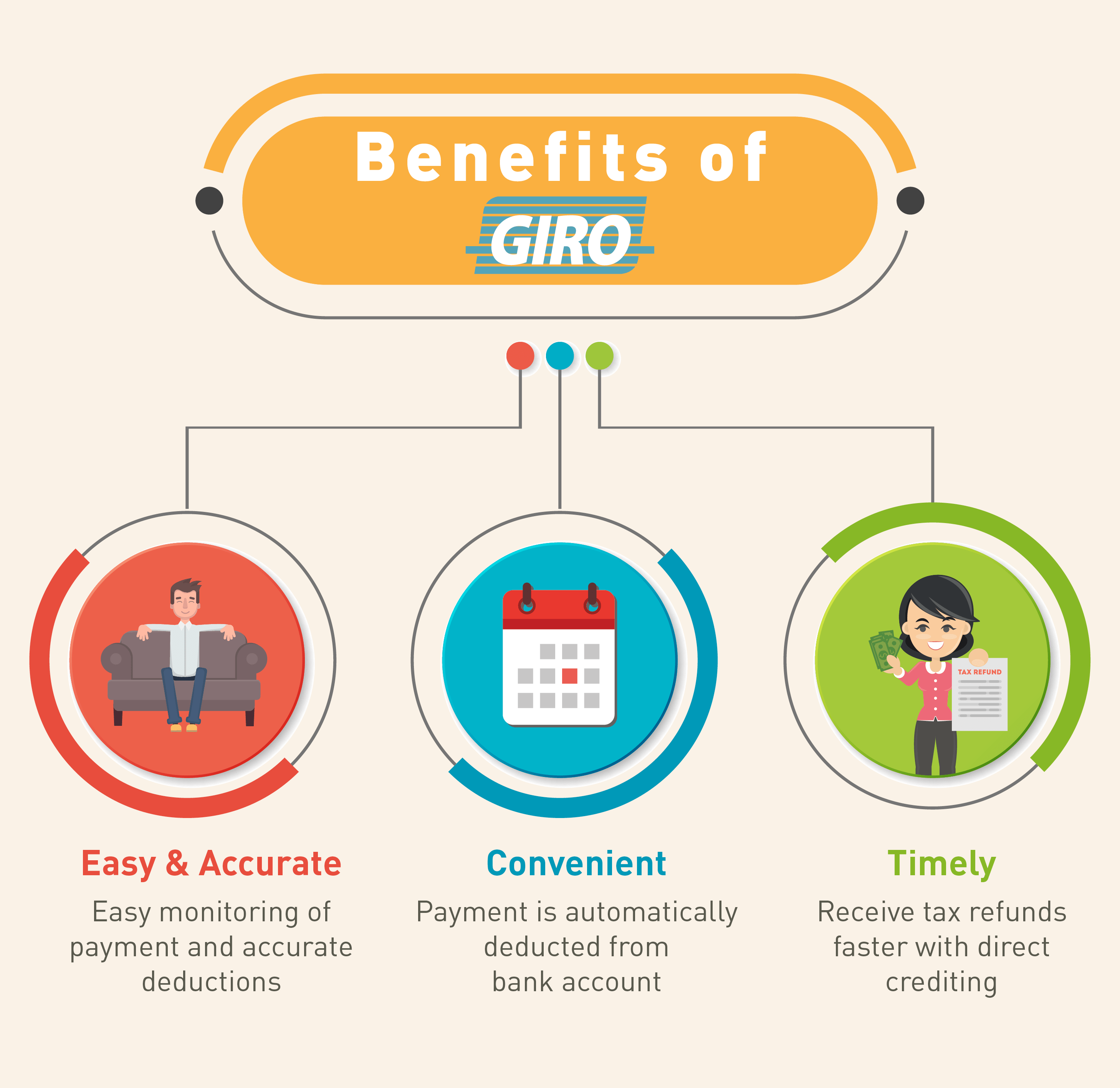

You can still use GIRO

IRAS allows taxpayers to split their payment into 12 interest-free instalments via GIRO. This is great for maximising your cashflow, and something I opt for each year.

Setting up GIRO for income tax can be done via the following methods:

- Instant

- myTax portal (DBS/POSB, UOB, Bank of China, Citibank, HSBC, Maybank)

- Internet banking (DBS/POSB, OCBC and UOB customers)

- AXS stations (DBS/POSB customers)

- 3 weeks processing

- GIRO application form (all bank customers)

Once your GIRO arrangement has been approved, you can view the monthly instalment by logging to myTax Portal, selecting Account > View Payment Plan > View Plan.

There are no issues using GIRO if you opt for an indirect payment facility, as the bank simply credits the cash to your account, and how you go about paying IRAS after that is up to you.

It’s also possible to use GIRO when you’re paying via a direct payment facility, though you’ll want to make manual payments well in advance of each month’s scheduled deduction (on the 6th of each month) to avoid double payment.

To illustrate, suppose your tax bill is S$12,000 and you opt for GIRO. IRAS will split your tax bill such that S$1,000 comes due each month.

| Month | Manual Payment | GIRO | Total Paid |

| May 2025 | – | S$1,000 | S$1,000 |

| Jun 2025 | – | S$1,000 | S$2,000 |

| Jul 2025 | S$400 | S$600 | S$3,000 |

| Aug 2025 | – | S$1,000 | S$4,000 |

| Sep 2025 | S$1,500 | – | S$5,500 |

| Oct 2025 | – | S$500 | S$6,000 |

| Nov 2025 | – | S$1,000 | S$7,000 |

| Dec 2025 | – | S$1,000 | S$8,000 |

| Jan 2026 | – | S$1,000 | S$9,000 |

| Feb 2026 | – | S$1,000 | S$10,000 |

| Mar 2026 | – | S$1,000 | S$11,000 |

| Apr 2026 | – | S$1,000 | S$12,000 |

Suppose you make a manual payment of S$400 in July 2025. According to your payment schedule, you were supposed to pay S$1,000 in July, so GIRO will automatically adjust to deduct S$600 instead of S$1,000 for that month.

Then suppose you make a manual payment of S$1,500 in September 2025. According to your payment schedule, you only needed to pay S$1,000 in September, so GIRO won’t take any deduction for this month.

When October 2025 comes round, assuming you make no further manual payment, GIRO will deduct S$500 to put you “back on schedule” with S$6,000 paid off by the end of October 2025.

Now, it’s important to keep in mind that IRAS GIRO deductions take place on the 6th of the month the tax is due (or the next working day if that happens to be a weekend or public holiday). If your manual payment is made too close to this date, it’s possible the full GIRO deduction will still take place.

Therefore, I would recommend making all manual payments at least two weeks in advance to avoid a double deduction (but if a double deduction happens it’s not the end of the world, since that amount goes towards offsetting the following month’s payment). In any case, the CardUp system won’t let you schedule tax payments during the last few and first few days of each month.

For more instructions on how to setup a recurring income tax payment series with CardUp, refer to this link.

When miles will be credited?

If you’re using CardUp, you can expect your credit card points to be awarded once the transaction posts.

However, under Citi PayAll’s promotions, only the base points area awarded when the transaction posts (e.g. 1.2 mpd with the Citi PremierMiles Card). You’ll need to wait several weeks after the promotion ends to receive the bonus component.

So if you’re hoping to use your miles for a trip in the near future, that’s something you need to factor in too.

What type of points are you earning?

When evaluating two cards with similar cost per mile figures, it’s helpful to think of qualitative factors as well.

| 💳 Comparing Points Currencies | |

| Expiry |

|

| Minimum Conversion |

|

| Pooling |

|

| Transfer Partners |

|

| Transfer Fees |

|

| Transfer Speed |

|

For example, Citi Miles would be superior to DBS Points or UOB UNI$, thanks to the sheer number of transfer partners available. Likewise, non-expiring Citi Miles and 90°N Miles would be more useful than expiring UNI$ or HSBC Rewards Points.

For the full analysis, refer to my guide below.

Conclusion

Income Tax Season 2025 is now underway, and we’re starting to see the promotions roll out. The current lowest cost per mile starts from 0.76 cents, which can be attractive especially for those looking to redeem First and Business Class tickets.

I’ll be updating this article as new tax payment promotions are announced, so be sure to bookmark it for future reference!

Thanks for the great article summarizing all the options! May I know if the T&Cs state explicitly that payments made through both the Standard Chartered Tax Payment Facility count towards the S$20,000 minimum spend requirement? Because based on 19c of https://www.sc.com/sg/terms-and-conditions/beyond-welcome-tnc/, it seems that 9311 is not counted: https://www.sc.com/sg/terms-and-conditions/cc-retail-transaction-exclusions/ Unless the Tax Payment Facility is a different MCC?

this information has been confirmed by stanchart’s PR team.

Hi Aaron! Thanks a lot for this article, really appreciate the effort put into it. AMEX currently has this sign-up offer for the The American Express® Singapore Airlines KrisFlyer Credit Card (https://www.americanexpress.com/sg/credit-cards/singapore-airlines-krisflyer-credit-card/) – up to 17k KrisFlyer miles if one spends min. $1k within same month. Would you know if paying for my upcoming income tax through CardUp would be qualifying spends (to hit the $1k) to get the free miles? I called the AMEX CSO and she advised against it. However, also noted your articles that using CardUp to pay income tax on personal AMEX cards counts as qualifying… Read more »

yes

Cardup does not seem to offer promo codes for Mastercard payments of taxes

In Summary of Tax Payment Options table, what does IPM stand for?

ipaymy

Thanks for sharing! How should I go about paying via CardUp and GIRO? In the example you gave, if my tax bill were S$1,000 per month, I could pay S$167 via CardUp (to earn miles) and S$833 via GIRO (to earn 6% rebates).

Let’s say for the month of May 2025, does that mean that I should pay S$167 ~2 weeks before the 6 May 2025 via CardUp (e.g., 22 April 2025), and then GIRO will deduct S$833 from my account on 6 May 2025?

Thanks for the timely annual update. I see that the recurring Visa promo code has 2 redemption limit per user. Am I correct to say that the first 2 monthly GIRO payments via Cardup using the Visa card will be at the discounted rate of 1.75% but goes back to the normal rate after that?

If that is the case, it seems more rewarding to make a one-time income tax payment using Cardup and milk the discounted rate of 1.75% instead of the recurring GIRO method.

Happy to hear your thoughts

nope, all the monthly payments will be discounted.

I can’t seem to link my UOB Pvri Amex card to Card up. Try a few times but there’s a prompt that says error.