Here’s The MileLion’s review of the Maybank Horizon Visa Signature, which underwent a major revamp in late 2023 that introduced 2.8 mpd on air tickets and foreign currency (FCY) spending.

While it’s true that 2.8 mpd is not exactly market-leading — you could earn up to 4 mpd on these categories with other cards — what’s appealing is the absence of a cap for FCY spend, and a generous S$10,000 monthly cap for air tickets.

Moreover, this is one of the only cards left on the market to still offer rewards for education, hospitals, insurance premiums and utilities, so if you can overlook the relatively short validity of TREATS Points, this could very well be worth considering.

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It Leave It |

|

| What do these ratings mean? |

|

| The Maybank Horizon Visa Signature excels at FCY and air ticket spending, and its relative lack of exclusions is a pleasant surprise. | |

| 👍 The good | 👎 The bad |

|

|

| 💳 Full List of Credit Card Reviews | |

Overview: Maybank Horizon Visa Signature

Let’s start this review by looking at the key features of the Maybank Horizon Visa Signature.

|

|||

| Apply | |||

| Income Req. | S$30,000 p.a. | Points Validity | 12-15 months |

| Annual Fee | S$196.20 (3 yrs free) |

Min. Transfer |

25,000 points (10,000 miles)* |

| Miles with Annual Fee |

N/A | Transfer Partners |

4 |

| FCY Fee | 3.25% | Transfer Fee | S$27.25 |

| Local Earn | 0.16 to 1.2 mpd | Points Pool? | Yes |

| FCY Earn | 2.8 mpd |

Lounge Access? | No |

| Special Earn | 2.8 mpd on air tickets | Airport Limo? | No |

| Cardholder Terms and Conditions | |||

| *For KrisFlyer; 5,000 miles for Cathay and MAS, 2,000 points for AirAsia | |||

The Maybank Horizon Visa Signature Card comes in two different varieties:

- The “classic” Maybank Horizon Visa Signature Card

- The Maybank Privilege Horizon Visa Signature Card

(1) is available to the general public, while (2) is for Maybank Privilege Banking customers with a minimum deposit or investment of S$50,000.

|

|

|

| Horizon | Privilege Horizon | |

| Min. AUM | N/A | S$50K |

| Annual Fee | Waive for 3 years | Perpetual waiver |

| Airport Transfer | N/A | 2x free Grab rides |

| Lounge Access | Min. S$1,000 spend | Min. S$500 spend |

Both cards have identical earn rates, but the Privilege version has additional benefits such as S$20 off two Grab rides to the airport per year, a perpetual annual fee waiver, and half the minimum spend requirement for lounge visits.

This article will focus on the classic Maybank Horizon Visa Signature Card.

How much must I earn to qualify for a Maybank Horizon Visa Signature Card?

The Maybank Horizon Visa Signature Card has a minimum income requirement of S$30,000 p.a., the MAS-mandated minimum.

I’m not aware of any secured credit card option for those who don’t meet the minimum requirement, but there’s no harm visiting a branch to check.

How much is the Maybank Horizon Visa Signature Card annual fee?

| Principal Card | Supp. Card | |

| First 3 Years | Waived | Free |

| Subsequent | S$196.20 | Free |

The Maybank Horizon Visa Signature Card has an annual fee of S$196.20, which is waived for the first three years. Up to two supplementary cards are free for life.

Subsequent years’ annual fees will be automatically waived with a minimum total spend of S$18,000 per membership year. Maybank does not appear to be strictly enforcing this rule, however, as there are many data points from customers who have received waivers without meeting this threshold.

No miles are offered upon approval or renewing this card.

What welcome offers are available?

|

|||

| Apply |

New-to-bank customers who apply for a Maybank Horizon Visa Signature will receive a Samsonite INTERLACE Spinner 67/24 EXP luggage (worth S$520).

A minimum spend of S$1,300 within the first two months of approval is required.

New-to-bank customers are defined as those who:

- Do not currently hold a principal Maybank credit card or CreditAble account

- Have not cancelled a principal Maybank credit card or CreditAble account in the past nine months

The T&Cs of this offer can be found here.

In my experience, Maybank is extremely fast with the gift fulfilment, and I received mine within days of meeting the minimum spend.

How many miles do I earn?

| 🇸🇬 SGD Spend | 🌎 FCY Spend | ⭐ Bonus Spend |

| 0.16-1.2 mpd | 2.8 mpd | Air tickets: 2.8 mpd |

The Maybank Horizon Visa Signature Card’s earn structure depends on whether you spend at least S$800 per calendar month.

Spend <S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities Rentals Professional Services |

0.16 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Air Tickets Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other SGD spend | 0.4 mpd | |

| FCY | All FCY spend | 1.2 mpd |

0.16 mpd

SGD transactions on education, insurance, medical, utilities, rental and professional services will earn 2 TREATS Points per S$5 spent (0.16 mpd).

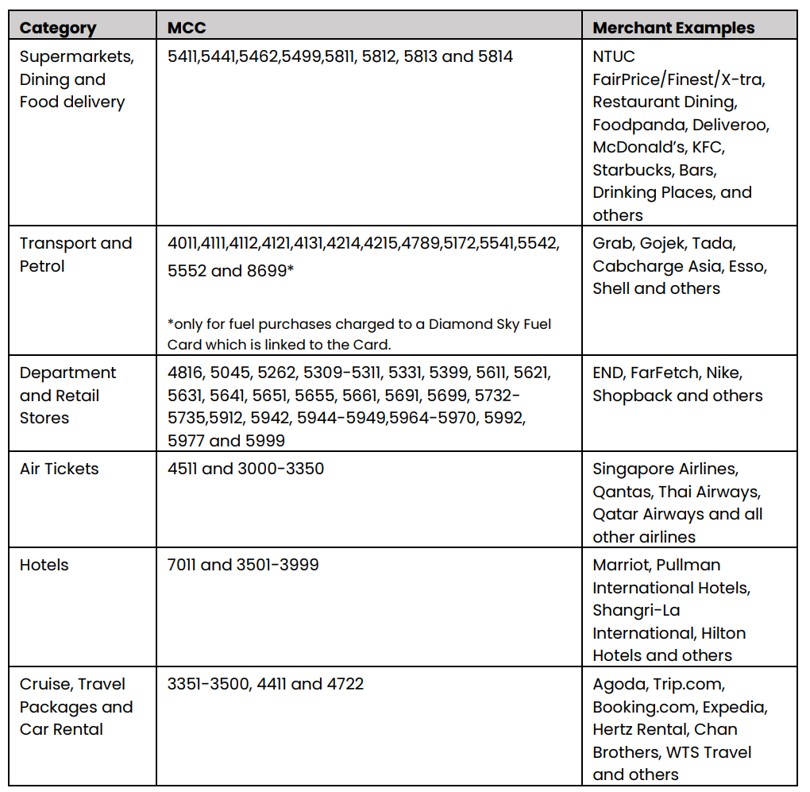

| Category | MCCs |

| Insurance | 6300 |

| Medical | 4119, 5047, 5122, 5912, 5975-5976, 8011, 8021, 8031, 8041-8043, 8049, 8050, 8062, 8071 and 8099 |

| Utilities | 4900 |

| Education | 8211, 8220, 8241, 8244, 8249, 8299 |

| Rentals | 6513 |

| Professional Services | 7399 |

This sounds low, but given that other banks usually exclude most of these categories altogether, it’s still better than nothing. Moreover, the mere fact that these transactions earn points means you can use them to meet the minimum spend for welcome offers on Maybank cards.

For the avoidance of doubt, you will still earn either 1.2 mpd (<S$800 per calendar month) or 2.8 mpd (≥S$800 per calendar month) on all of these categories if they are spent in FCY, as the FCY spending bonus takes precedence.

1.2 mpd

Cardholders will earn 15 TREATS points per S$5 spent (1.2 mpd) on:

- FCY transactions in any category

- SGD transactions in the following categories:

0.4 mpd

Any SGD transaction that does not fall into the MCCs listed in the previous sections will earn 5 TREATS points per S$5 spent (0.4 mpd).

Spend ≥S$800 per calendar month

| Currency | Category | Earn Rate |

| Local | Education Insurance Medical Utilities Rentals Professional Services |

0.16 mpd |

| Dining Food Delivery Supermarkets Transport Petrol Department and Retail Stores Hotels Cruises Travel Packages Car Rental |

1.2 mpd | |

| All other SGD spend | 0.4 mpd | |

| Local or FCY | Air Tickets | 2.8 mpd* |

| FCY | All FCY spend | 2.8 mpd |

| *Capped at S$10,000 per calendar month |

||

Cardholders who spend at least S$800 per calendar month will earn:

- 35 TREATS points per S$5 spent (2.8 mpd) on FCY spend (no cap)

- 35 TREATS points per S$5 spent (2.8 mpd) on air tickets (capped at S$10,000 per calendar month)

Maybank defines FCY spend as card retail transactions posted in foreign currencies, both online or in-person.

Air ticket spend is defined as transactions posted in SGD (if you have air tickets in FCY, they fall under the previous paragraph, with no cap) under MCCs 4511 and 3000-3350. This includes Singapore Airlines, Scoot, British Airways, Cathay Pacific, Qatar Airways and pretty much every major airline out there.

All FCY transactions are subject to a 3.25% fee, which means using your Maybank Horizon Visa Signature Card overseas represents buying miles at 1.16 cents.

| 💳 FCY Fees by Issuer and Card Network |

||

| Issuer | ↓ MC & Visa | AMEX |

| Standard Chartered | 3.5% | N/A |

| American Express | N/A | 3.25% |

| Citibank | 3.25% | N/A |

| DBS | 3.25% | 3% |

| HSBC | 3.25% | N/A |

| Maybank | 3.25% | N/A |

| OCBC | 3.25% | N/A |

| UOB | 3.25% | 3.25% |

| BOC | 3% | N/A |

| CIMB | 3% | N/A |

What counts towards the S$800 minimum spend?

All transactions that are eligible to earn TREATS Points will also count towards the minimum spend.

So for example, education payments and utilities bills will all be included in the S$800 figure. However, insurance premiums are not included, despite the fact they earn rewards.

Transaction date or posting date?

Technically speaking, Maybank tracks minimum spend and bonus caps by posting date, not transaction date.

In practice, however, all transactions charged in a given month and posted by the 6th of the following month are considered to be part of the month in which they were charged.

| 💳 Maybank Horizon Visa Signature |

||

| Transaction Date | Posting Date | Counts Towards |

| Month X | By the 6th of Month X+1 | Month X |

| Month X+1 | By the 6th of Month X+2 | Month X+1 |

In other words, you can comfortably spend up till the last calendar day of the month, and not have to worry about transactions “leaking” into the following month (it’s not impossible, but six days should be more than enough time for even the slowest of merchants to post).

Which cards track spending by transaction date vs posting date?

When are TREATS Points credited?

Base TREATS Points are credited when the transaction posts, which usually takes 1-3 working days.

Bonus TREATS Points are credited on the 7th day of the following calendar month, in a lump sum.

How are TREATS Points calculated?

Here’s how you can work out the TREATS Points earned on your Maybank Horizon Visa Signature Card.

For FCY spend & air tickets

Spend <S$800 per calendar month

| Base Points (3X) |

Round down transaction to the nearest S$5, divide by 5, then multiply by 15 |

Spend ≥S$800 per calendar month

| Base Points (3X) |

Round down transaction to the nearest S$5, divide by 5, then multiply by 15 |

| Bonus Points (4X) | Sum up all eligible transactions. Divide by 5, then multiply by 20. Round to the nearest whole number |

If you’re an Excel geek, here’s the formulas you need to calculate points:

For FCY spend & air tickets

Spend <S$800 per calendar month

| Base Points (3X) | =ROUND (ROUNDDOWN(X/5,0)*15,0) |

| Where X= Amount Spent |

|

Spend ≥S$800 per calendar month

| Base Points (3X) | =ROUND (ROUNDDOWN(X/5,0)*15,0) |

| Bonus Points (4X) |

=ROUND(Y/5*20,0) |

| Where X= Amount Spent, Y= Sum of all eligible transactions |

|

For the full list of formulas that banks use to calculate credit card points, do refer to these articles:

What transactions aren’t eligible for TREATS Points?

A full list of transactions that do not earn TREATS Points can be found in the T&Cs at point 2.2.

I’ve highlighted a few noteworthy categories below:

- Betting and gambling transactions

- Brokerage and securities transactions

- Charitable donations

- Government services

- Prepaid account top-ups, e.g. GrabPay and YouTrip

For avoidance of doubt, you will earn rewards on education, insurance premiums, hospital bills and utilities payments. While the earn rate is just 0.16 mpd when in SGD, charge it in FCY and the earn rate jumps to 2.8 mpd!

I can imagine this being great for anyone with kids studying overseas, for example.

What do I need to know about TREATS Points?

| ❌ Expiry | ↔️ Pooling | 💰 Transfer Fee |

| 12-15 months | Yes |

S$27.25 |

| ⬆️ Min. Transfer | ✈️ No. of Partners | ⏱️ Transfer Time |

| Varies | 4 | 1-2 working days (to KrisFlyer) |

Expiry

TREATS Points earned on the Maybank Horizon Visa Signature expire one year from the quarterly period in which they were earned, which means a validity of 12-15 months.

| Points Earned | Points Expire On |

| 1 January to 31 March 2025 | 31 March 2026 |

| 1 April to 30 June 2025 | 30 June 2026 |

| 1 July to 30 September 2025 | 30 September 2026 |

| 1 October to 31 December 2025 | 31 December 2026 |

However, Maybank offers a Rewards Infinite (RI) programme to cardholders who spend at least S$24,000 in a membership year.

If you’re an RI member, your TREATS Points will never expire. The good news is that the RI membership starts as soon as you hit S$24,000 spending, so you can even enjoy it within your first membership year.

Maybank Visa Infinite and Maybank World Mastercard cardholders are automatically granted an RI membership without the need for minimum spend. If you hold one of these cards, the non-expiring benefit extends to the TREATS Points earned on your Maybank Horizon Visa Signature Card too.

Pooling

TREATS Points pool with other Maybank cards. If you have 20,000 TREATS Points on the Maybank Visa Infinite, and 5,000 TREATS Points on the Maybank Horizon Visa Signature, you can redeem 25,000 TREATS Points in a single redemption.

This also means that if you cancel your Maybank Horizon Visa Signature Card, you won’t lose your accumulated TREATS Points unless it happens to be your very last TREATS-earning card.

Transfer partners & fees

TREATS Points can be transferred to four airline partners at the following ratios.

| Frequent Flyer Programme | Conversion Ratio (TREATS Points: Partner) |

| 25,000 : 10,000 | |

| 12,500 : 5,000 | |

|

12,500 : 5,000 |

| 4,000 : 2,000 |

Malaysia Airlines Enrich and AirAsia Rewards are close to worthless in my opinion, so that leaves Asia Miles and KrisFlyer as the only realistic options.

All conversions have an admin fee of S$27.25.

Transfer time

Conversions to KrisFlyer miles are generally completed within 1-2 working days.

Other card perks

Complimentary lounge access

Principal Maybank Horizon Visa Signature Cardholders will receive a complimentary lounge pass when they spend a minimum of S$1,000 in a single retail transaction in the three months prior to the lounge visit.

This can be redeemed for a 3-hour visit to any of the following lounges:

- Singapore

- Plaza Premium Lounge Terminal 1

- Ambassador Transit Lounge Terminal 2

- Ambassador Transit Lounge Terminal 3

- Blossom Lounge Terminal 4

- Kuala Lumpur

- Plaza Premium Lounge KLIA Terminal 1

- Plaza Premium Lounge KLIA Terminal 2

- Hong Kong

- Plaza Premium Lounge Terminal 1 (Near Gate 35)

- Plaza Premium Lounge Terminal 1 (Near Gate 1)

A maximum of one complimentary visit per month will be issued. Accompanying guests will enjoy 20% off walk-in rates.

I wouldn’t consider this to be a major selling point, since many other credit cards offer lounge access for free.

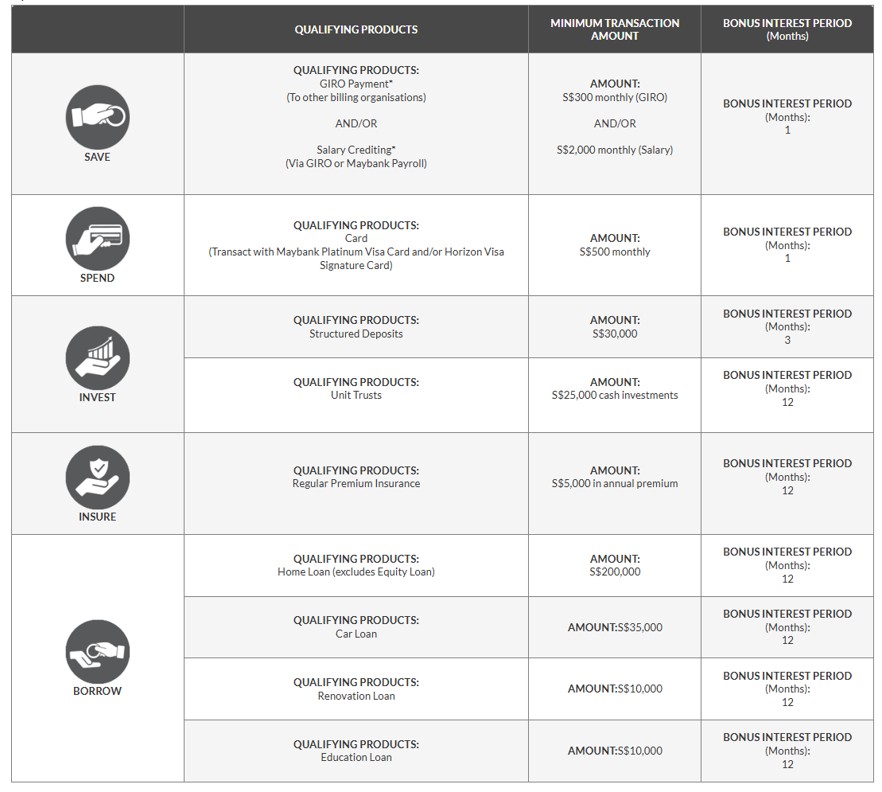

Maybank SaveUp account

SaveUp is Maybank’s high interest savings account, and spending at least S$500 per calendar month on the Maybank Horizon Visa Signature qualifies as one activity for bonus interest.

| Number of Qualifying Activities |

|||

| 1x | 2x | 3x | |

| First S$50K | 0.3% p.a. | 1% p.a. | 2.75% p.a. |

| Next S$25K | 1% p.a. | 1.5% p.a. | 3.75% p.a. |

| Base Interest | 0.25% p.a. | ||

| Maximum EIR | 0.78% p.a. | 1.42% p.a. | 3.33% p.a. |

That said, you’ll need at least three activities to earn a decent interest rate, so in addition to crediting your salary or making GIRO bill payments, you’ll have to take out a loan or purchase selected investment or insurance products.

Complimentary travel insurance

| Accidental Death | S$1,000,000 |

| Medical Expenses | N/A |

| Others | Missed Connection: S$400 Luggage Delay: S$400 Lost Luggage: S$1,000 |

| Policy Wording | |

Maybank Horizon Visa Signature Cardholders receive complimentary travel insurance when they charge their full travel fares to their card. Unfortunately, coverage will not apply in situations where you redeem miles for an award ticket, and charge the taxes and fees to your card.

This features up to S$1,000,000 coverage for accidental death or total permanent disablement, S$400 for luggage delays or missed connections, and S$1,000 for luggage loss.

However, there is no coverage for medical expenses or emergency medical evacuation. Because of this, I highly advise that you purchase comprehensive travel insurance elsewhere.

Terms & Conditions

Summary Review: Maybank Horizon Visa Signature

Maybank Horizon Visa Signature Maybank Horizon Visa Signature |

|

| 🦁 MileLion Verdict | |

| ☑ Take It ☐ Take It Or Leave It Leave It |

Given that the Maybank Horizon Visa Signature’s earn rate maxes out at 2.8 mpd, why would you choose it when other cards offer 4 mpd?

Two reasons.

The first is caps. Obviously, you should try to max out the FCY spending bonuses on the Maybank XL Rewards Card and UOB Visa Signature Card first, but once those two are out of the picture, the Maybank Horizon Visa Signature can step in to offer an uncapped 2.8 mpd on the remainder (though those who spend really big on FCY should consider a Maybank World Mastercard instead, which offers an uncapped 3.2 mpd with a minimum spend of S$4,000).

Likewise, air tickets could be purchased with the DBS Woman’s World Card or Maybank XL Rewards Card, but their S$1,000 monthly caps will likely be insufficient for those buying Business Class tickets, or tickets for multiple people.

The second is exclusions. It’s refreshing to see so few rewards exclusion categories, with cardholders able to earn points on education, hospitals, insurance premiums and utilities bills. Most of these are excluded by other banks.

The main drawbacks are the limited lifespan of TREATS Points and the need to clock at least S$800 a month to enjoy the 2.8 mpd earn rate, but if the lack of cap is what attracts you, then it’s unlikely a minimum spend requirement will be much of a barrier in the first place.

So that’s my review of the Maybank Horizon Visa Signature. What do you think?

Hello! May I ask for S$800 minimum spending per calendar month requirement, is it I have to spend S$800 for each calendar month during the entire 3-4 month promotion period, or if I want to enjoy the 3.2mpd upsized promotion for my spending in December, then I only need to spend S$800 in December (no need to spend any money in Nov or January)?

Curious to know about this too

Does anyone know if we can still use RentHero for Maybank Horizon card?

Not a deal breaker but Maybank cards don’t support Google Pay. Only Apple and Samsung.

I have received the bonus TREATS Points (4X TREATS Points) separately from the base (3X TREATS Points) for the month of Mar 2024 spending. Base points were reflected once transactions were posted whilst I have seen the bonus points reflecting today.

0.24 mpd – for Education, Insurance, Medical and Utilities

assume I spend $800 on such charges.

I’ll get 192 miles.

assume 1 mile @ 1-1.5 cents, 192 miles = $1.92 – $2.88

for $2.88 on the most-cards-excluded-MCCs, is it worth the time?

Sorry – not worth the hassle of dealing with a points redemption app that insists my personal phone be configured to suit the bank’s security requirements.

Bit of a wish .. but any cards that offer points for bokerage and securities? cant seem to find – which would make sense. Cheers

T&C for welcome gifts states $600 for each month in the first 2 months. If spending is $1300 in a single transaction it doesn’t qualify?

refer here: https://milelion.com/2023/11/26/impressive-maybanks-rapid-gift-fulfillment/

tl;dr: spending in a single month is fine too.

$1,200 is only if you apply for creditable. if not it’s $1,300.

Thanks for the clarification!

note that points are capped at 1,000,000 and stop accruing on new transactions if not used

How is the lounge access issued if one meets the eligible spend?

If i were to use the card solely for air tickets, does the spend of the air ticket count as the min $800 per month for 2.8mpd? i.e. i spend $1000 on the air ticket and nothing else. am i still eligible for the 2.8mpd?

If i use ezlink auto top up feature, can it be counted into the rewards infinite program spending?

Although Aaron has mentioned that SGD transactions on education, insurance, medical and utilities will earn 2 TREATS Points per S$5 spent (0.16 mpd) for the Maybank Horizon Visa Signature Card, is that a better earn rate than using the Amex True Cashback Card (which awards 1.5% cashback) to pay?

not all merchants will accept amex, which is why they can still offer this low rate.