UOB has announced a small hike to its administrative fee for converting UNI$ into KrisFlyer or Asia Miles.

Don’t panic, however. It’s a very marginal increase of S$2, and UOB’s premium cardholders will continue to enjoy a fee waiver.

UOB increasing points conversion fee

From 15 December 2025, UOB’s points conversion fee will increase from S$25 to S$27.

The fee is the same for both KrisFlyer and Asia Miles conversions, and a minimum conversion of 5,000 UNI$ (10,000 miles) is required. You’ll pay the same fee regardless of how many UNI$ are transferred, so it’s always more worthwhile to make large, lump sum conversions, instead of small, ad-hoc ones.

As before, the points conversion fee is waived for holders of UOB’s premium cards, defined as:

- UOB Visa Infinite Card

- UOB Visa Infinite Metal Card

- UOB Privilege Banking Card

- UOB Reserve Card

- UOB Reserve Diamond Card

Since UNI$ pool, anyone who holds one of these cards can also enjoy free conversions of points earned through other UOB cards.

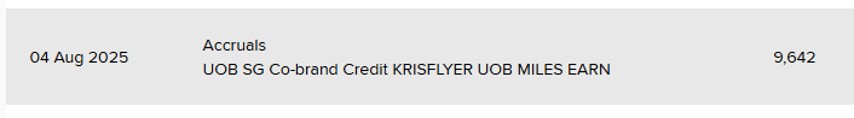

As a reminder, there is no conversion fee applicable to the KrisFlyer UOB Credit Card, since it earns KrisFlyer miles instead of UNI$. These are automatically batched and deposited into your KrisFlyer account each month, usually on the 3rd or 4th.

No change to auto-conversion programme

|

| FAQs |

| T&Cs |

| Read Point 53-55 |

UOB also offers a KrisFlyer Auto Conversion Programme, which automatically converts UNI$ to KrisFlyer miles at the end of each month.

The fee for this programme will remain the same at S$50 per 12-month period.

Upon successful enrolment, an automatic conversion will be effected on the last calendar day of each month. Should this fall on a Saturday, Sunday or Public Holiday, the auto conversion will take place the next working day.

All UNI$ above 15,000 UNI$ will be converted in blocks of 2,500 UNI$ (5,000 KrisFlyer miles). A temporary S$25 (from 15 December 2025, S$27) conversion fee will appear in your card account, which will be automatically reversed within seven working days.

I generally don’t think this programme is worth it, because of the silly requirement to maintain a minimum “working capital” of UNI$15,000 in your account. Moreover, auto-conversion also robs you of the two-year validity on the UOB side, and starts the three-year expiry clock on the KrisFlyer side prematurely.

How much do banks charge for conversions?

UOB isn’t the only bank that charges for conversions, of course. Here’s a round-up of how its revised S$27 fee compares with the rest of the market.

| 💰 Points Conversion Fees by Bank |

||

| Issuer | Per Conversion | Annual Option |

|

Free | N/A |

|

S$30 | N/A |

| S$27.251 | N/A | |

| S$27.252 | S$43.603 | |

| Free | N/A | |

| S$27.25 | N/A | |

| S$25 | N/A | |

| S$27.25 | N/A | |

| S$274 | S$505 | |

| 1. Waived for Citi ULTIMA 2. Waived for DBS Insignia 3. Automatic conversions in blocks of 500 DBS points (1,000 miles) each quarter. Additional ad-hoc redemptions can be done for free. Does not apply to DBS yuu Card 4. Waived for UOB Reserve, UOB Reserve Diamond, UOB Visa Infinite Metal, UOB Visa Infinite and UOB Privilege Banking Card 5. Automatic conversions in blocks of UNI$2,500 (5,000 miles) each month for balances above UNI$15,000. Additional ad-hoc redemptions cost S$27 each |

||

As you can see, the standard fee is S$25, but some banks choose to include GST in this amount, and others don’t (making the total fee S$27.25). So in that sense, UOB’s fee is a little odd- where did the S$0.25 go?

Anyway, I find it highly annoying that banks continue to charge these fees, which have very little to do with the cost of conversions. If you want to avoid it, and don’t qualify for one of UOB’s premium cards, then HSBC would be the next best alternative.

Conclusion

From 15 December 2025, UOB will increase its UNI$ conversion fee to S$27, an 8% increase from the current S$25.

This fee will continue to be waived for UOB’s premium cardholders, and there is no change to the cost of the UOB KrisFlyer Auto Conversion Programme.

If saving the S$2 is important to you, be sure to make your conversion before this date!

what is the best way to find out UNI$ that are expiring in the next 12-24 months so that I can maximise the ad-hoc conversion fee?

My experience is chat with the agent. they will give you the UNI$ to be expired in quarterly basis. so you need to add up your self. For example, 50,000 by Dec 2026, 43,000 by Mar 2027. So total to be expired by March 2027 is actually 93,000. Always clarify with the chat agent if this calculation is correct. It is useful.

I submitted my first-time conversion from UNI$ to KrisFlyer on 19th Nov. Do you have any idea how long it will take for the miles to reflect in my KrisFlyer account?

I submitted my first-time conversion from UNI$ to KrisFlyer on 19th Nov. Do you have any idea how long it will take for the miles to reflect in my KrisFlyer account?