The UOB Preferred Platinum Visa and UOB Visa Signature were historically among the easiest miles cards to use. Is there a contactless terminal? Great! Tap your phone and earn 4 mpd. No worrying about MCCs (general exclusions aside, of course).

But things got a lot trickier earlier this year, when UOB introduced its latest shenanigan: bonus sub-caps. With this change, it’s no longer possible to max out the bonus cap by spending on a single bonus category. Instead, you must spend across both categories in order to fully utilise the card’s overall bonus cap.

Spending across both bonus categories will get real messy, real fast. UOB doesn’t keep a running tally of the remaining bonus cap for each of them, nor does it categorise your spending. All your transactions are lumped together, so the only way to figure out how much bonus cap remains for each category is to tally up items line by line, a highly manual process that’s prone to (costly) mistakes.

Fortunately, there’s now a much easier way.

Track the UOB PPV and Visa Signature with HeyMax Card Maximiser

|

| Get a HeyMax Account |

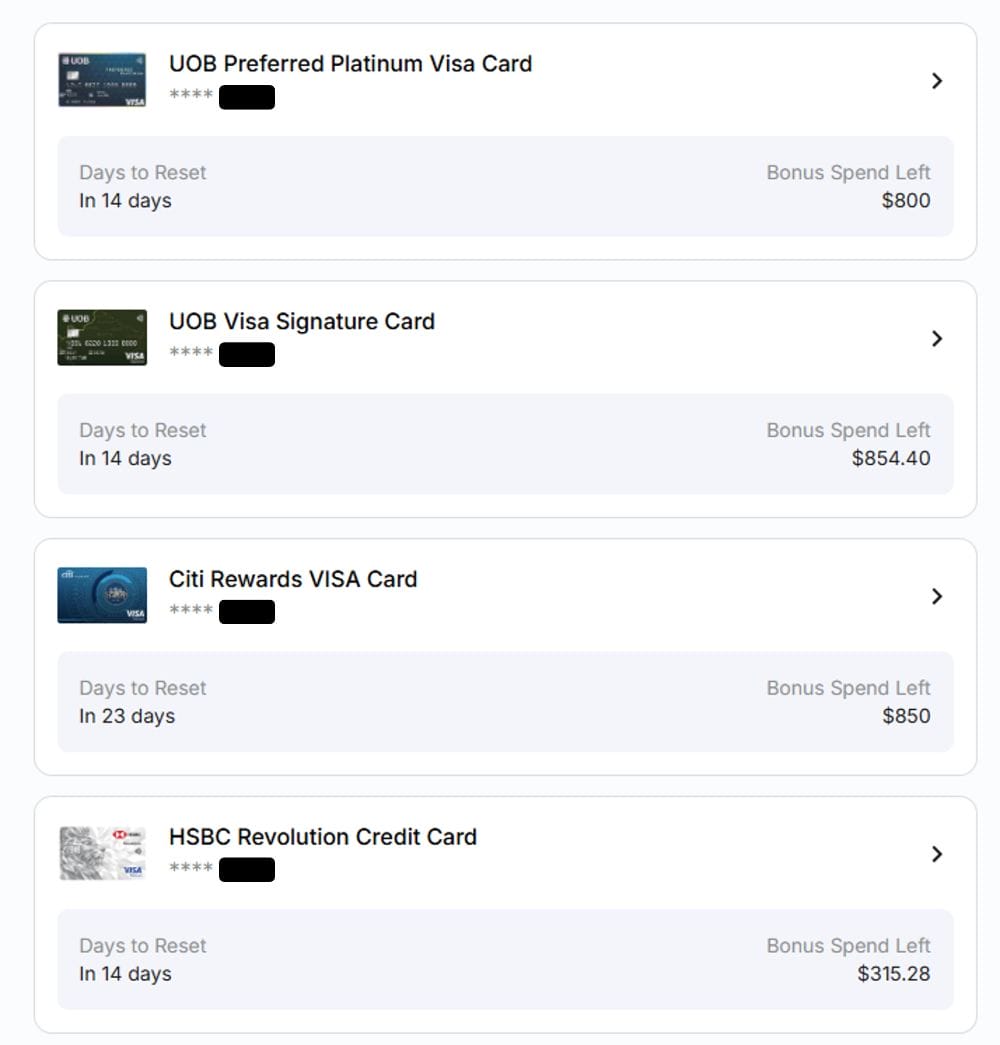

The HeyMax Card Maximiser now supports the UOB Preferred Platinum Visa and UOB Visa Signature, automatically tracking bonus caps and minimum spend (for the latter) in the background.

If this is your first time linking these cards to HeyMax, this tracker will only come in useful from the following calendar or statement month, as HeyMax won’t have access to your pre-linking transactions.

However, if you previously linked these cards to HeyMax, it will already have tabulated your transactions from the start of this calendar or statement month, as the case may be.

UOB Preferred Platinum Visa

Here’s a reminder of the rules for earning 4 mpd with the UOB Preferred Platinum Visa.

| Category | Min. Spend | Bonus Cap |

| Mobile Contactless | N/A | S$600 per c. month |

| Selected Online Transactions (e.g. dining, entertainment, shopping, supermarkets) |

N/A | S$600 per c. month |

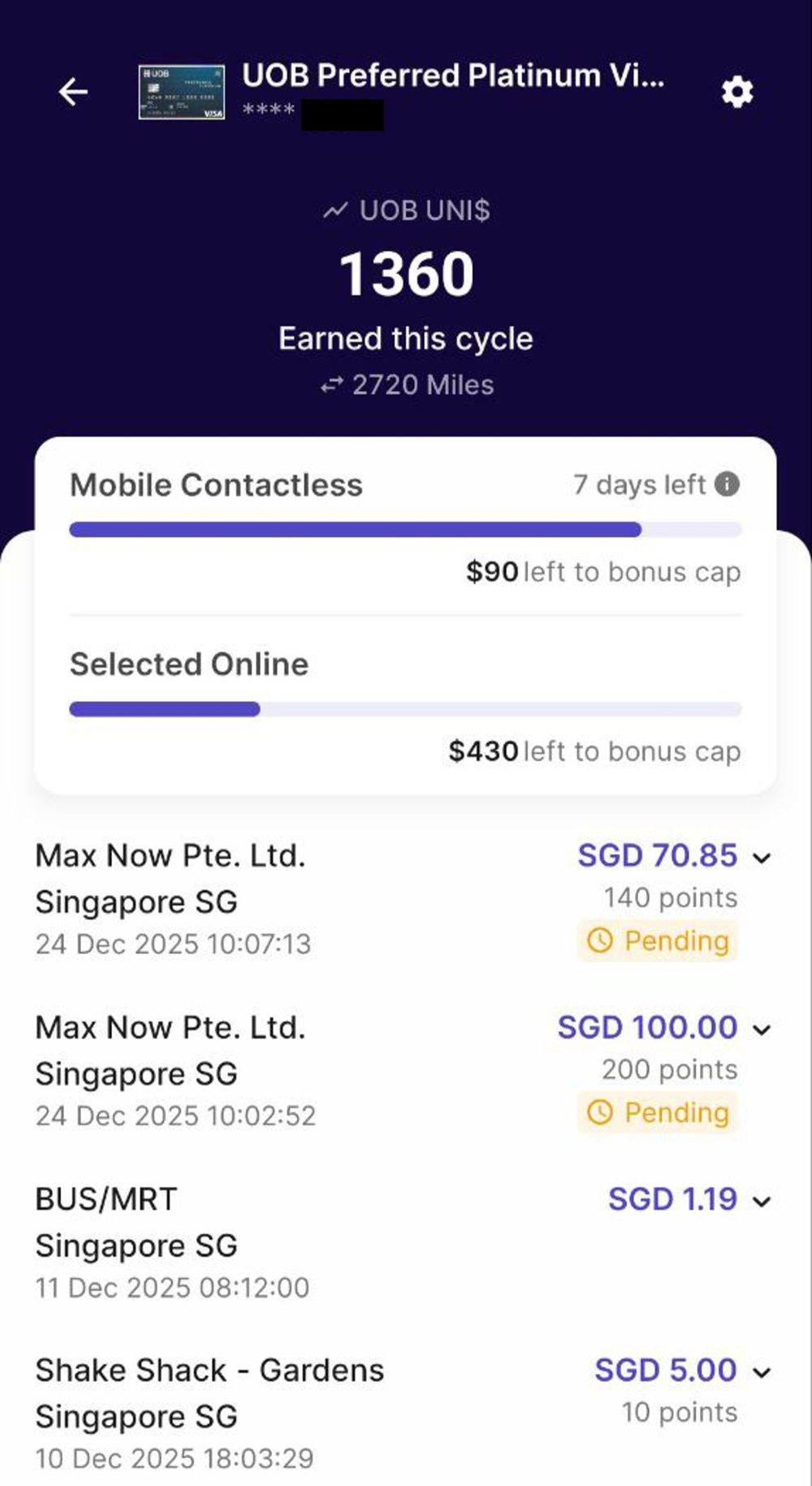

And here’s how it appears in the HeyMax Card Maximiser.

The bonus cap resets at the end of each calendar month, so as of today, 24 December 2025, I have seven days of spending left to go (probably slightly less, since UOB tracks bonus caps based on posting date, not transaction date, and transactions take time to post).

UOB Visa Signature

Here’s a reminder of the rules for earning 4 mpd with the UOB Visa Signature.

| Category | Min. Spend | Bonus Cap |

| Contactless & Petrol | S$1K per s. month | S$1.2K per s. month |

| Foreign Currency | S$1K per s. month | S$1.2K per s. month |

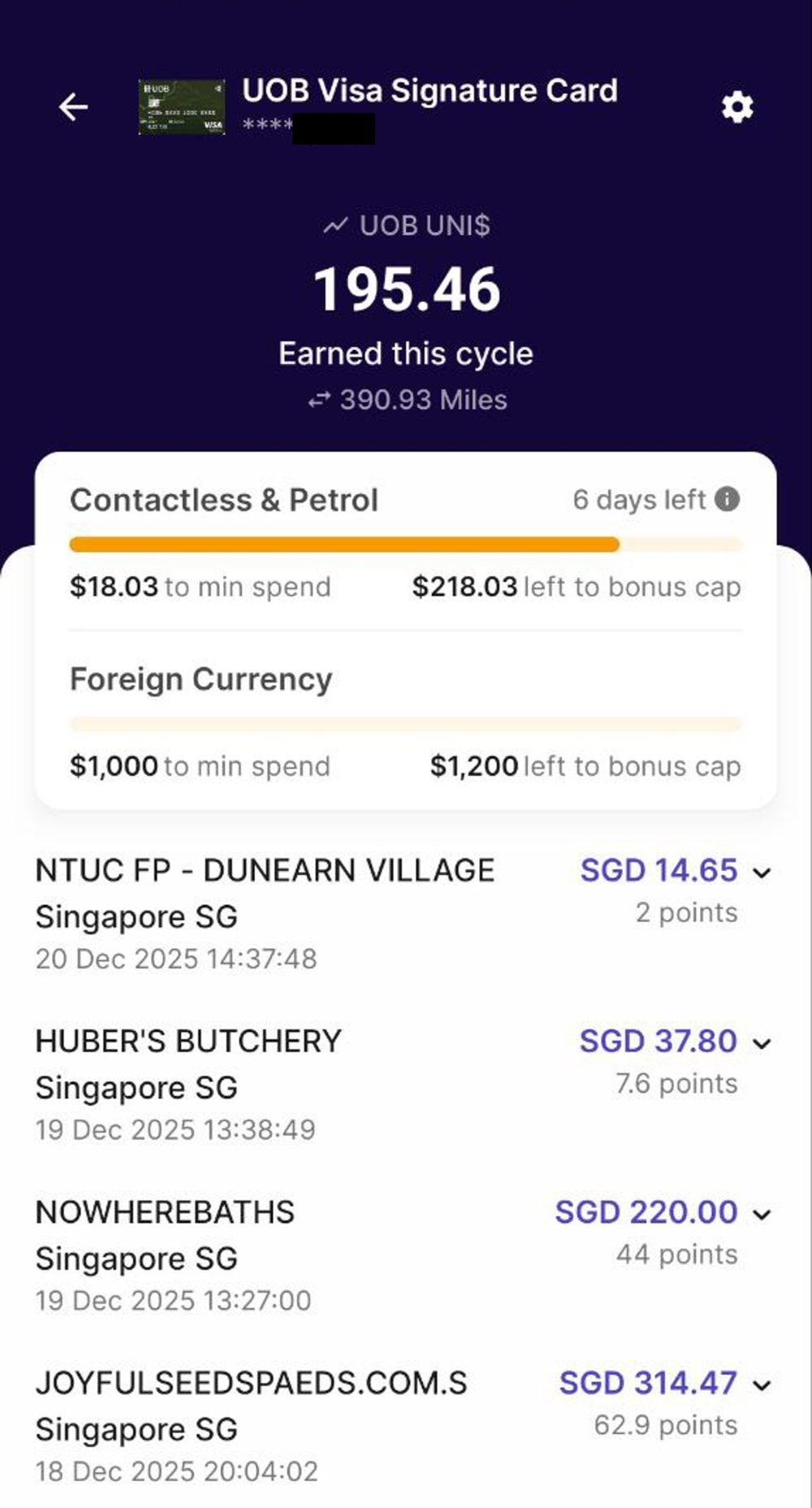

And here’s how it appears in the HeyMax Card Maximiser.

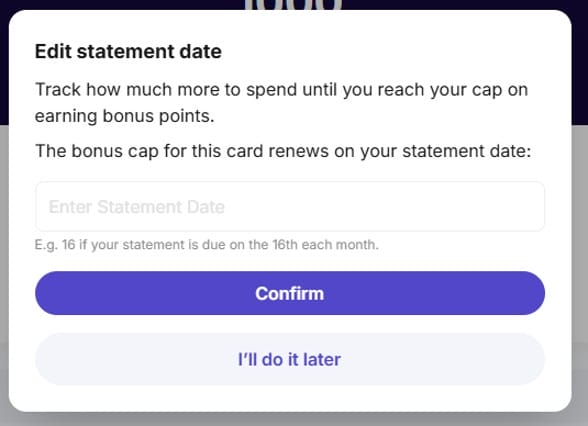

The UOB Visa Signature tracks its bonus caps and minimum spends by statement month, so you’ll need to provide that information to the HeyMax app for it to work properly. In my case, I’ve shifted my statement month to align with the calendar month, so I enter 31st and it automatically uses the last day as the cut-off.

In fact, the Card Maximiser just alerted me to the fact that I’m still S$18 shy of the minimum spend for Contactless & Petrol. I was under the impression that I’d already hit the minimum- see how easy it is to goof up?

It’s beyond the scope of this article to discuss how the UOB Visa Signature’s minimum spend works, but I’ve written a dedicated guide explaining just that, so refer to the link below.

How does the UOB Visa Signature’s minimum spend requirement work?

This makes life so much easier

I can’t overstate how awesome it is that these two cards are now supported.

Sure, there were workarounds like getting a supplementary card and using it for the second bonus category, while using the principal card exclusively for the first bonus category. But there’s paperwork involved (not to mention you can’t give a supplementary card to yourself), and then you’d have to remember which card is for what category.

This is just a much better way of doing things, and should lead to far fewer “overshoot” or “undershoot” situations, where you either spend too much or too little.

So hats off to the HeyMax team for getting this working, because it’s going to make life a lot easier.

Recap: HeyMax Card Maximiser

|

| Get a HeyMax account |

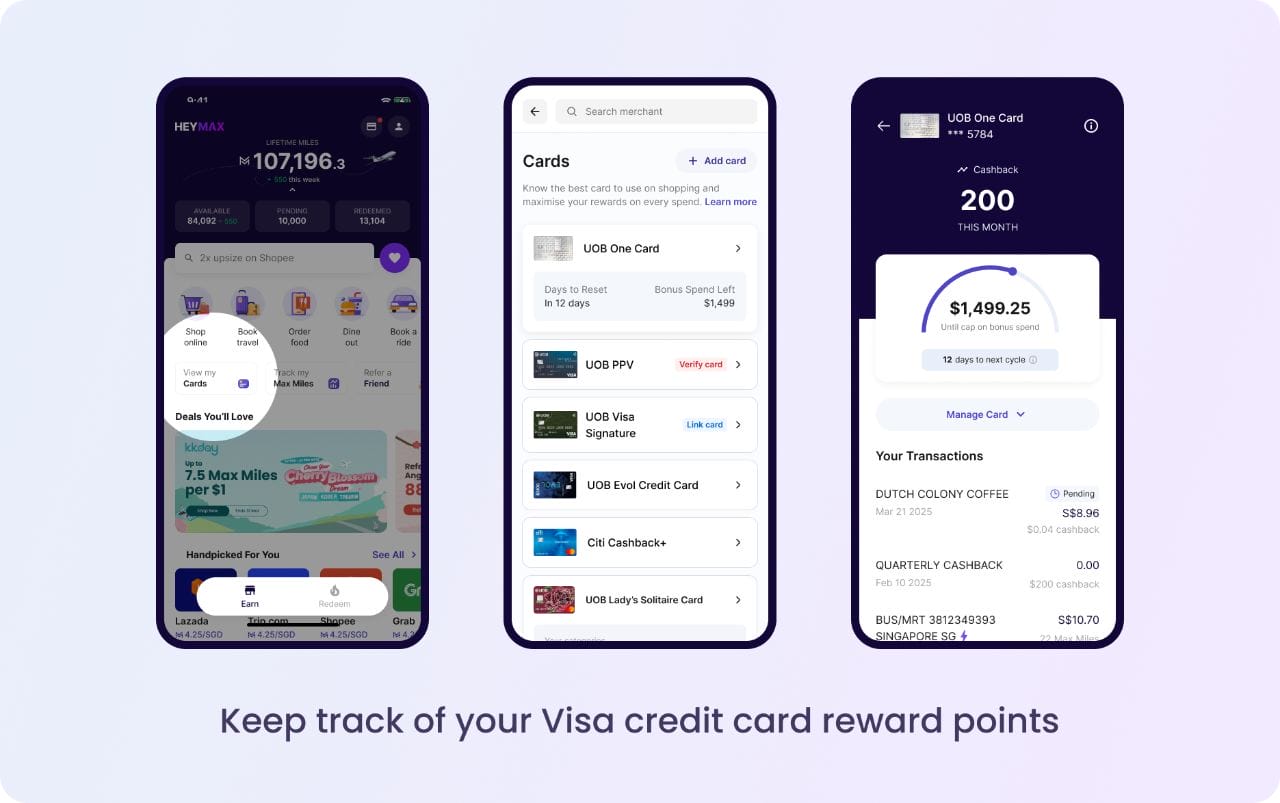

The HeyMax Card Maximiser allows you to automatically track your expenditure, points earned and remaining bonus cap for selected Visa cards.

To use the Card Maximiser, you need to first pair your card with your HeyMax account.

- Log in to your HeyMax account

- Navigate to Your Cards

- Click on Add Card, then follow the instructions

A test transaction of S$0.01 (or S$1, depending on the card) will be charged and later refunded. This is very similar to ShopBack GO or Qatar’s Card Linked Offers, both of which rely on the transaction feed that Visa provides to track and reward card spending.

Once the linking is completed, HeyMax will start tracking how much you’ve spent on each card, and deduct it from the bonus cap accordingly.

In the case of the Citi Rewards Visa, StanChart Journey Card and UOB Visa Signature, where bonus caps are tracked by statement month, you’ll be prompted to enter the last day of your statement date so the system knows when to reset your cap.

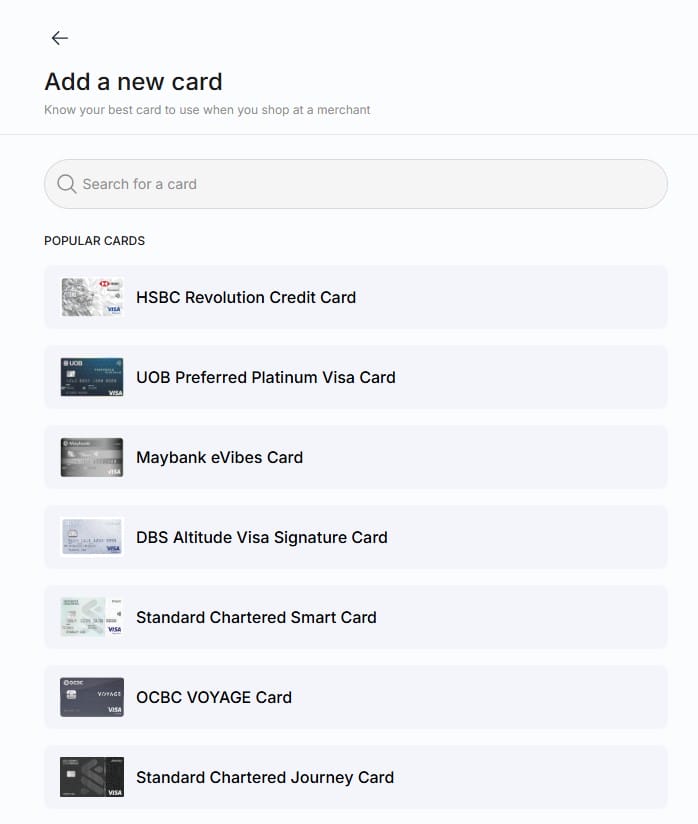

While the Card Maximiser supports transaction tracking for (almost) every Visa card, the calculation of points earned and remaining bonus caps is only supported for the following Visa cards.

| 💳 HeyMax Card Maximiser Supported cards for points and bonus cap tracking |

||

| Card | Earn Rate | Bonus Cap |

Chocolate Visa Debit Card Chocolate Visa Debit CardApply |

1 mpd | S$1K per c. month |

Citi PremierMiles Visa Citi PremierMiles Visa |

1.2 mpd (SGD) 2.2 mpd (FCY) |

N/A |

Citi Rewards Visa Citi Rewards Visa |

4 mpd | S$1K per s. month |

DBS Altitude Visa DBS Altitude VisaApply |

1.3 mpd (SGD) 2.2 mpd (FCY) |

N/A |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd (SGD) 2.2 mpd (FCY) |

N/A |

DBS yuu Visa DBS yuu VisaApply |

10 mpd | S$823 per c. month |

HSBC Revolution HSBC RevolutionApply |

4 mpd | S$1.5K per c. month |

Maybank Horizon Visa Signature Maybank Horizon Visa SignatureApply |

2.8 mpd | S$10K per c. month (for air tickets; no cap for FCY) |

StanChart Journey Card StanChart Journey CardApply |

3 mpd | S$1K per s. month |

StanChart Smart Card StanChart Smart CardApply |

9.28 mpd | N/A |

UOB Preferred Platinum Visa UOB Preferred Platinum VisaApply |

4 mpd | S$1.2K per c. month (2x sub-cap of S$600) |

UOB Visa Signature UOB Visa SignatureApply |

4 mpd | S$2.4K per s. month (2x sub-cap of S$1.2K) |

Conclusion

The HeyMax Card Maximiser now supports the UOB Preferred Platinum Visa and UOB Visa Signature, making it significantly easier to manage their finicky bonus sub-caps. All you need to do is link the cards once, after which everything will be automatically tracked and tallied.

Before someone asks, no, there’s no support forthcoming for the UOB Lady’s Solitaire Card, because unfortunately the Card Maximiser only works with Visa (apparently the transaction feed that makes the Card Maximiser possible is only available with Visa).

Still, it’s a great feature to have, and anything that reduces cognitive load is a win in my book.

Checked and my PPV is still “lumped” as one “bonus tracker”, as opposed to one each for “Contactless” and “Online spend”. Hoping it is being rolled out progressively to all HeyMax users , as it would be a dope feature!

update the app and it should appear.

seems like SimplyGo transactions are still calculated individually instead of accumulated spend

Hey there, Long Yin from HeyMax here. You’re right we had missed this out. Our team is working on a fix to aggregate your SimplyGo transactions for the month in our calculation. Stay tuned!

Hello! Can you also help to fix the points calculation for the UOB Visa Signature please. If you look at Aaron’s screenshot above, there are decimals for the points which shouldn’t be the case. E.g. Huber’s Buchery 7.6 points, should only be 7 points.

This function is so useful.

Then towards the end of the calander, you can top up with vouchers to max out the 4mpds for online spend.

Exceptionally useful.

Hi, if I give my wife a supplementary card, do I have to add that into my heymax app too? And I have to sum up the 2 cards to get the correct amt spend, is that so? Thanks!

Same question! Hope there’ll be an answer soon 😀