When using credit cards with bonus caps or minimum spend requirements, one crucial question is whether spending is tracked based on transaction date or posting date.

While the two are usually very close, they’re often not the same— and that can make a huge difference to how many miles you earn!

In this post, I’ll explain why the distinction is important, and how different cards handle it.

| 📅 Calendar month, statement month, membership year? |

| Another common question is whether credit cards tracking spending based on calendar month, statement month, membership year (or even something else!). I’ve answered that in a separate post here. |

What’s the difference between transaction date and processing date?

Here’s the difference between transaction date and posting date:

- Transaction date: The date the transaction actually takes place

- Posting date: The date the transaction is processed and reflected in your card account

Most merchants don’t send each individual payment to the bank immediately. Instead, they collect the day’s transactions and submit them in a batch at the close of business, and if it happens to be a weekend or public holiday, the batching may be delayed. There may also be further delays due to fraud screening or network issues.

Therefore, the posting date usually comes after the transaction date, with a 1-3 day lag. There can instances where the transaction and posting date happen to be the same — see below — but you shouldn’t count on it.

Most of the time, this doesn’t really matter. But if you’re spending towards the end of the month, you might end up with a situation where where your transaction date is in Month X, but your posting date is in Month X+1.

Here’s three scenarios illustrating how this can mess up your day.

Monthly bonus caps

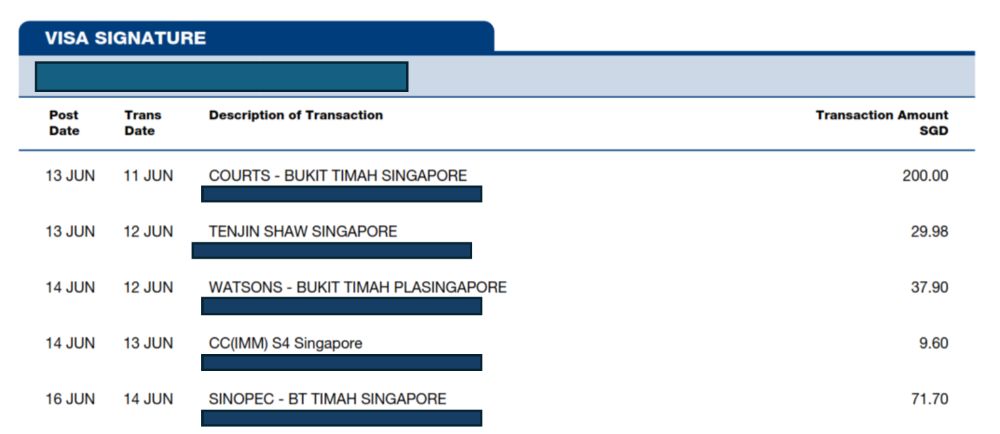

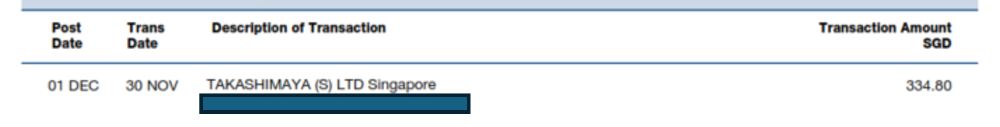

If I make a transaction on the UOB Lady’s Card on 30 November, but it posts on 1 December, that spending will count towards December’s bonus cap and not November’s.

This could result in me underutilising November’s bonus cap, or overutilising December’s.

Min. spend for bonus miles

Suppose I have a UOB Visa Signature Card, and my statement date (i.e. the last day of the statement period) is the 15th of each month. In the current statement period, I’ve already made S$900 in FCY spend, and on 14 November, I make a further transaction of S$300 in FCY.

If this transaction only posts two days later, on 16 November, it will count towards the minimum spend for the November-December statement period. My S$900 FCY spend would only earn 0.4 mpd, because the sum of my posted transactions in the October-November statement period is less than S$1,000.

Min. spend for welcome offers

Suppose I sign up for a credit card that offers 10,000 bonus miles with a minimum spend of S$2,000 within 60 days. So far, I’ve already spent S$1,800, and towards the end of the 60-day period, I make a further transaction of S$300.

If that transaction posts after the 60-day period ends, then I will not receive the bonus miles, because the sum of my posted transactions in the 60-day period is less than S$2,000.

Card by card: transaction vs posting date

Here’s a card by card rundown of how some popular credit cards track their minimum spend and bonus caps.

| Card | Feature | Is Based On |

Citi Rewards Card Citi Rewards CardApply |

Monthly cap (S$1,000) for 4 mpd on online spending | Posting |

DBS Woman’s World Card DBS Woman’s World CardApply |

Monthly cap (S$1,500)1 for 4 mpd on online spending | Trxn |

DBS yuu Card DBS yuu CardApply |

Monthly min. spend (S$600) and cap (S$600) for 10 mpd on yuu merchants | Trxn |

HSBC Revolution HSBC RevolutionApply |

Monthly cap (S$1,500)2 for 4 mpd on selected MCCs | Posting |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

Monthly min. spend (S$800) for 2.8 mpd on FCY and air tickets, and cap (S$10,000 for air tickets) | Special case- see below |

Maybank World Mastercard Maybank World MastercardApply |

Monthly min. spend (S$4,000)3 for 3.2 mpd on FCY | Special case- see below |

OCBC Rewards Card OCBC Rewards CardApply |

Monthly cap (S$1,110) for 4 mpd on selected MCCs | Posting |

StanChart Journey Card StanChart Journey CardApply |

Monthly cap (S$1,000) for 3 mpd on selected MCCs | Posting |

StanChart Smart Card StanChart Smart CardApply |

Monthly min. spend (S$800 or S$1,500) for 7.42/9.28 mpd on selected MCCs | Posting |

StanChart Visa Infinite StanChart Visa InfiniteApply |

Monthly min. spend (S$2,000) for 1.4/3 mpd on local/FCY spend | Posting |

UOB Lady’s Card UOB Lady’s Card Apply |

Monthly cap (S$1,000) for 4 mpd on selected MCCs | Posting |

UOB Lady’s Solitaire UOB Lady’s Solitaire Apply |

Monthly cap (S$2,000)4 for 4 mpd on selected MCCs | Posting |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

Monthly cap (S$1,110) for 4 mpd on contactless, and selected online MCCs | Posting |

UOB Visa Signature UOB Visa SignatureApply |

Monthly min. spend (S$1,000) for 4 mpd on FCY, contactless and petrol, and cap (S$2,000)5 | Posting |

| 1. Cut to S$1,000 from 1 August 2025 2. Cut to S$1,000 from 1 November 2025 3. Earn 2.8 mpd on FCY spend with min. spend of S$800 per calendar month 4. Cut to S$1,500 from 1 August 2025 5. Cap of S$2,400 from statement date ending 1 September 2025 onwards, split into S$1,200 for FCY and S$1,200 for contactless and petrol |

||

The tl;dr version is that only DBS and Maybank track spending by transaction date. So even if it’s 11 p.m on the last day of the month and you haven’t hit the minimum spend on the DBS yuu Card yet- there’s still time!

| Eligible Spend must be charged to your DBS yuu Card within the calendar month, based on transaction date. The transaction date is determined based on the merchant settlement date between the merchant and their acquirer (subject to merchant or their acquirer’s timezone). |

For the rest of the banks in Singapore, tracking is based on posting date (there’s no point listing every card in the table because there’s just too many).

However, there are two important quirks to be highlighted.

DBS

While DBS tracks spending by transaction date, they do not follow Singapore time. The transaction date is “subject to merchant or their acquirer’s timezone”.

This throws a further spanner into the works, because even if you know the merchant’s timezone, their acquirer may be a different timezone. Unfortunately, there are conflicting reports online- some report their transactions made early in Month X end up reflecting a transaction date of Month X-1, and others report their transactions made late in Month X end up reflecting a transaction date of in Month X+1.

You might think that transacting in Singapore would remove all ambiguity, but again, there are reports saying otherwise. If you want to be safe, it’s better to avoid transactions on the 31st and 1st altogether.

Maybank

When computing the S$800 minimum spend necessary to trigger the 2.8 mpd for air tickets and FCY spend, the Maybank Horizon Visa Signature will consider transactions made in Month X but posted by the 6th of Month X+1 to be part of Month X’s minimum spending.

|

Retail transactions charged to a Card made within a calendar month that are successfully posted to a Card Account prior to the 6th day of the following calendar month, will be counted towards the minimum spend of the month that the retail transactions are made. Retail transactions charged to the Card which made within a calendar month but are only posted to a Card Account after the 6th day of the following month will be counted towards the following month’s minimum spend. |

This is not explicitly addressed in the T&Cs, but I would assume the S$10,000 monthly cap for earning 2.8 mpd on air tickets also follows this rule (that is, air ticket transactions which post by the 6th will be taken as part of the previous month’s bonus cap).

Likewise, when computing the S$4,000 minimum spend necessary to trigger the 3.2 mpd for FCY spend (or the S$800 minimum spend necessary to trigger the 2.8 mpd for FCY spend), the Maybank World Mastercard will consider transactions made in Month X but posted by the 7th of Month X+1 to be part of Month X’s minimum spending.

|

Retail transactions charged to a Card made within a calendar month that are successfully posted to a Card Account prior to the 7th day of the following calendar month, will be counted towards the minimum spend of the month that the retail transactions are made. Retail transactions charged to the Card which made within a calendar month but are only posted to a Card Account after the 7th day of the following month will be counted towards the following month’s minimum spend. |

| ⚠️ Important note |

|

I realise the language here is annoyingly vague. For the Maybank Horizon Visa Signature, Maybank says that transactions posted prior to the 6th day of the following calendar month will be deemed the minimum spend of the current calendar month, and transactions posted after the 6th day of the following calendar month will be deemed the minimum spend of the following calendar month. What about transactions that post on the 6th then? Maybank has confirmed that a transaction made on the 6th of the following calendar month will count towards the minimum spend of the current calendar month. For the Maybank World Mastercard, transactions posted on the 7th of the following calendar month will count towards the minimum spend of the current calendar month. As to why one card uses the 6th as the cutoff date, and another card uses the 7th, only Maybank knows! |

Either way, this policy is beneficial in the sense that “late arriving” transactions completed towards the end of a month will still count towards the minimum spend for that month. For the avoidance of doubt, transactions made in a Month X that post before the 6th/7th of Month X will still count towards Month X’s spend, not Month X-1.

| ❓ What about the Maybank Visa Infinite? |

|

The Maybank Visa Infinite earns 3.2 mpd on FCY spend, subject to a minimum spend of S$4,000 in a calendar month. However, its T&Cs do not feature the same wording as the Maybank Horizon Visa Signature or Maybank World Mastercard. Therefore, my assumption is that there is no similar concession here, and the monthly minimum spend is based on posted transactions within the calendar month only. |

If all this is confusing you, refer to the table below.

| 💳 Maybank Horizon Visa Signature |

||

| Transaction Date | Posting Date | Counts Towards |

| Month X | By the 6th of Month X+1 | Month X |

| Month X+1 | By the 6th of Month X+2 | Month X+1 |

| 💳 Maybank World Mastercard |

||

| Transaction Date | Posting Date | Counts Towards |

| Month X | By the 7th of Month X+1 | Month X |

| Month X+1 | By the 7th of Month X+2 | Month X+1 |

Do any merchants post on the same day?

If it’s almost the end of the month/spending period and you want to sneak in an additional transaction to meet the minimum spend, or fully utilise the bonus cap, then the following merchants have reported by the MileChat community to post on the same day.

- 7-11

- Cold Storage

- Food Junction

- Food Republic

- Genki Sushi

- Joyden Seafood

- Singlife (though it doesn’t earn points or count towards minimum spend anyway…)

- Starbucks

- Sushi Tei

- Toastbox

- ToriQ

Keep in mind, I can’t promise it will be the same for you (it could depend on outlet, or even which bank’s credit card you’re using). Search the MileChat for “same day post” to find more examples (or don’t, and get mercilessly abused).

Conclusion

The distinction between transaction and posting dates becomes crucial when you’re nearing the end of the month, or the end of the spending period for a welcome bonus.

Many people believe that so long as they swipe their card within the month or period, the transaction will qualify. But, with the exception of DBS (and probably Maybank), that’s not true. A transaction usually takes at least a day to post, and a day could make all the difference!

Any other merchants you know of that post on the same day?

Worth pointing out that Maybank Visa Infinite’s limousine benefit is based on transaction date. However, when they process your limousine request, they look at posting date. Likewise, when you call in to enquire on your utilised balances, you will be given the amount based on posting date. Also, their system only shows the posted amount from the previous business day, i e., current day posted transactions are not shown to them. Be mindful of this “bug”! I had a few encounters with “rejected” limousine requests because of the above. It will require you to call in to remind them to… Read more »

Thanks for compiling it. Don’t know how you get the data, but it’s helpful!

Must be a lot of hard work. Hope Aaron is not overworked.

Thanks Aaron. From your previous blog on DBS bonus miles, I signed up from it regarding 8 miles per dollar last year. I called up DBS to ask them if it was posted or transacted date. I was told it was transaction date by their customer service. And I put it at the last day of October. However, no points were posted and I appealed to DBS and they gave me the bonus miles.

might be a timezone issue? that’s been a common complaint from people who transacted with dbs cards around 31st or 1st

Is there a change in DBS policy? Cos in their updated T&Cs, they mentioned this “posted to your DBS yuu Card with minimum of S$600 total Eligible Spend charged and posted to your DBS yuu Card in the same calendar month” but it does contradict another line that states “Eligible Spend must be charged to your DBS yuu Card within the calendar month, based on transaction date” Similar stuff in DBS women’s “The additional 9X DBS Points or 7X DBS Points are only applicable for the first S$1,500 online spend per calendar month, charged to the Card (i.e. transaction date)… Read more »

no change. this is a common misunderstanding- refer to this thread.

https://t.me/milelion/1060042

I notice there is a misinformation on dbs woman. It should be posted date instead of transaction date

incorrect. it is transaction date.