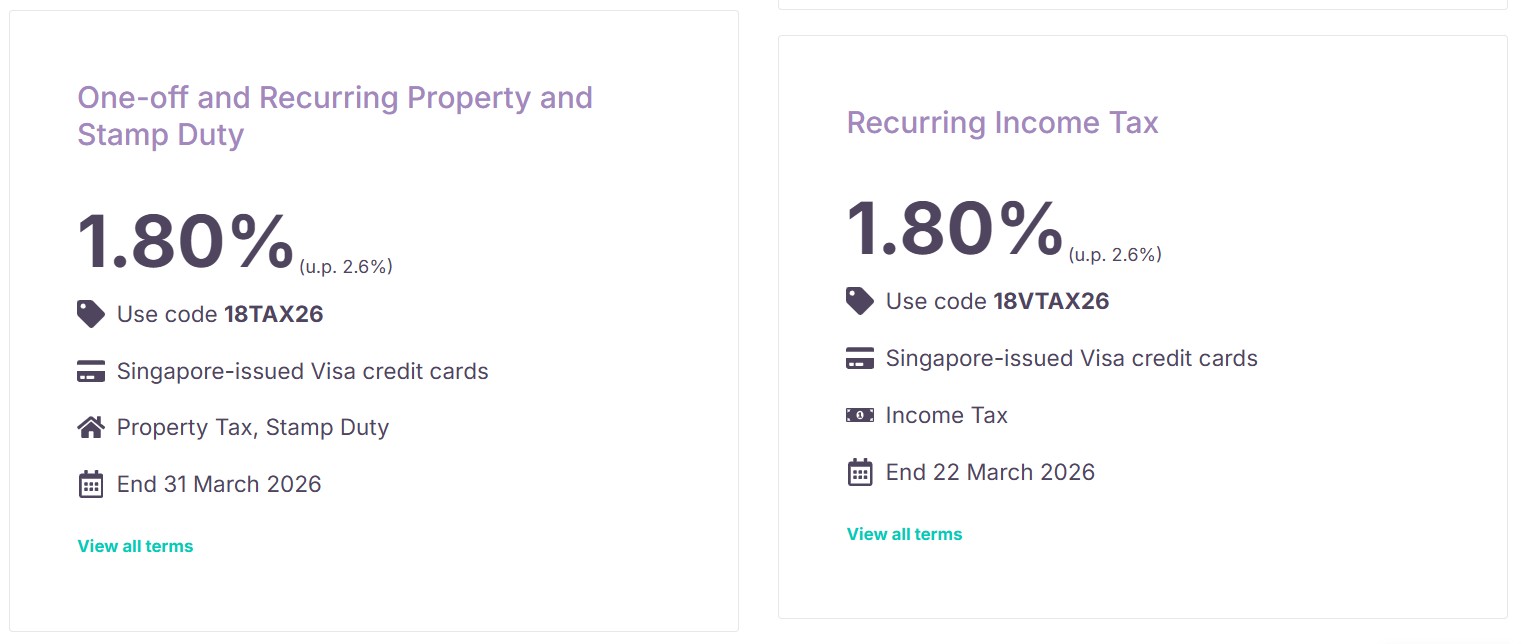

CardUp has unveiled an early promotion for paying taxes, which offers Visa cardholders a discounted rate of 1.8% for personal income tax, property tax and stamp duty.

This is marginally higher than last year’s promotion, which offered a 1.75% admin fee, but it still allows customers to buy miles at a very attractive price that starts from 1.11 cents each.

Payments need to be made between now and the end of March 2026, but don’t let the relatively short validity period worry you— CardUp is almost certainly going to launch a separate income tax promotion once the season starts in earnest in April.

CardUp promotions for tax payments

Income tax payments (1.8%)

|

|

| Code | 18VTAX26 |

| Limit | No cap on individual uses or overall redemptions |

| Admin Fee | 1.8% |

| Min. Spend | None |

| Cap | None |

| Schedule By | 22 March 2026, 6 p.m (SGT) |

| Due Date By | 25 March 2026 |

| Eligible Cards | Visa |

| Eligibility | New & Existing users |

| 18VTAX26 T&Cs | |

CardUp customers can use the promo code 18VTAX26 to enjoy a 1.8% fee for recurring income tax payments, instead of the usual 2.6%.

Payments must be scheduled by 22 March 2026, with a due date no later than 25 March 2026.

Do note that this promotion only applies to recurring income tax payments in respect of YA2025’s income tax bill. You will not be allowed to prepay your YA2026 income tax bill with this promotion— though as mentioned, CardUp will certainly launch another promotion once that starts in April.

The promotion is only valid for payments made with a Visa card issued in Singapore,

Property tax & stamp duty (1.8%)

|

|

| Code | 18TAX26 |

| Limit | No cap on individual uses or overall redemptions |

| Admin Fee | 1.8% |

| Min. Spend | None |

| Cap | S$10,000 per month |

| Schedule By | 31 March 2026, 6 p.m (SGT) |

| Due Date By | 6 April 2026 |

| Eligible Cards | Visa |

| Eligibility | New & Existing users |

| 18TAX26 T&Cs | |

CardUp customers can use the promo code 18TAX26 to enjoy a 1.8% fee for property tax (one-off or recurring) and stamp duty payments (one-off).

This is capped at S$10,000 per calendar month. Any payments in excess of S$10,000 will be subject to the usual 2.6% fee.

The promotion is only valid for payments made with a Visa card issued in Singapore. It’s also worth noting that OCBC cards are explicitly excluded, though certain OCBC cardholders might be eligible for something better (see below).

What’s the cost per mile?

Here’s the cost per mile for various Visa cards in Singapore, given their earn rates and a 1.8% admin fee.

| Card | Earn Rate | Cost Per Mile (1.8% fee) |

DBS Insignia Card DBS Insignia CardApply |

1.6 mpd | 1.11¢ |

UOB Reserve Card UOB Reserve CardApply |

1.6 mpd | 1.11¢ |

OCBC VOYAGE Card OCBC VOYAGE Card(Premier, PPC, BOS) Ineligible for 18TAX26 Apply |

1.6 mpd | 1.11¢ |

Citi ULTIMA Card Citi ULTIMA CardApply |

1.6 mpd | 1.11¢ |

DBS Vantage Card DBS Vantage CardApply |

1.5 mpd | 1.18¢ |

StanChart Visa Infinite Card StanChart Visa Infinite CardApply |

1.4 mpd^ | 1.26¢ |

UOB PRVI Miles Visa Card UOB PRVI Miles Visa CardApply |

1.4 mpd | 1.26¢ |

UOB Visa Infinite Metal Card UOB Visa Infinite Metal CardApply |

1.4 mpd | 1.26¢ |

OCBC VOYAGE Card OCBC VOYAGE CardIneligible for 18TAX26 Apply |

1.3 mpd |

1.36¢ |

OCBC 90°N Visa Card OCBC 90°N Visa CardIneligible for 18TAX26 Apply |

1.3 mpd | 1.36¢ |

DBS Altitude Visa Card DBS Altitude Visa CardApply |

1.3 mpd | 1.36¢ |

OCBC Premier Visa Infinite Card OCBC Premier Visa Infinite CardIneligible for 18TAX26 Apply |

1.28 mpd | 1.38¢ |

Citi PremierMiles Visa Card Citi PremierMiles Visa Card |

1.2 mpd | 1.47¢ |

Maybank Visa Infinite Card Maybank Visa Infinite CardApply |

1.2 mpd | 1.47¢ |

StanChart Journey Card StanChart Journey CardApply |

1.2 mpd | 1.47¢ |

| *Capped at S$1,000 per calendar month, after which 0.4 mpd ^With a minimum spend of S$2,000 per statement month, otherwise 1 mpd (1.72 cpm). CardUp spending counts towards the minimum spend |

||

To illustrate how this works, suppose you have a S$1,000 monthly instalment on your YA2025 income tax bill.

- S$1,018 will be charged to your credit card (S$1,000 bill + 1.8% fee)

- Assuming a 1.4 mpd card, you will earn 1,425 miles (S$1,018 x 1.4 mpd; ignoring rounding)

- Given a S$18 fee, the cost per mile is 1.26 cents each (S$18/1,425 miles)

Remember, both the tax payment amount and the CardUp fee are eligible to earn miles.

Even if you have an entry-level 1.2 mpd card, the cost per mile is a fairly attractive 1.47 cents. That can drop to as little as 1.11 cents, for those who have a higher-earning card. It’s just a shame that Mastercards are not eligible, as a 2 mpd StanChart Beyond would be a dream pairing.

OCBC cardholders get a lower fee

If you’re an OCBC cardholder, you may be eligible for a lower CardUp fee.

For example, OCBC VOYAGE and OCBC Premier Infinite customers enjoy a 1.73% fee on recurring income tax payments scheduled by 20 March 2026, while OCBC 90N Visa and Mastercard customers can enjoy a 1.55% fee on any payment (though this is limited to new customers only).

Refer to the post below for all the details.

CardUp x OCBC: Pay bills with discounted fees starting from 1.55%

Full list of CardUp promo codes

I recently compiled the full list of CardUp promo codes for 2026, which cover special deals for rental, renovations, homeowner payments and more. I’ll be updating this throughout the year as more deals roll in, so be sure to bookmark it for future reference.

Conclusion

CardUp is now offering new and existing customers a 1.8% fee for making personal income tax, property tax and stamp duty payments to IRAS. This reduces the cost per mile to as little as 1.1 cents each, even if it is marginally more expensive than last year’s 1.75% promotion.

It’s quite likely that we’ll be seeing other payment platforms roll out offers of their own in the weeks and months to come including, hopefully, offers for AMEX and Mastercard, so stay tuned for those.

Is DBS Vantage still awarding miles for cardup ?

A bit late CardUp. Property tax is due January 31 and I at least have already paid. How about doing this in December latest or even better when we actually receive our assessment (Nov 25, due Jan 31 following year)?

Hi, can I check if you have any perspectives or answers for paying via HITPAY for miles please?

Hi can I check if you have any research/articles done on payment via credit card via HitPay to get miles please? Thank you!

Too bad I usually only get my IRAS tax bill June; a few months too late for this offer.