The Maybank Horizon Visa Signature is one of my favourite cards, with a generous earn rate of 2.8 mpd on air tickets and foreign currency (FCY) spending— even occasionally upsized to 3.2 mpd.

But that’s not all it does. This is one of the few cards on the market that still offers rewards for donations, education, hospitals, insurance premiums and utilities. And no, this isn’t some oversight; in fact, it’s actively advertised by the bank.

However, Maybank will be tightening its rewards exclusion list come July 2025. Donations will cease to earn rewards on all Maybank cards, and the Horizon will see reduced earn rates of just 0.16 mpd for the Insurance, Medical, Utilities and Education categories. Insurance premiums will also no longer count toward the S$800 minimum spend required to unlock bonus rates.

It’s a disappointing change, but not a deal-breaker for me as I don’t use the Horizon for these categories in the first place.

Revisions to Maybank Horizon Visa Signature

Reduced earn rates for selected categories

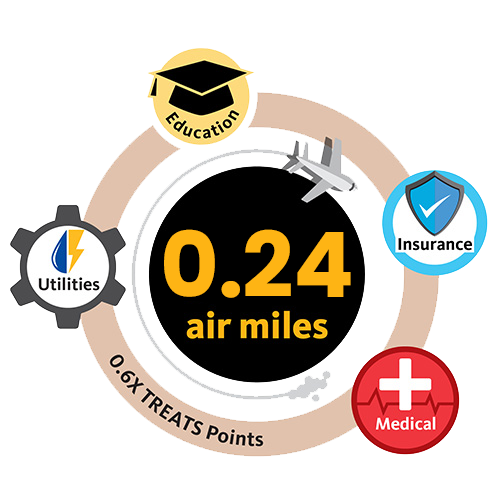

Maybank Horizon Visa Signature cardholders currently earn 0.24 mpd for SGD transactions in the Education, Insurance, Medical and Utilities categories.

From 1 July 2025, the earn rate will be cut by 33% to 0.16 mpd. In addition to this, Rentals and Professional Services — both of which currently earn 0.4 mpd — will be added to this grouping.

Maybank doesn’t actually disclose the MCCs under each of these categories in the Horizon’s T&Cs, but we can find them listed under the Platinum Visa.

| Category | MCCs |

| Insurance | 6300 |

| Medical | 4119, 5047, 5122, 5912, 5975-5976, 8011, 8021, 8031, 8041-8043, 8049, 8050, 8062, 8071 and 8099 |

| Utilities | 4900 |

| Education | 8211, 8220, 8241, 8244, 8249, 8299 |

| Rentals | 6513 |

| Professional Services | 7399 |

For the avoidance of doubt, you will still earn either 1.2 or 2.8 mpd on all of the above categories if they are spent in FCY, as the FCY spending bonus takes precedence.

Here’s how the card’s earn rates by category will look like following the revisions.

Spend <S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities Rentals New Professional Services New |

0.16 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Air Tickets Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other SGD spend | 0.4 mpd | |

| FCY | All FCY spend | 1.2 mpd |

Spend ≥S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities Rentals New Professional Services New |

0.16 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other SGD spend | 0.4 mpd | |

| Local or FCY | Air Tickets | 2.8 mpd* |

| FCY | All FCY spend | 2.8 mpd |

| *Capped at S$10,000 per calendar month |

||

Insurance no longer counts towards minimum spend

Maybank Horizon Visa Signature cardholders who spend at least S$800 per calendar month (on any retail transactions) earn:

- 2.8 mpd on FCY spend (no cap)

- 2.8 mpd on air tickets (capped at S$10,000 per calendar month)

From 1 July 2025, insurance premiums will no longer count towards the S$800 minimum spend requirement.

This change mirrors a similar update to the Maybank Visa Infinite, which recently excluded insurance premiums from the S$3,000 minimum spend required for complimentary airport limo rides, although miles continue to be awarded for such transactions.

No more points for donations

In case you missed it, Maybank will be adding some card-wide exclusions from 1 July 2025,with the following MCCs no longer earning rewards.

| MCC | Examples |

| MCC 7523 Automobile Parking Lots & Garages |

|

| MCC 8398 Charitable and Social Services Organisations |

|

| MCC 8651 Political Organisations |

|

| MCC 8661 Religious Organisations |

|

For more on these changes, refer to the post below.

Do these changes matter?

While no one likes nerfs, I’m fairly indifferent because I’ve not been using the Maybank Horizon Visa Signature for any of these categories in the first place.

Instead, any education, insurance, medical or utilities spending is diverted to the Chocolate Visa Debit Card, which earns 2 mpd on the first S$1,000 per calendar month on almost anything (just not AXS!).

Chocolate Visa Card Chocolate Visa Card |

|||

| Apply here |

Of course, this won’t last forever, and when the inevitable Chocolate nerf happens, there will be almost no cards offering rewards for these categories. In that sense, even the 0.16 mpd offered by the Maybank Horizon Visa Signature would be better than nothing…but not by much.

Overview: Maybank Horizon Visa Signature

|

|||

| Apply Here | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 months |

| Annual Fee | S$196.20 (3 yrs free) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 0.24-1.2 mpd^ | Points Pool? | Yes |

| FCY Earn | 2.8 mpd |

Lounge Access? | No |

| Special Earn | 2.8 mpd on air tickets | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; 5,000 miles for Cathay and MAS, 2,000 points for Air Asia ^0.16-1.2 mpd from July 2025 |

|||

The Maybank Horizon Visa Signature has a minimum income requirement of S$30,000, and its S$196.20 annual fee is waived for the first three years.

The big draw here is the ability to earn 2.8 mpd on air tickets (capped at S$10,000 per calendar month) and 2.8 mpd on FCY spending (no cap), with a minimum monthly spend of S$800. It’s not quite as good as the Maybank World Mastercard or Maybank Visa Infinite though, which offer 3.2 mpd on FCY spending, albeit with a hefty minimum spend of S$4,000.

Refer to my detailed review below for everything you need to know.

Conclusion

The Maybank Horizon Visa Signature will be revising its earn rates from 1 July 2025, which will see the already meagre rewards for education, insurance, medical and utilities further cut to 0.16 mpd.

Insurance premiums will also no longer count towards the S$800 minimum spend required to earn bonus miles on air tickets and FCY transactions, so plan accordingly.

That said, most banks already exclude these transactions from rewards altogether, so it’s good that Maybank still offers something— however small.

Although donations do not earn points, do donations, local or foreign spending, still count towards the $800 spending?

Insurance premium in FCY should still count under 2.8mpd for FCY, and count towards the SGD 800 minimum spending requirement?

wait so now you need to spend even more in order to get non expiry points since the points are now worth less?