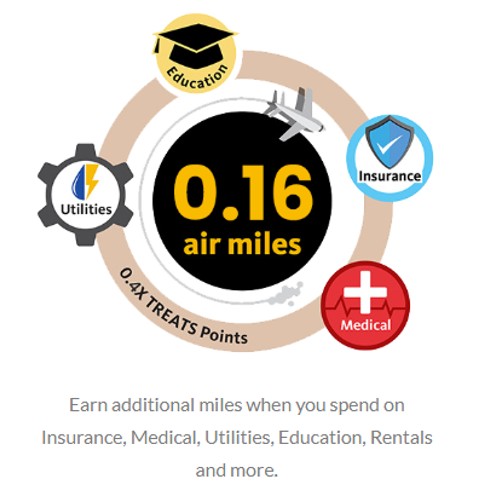

The Maybank Horizon Visa Signature is one of the few cards on the market that still offers rewards for insurance, medical bills, education, rentals and utilities. That’s not some oversight; it’s a feature the bank actively advertises. And while the earn rate is relatively meagre, it’s still better than nothing.

Unfortunately, Maybank will soon be tightening this even further. After cutting the earn rate from 0.24 mpd to 0.16 mpd in July 2025, it will also place a S$3,000 monthly spending cap (480 miles) on such transactions, effective 1 December 2025.

In addition to this, it will also exclude such transactions from the S$800 minimum spend required to unlock the Horizon’s bonus earn rates on foreign currency and air ticket spend, and exclude utilities from rewards altogether.

Revisions to Maybank Horizon Visa Signature

Cap on miles for Selected Categories

Maybank Horizon Visa Signature cardholders currently earn an uncapped 0.16 mpd on SGD spend on education, insurance, medical, rentals, professional services and utilities, collectively known as “Selected Categories”.

| Category | MCCs |

| Insurance | 6300 |

| Medical | 4119, 5047, 5122, 5912, 5975-5976, 8011, 8021, 8031, 8041-8043, 8049, 8050, 8062, 8071 and 8099 |

| Education | 8211, 8220, 8241, 8244, 8249, 8299 |

| Rentals | 6513 |

| Professional Services | 7399 |

| Utilities | 4900 |

While 0.16 mpd is close to negligible, it’s still more than what you’d earn with competing cards, which generally exclude such transactions altogether.

From 1 December 2025, the 0.16 mpd earn rate for Selected Categories will be capped at S$3,000 per month, or 480 miles. Furthermore, utilities will be excluded from earning rewards altogether, in line with Maybank’s other credit and debit cards.

Selected Categories will not count towards minimum spend

From 1 December 2025, spending on Selected Categories will no longer count towards:

- the S$800 minimum monthly spend required to earn 2.8 mpd on FCY spend (uncapped) and 2.8 mpd on air tickets (capped at S$10,000 per calendar month)

- the S$1,000 single-transaction spend required to earn a complimentary Plaza Premium Lounge pass valid at selected airports

Going forward, cardholders will need to rely on other types of spending to meet the minimum spend.

FCY spending bonus takes precedence

One important thing to highlight is that the Maybank Horizon Visa Signature’s FCY spending bonus overrides the aforementioned cap.

In other words, if you were to spend on education, insurance, medical, rentals, or professional services in FCY, you would earn an uncapped 2.8 mpd, subject to meeting the S$800 minimum spend. Even if you fail to meet the minimum spend, you’d still earn an uncapped 1.2 mpd.

This makes the Maybank Horizon Visa Signature a fantastic choice for paying overseas university tuition, medical treatment, or management fees for any property you might own.

Maybank adding more rewards exclusions

In case you missed it, Maybank will be adding more card-wide exclusions from 1 December 2025, with the following MCCs no longer earning rewards.

| MCC | Description |

| 4829 | Money Transfer |

| 6010 6011 6050 6529 6530 6534 7511 | Cash Disbursement, Quasi-cash, Top-ups |

| 7349 | Cleaning, Maintenance & Janitorial Services |

| 4900 | Utilities |

| 5960 6381 6399 |

Insurance Related^ |

| ^Not applicable to Maybank Platinum Visa Card, Maybank Horizon Visa Signature Card and Maybank Visa Infinite Card | |

|

|

The main exclusion to note here is utility bills, which means the exclusion is now universal across Singapore banks (at least where miles-earning cards are concerned).

And before you start panicking about Instarem and SimplyGo, have a read of the article below to find out what’s really excluded!

Overview: Maybank Horizon Visa Signature

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 months |

| Annual Fee | S$196.20 (3 yrs free) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | Up to 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2.8 mpd |

Lounge Access? | No |

| Special Earn | 2.8 mpd on air tickets | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; 5,000 miles for Cathay and MAS, 2,000 points for Air Asia | |||

The Maybank Horizon Visa Signature has a minimum income requirement of S$30,000, and its S$196.20 annual fee is waived for the first three years.

Here’s how the card’s earn rates by category will look like following the revisions.

Spend <S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Rentals Professional Services |

0.16 mpd Capped at S$3K per c. month |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Air Tickets Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other SGD spend | 0.4 mpd | |

| FCY | All FCY spend | 1.2 mpd |

Spend ≥S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Rentals Professional Services |

0.16 mpd Capped at S$3K per c. month |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other SGD spend | 0.4 mpd | |

| Local or FCY | Air Tickets | 2.8 mpd* |

| FCY | All FCY spend | 2.8 mpd |

| *Capped at S$10,000 per calendar month |

||

The big draw here is the ability to earn 2.8 mpd on air tickets (capped at S$10,000 per calendar month) and 2.8 mpd on FCY spending (no cap), with a minimum monthly spend of S$800. It’s not quite as good as the Maybank World Mastercard or Maybank Visa Infinite though, which offer 3.2 mpd on FCY spending, albeit with a hefty minimum spend of S$4,000.

Refer to my detailed review for everything else you need to know about the card.

Conclusion

From 1 December 2025, the Maybank Horizon Visa Signature will tighten its rewards for Selected Category spending, with a new S$3,000 monthly spending cap on the 0.16 mpd earn rate.

Truth be told, however, this was never really my main use case for the card. I’m personally in it for the uncapped 2.8 mpd on FCY transactions and 2.8 mpd on air tickets, capped at S$10,000 per month (though I’m currently funnelling most of this spend to the BOC Elite Miles Card to take advantage of its current promotion).

Perhaps more annoyingly, Selected Category spending will no longer count towards the S$800 minimum required to trigger the bonus earn rates, so you’ll need to revise your strategy accordingly.

Hi, given that there are not many, if any, competing mile earning cards for comparison, as well as the meager miles return, maybe its time to consider cashback cards for these categories – eg UOB absolute etc

problem with uob absolute though is amex acceptance. if there were a no questions asked visa/mc cashback card, then we’re talking.

Hi! If the I spend all on air tickets for a calendar month in excess of $800, does that unlock the 2.8mpd ? Thanks!

is the cap for 2.8mpd on airticket spend still S$10,000 per calendar month? The website says Bonus TREATS Points for air tickets capped at 40,000.